Ready to dive into auditing? This guide breaks down the... Show more

Sign up to see the contentIt's free!

Access to all documents

Improve your grades

Join milions of students

Subjects

Triangle Congruence and Similarity Theorems

Triangle Properties and Classification

Linear Equations and Graphs

Geometric Angle Relationships

Trigonometric Functions and Identities

Equation Solving Techniques

Circle Geometry Fundamentals

Division Operations and Methods

Basic Differentiation Rules

Exponent and Logarithm Properties

Show all topics

Human Organ Systems

Reproductive Cell Cycles

Biological Sciences Subdisciplines

Cellular Energy Metabolism

Autotrophic Energy Processes

Inheritance Patterns and Principles

Biomolecular Structure and Organization

Cell Cycle and Division Mechanics

Cellular Organization and Development

Biological Structural Organization

Show all topics

Chemical Sciences and Applications

Atomic Structure and Composition

Molecular Electron Structure Representation

Atomic Electron Behavior

Matter Properties and Water

Mole Concept and Calculations

Gas Laws and Behavior

Periodic Table Organization

Chemical Thermodynamics Fundamentals

Chemical Bond Types and Properties

Show all topics

European Renaissance and Enlightenment

European Cultural Movements 800-1920

American Revolution Era 1763-1797

American Civil War 1861-1865

Global Imperial Systems

Mongol and Chinese Dynasties

U.S. Presidents and World Leaders

Historical Sources and Documentation

World Wars Era and Impact

World Religious Systems

Show all topics

Classic and Contemporary Novels

Literary Character Analysis

Rhetorical Theory and Practice

Classic Literary Narratives

Reading Analysis and Interpretation

Narrative Structure and Techniques

English Language Components

Influential English-Language Authors

Basic Sentence Structure

Narrative Voice and Perspective

