Accounting is a language that tells the story of a... Show more

Sign up to see the contentIt's free!

Access to all documents

Improve your grades

Join milions of students

Subjects

Triangle Congruence and Similarity Theorems

Triangle Properties and Classification

Linear Equations and Graphs

Geometric Angle Relationships

Trigonometric Functions and Identities

Equation Solving Techniques

Circle Geometry Fundamentals

Division Operations and Methods

Basic Differentiation Rules

Exponent and Logarithm Properties

Show all topics

Human Organ Systems

Reproductive Cell Cycles

Biological Sciences Subdisciplines

Cellular Energy Metabolism

Autotrophic Energy Processes

Inheritance Patterns and Principles

Biomolecular Structure and Organization

Cell Cycle and Division Mechanics

Cellular Organization and Development

Biological Structural Organization

Show all topics

Chemical Sciences and Applications

Atomic Structure and Composition

Molecular Electron Structure Representation

Atomic Electron Behavior

Matter Properties and Water

Mole Concept and Calculations

Gas Laws and Behavior

Periodic Table Organization

Chemical Thermodynamics Fundamentals

Chemical Bond Types and Properties

Show all topics

European Renaissance and Enlightenment

European Cultural Movements 800-1920

American Revolution Era 1763-1797

American Civil War 1861-1865

Global Imperial Systems

Mongol and Chinese Dynasties

U.S. Presidents and World Leaders

Historical Sources and Documentation

World Wars Era and Impact

World Religious Systems

Show all topics

Classic and Contemporary Novels

Literary Character Analysis

Rhetorical Theory and Practice

Classic Literary Narratives

Reading Analysis and Interpretation

Narrative Structure and Techniques

English Language Components

Influential English-Language Authors

Basic Sentence Structure

Narrative Voice and Perspective

Show all topics

496

•

Feb 2, 2026

•

studywithnessa

@studywithnessa

Accounting is a language that tells the story of a... Show more

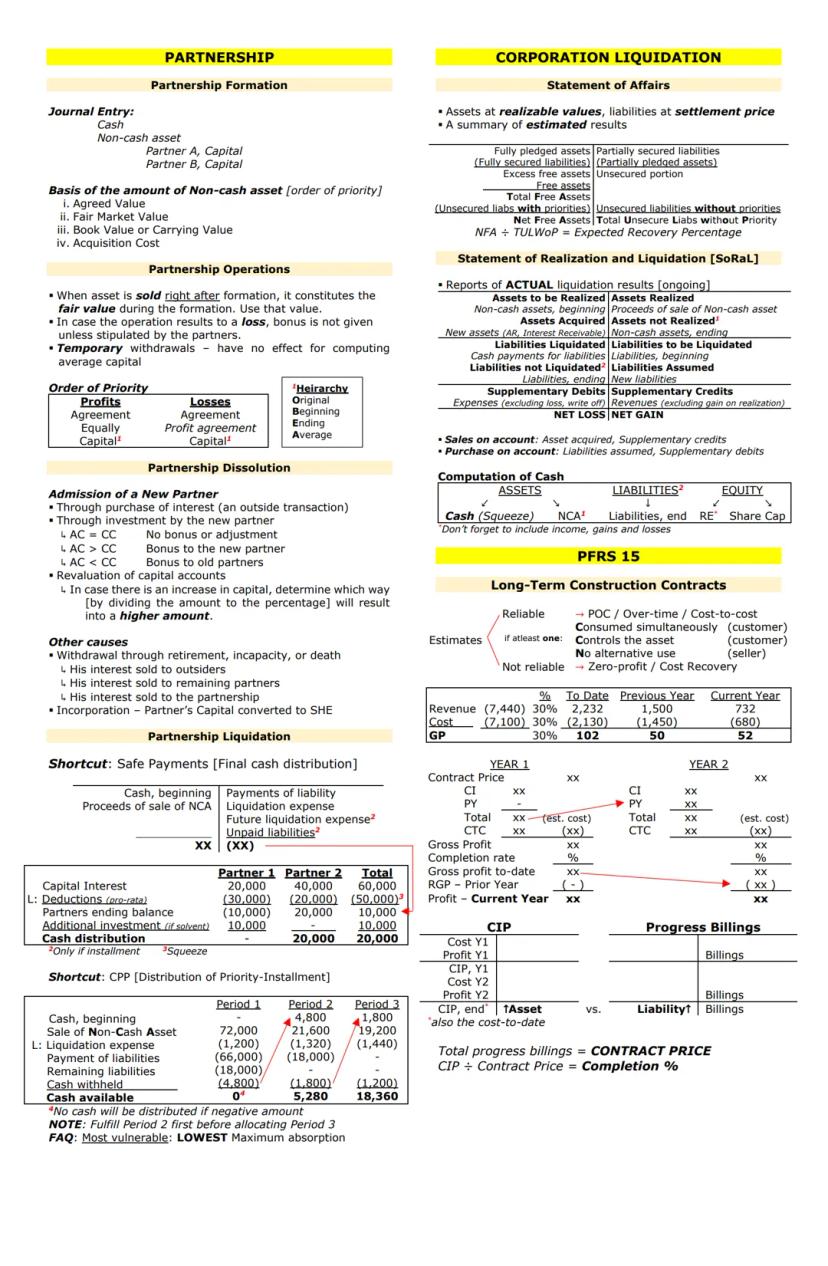

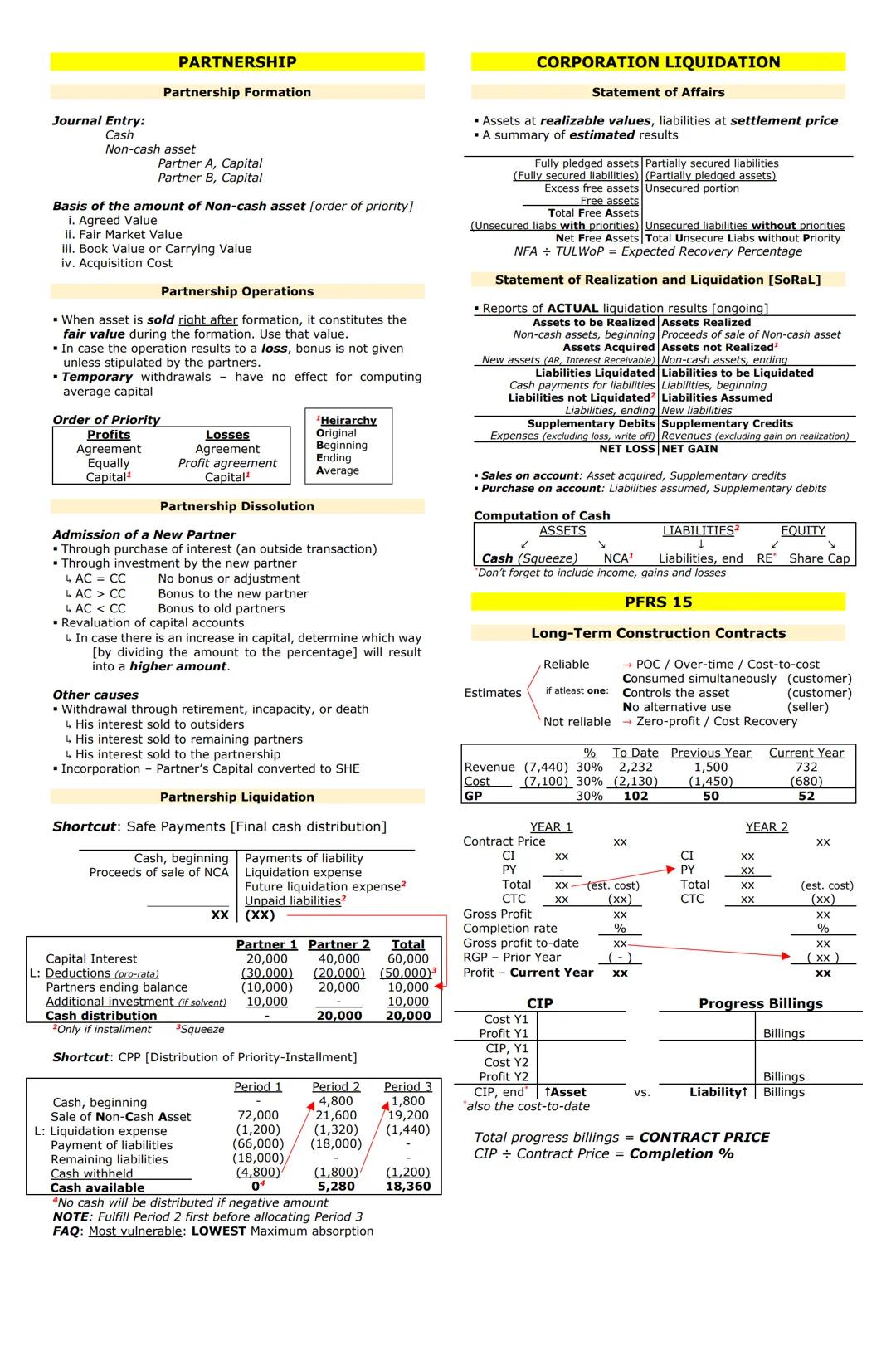

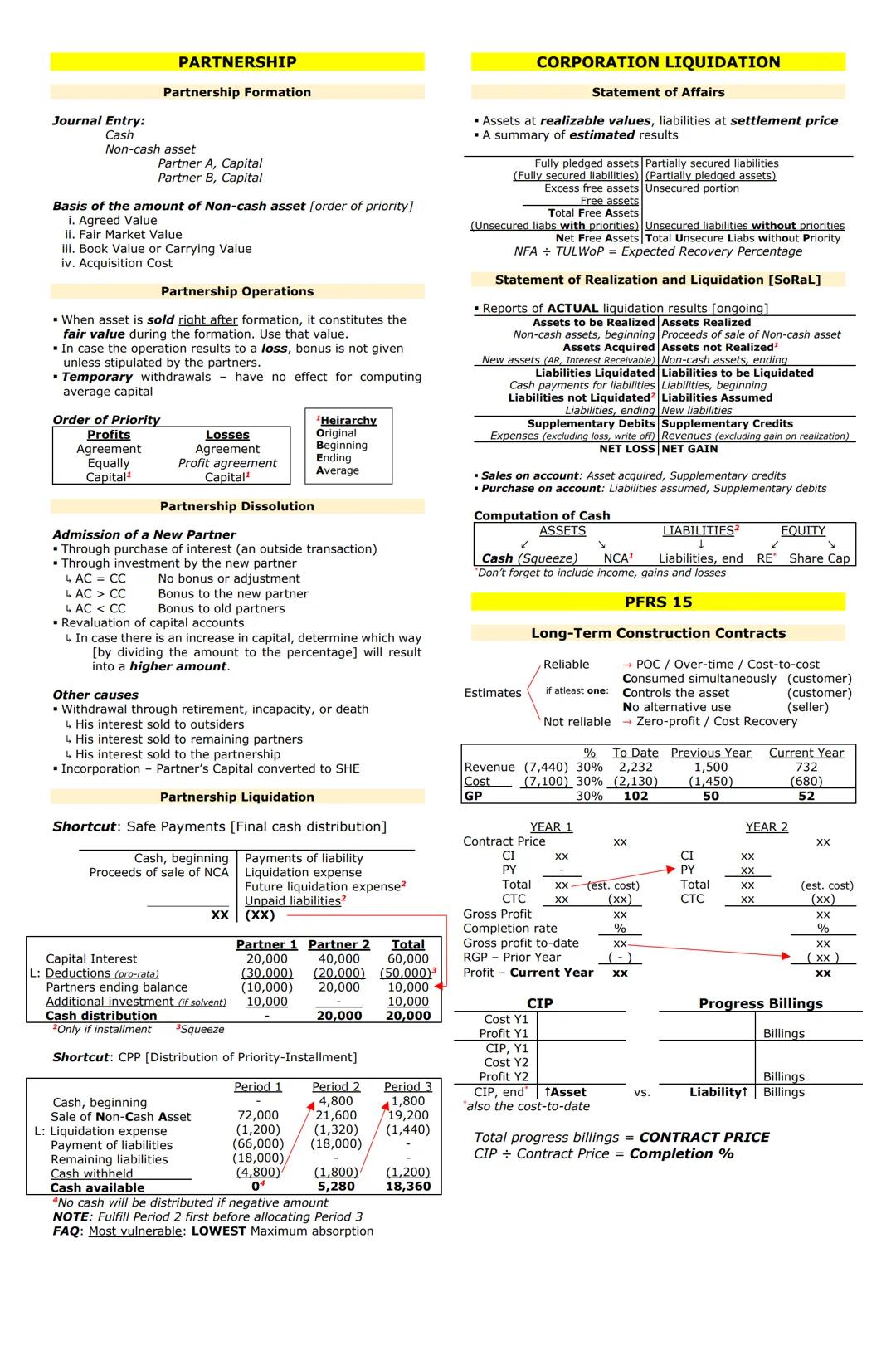

Partnerships begin with formation, where partners contribute assets to create the business. When recording non-cash assets, the valuation follows a clear priority order: agreed value first, then fair market value, followed by book value, and lastly acquisition cost.

During operations, profits and losses follow their own priority hierarchy. First, check for specific agreements between partners. If none exist, profits are split equally, while losses follow the profit agreement. If all else fails, allocate based on capital contributions. For capital calculations, remember that temporary withdrawals don't affect average capital determination.

Partnership dissolution happens in several ways. A new partner might join through outside purchase or direct investment. When a new partner's investment (LAC) equals the capital credit (CC), no adjustment is needed. If LAC exceeds CC, the new partner receives a bonus. If LAC is less than CC, existing partners receive the bonus.

For liquidation, use the Safe Payments method to determine final cash distribution. First, calculate available cash by adding beginning cash and proceeds from non-current assets, then subtracting liabilities and expenses. Finally, distribute based on partners' capital interests after making proportional deductions for any negative balances.

Pro Tip: When a partnership dissolves, the most vulnerable partner is the one with the lowest maximum absorption capacity, meaning they have the least ability to absorb losses beyond their capital contribution.

In corporate liquidation, two main statements guide the process. The Statement of Affairs shows assets at realizable values and liabilities at settlement prices, helping estimate the recovery percentage. The Statement of Realization and Liquidation (SoRaL) tracks the actual results as liquidation progresses.

For long-term construction contracts under PFRS 15, use the percentage-of-completion method when estimates are reliable. This happens when customers simultaneously consume benefits, control the asset, or the seller has no alternative use for it. When estimates aren't reliable, use the zero-profit/cost recovery method.

