Sources of Business Finance and Financial Management- A comprehensive... Show more

Sign up to see the contentIt's free!

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

Subjects

Triangle Congruence and Similarity Theorems

Triangle Properties and Classification

Linear Equations and Graphs

Geometric Angle Relationships

Trigonometric Functions and Identities

Equation Solving Techniques

Circle Geometry Fundamentals

Division Operations and Methods

Basic Differentiation Rules

Exponent and Logarithm Properties

Show all topics

Human Organ Systems

Reproductive Cell Cycles

Biological Sciences Subdisciplines

Cellular Energy Metabolism

Autotrophic Energy Processes

Inheritance Patterns and Principles

Biomolecular Structure and Organization

Cell Cycle and Division Mechanics

Cellular Organization and Development

Biological Structural Organization

Show all topics

Chemical Sciences and Applications

Atomic Structure and Composition

Molecular Electron Structure Representation

Atomic Electron Behavior

Matter Properties and Water

Mole Concept and Calculations

Gas Laws and Behavior

Periodic Table Organization

Chemical Thermodynamics Fundamentals

Chemical Bond Types and Properties

Show all topics

European Renaissance and Enlightenment

European Cultural Movements 800-1920

American Revolution Era 1763-1797

American Civil War 1861-1865

Global Imperial Systems

Mongol and Chinese Dynasties

U.S. Presidents and World Leaders

Historical Sources and Documentation

World Wars Era and Impact

World Religious Systems

Show all topics

Classic and Contemporary Novels

Literary Character Analysis

Rhetorical Theory and Practice

Classic Literary Narratives

Reading Analysis and Interpretation

Narrative Structure and Techniques

English Language Components

Influential English-Language Authors

Basic Sentence Structure

Narrative Voice and Perspective

Show all topics

268

•

Dec 20, 2025

•

Amilie du Toit

@amiliedutoit_uajk

Sources of Business Finance and Financial Management- A comprehensive... Show more

This page delves into share issues and bank loans as sources of finance for businesses.

Share issues allow limited companies to sell shares for extra capital. Public Limited Companies (PLCs) can sell shares on the stock market.

Definition: A share represents a unit of ownership in a company.

Advantages of share capital include:

Disadvantages of issuing shares include:

Bank loans are another financing option, typically offered for 5-10 years. Commercial mortgages, a type of secured loan, are used to buy business premises like offices or factories.

Example: A retail business might use a commercial mortgage to purchase a new store location.

This page explores debt factoring and debentures as financing methods for businesses.

Debt factoring involves businesses selling unpaid invoices to a factoring company, which then collects from customers.

Highlight: Debt factoring can improve cash flow by providing immediate payment for outstanding invoices.

Advantages of debt factoring include:

Disadvantages of debt factoring include:

Example: A manufacturing company might use debt factoring to quickly convert its accounts receivable into cash, improving its working capital.

Debentures are loans borrowed through the stock market. They offer advantages like long-term repayment but have disadvantages such as annual interest payments regardless of profit.

This section discusses government grants and venture capital as sources of business finance.

Government grants are offered to encourage entrepreneurship and start new businesses. They provide financial assistance and expert knowledge.

Highlight: Government grants can be particularly beneficial for those with poor credit ratings who might struggle to secure traditional financing.

Venture capital involves large loans from individuals or organizations willing to take risks on businesses that banks might consider too risky.

Advantages of venture capital:

Example: A tech startup might secure venture capital funding to develop and launch a new innovative product.

Venture capitalists usually part-own the business in return for taking the risk, which can be both an advantage and a disadvantage depending on the business's perspective.

This page covers crowdfunding as a financing option and introduces cash flow management concepts.

Crowdfunding involves raising small amounts of money from a large number of people, typically through a website.

Advantages of crowdfunding:

Disadvantages of crowdfunding:

The page also introduces cash budgeting, highlighting its benefits:

Definition: A cash budget is a financial planning tool that estimates a company's cash inflows and outflows over a specific period.

This section focuses on methods to improve cash flow and introduces income statements.

Methods to improve cash flow include:

Vocabulary: Just-In-Time (JIT) is an inventory strategy that aligns raw-material orders from suppliers directly with production schedules.

The page then introduces income statements, also known as profit and loss accounts. These financial documents summarize an organization's income and expenses over a specific period.

Key components of an income statement include:

Definition: Gross profit is the difference between sales and the cost of goods sold.

This final page delves deeper into the components of profit and loss in financial statements.

Key concepts covered include:

Gross Profit: This represents the money made from buying and selling goods before accounting for other expenses.

Formula: Gross Profit = Sales - Cost of Sales

Profit/Loss for the Year: This is the final profit or loss figure after subtracting all expenses from the gross profit.

Formula: Profit for Year = Gross Profit - Expenses

Expenses: These are the various costs a business must pay that are not directly related to the production of goods or services.

Example: Expenses might include utility bills, rent, or administrative costs.

The page emphasizes that the profit or loss recorded should accurately reflect the company's trading performance for the given period.