Show all topics

272

•

Jan 28, 2026

•

studywithnessa

@studywithnessa

Ready to dive into auditing? This guide breaks down the... Show more

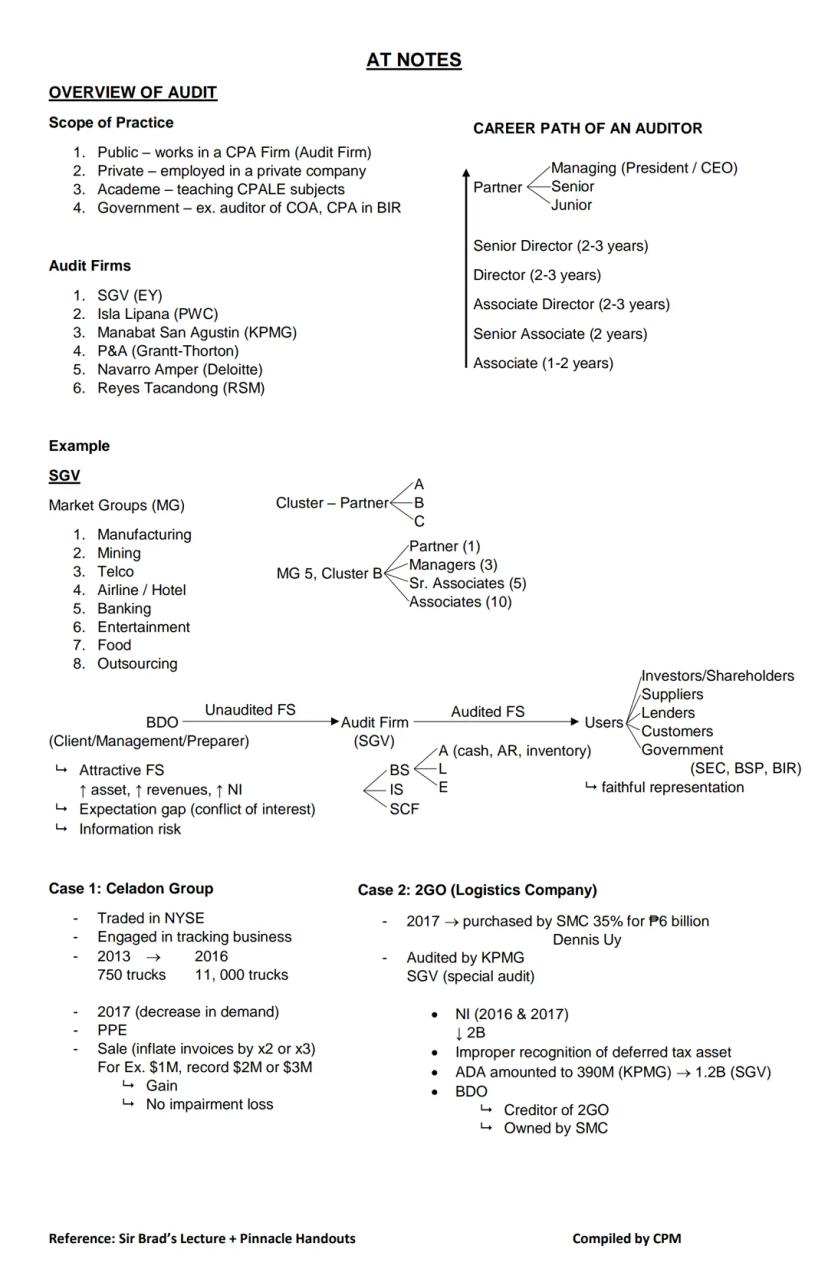

Ever wondered what auditors actually do? Certified Public Accountants (CPAs) can work in several environments, including public practice at audit firms, private companies, academic institutions, or government agencies like the Commission on Audit.

The "Big 5" audit firms in the Philippines include SGV (EY), Isla Lipana (PWC), Manabat San Agustin (KPMG), P&A , and Navarro Amper (Deloitte). These firms are organized by market groups that specialize in specific industries like manufacturing, mining, telecommunications, and banking.

A typical career path in auditing starts as an Associate , progressing to Senior Associate, then through various director levels before potentially becoming a Partner. Partners typically oversee multiple managers, who in turn supervise senior associates and associates in a pyramid structure.

Reality Check: The auditing profession exists largely because of the "expectation gap" - company management wants to present attractive financial statements (with higher assets and revenues), while users need reliable information. Recent scandals at Celadon Group and 2GO demonstrate why independent auditors are crucial for verifying financial information.

The audit process helps reduce information risk by providing assurance that financial statements fairly represent a company's performance and position, giving stakeholders more confidence in the data they're using to make decisions.

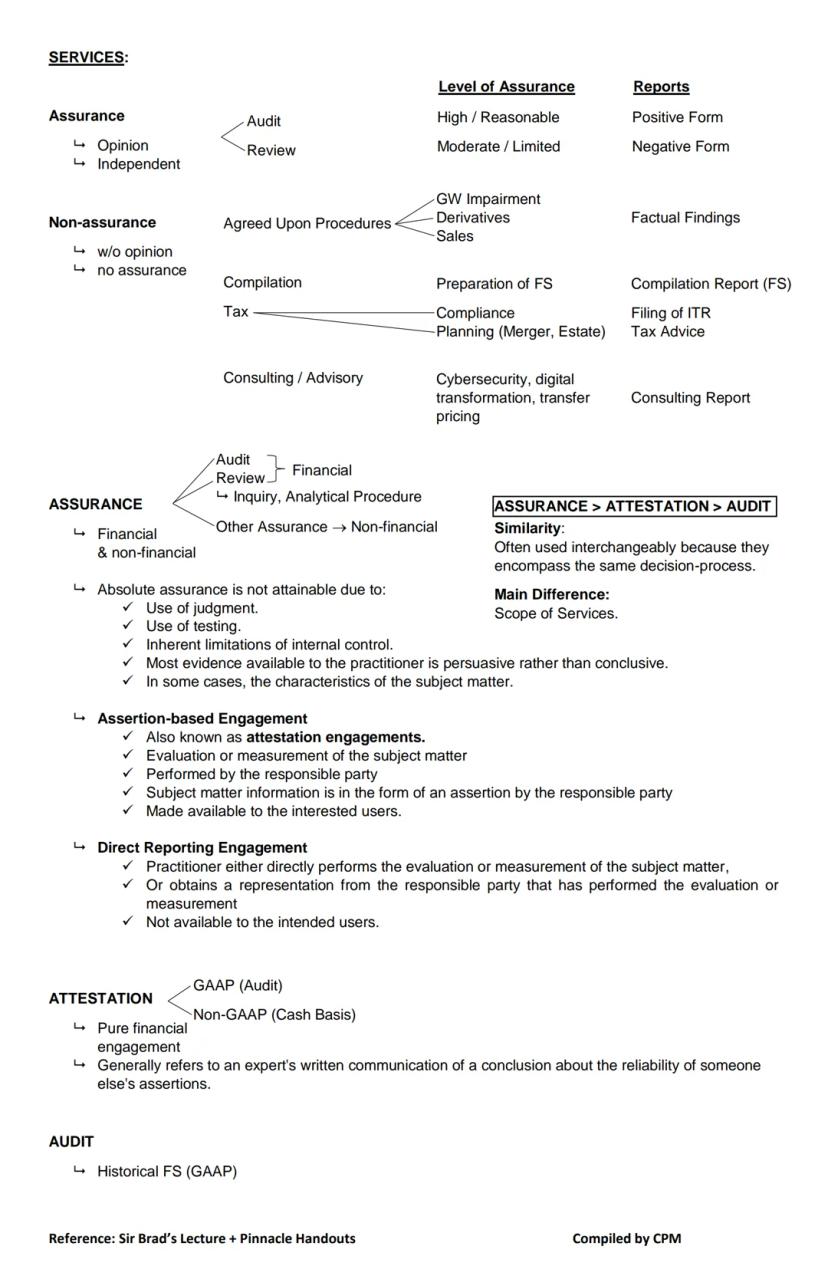

Auditors provide both assurance and non-assurance services, but the difference matters! Assurance services involve expressing an independent opinion, while non-assurance services don't provide any guarantees about the information.