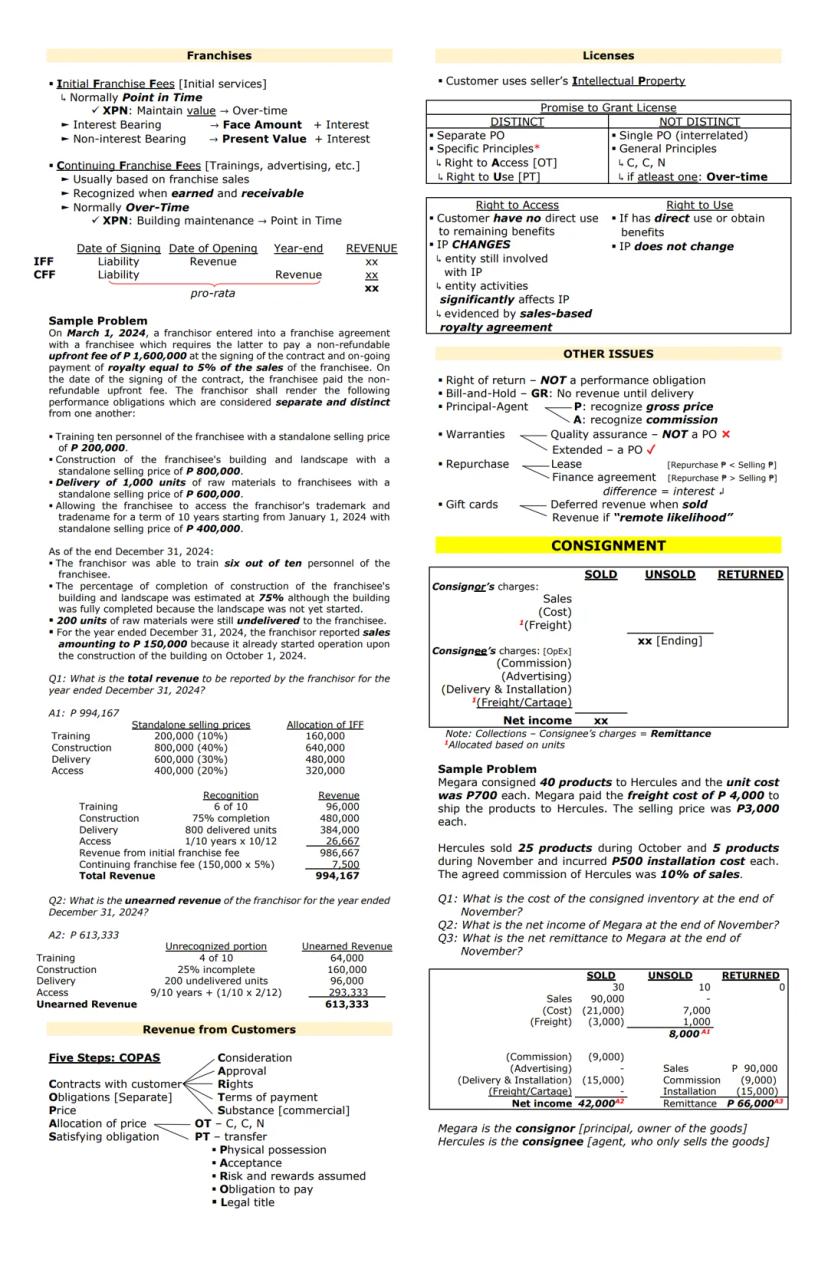

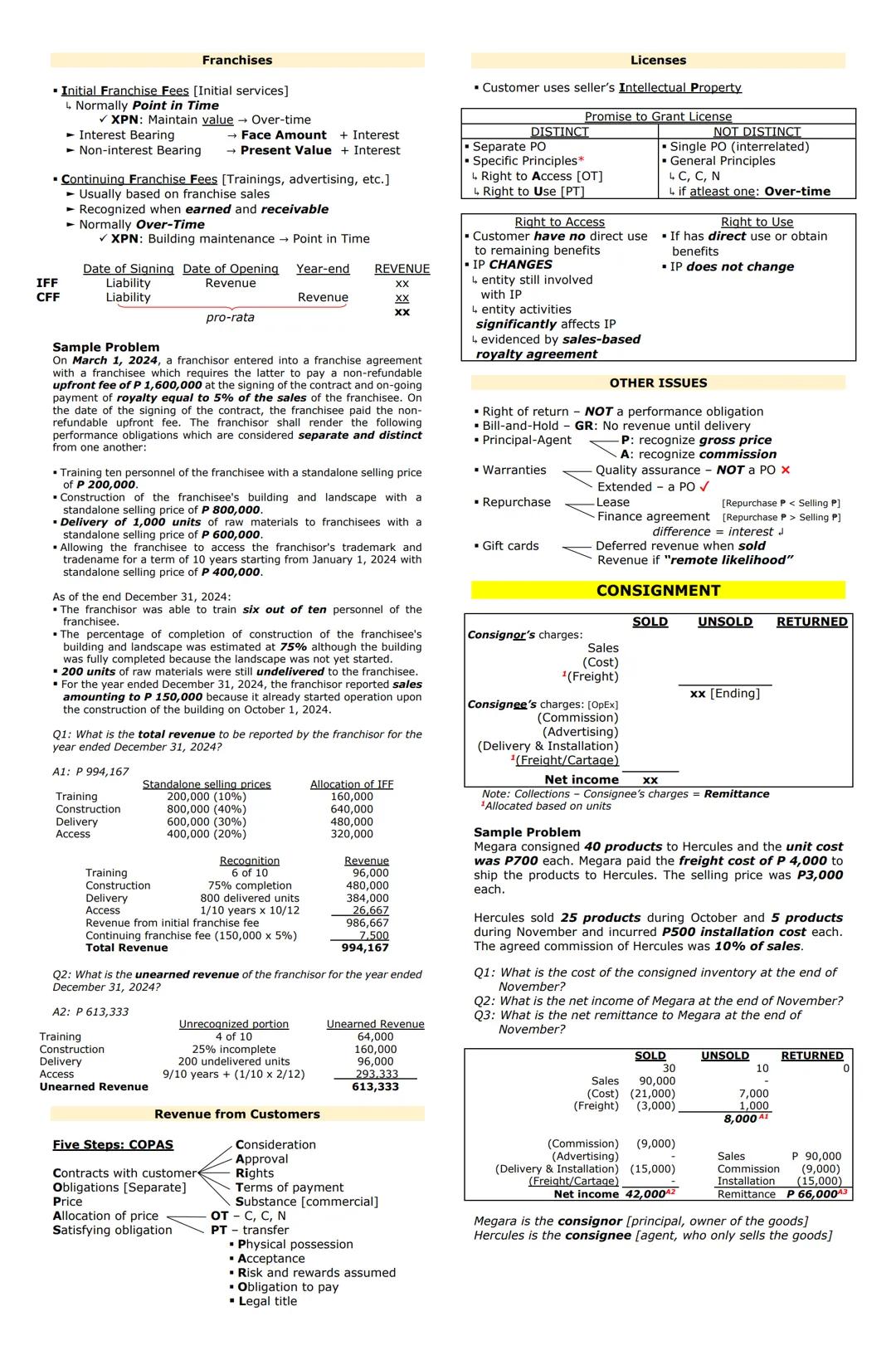

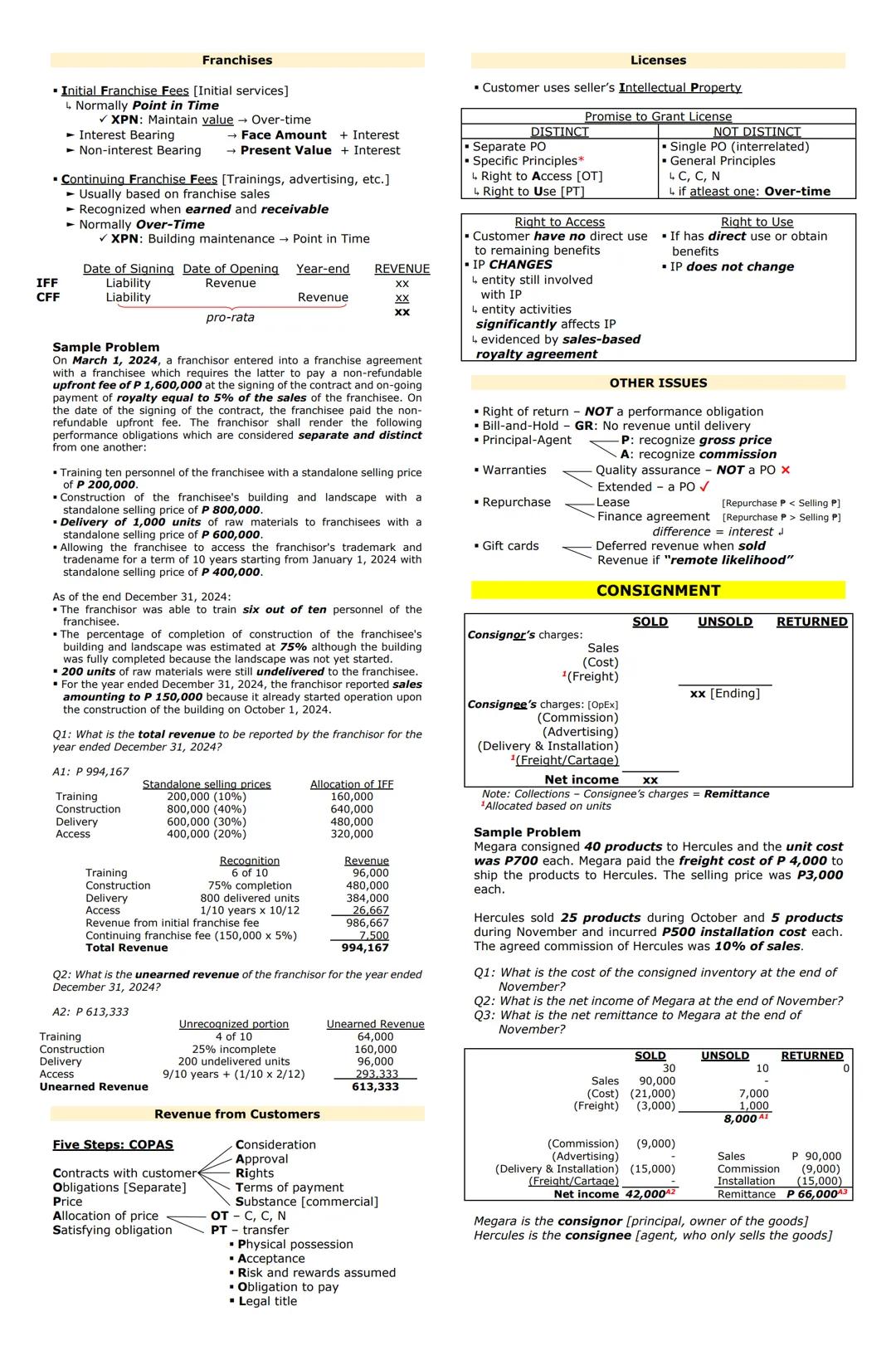

Franchise accounting revolves around two main revenue streams: initial franchise fees and continuing franchise fees. Initial franchise fees are typically recognized at a point in time when the franchisor completes initial services. However, if the franchisor must maintain value over time, recognition is spread out over that period.

Continuing franchise fees (like royalties based on sales) are usually recognized over time as the franchisee earns revenue. An exception occurs with one-time services like building maintenance, which are recognized at a point in time when completed.

Remember: Initial franchise fees that are interest-bearing should be recorded at face amount plus interest, while non-interest-bearing fees should be recorded at present value plus interest.

When a franchise agreement involves multiple performance obligations, you'll need to allocate the initial fee based on each obligation's standalone selling price. For example, if training represents 10% of total standalone value, then 10% of the initial fee would be allocated to training.

Revenue recognition follows the COPAS five-step model:

Performance obligations can be satisfied over time (OT) or at a point in time (PT). For point-in-time recognition, look for indicators like physical possession, customer acceptance, transfer of risks and rewards, obligation to pay, or legal title transfer.

Licenses allow customers to use a seller's intellectual property. The key distinction is between right to access (recognized over time) and right to use (recognized at a point in time). Right to access applies when the IP changes over time, the entity remains involved with the IP, and the entity's activities significantly affect the IP.

In consignment arrangements, the consignor (owner) retains ownership while the consignee (agent) sells the goods. The consignor records sales, costs, and freight, while the consignee records their charges like commissions, advertising, and delivery as operating expenses.

When calculating final results, track items as sold, unsold, or returned. Remember that the remittance amount equals collections minus the consignee's charges, and allocations are typically based on units.