Highlight: Understanding these financial concepts is crucial for effective business management and decision-making.

This final page discusses business expenses and their impact on financial statements.

Expenses are the costs that an organization has to pay, such as utility bills (e.g., gas) or rent. These expenses are subtracted from the gross profit to determine the final profit or loss for the year.

Understanding and managing these expenses is crucial for maintaining profitability and making informed business decisions.

Vocabulary: Expenses - The costs incurred by a business in the process of generating revenue.

Highlight: Careful management and analysis of expenses are essential for maintaining a healthy profit margin and ensuring long-term business success.

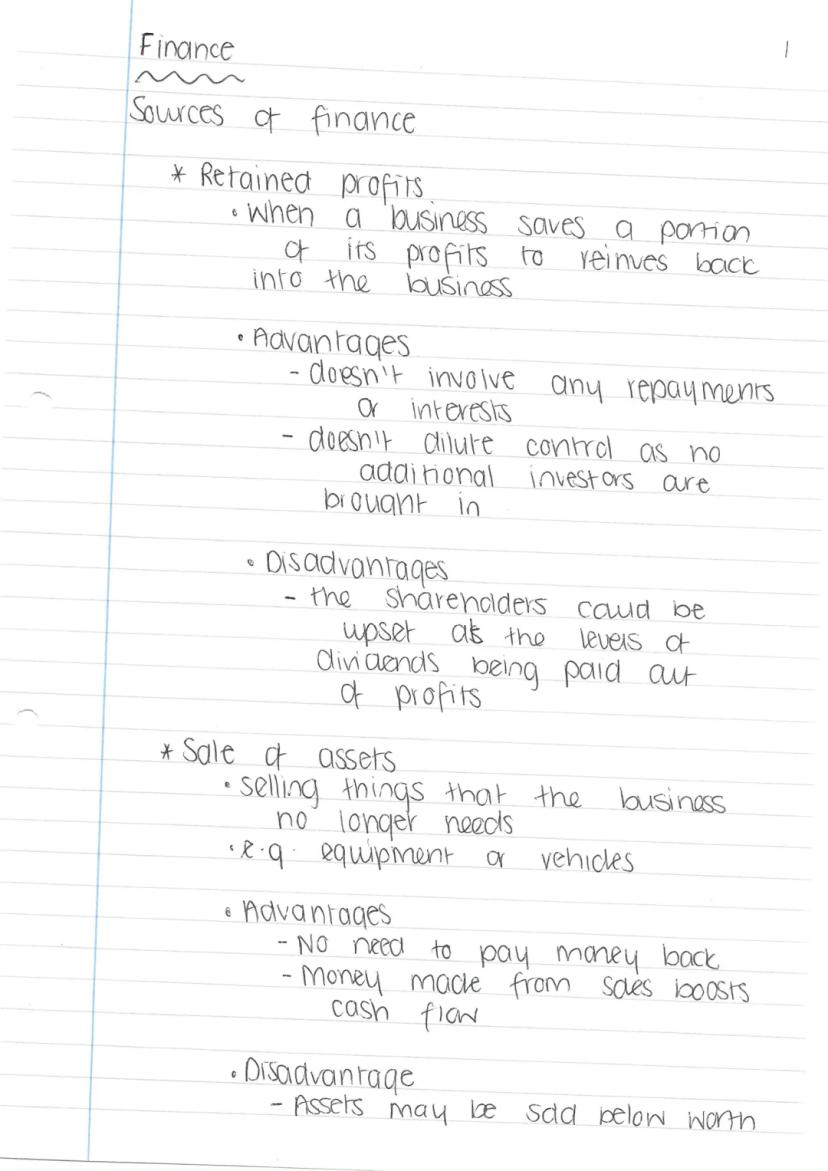

This page introduces two important sources of business finance: retained profits and sale of assets.

Retained profits refer to the portion of a company's earnings saved for reinvestment. This method offers several advantages:

Highlight: Retained profits don't require repayments or interest, and they don't dilute control by bringing in additional investors.

However, there are also disadvantages to consider:

Example: Shareholders might be upset due to lower dividend payouts from profits.

The sale of assets involves selling items the business no longer needs, such as equipment or vehicles. This method has its own set of pros and cons:

Advantages of using retained profit for expansion include no need for repayment and improved cash flow. A potential drawback is that assets may be sold below their actual worth.

Vocabulary: Cash flow refers to the movement of money in and out of a business.

Our AI companion is specifically built for the needs of students. Based on the millions of content pieces we have on the platform we can provide truly meaningful and relevant answers to students. But its not only about answers, the companion is even more about guiding students through their daily learning challenges, with personalised study plans, quizzes or content pieces in the chat and 100% personalisation based on the students skills and developments.

You can download the app in the Google Play Store and in the Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE THE SCHOOLGPT. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE THE SCHOOLGPT. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

Amilie du Toit

@amiliedutoit_uajk

Sources of Business Finance and Financial Management - A comprehensive guide exploring various financing options including retained profits, share issues, and debt factoring, along with their advantages and disadvantages for business growth and sustainability.