Assurance services can be either financial or non-financial, but absolute assurance is impossible due to inherent limitations like the need for judgment, testing limitations, and the fact that most evidence is persuasive rather than conclusive.

Two main types of assurance engagements exist:

The hierarchy of services is important to understand:

Quick Tip: Remember that ASSURANCE > ATTESTATION > AUDIT. These terms are often used interchangeably but have different scopes of service. An audit is always an attestation, which is always an assurance service - but not vice versa!

Non-assurance services include tax preparation, consulting and advisory services like cybersecurity and digital transformation - all valuable but distinct from the assurance work that is the core of auditing.

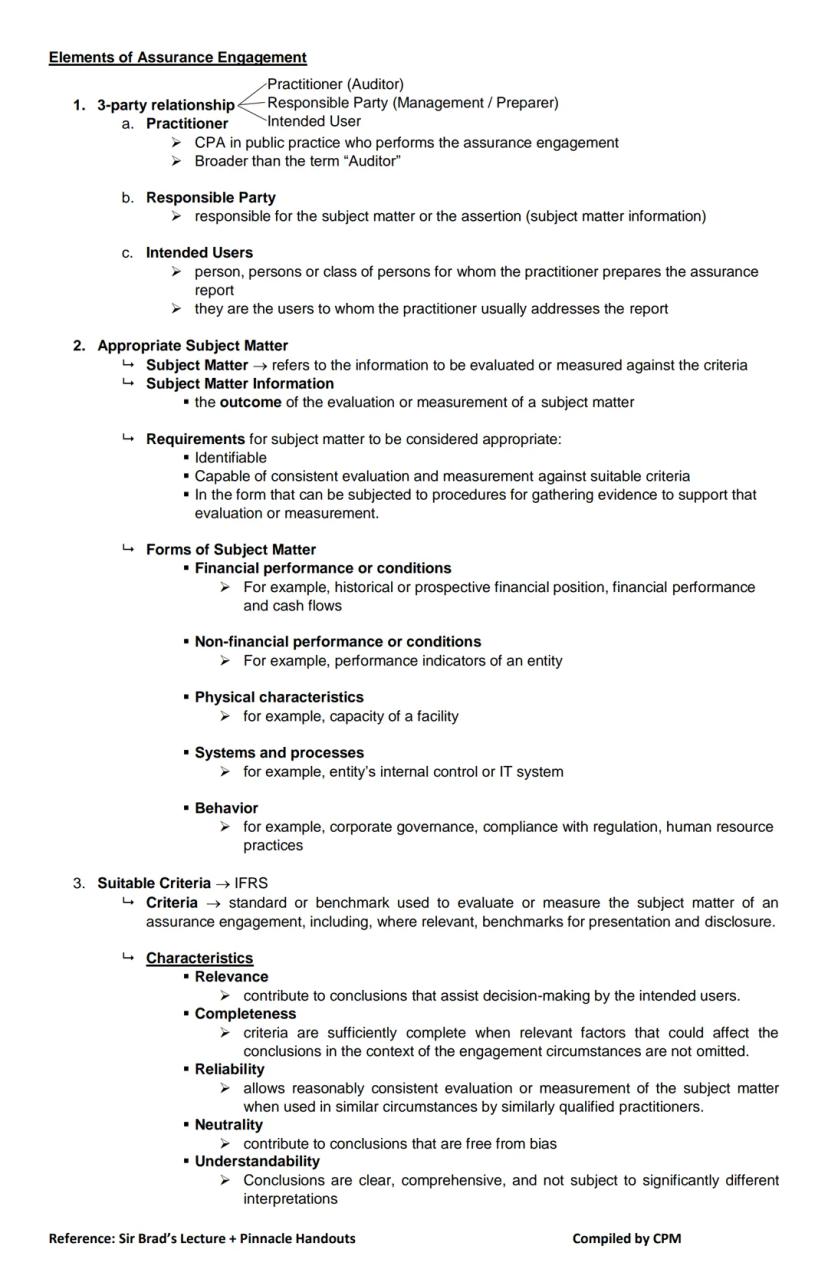

Every assurance engagement requires five key elements to function properly. First, there must be a three-party relationship involving:

Second, there must be an appropriate subject matter - information that can be evaluated against criteria. Good subject matter must be identifiable, consistently measurable, and capable of being examined with evidence. This could include financial performance, non-financial metrics, physical characteristics, systems, or even behavior like corporate governance.