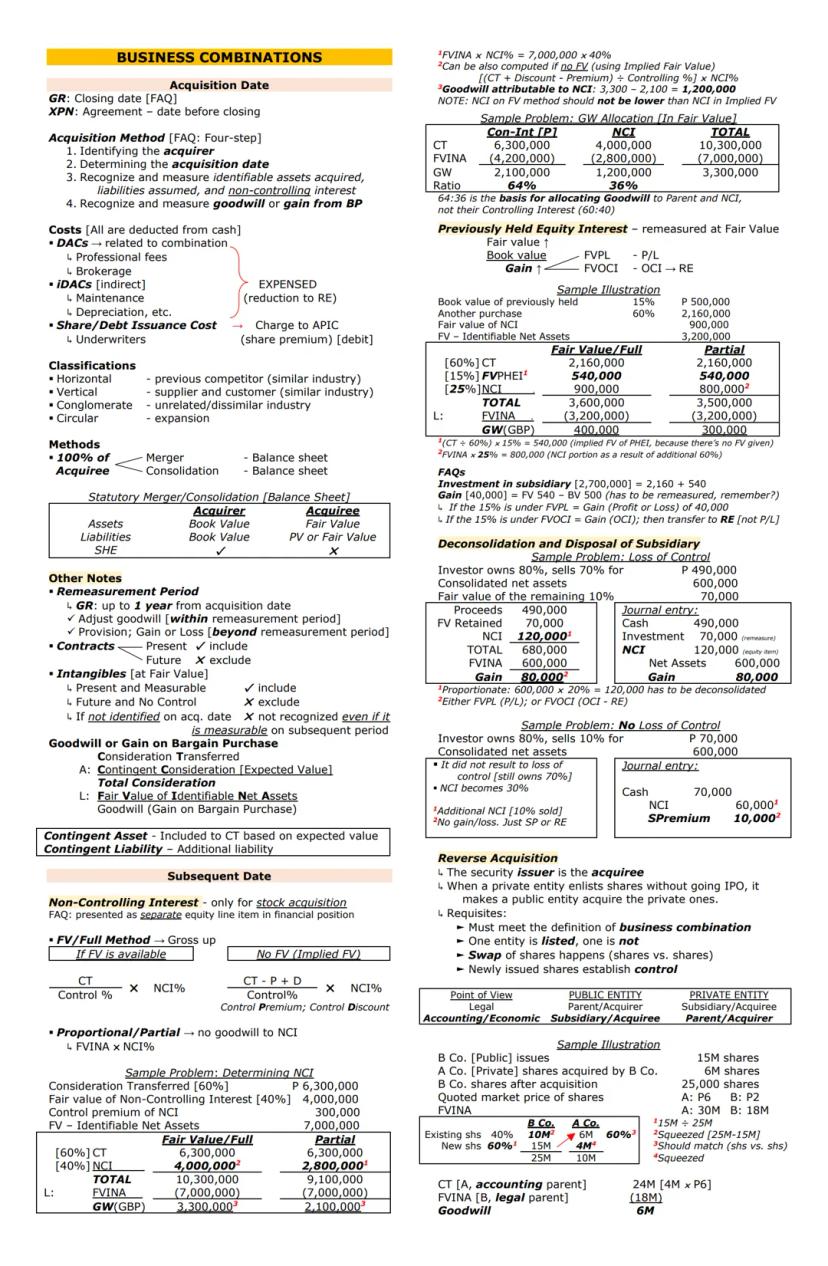

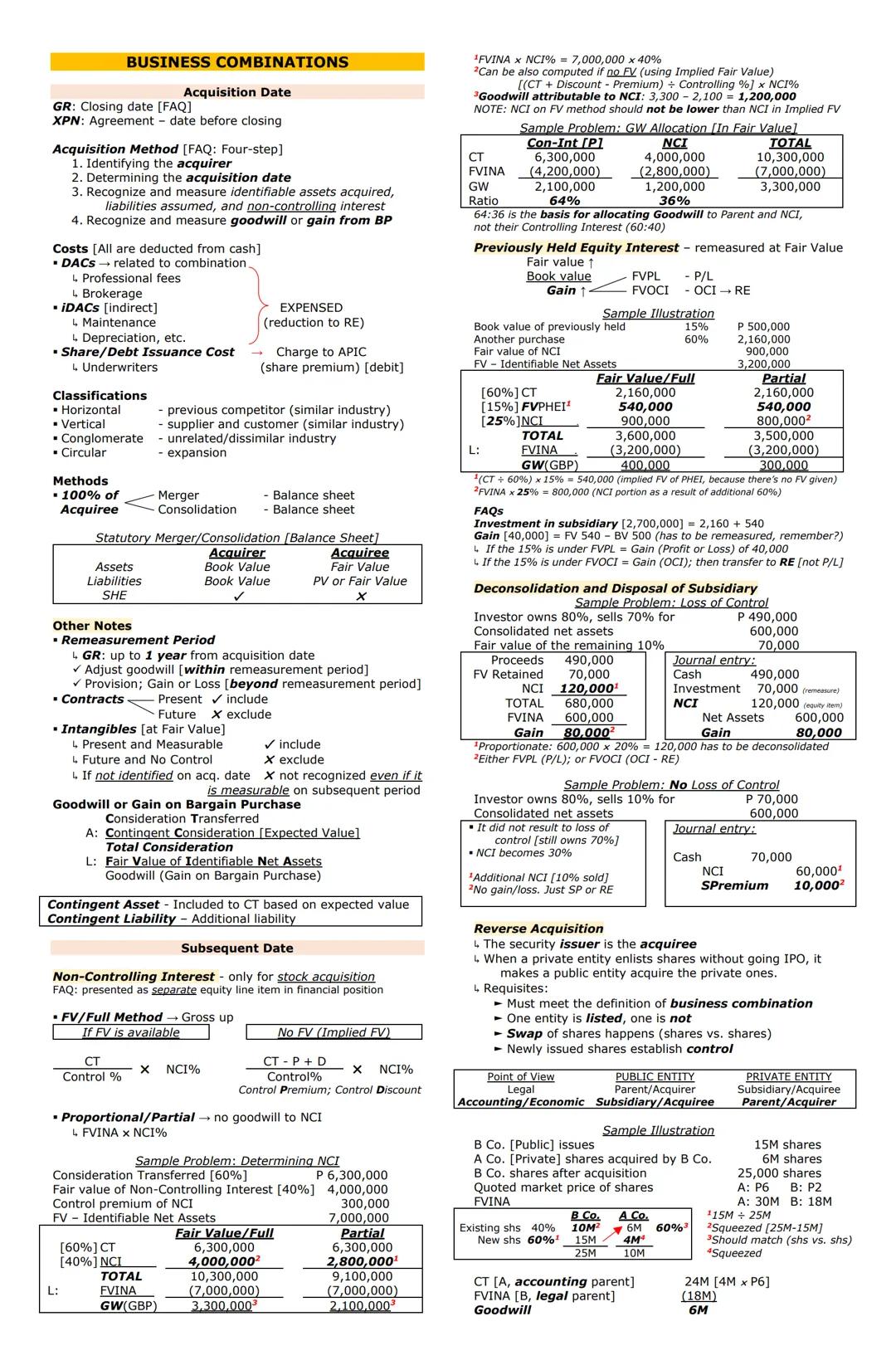

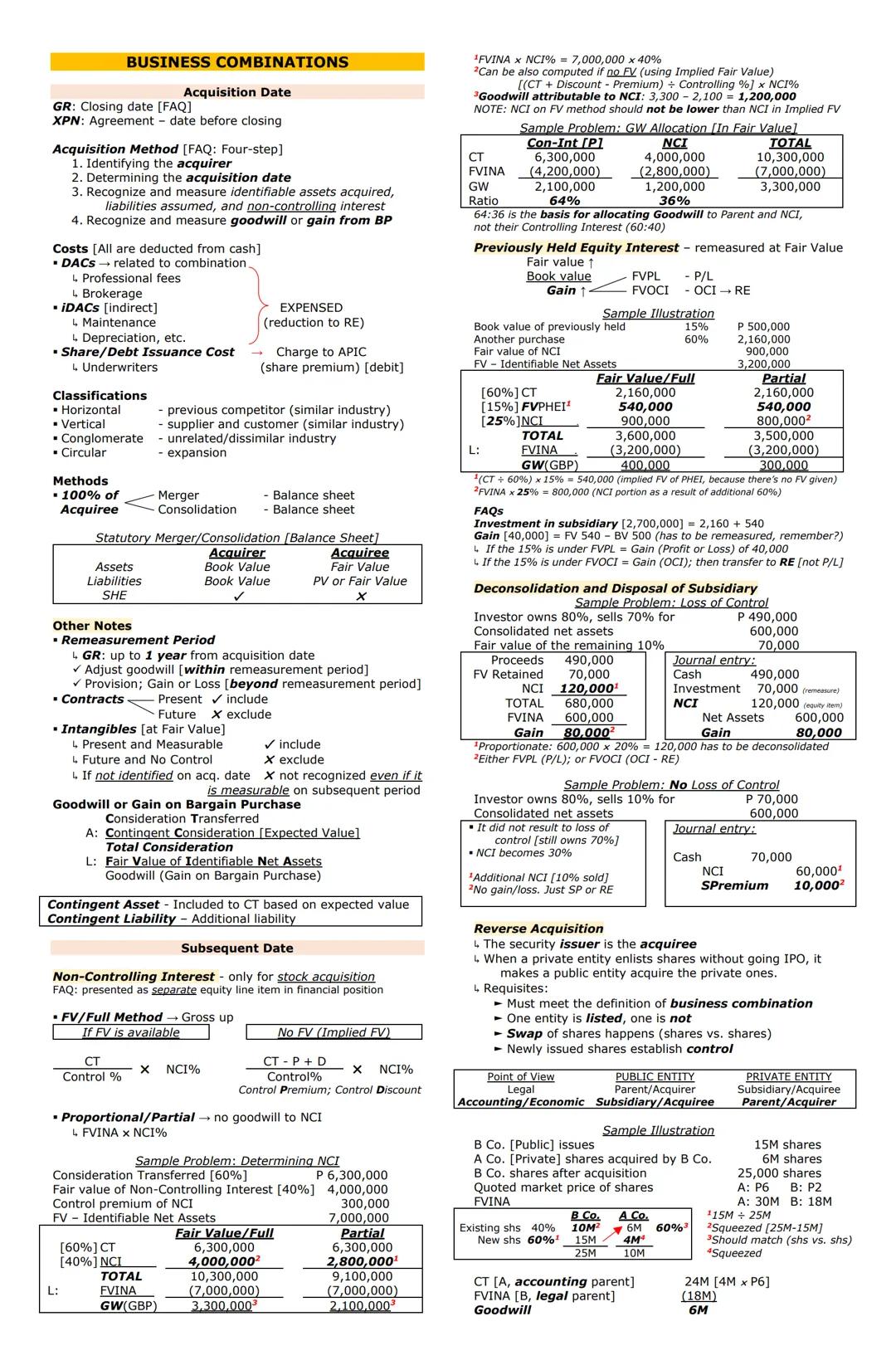

Business combinations involve one entity acquiring control of another. The acquisition date is generally the closing date, though it may be the agreement date in some cases. The acquisition method involves four steps: identifying the acquirer, determining the acquisition date, measuring assets and liabilities, and calculating goodwill or bargain purchase gain.

Transaction costs related to the combination—like professional fees, brokerage fees, and indirect costs—are expensed (reducing retained earnings). Share issuance costs are charged to additional paid-in capital or share premium.

Important: During the remeasurement period (up to one year after acquisition), adjustments to goodwill can be made as new information about acquisition-date fair values becomes available. After this period, adjustments go to profit or loss.

Business combinations are classified as horizontal (acquiring competitors), vertical , conglomerate (acquiring unrelated businesses), or circular (expansion). Methods include merger or consolidation, which combine balance sheets.

When determining non-controlling interest (NCI), two main approaches exist:

For previously held equity interests in step acquisitions, the acquirer must remeasure existing holdings at fair value. The resulting gain or loss is recognized in profit/loss (for FVPL investments) or directly to retained earnings (for FVOCI investments).

When disposing of a subsidiary, the accounting depends on whether control is lost:

Reverse acquisitions occur when a private entity effectively acquires a public entity while legally appearing as the acquiree. This typically happens when a private company wants public listing without an IPO. In these situations, the legal parent (public entity) is the accounting acquiree, while the legal subsidiary (private entity) is the accounting acquirer.