• Explores multiple financing sources from... Show more

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

This page delves into share issues and bank loans as sources of finance for businesses.

Share issues allow limited companies to sell shares for extra capital. Public Limited Companies (PLCs) can sell shares on the stock market.

Definition: A share represents a unit of ownership in a company.

Advantages of share capital include:

Disadvantages of issuing shares include:

Bank loans are another financing option, typically offered for 5-10 years. Commercial mortgages, a type of secured loan, are used to buy business premises like offices or factories.

Example: A retail business might use a commercial mortgage to purchase a new store location.

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

This page explores debt factoring and debentures as financing methods for businesses.

Debt factoring involves businesses selling unpaid invoices to a factoring company, which then collects from customers.

Highlight: Debt factoring can improve cash flow by providing immediate payment for outstanding invoices.

Advantages of debt factoring include:

Disadvantages of debt factoring include:

Example: A manufacturing company might use debt factoring to quickly convert its accounts receivable into cash, improving its working capital.

Debentures are loans borrowed through the stock market. They offer advantages like long-term repayment but have disadvantages such as annual interest payments regardless of profit.

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

This section discusses government grants and venture capital as sources of business finance.

Government grants are offered to encourage entrepreneurship and start new businesses. They provide financial assistance and expert knowledge.

Highlight: Government grants can be particularly beneficial for those with poor credit ratings who might struggle to secure traditional financing.

Venture capital involves large loans from individuals or organizations willing to take risks on businesses that banks might consider too risky.

Advantages of venture capital:

Example: A tech startup might secure venture capital funding to develop and launch a new innovative product.

Venture capitalists usually part-own the business in return for taking the risk, which can be both an advantage and a disadvantage depending on the business's perspective.

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

This page covers crowdfunding as a financing option and introduces cash flow management concepts.

Crowdfunding involves raising small amounts of money from a large number of people, typically through a website.

Advantages of crowdfunding:

Disadvantages of crowdfunding:

The page also introduces cash budgeting, highlighting its benefits:

Definition: A cash budget is a financial planning tool that estimates a company's cash inflows and outflows over a specific period.

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

This section focuses on methods to improve cash flow and introduces income statements.

Methods to improve cash flow include:

Vocabulary: Just-In-Time (JIT) is an inventory strategy that aligns raw-material orders from suppliers directly with production schedules.

The page then introduces income statements, also known as profit and loss accounts. These financial documents summarize an organization's income and expenses over a specific period.

Key components of an income statement include:

Definition: Gross profit is the difference between sales and the cost of goods sold.

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

This final page delves deeper into the components of profit and loss in financial statements.

Key concepts covered include:

Gross Profit: This represents the money made from buying and selling goods before accounting for other expenses.

Formula: Gross Profit = Sales - Cost of Sales

Profit/Loss for the Year: This is the final profit or loss figure after subtracting all expenses from the gross profit.

Formula: Profit for Year = Gross Profit - Expenses

Expenses: These are the various costs a business must pay that are not directly related to the production of goods or services.

Example: Expenses might include utility bills, rent, or administrative costs.

The page emphasizes that the profit or loss recorded should accurately reflect the company's trading performance for the given period.

Highlight: Understanding these financial concepts is crucial for effective business management and decision-making.

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

This final page discusses business expenses and their impact on financial statements.

Expenses are the costs that an organization has to pay, such as utility bills (e.g., gas) or rent. These expenses are subtracted from the gross profit to determine the final profit or loss for the year.

Understanding and managing these expenses is crucial for maintaining profitability and making informed business decisions.

Vocabulary: Expenses - The costs incurred by a business in the process of generating revenue.

Highlight: Careful management and analysis of expenses are essential for maintaining a healthy profit margin and ensuring long-term business success.

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

This page introduces two important sources of business finance: retained profits and sale of assets.

Retained profits refer to the portion of a company's earnings saved for reinvestment. This method offers several advantages:

Highlight: Retained profits don't require repayments or interest, and they don't dilute control by bringing in additional investors.

However, there are also disadvantages to consider:

Example: Shareholders might be upset due to lower dividend payouts from profits.

The sale of assets involves selling items the business no longer needs, such as equipment or vehicles. This method has its own set of pros and cons:

Advantages of using retained profit for expansion include no need for repayment and improved cash flow. A potential drawback is that assets may be sold below their actual worth.

Vocabulary: Cash flow refers to the movement of money in and out of a business.

Our AI companion is specifically built for the needs of students. Based on the millions of content pieces we have on the platform we can provide truly meaningful and relevant answers to students. But its not only about answers, the companion is even more about guiding students through their daily learning challenges, with personalised study plans, quizzes or content pieces in the chat and 100% personalisation based on the students skills and developments.

You can download the app in the Google Play Store and in the Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

7

Smart Tools NEW

Transform this note into: ✓ 50+ Practice Questions ✓ Interactive Flashcards ✓ Full Mock Exam ✓ Essay Outlines

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE THE SCHOOLGPT. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE THE SCHOOLGPT. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user