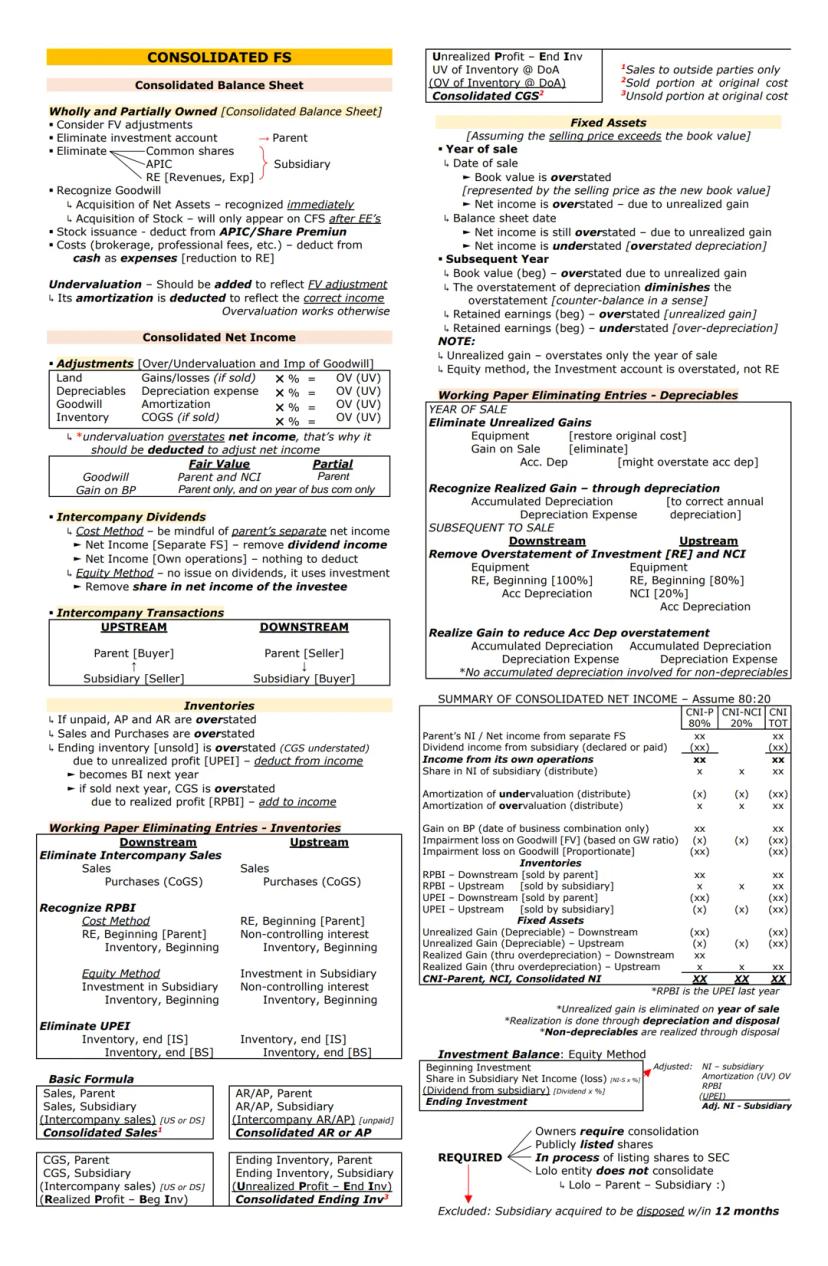

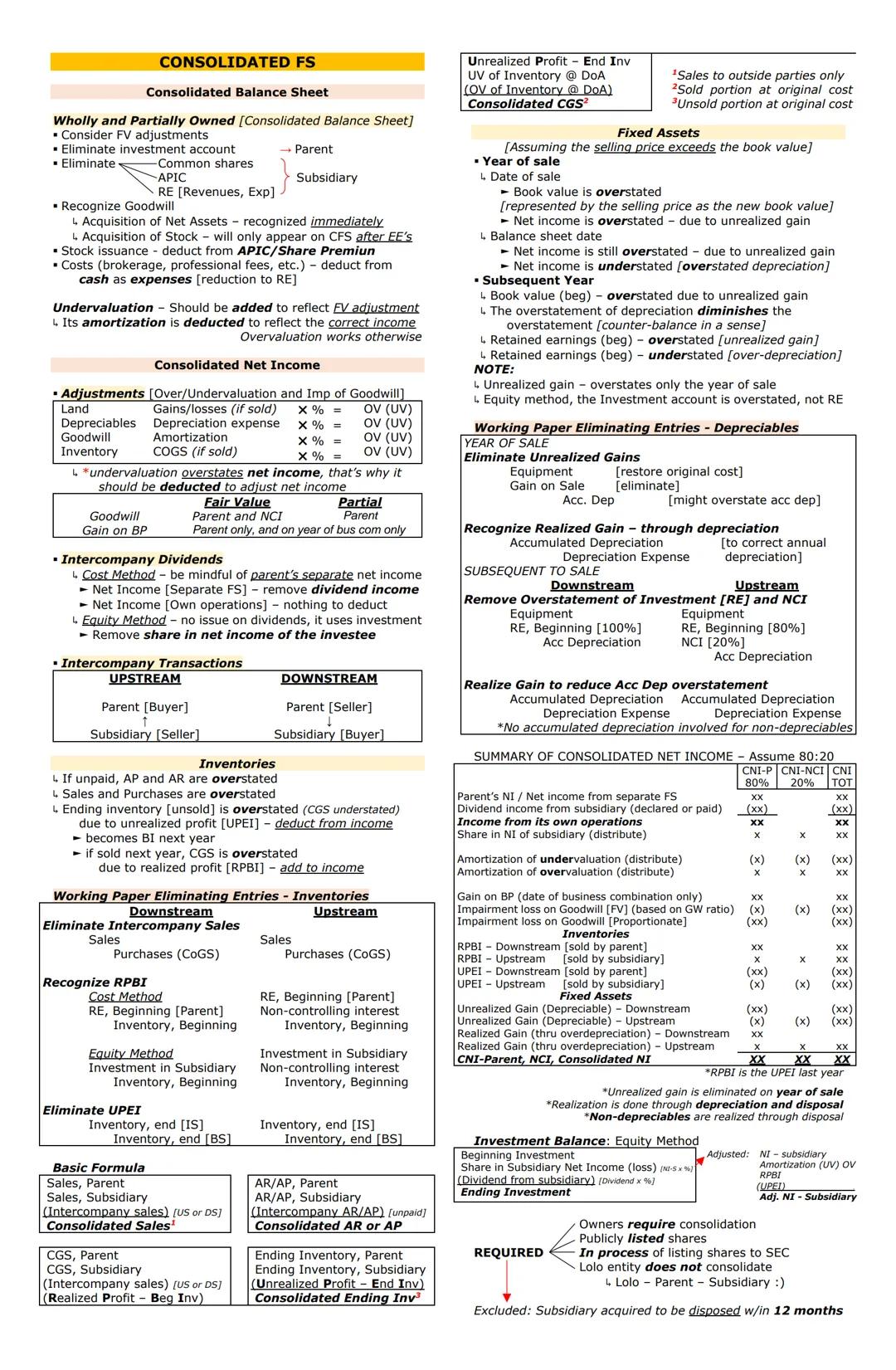

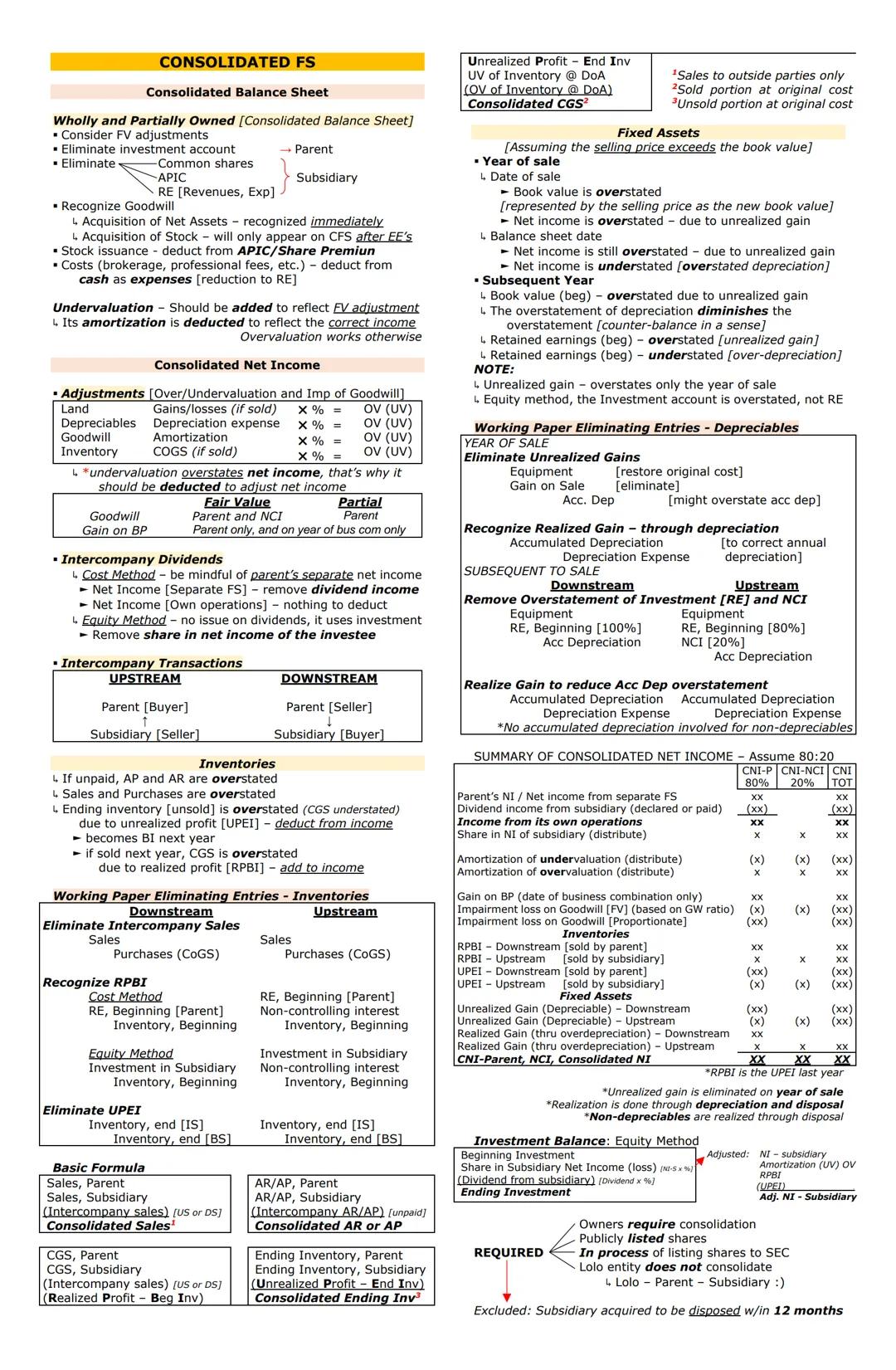

Consolidated financial statements combine parent and subsidiary companies into a single set of reports. When preparing these statements, you'll need to eliminate the investment account and recognize goodwill, while adjusting for fair value differences between book and market values.

For wholly and partially owned subsidiaries, the process includes considering fair value adjustments, eliminating intercompany accounts, and recognizing non-controlling interests. Stock issuance costs reduce Additional Paid-in Capital, while transaction costs (like professional fees) reduce retained earnings.

Key Concept: Undervaluation adjustments increase values to reflect fair value, while overvaluation adjustments decrease values. Their amortization affects consolidated net income in opposite ways.

Consolidated net income requires several adjustments, including:

For intercompany transactions, remember the direction matters:

When eliminating intercompany inventory transactions, be careful to:

For intercompany fixed asset transactions, you'll need to:

The equity method for investment accounting requires adjusting the investment balance for:

Consolidation is required when the parent has control, when shares are publicly listed or in the process of being listed, or when a grandparent entity doesn't consolidate. Exclusions apply to subsidiaries acquired solely for disposal within 12 months.

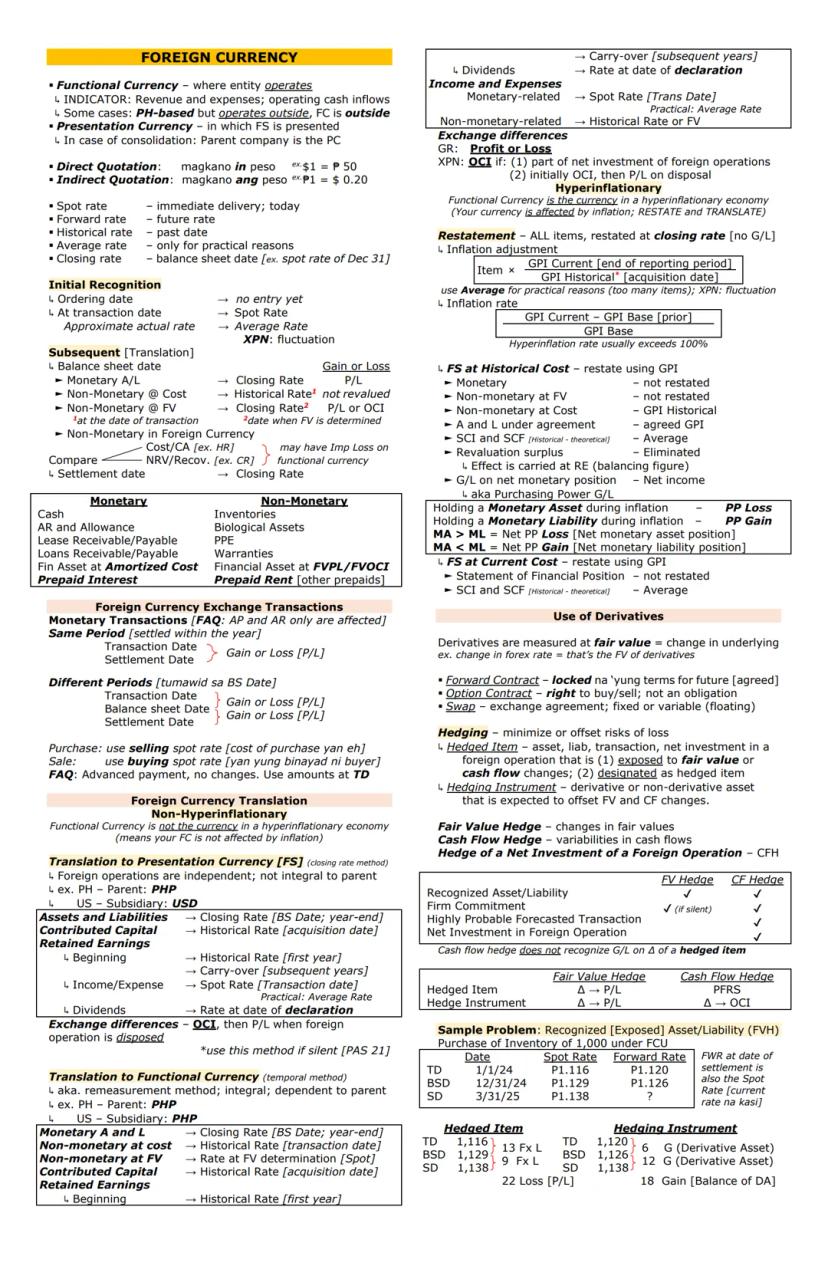

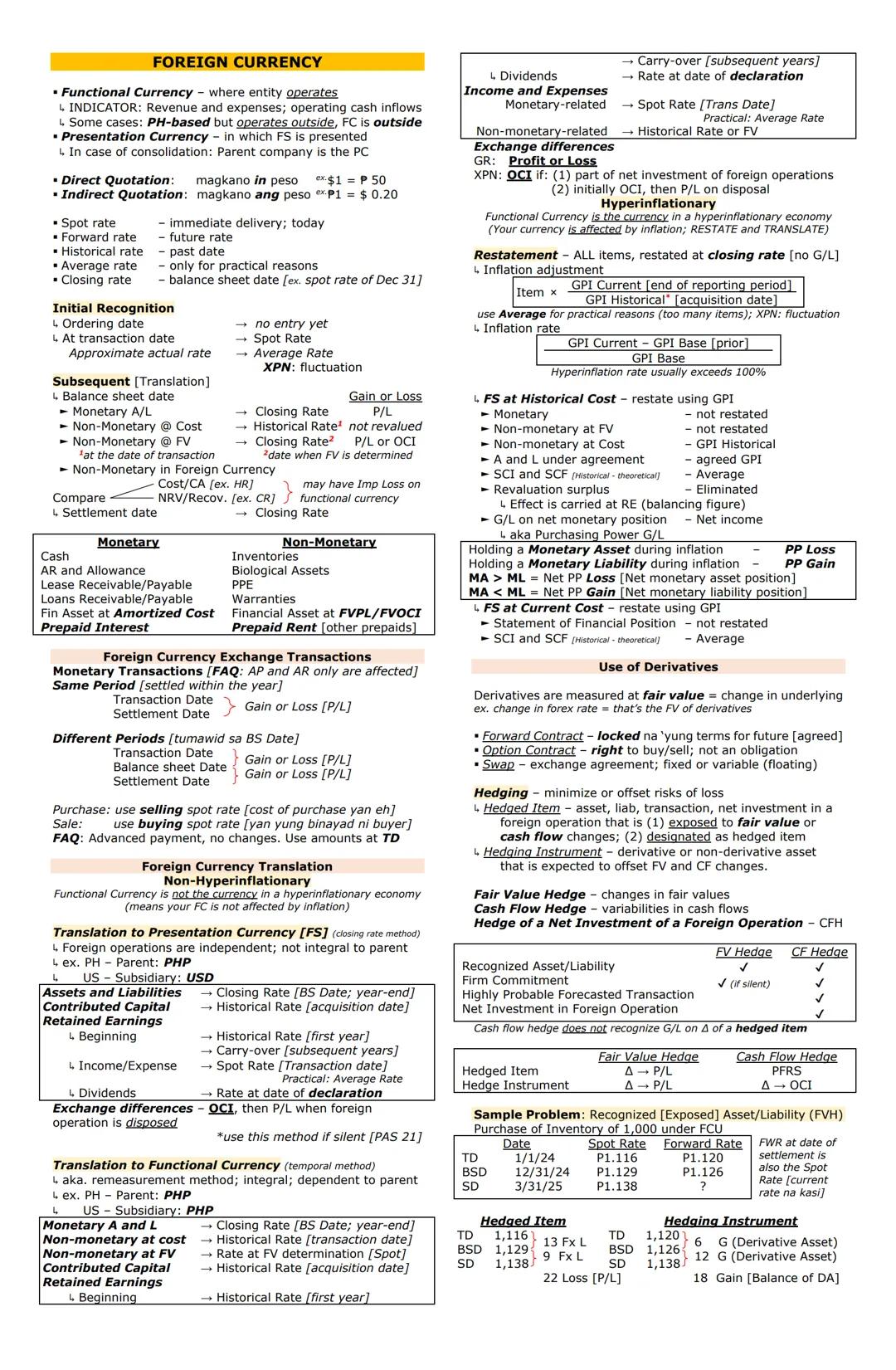

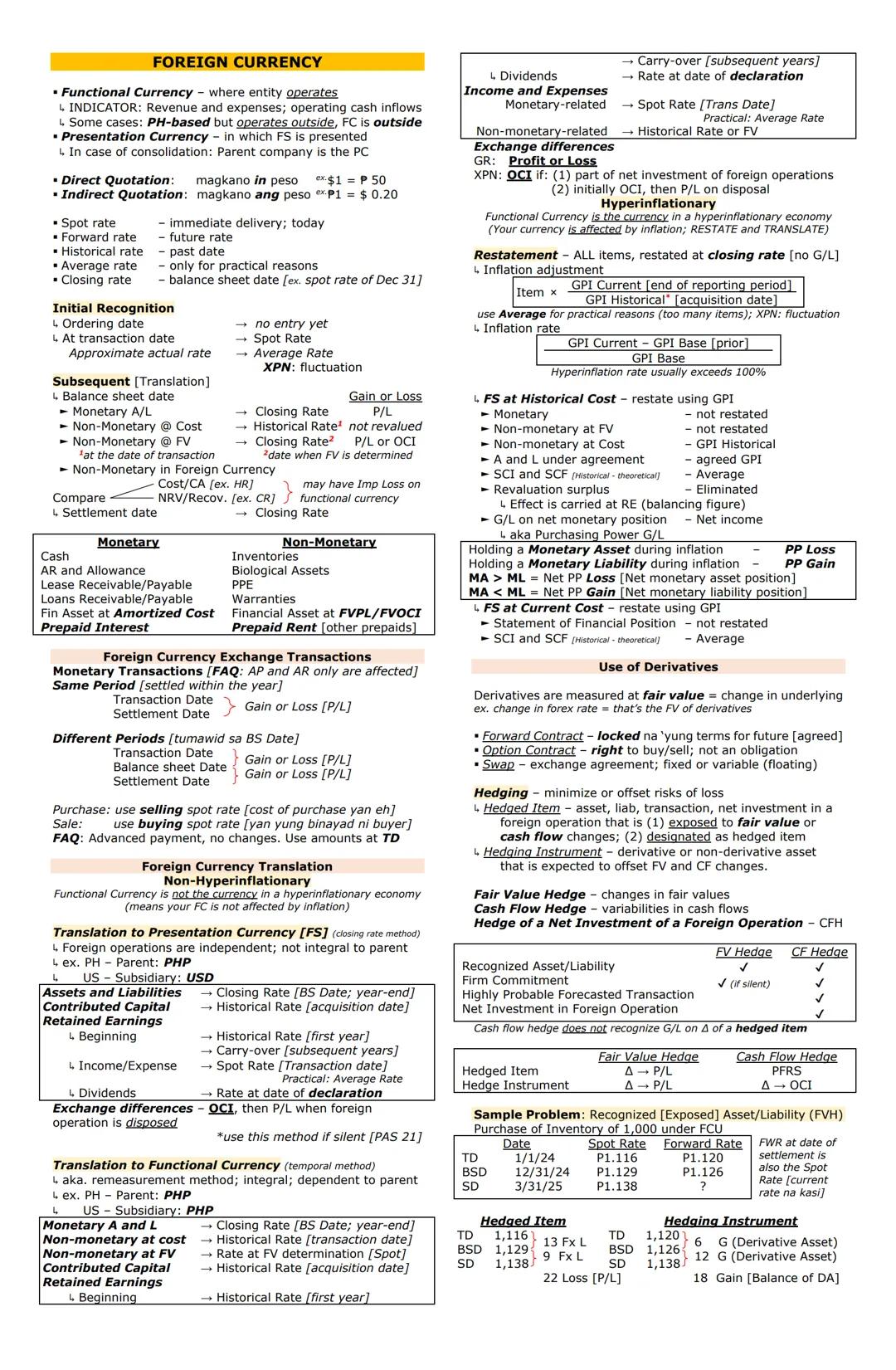

When dealing with international transactions, understanding currency distinctions is crucial. Functional currency is the currency of the primary economic environment where the entity operates. Presentation currency is the currency used in financial statements.

Exchange rates come in different forms: spot rates for immediate delivery, forward rates for future transactions, historical rates from past dates, and average rates used for practical purposes. For translation, use the closing rate at the balance sheet date.

Remember: Monetary items (like cash, receivables, and payables) are translated at closing rates with gains/losses to profit or loss. Non-monetary items at historical cost stay at historical rates, while those at fair value use rates from when fair value was determined.

When translating foreign operations to presentation currency, use the closing rate method for independent operations. This translates assets and liabilities at closing rates, equity at historical rates, and income/expenses at transaction date rates (or average rates for practicality). Exchange differences go to Other Comprehensive Income (OCI).

For dependent operations, use the temporal method (remeasurement). This translates monetary items at closing rates, non-monetary items at historical or fair value rates, and recognizes exchange differences in profit or loss.

In hyperinflationary economies, all items must be restated using a general price index before translation. This helps counter the effects of severe inflation, which typically exceeds 100%.

Derivatives help manage foreign exchange risk through:

Hedging strategies include:

For recognized assets/liabilities, fair value hedges account for both the hedged item and hedging instrument at fair value with changes to profit/loss. Cash flow hedges recognize the effective portion in OCI and the ineffective portion in profit/loss.

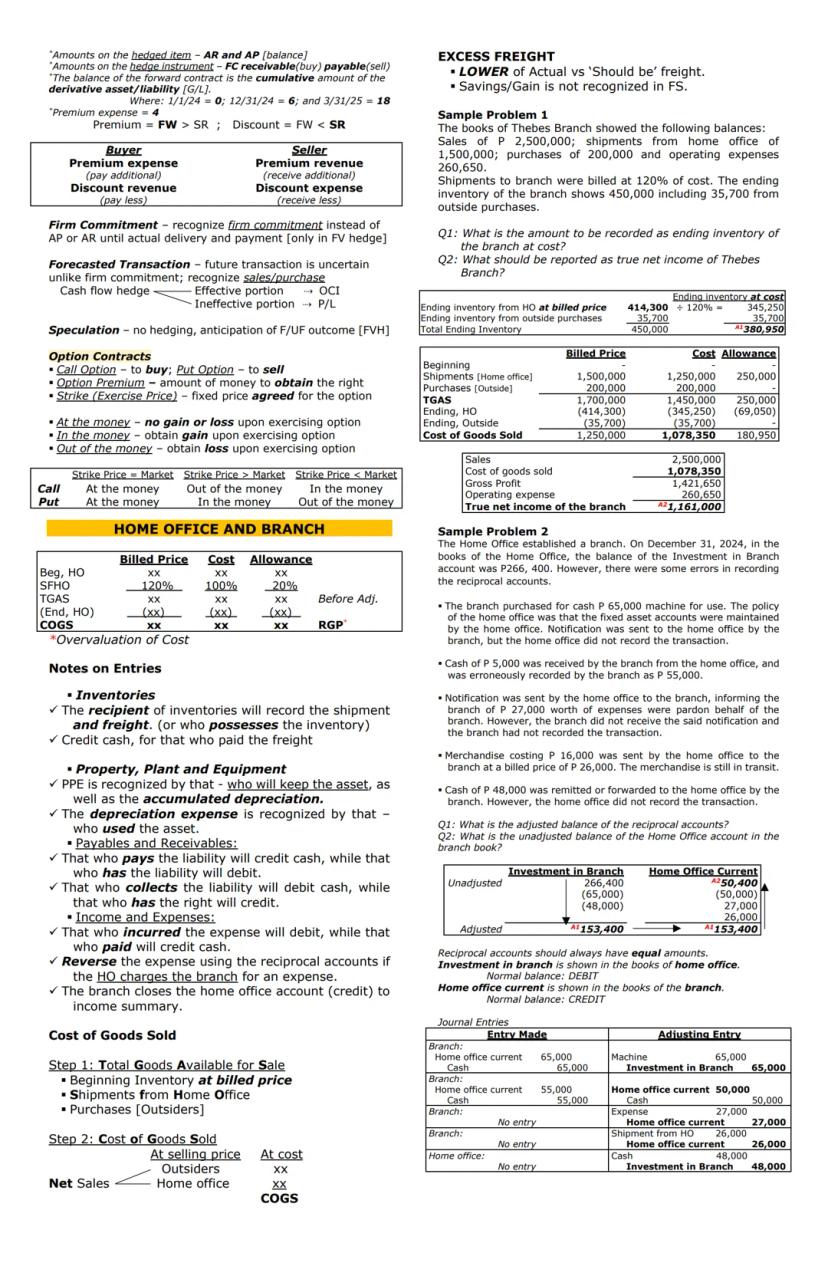

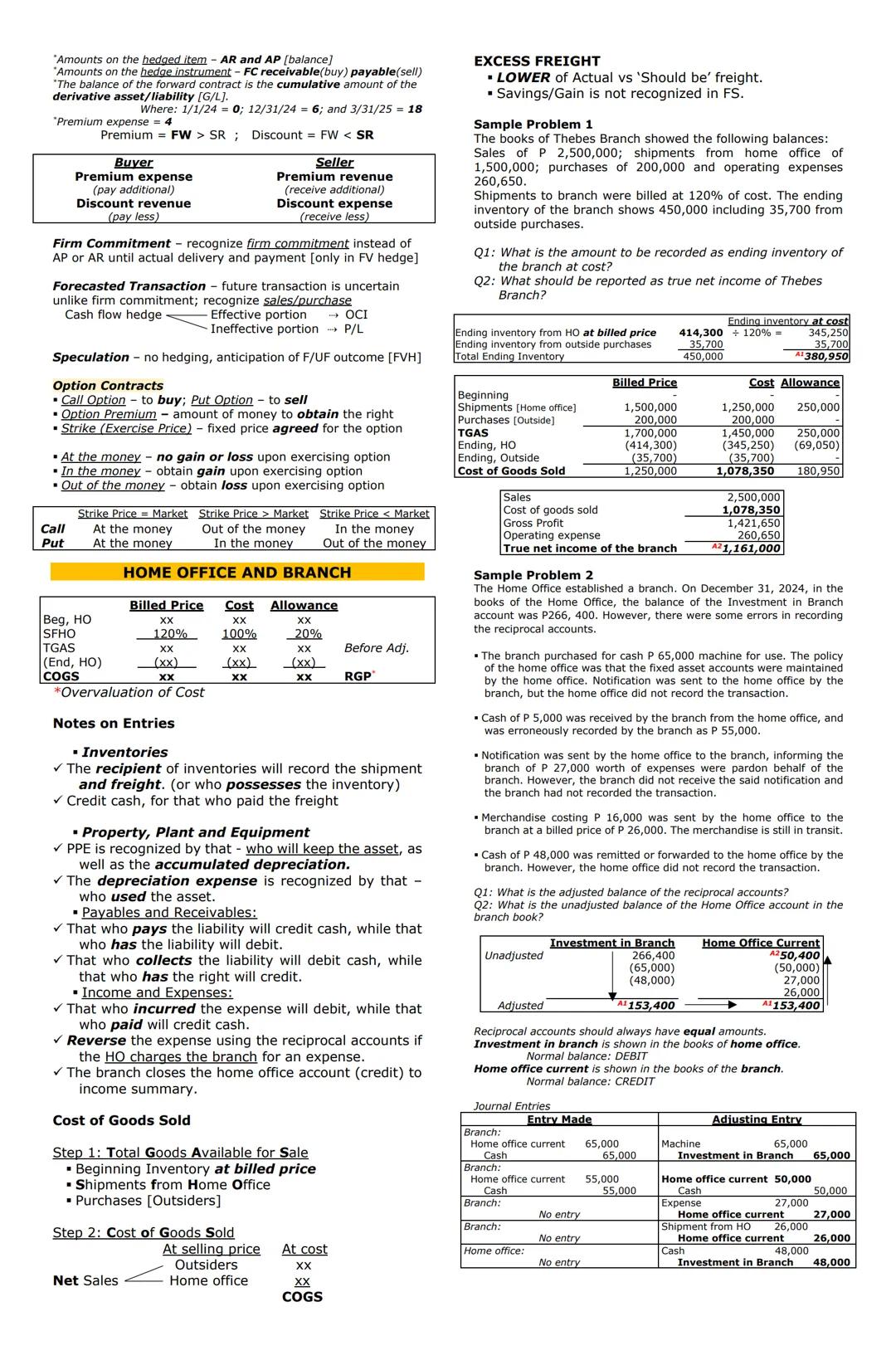

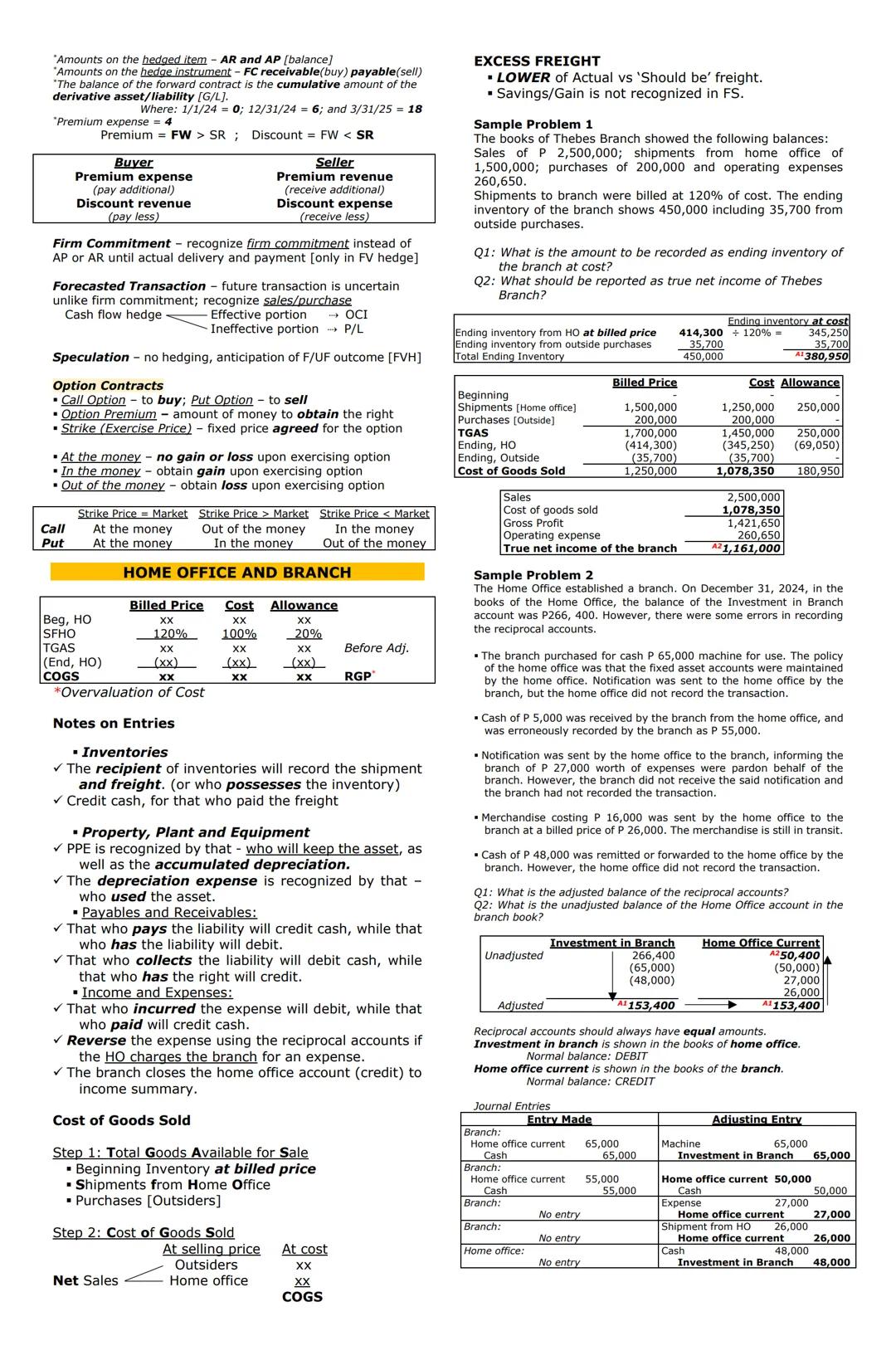

Home office and branch accounting tracks operations between a main office and its remote locations. One key area is inventory accounting, where shipments are often recorded at billed price (cost plus markup).

To determine true profit, you must eliminate the unrealized profit in ending inventory. This requires separating ending inventory into home office shipments (at billed price) and outside purchases, then converting home office inventory to cost.

Formula to Remember: Cost = Billed Price ÷ Markup Percentage

For the correct accounting entries between home office and branch:

The home office account in branch books and the investment in branch account in home office books are reciprocal accounts that should have equal balances. Any discrepancies require adjusting entries to ensure they match.

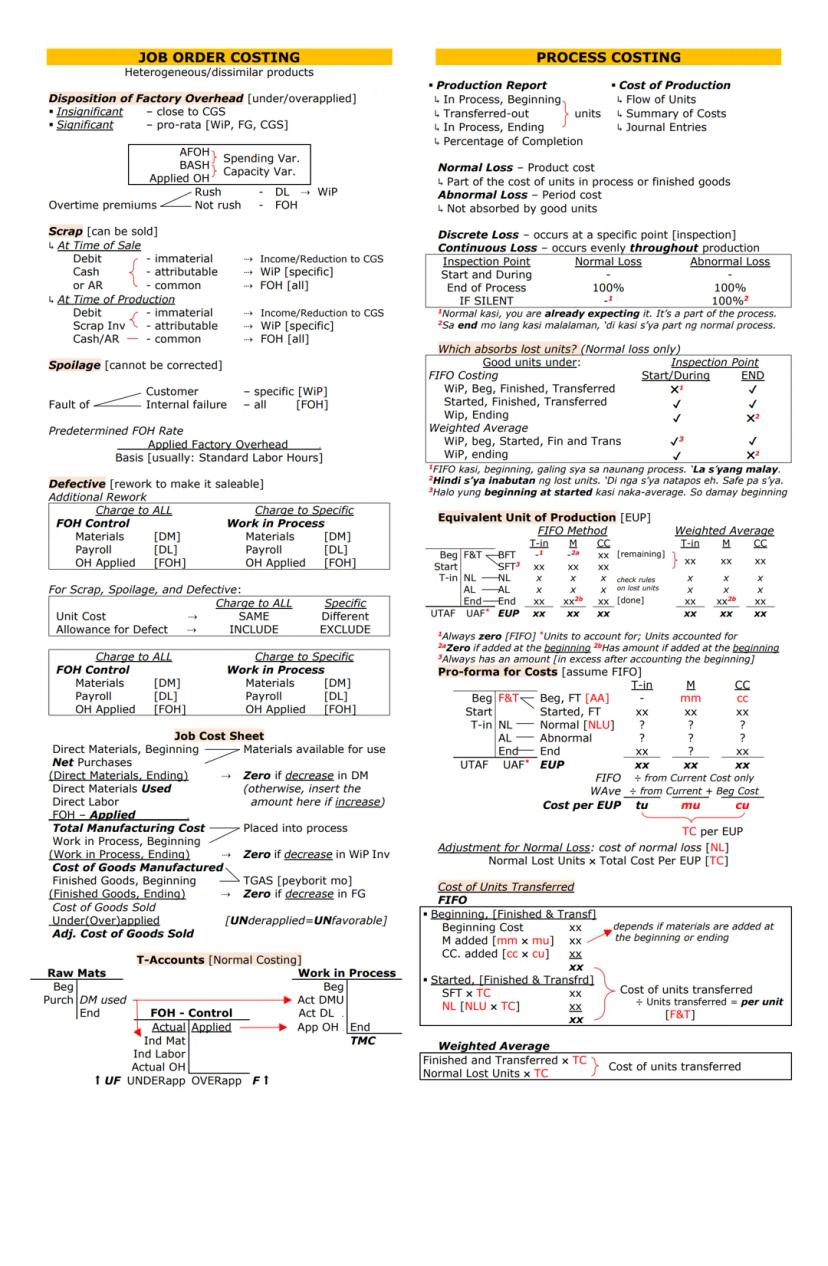

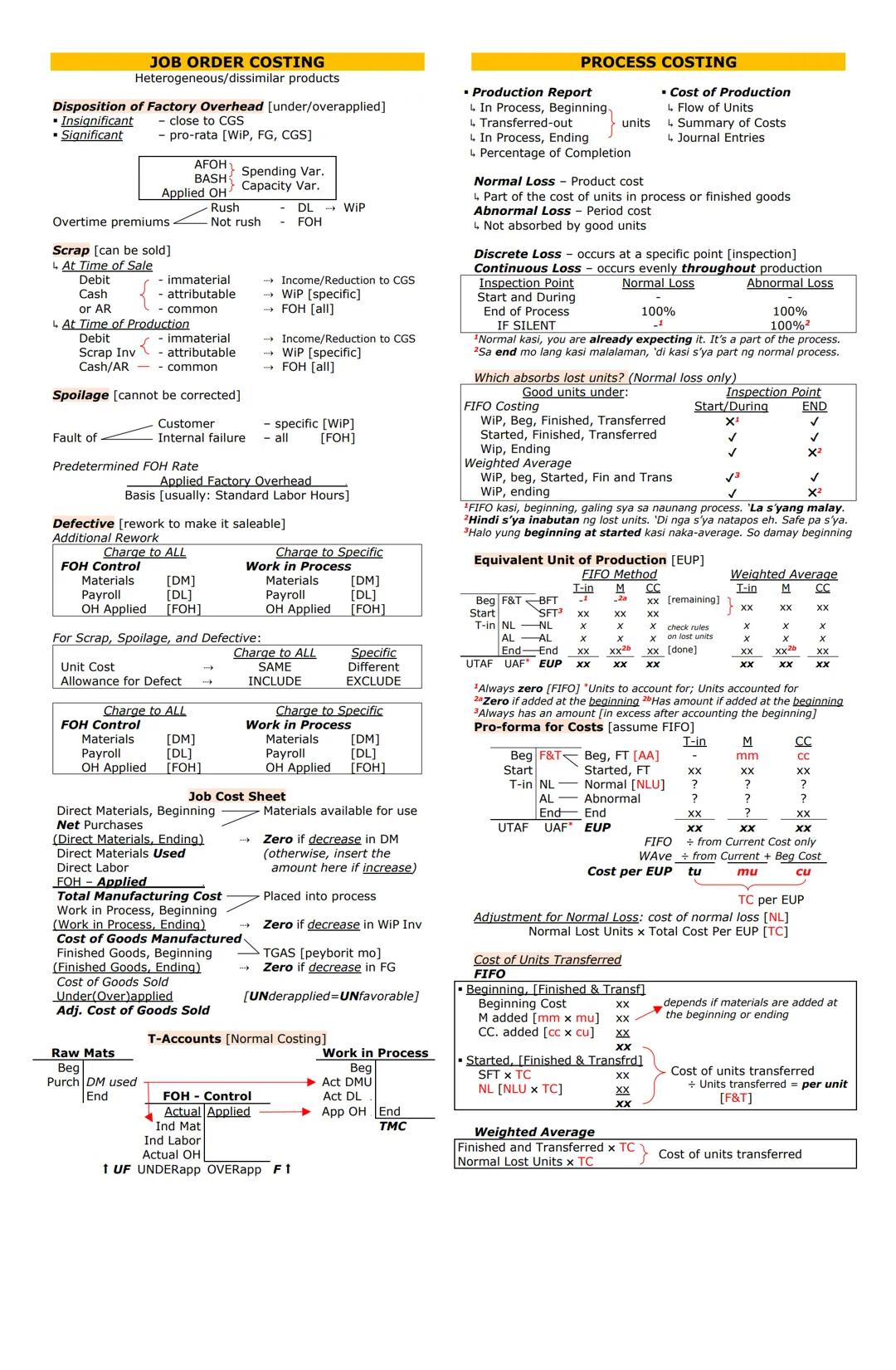

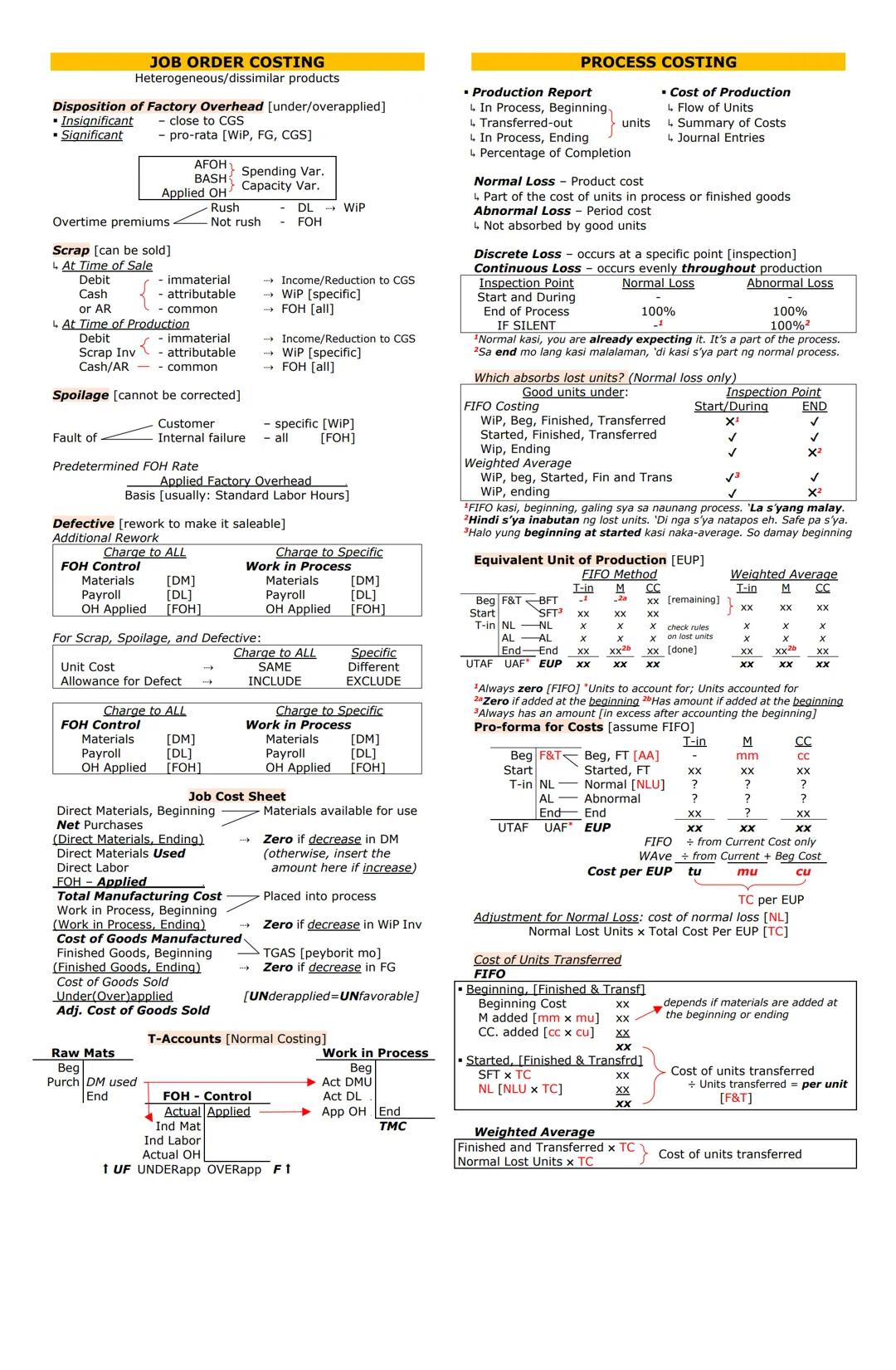

Job order costing tracks costs for heterogeneous products manufactured in distinct batches or jobs. When factory overhead is under/overapplied, insignificant differences are closed to Cost of Goods Sold, while significant differences are allocated proportionally among Work in Process, Finished Goods, and Cost of Goods Sold.

For abnormal production issues:

The predetermined factory overhead rate is calculated by dividing estimated overhead by an activity base (often standard labor hours). This rate is used to apply overhead to jobs throughout the period.

For a complete job cost sheet, track all manufacturing costs (direct materials, direct labor, and applied overhead) plus beginning work in process, then deduct ending work in process to arrive at cost of goods manufactured. Finally, adjust for beginning and ending finished goods to determine cost of goods sold.

Process costing tracks costs for homogeneous products manufactured in continuous flows. The production report shows flow of units, summarizes costs, and records journal entries, with percentage of completion being a crucial factor.

Lost units are classified as either normal (expected, absorbed by good units) or abnormal (unexpected, treated as period costs). Additionally, losses can be discrete (occurring at specific points) or continuous (occurring throughout production).

Key Distinction: Normal losses are part of the cost of good units, while abnormal losses are period costs and not absorbed by good units.

Equivalent units of production (EUP) measure partially completed units in terms of fully completed units. The calculation differs between FIFO and weighted average methods:

When calculating costs transferred out:

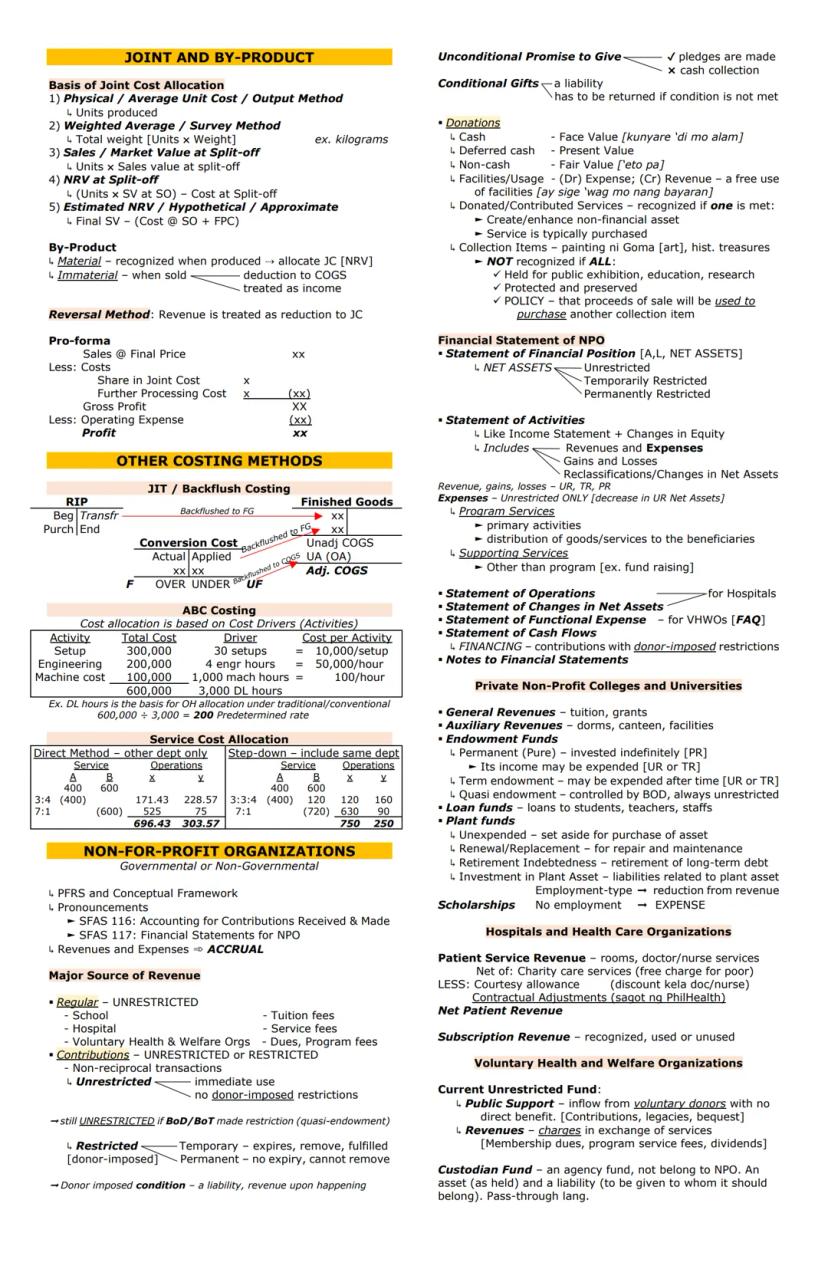

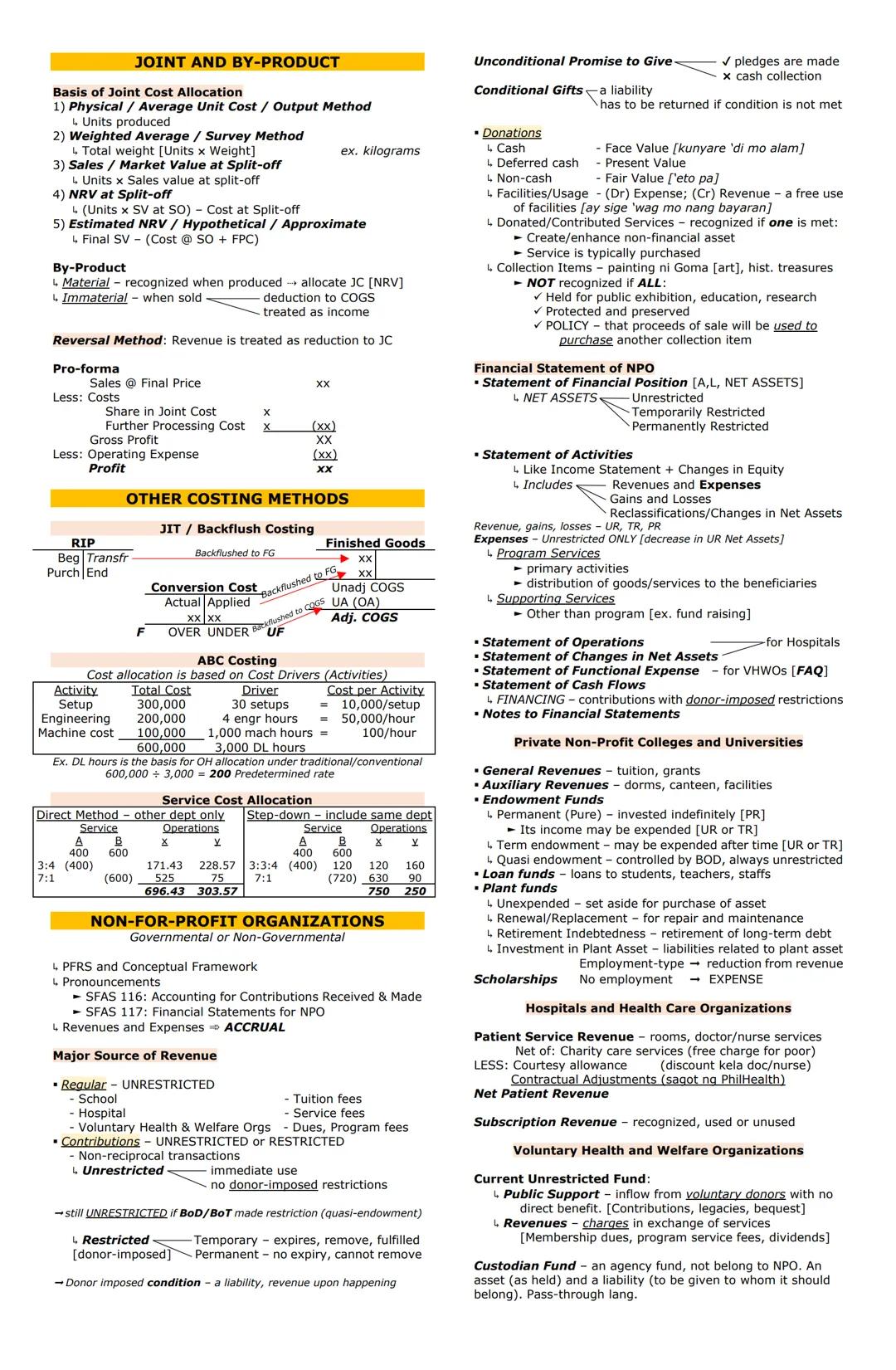

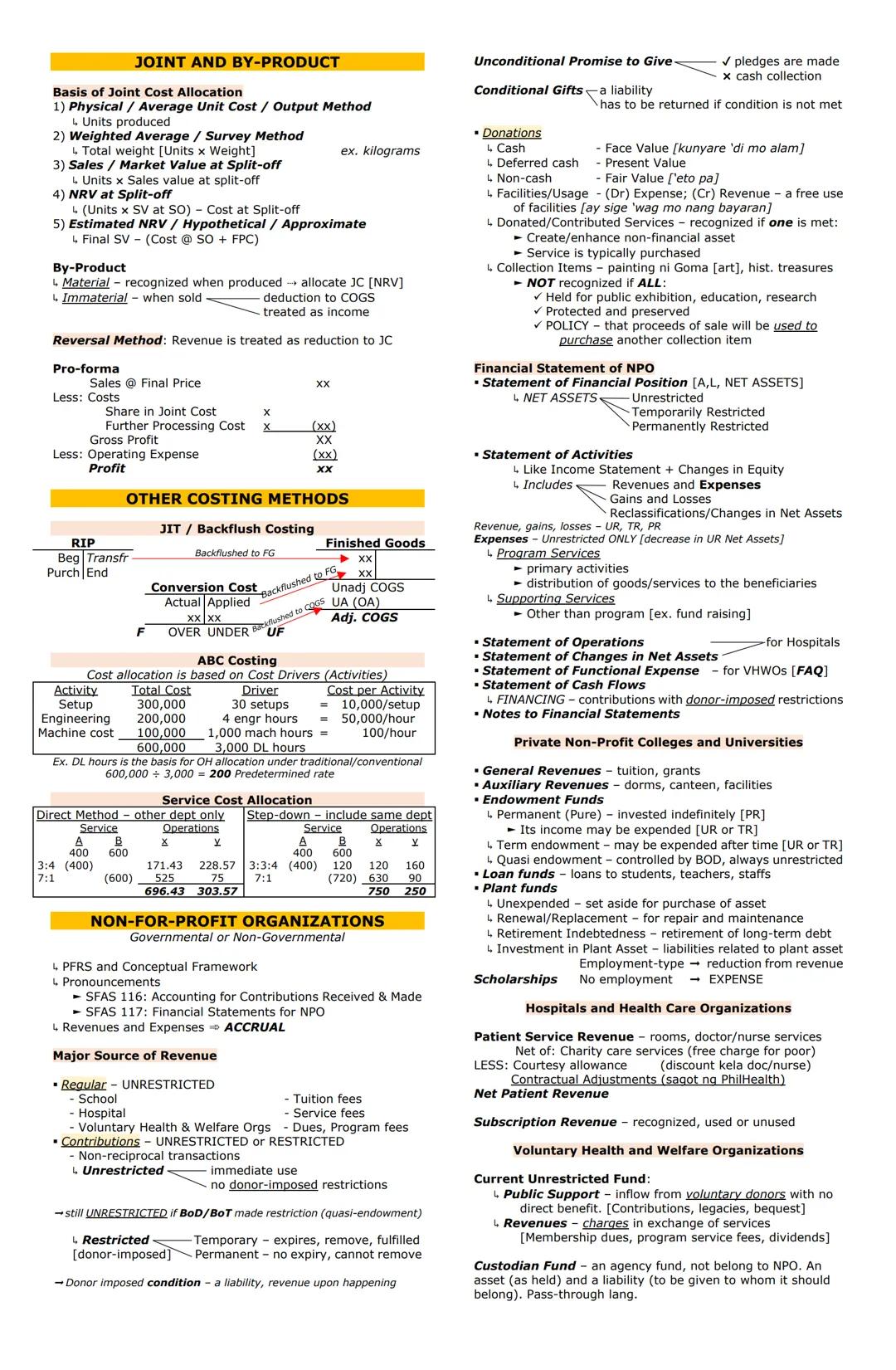

Joint products are multiple significant products that emerge from a single production process. The joint cost can be allocated using several methods:

By-products are minor outputs from the production process. If material, they're recognized when produced (allocating joint costs based on NRV). If immaterial, they're recognized when sold (as a deduction to COGS or income).

Just-in-Time (JIT) or Backflush costing simplifies the process by bypassing detailed tracking of WIP. Costs are "backflushed" directly to finished goods.

Activity-Based Costing (ABC) allocates overhead based on cost drivers (activities) rather than arbitrary bases like direct labor hours. This provides more accurate product costs by recognizing that different products consume activities differently.

Service department cost allocation distributes service department costs to operating departments using either:

Non-profit organizations (NPOs) follow specialized accounting rules while still using accrual-based accounting. Their major revenue sources include regular unrestricted income (like tuition or service fees) and contributions that may be either unrestricted or restricted.

Contributions are classified as:

Important Distinction: If the board of directors restricts funds (not donors), they remain unrestricted and are called quasi-endowments.

For donations, valuation depends on the type:

Financial statements for NPOs include:

Different types of NPOs have specialized accounting considerations:

The "custodian fund" is unique to NPOs - it's simply a pass-through account where the NPO holds funds temporarily that belong to others. It appears as both an asset and a liability since the NPO doesn't own these resources.

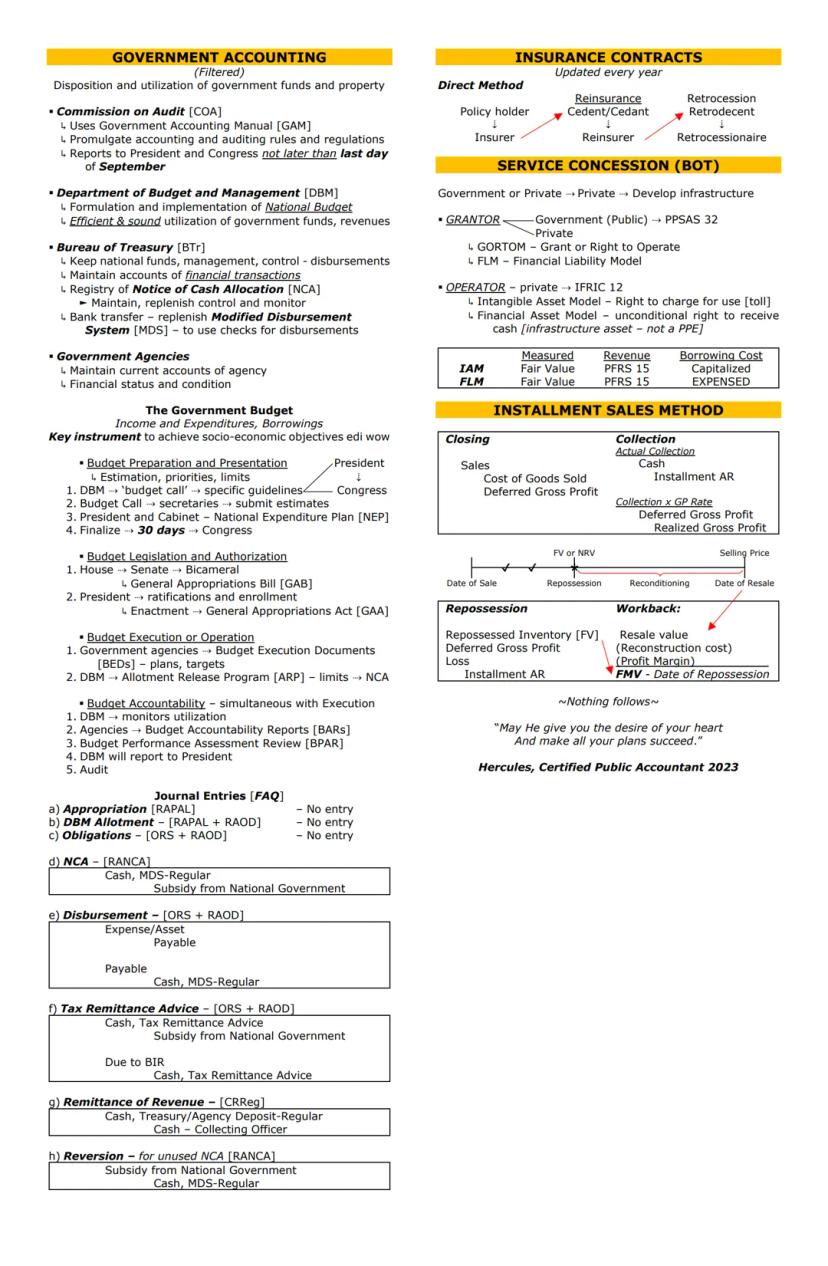

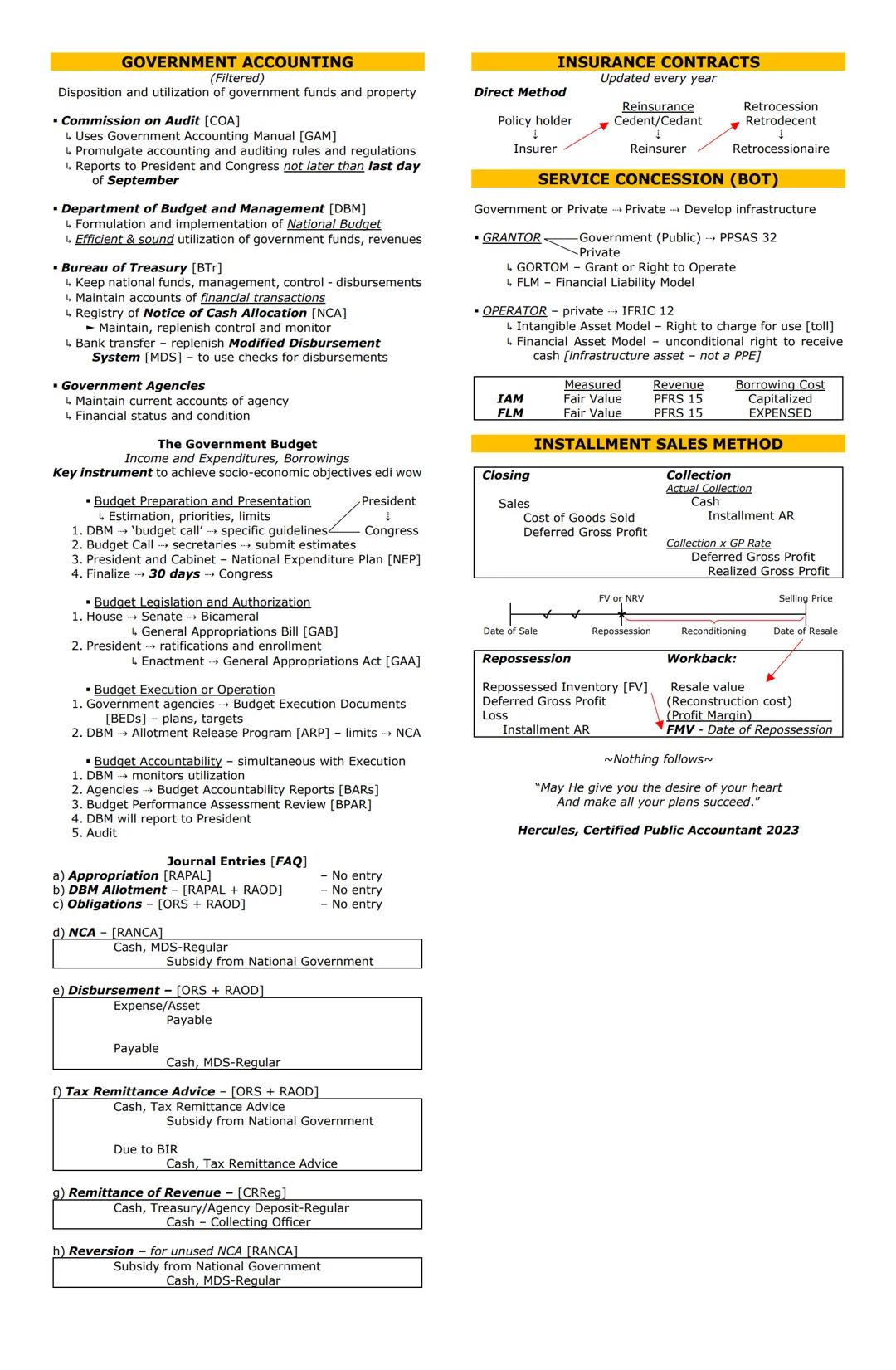

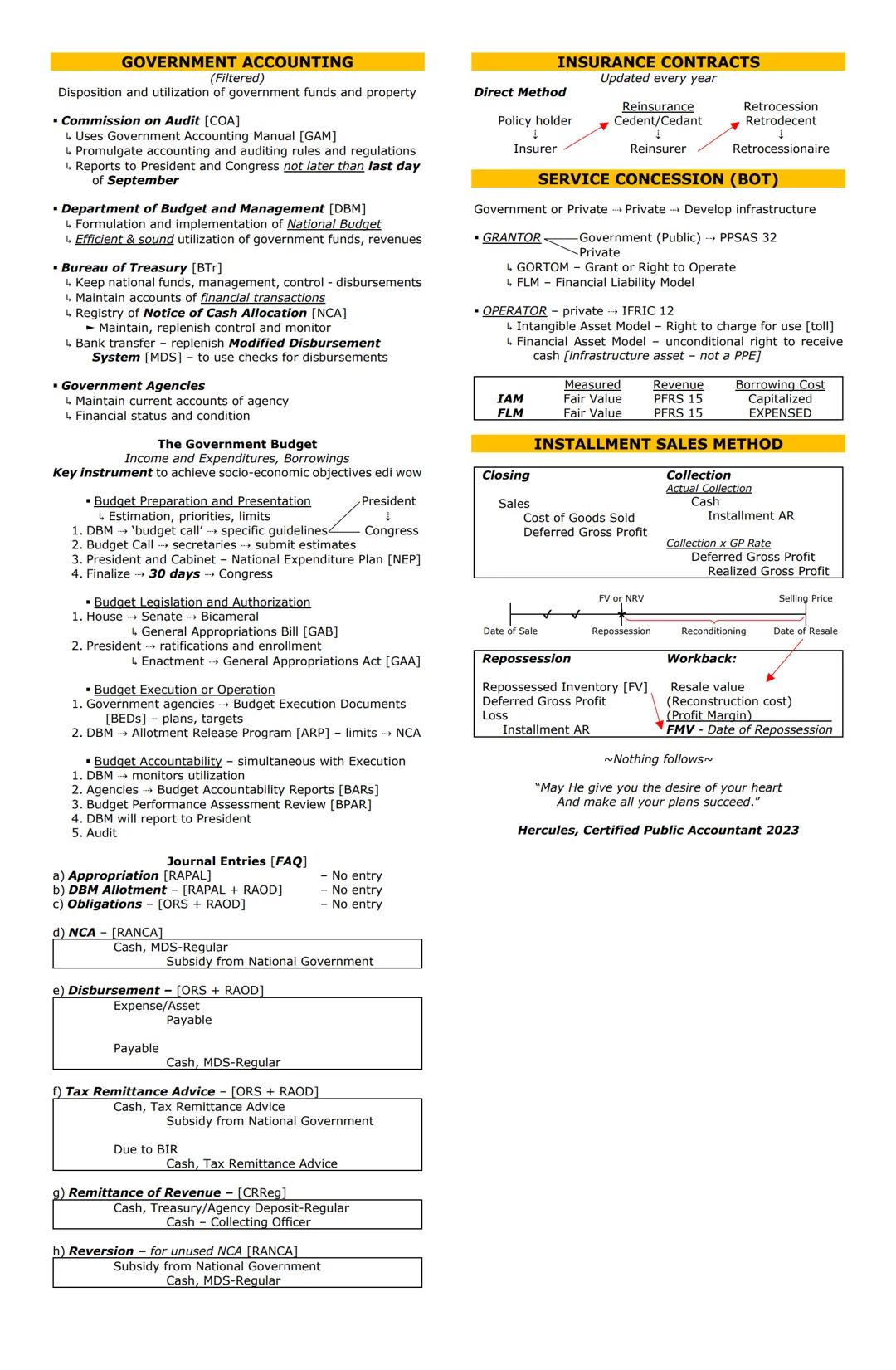

Government accounting focuses on the disposition and utilization of public funds and property. Key agencies include the Commission on Audit (COA), Department of Budget and Management (DBM), and Bureau of Treasury (BTr).

The budget process is a critical governmental function with four phases:

Remember: The budget is the government's key instrument for achieving socio-economic objectives.

Insurance Contracts involve relationships between policyholders, insurers, reinsurers, and potentially retrocessionaires in a chain of risk transfer.

Service Concession Arrangements involve private entities developing infrastructure for government use. The operator can use either the Intangible Asset Model (right to charge users) or Financial Asset Model (right to receive cash) depending on payment structure.

Installment Sales Method recognizes profit as cash is collected rather than at the point of sale. The gross profit rate (profit ÷ sales) is applied to each collection to determine realized gross profit. When repossession occurs, the repossessed inventory is recorded at fair value, with any difference between fair value and the remaining receivable recognized as gain or loss.

For government journal entries, most budget-related events (appropriation, allotment, obligations) don't require entries. Actual transactions like receiving Notice of Cash Allocation, disbursements, tax remittance, and revenue remittance do require journal entries to record the flow of funds.

Understanding these specialized accounting topics completes your overview of key accounting concepts that help organizations accurately record their financial activities and comply with relevant standards and regulations.

Our AI companion is specifically built for the needs of students. Based on the millions of content pieces we have on the platform we can provide truly meaningful and relevant answers to students. But its not only about answers, the companion is even more about guiding students through their daily learning challenges, with personalised study plans, quizzes or content pieces in the chat and 100% personalisation based on the students skills and developments.

You can download the app in the Google Play Store and in the Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

studywithnessa

@studywithnessa

Accounting is a language that tells the story of a business through numbers, transactions, and financial statements. This concise guide covers key accounting topics from partnerships and revenue recognition to specialized accounting areas like foreign currency, consolidations, and costing methods.

Access to all documents

Improve your grades

Join milions of students

Partnerships begin with formation, where partners contribute assets to create the business. When recording non-cash assets, the valuation follows a clear priority order: agreed value first, then fair market value, followed by book value, and lastly acquisition cost.

During operations, profits and losses follow their own priority hierarchy. First, check for specific agreements between partners. If none exist, profits are split equally, while losses follow the profit agreement. If all else fails, allocate based on capital contributions. For capital calculations, remember that temporary withdrawals don't affect average capital determination.

Partnership dissolution happens in several ways. A new partner might join through outside purchase or direct investment. When a new partner's investment (LAC) equals the capital credit (CC), no adjustment is needed. If LAC exceeds CC, the new partner receives a bonus. If LAC is less than CC, existing partners receive the bonus.

For liquidation, use the Safe Payments method to determine final cash distribution. First, calculate available cash by adding beginning cash and proceeds from non-current assets, then subtracting liabilities and expenses. Finally, distribute based on partners' capital interests after making proportional deductions for any negative balances.

Pro Tip: When a partnership dissolves, the most vulnerable partner is the one with the lowest maximum absorption capacity, meaning they have the least ability to absorb losses beyond their capital contribution.

In corporate liquidation, two main statements guide the process. The Statement of Affairs shows assets at realizable values and liabilities at settlement prices, helping estimate the recovery percentage. The Statement of Realization and Liquidation (SoRaL) tracks the actual results as liquidation progresses.

For long-term construction contracts under PFRS 15, use the percentage-of-completion method when estimates are reliable. This happens when customers simultaneously consume benefits, control the asset, or the seller has no alternative use for it. When estimates aren't reliable, use the zero-profit/cost recovery method.

Access to all documents

Improve your grades

Join milions of students

Franchise accounting revolves around two main revenue streams: initial franchise fees and continuing franchise fees. Initial franchise fees are typically recognized at a point in time when the franchisor completes initial services. However, if the franchisor must maintain value over time, recognition is spread out over that period.

Continuing franchise fees (like royalties based on sales) are usually recognized over time as the franchisee earns revenue. An exception occurs with one-time services like building maintenance, which are recognized at a point in time when completed.

Remember: Initial franchise fees that are interest-bearing should be recorded at face amount plus interest, while non-interest-bearing fees should be recorded at present value plus interest.

When a franchise agreement involves multiple performance obligations, you'll need to allocate the initial fee based on each obligation's standalone selling price. For example, if training represents 10% of total standalone value, then 10% of the initial fee would be allocated to training.

Revenue recognition follows the COPAS five-step model:

Performance obligations can be satisfied over time (OT) or at a point in time (PT). For point-in-time recognition, look for indicators like physical possession, customer acceptance, transfer of risks and rewards, obligation to pay, or legal title transfer.

Licenses allow customers to use a seller's intellectual property. The key distinction is between right to access (recognized over time) and right to use (recognized at a point in time). Right to access applies when the IP changes over time, the entity remains involved with the IP, and the entity's activities significantly affect the IP.

In consignment arrangements, the consignor (owner) retains ownership while the consignee (agent) sells the goods. The consignor records sales, costs, and freight, while the consignee records their charges like commissions, advertising, and delivery as operating expenses.

When calculating final results, track items as sold, unsold, or returned. Remember that the remittance amount equals collections minus the consignee's charges, and allocations are typically based on units.

Access to all documents

Improve your grades

Join milions of students

Business combinations involve one entity acquiring control of another. The acquisition date is generally the closing date, though it may be the agreement date in some cases. The acquisition method involves four steps: identifying the acquirer, determining the acquisition date, measuring assets and liabilities, and calculating goodwill or bargain purchase gain.

Transaction costs related to the combination—like professional fees, brokerage fees, and indirect costs—are expensed (reducing retained earnings). Share issuance costs are charged to additional paid-in capital or share premium.

Important: During the remeasurement period (up to one year after acquisition), adjustments to goodwill can be made as new information about acquisition-date fair values becomes available. After this period, adjustments go to profit or loss.

Business combinations are classified as horizontal (acquiring competitors), vertical , conglomerate (acquiring unrelated businesses), or circular (expansion). Methods include merger or consolidation, which combine balance sheets.

When determining non-controlling interest (NCI), two main approaches exist:

For previously held equity interests in step acquisitions, the acquirer must remeasure existing holdings at fair value. The resulting gain or loss is recognized in profit/loss (for FVPL investments) or directly to retained earnings (for FVOCI investments).

When disposing of a subsidiary, the accounting depends on whether control is lost:

Reverse acquisitions occur when a private entity effectively acquires a public entity while legally appearing as the acquiree. This typically happens when a private company wants public listing without an IPO. In these situations, the legal parent (public entity) is the accounting acquiree, while the legal subsidiary (private entity) is the accounting acquirer.

Access to all documents

Improve your grades

Join milions of students

Consolidated financial statements combine parent and subsidiary companies into a single set of reports. When preparing these statements, you'll need to eliminate the investment account and recognize goodwill, while adjusting for fair value differences between book and market values.

For wholly and partially owned subsidiaries, the process includes considering fair value adjustments, eliminating intercompany accounts, and recognizing non-controlling interests. Stock issuance costs reduce Additional Paid-in Capital, while transaction costs (like professional fees) reduce retained earnings.

Key Concept: Undervaluation adjustments increase values to reflect fair value, while overvaluation adjustments decrease values. Their amortization affects consolidated net income in opposite ways.

Consolidated net income requires several adjustments, including:

For intercompany transactions, remember the direction matters:

When eliminating intercompany inventory transactions, be careful to:

For intercompany fixed asset transactions, you'll need to:

The equity method for investment accounting requires adjusting the investment balance for:

Consolidation is required when the parent has control, when shares are publicly listed or in the process of being listed, or when a grandparent entity doesn't consolidate. Exclusions apply to subsidiaries acquired solely for disposal within 12 months.

Access to all documents

Improve your grades

Join milions of students

When dealing with international transactions, understanding currency distinctions is crucial. Functional currency is the currency of the primary economic environment where the entity operates. Presentation currency is the currency used in financial statements.

Exchange rates come in different forms: spot rates for immediate delivery, forward rates for future transactions, historical rates from past dates, and average rates used for practical purposes. For translation, use the closing rate at the balance sheet date.

Remember: Monetary items (like cash, receivables, and payables) are translated at closing rates with gains/losses to profit or loss. Non-monetary items at historical cost stay at historical rates, while those at fair value use rates from when fair value was determined.

When translating foreign operations to presentation currency, use the closing rate method for independent operations. This translates assets and liabilities at closing rates, equity at historical rates, and income/expenses at transaction date rates (or average rates for practicality). Exchange differences go to Other Comprehensive Income (OCI).

For dependent operations, use the temporal method (remeasurement). This translates monetary items at closing rates, non-monetary items at historical or fair value rates, and recognizes exchange differences in profit or loss.

In hyperinflationary economies, all items must be restated using a general price index before translation. This helps counter the effects of severe inflation, which typically exceeds 100%.

Derivatives help manage foreign exchange risk through:

Hedging strategies include:

For recognized assets/liabilities, fair value hedges account for both the hedged item and hedging instrument at fair value with changes to profit/loss. Cash flow hedges recognize the effective portion in OCI and the ineffective portion in profit/loss.

Access to all documents

Improve your grades

Join milions of students

Home office and branch accounting tracks operations between a main office and its remote locations. One key area is inventory accounting, where shipments are often recorded at billed price (cost plus markup).

To determine true profit, you must eliminate the unrealized profit in ending inventory. This requires separating ending inventory into home office shipments (at billed price) and outside purchases, then converting home office inventory to cost.

Formula to Remember: Cost = Billed Price ÷ Markup Percentage

For the correct accounting entries between home office and branch:

The home office account in branch books and the investment in branch account in home office books are reciprocal accounts that should have equal balances. Any discrepancies require adjusting entries to ensure they match.

Job order costing tracks costs for heterogeneous products manufactured in distinct batches or jobs. When factory overhead is under/overapplied, insignificant differences are closed to Cost of Goods Sold, while significant differences are allocated proportionally among Work in Process, Finished Goods, and Cost of Goods Sold.

For abnormal production issues:

The predetermined factory overhead rate is calculated by dividing estimated overhead by an activity base (often standard labor hours). This rate is used to apply overhead to jobs throughout the period.

For a complete job cost sheet, track all manufacturing costs (direct materials, direct labor, and applied overhead) plus beginning work in process, then deduct ending work in process to arrive at cost of goods manufactured. Finally, adjust for beginning and ending finished goods to determine cost of goods sold.

Access to all documents

Improve your grades

Join milions of students

Process costing tracks costs for homogeneous products manufactured in continuous flows. The production report shows flow of units, summarizes costs, and records journal entries, with percentage of completion being a crucial factor.

Lost units are classified as either normal (expected, absorbed by good units) or abnormal (unexpected, treated as period costs). Additionally, losses can be discrete (occurring at specific points) or continuous (occurring throughout production).

Key Distinction: Normal losses are part of the cost of good units, while abnormal losses are period costs and not absorbed by good units.

Equivalent units of production (EUP) measure partially completed units in terms of fully completed units. The calculation differs between FIFO and weighted average methods:

When calculating costs transferred out:

Joint products are multiple significant products that emerge from a single production process. The joint cost can be allocated using several methods:

By-products are minor outputs from the production process. If material, they're recognized when produced (allocating joint costs based on NRV). If immaterial, they're recognized when sold (as a deduction to COGS or income).

Just-in-Time (JIT) or Backflush costing simplifies the process by bypassing detailed tracking of WIP. Costs are "backflushed" directly to finished goods.

Activity-Based Costing (ABC) allocates overhead based on cost drivers (activities) rather than arbitrary bases like direct labor hours. This provides more accurate product costs by recognizing that different products consume activities differently.

Service department cost allocation distributes service department costs to operating departments using either:

Access to all documents

Improve your grades

Join milions of students

Non-profit organizations (NPOs) follow specialized accounting rules while still using accrual-based accounting. Their major revenue sources include regular unrestricted income (like tuition or service fees) and contributions that may be either unrestricted or restricted.

Contributions are classified as:

Important Distinction: If the board of directors restricts funds (not donors), they remain unrestricted and are called quasi-endowments.

For donations, valuation depends on the type:

Financial statements for NPOs include:

Different types of NPOs have specialized accounting considerations:

The "custodian fund" is unique to NPOs - it's simply a pass-through account where the NPO holds funds temporarily that belong to others. It appears as both an asset and a liability since the NPO doesn't own these resources.

Access to all documents

Improve your grades

Join milions of students

Government accounting focuses on the disposition and utilization of public funds and property. Key agencies include the Commission on Audit (COA), Department of Budget and Management (DBM), and Bureau of Treasury (BTr).

The budget process is a critical governmental function with four phases:

Remember: The budget is the government's key instrument for achieving socio-economic objectives.

Insurance Contracts involve relationships between policyholders, insurers, reinsurers, and potentially retrocessionaires in a chain of risk transfer.

Service Concession Arrangements involve private entities developing infrastructure for government use. The operator can use either the Intangible Asset Model (right to charge users) or Financial Asset Model (right to receive cash) depending on payment structure.

Installment Sales Method recognizes profit as cash is collected rather than at the point of sale. The gross profit rate (profit ÷ sales) is applied to each collection to determine realized gross profit. When repossession occurs, the repossessed inventory is recorded at fair value, with any difference between fair value and the remaining receivable recognized as gain or loss.

For government journal entries, most budget-related events (appropriation, allotment, obligations) don't require entries. Actual transactions like receiving Notice of Cash Allocation, disbursements, tax remittance, and revenue remittance do require journal entries to record the flow of funds.

Understanding these specialized accounting topics completes your overview of key accounting concepts that help organizations accurately record their financial activities and comply with relevant standards and regulations.

Our AI companion is specifically built for the needs of students. Based on the millions of content pieces we have on the platform we can provide truly meaningful and relevant answers to students. But its not only about answers, the companion is even more about guiding students through their daily learning challenges, with personalised study plans, quizzes or content pieces in the chat and 100% personalisation based on the students skills and developments.

You can download the app in the Google Play Store and in the Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

7

Smart Tools NEW

Transform this note into: ✓ 50+ Practice Questions ✓ Interactive Flashcards ✓ Full Practice Test ✓ Essay Outlines

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user