Third, the engagement needs suitable criteria - the benchmarks used to evaluate the subject matter. IFRS (International Financial Reporting Standards) is a common example for financial statements. For criteria to be suitable, they must demonstrate five key characteristics:

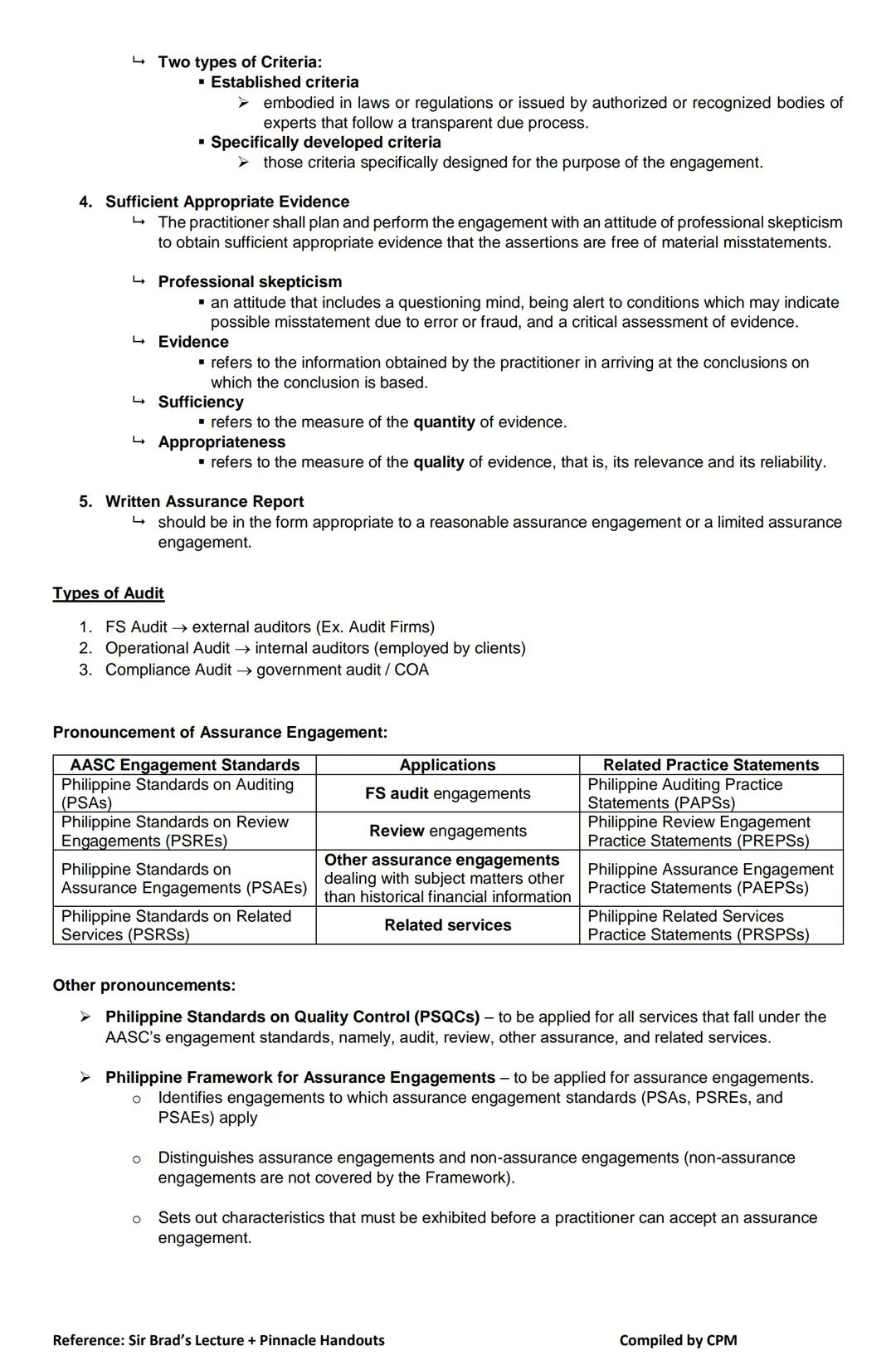

Remember This: Criteria can be either "established" (from laws or recognized expert bodies) or "specifically developed" for a particular engagement. The distinction matters because specifically developed criteria may require more explanation in your report.

The next two elements will be covered in the following page.

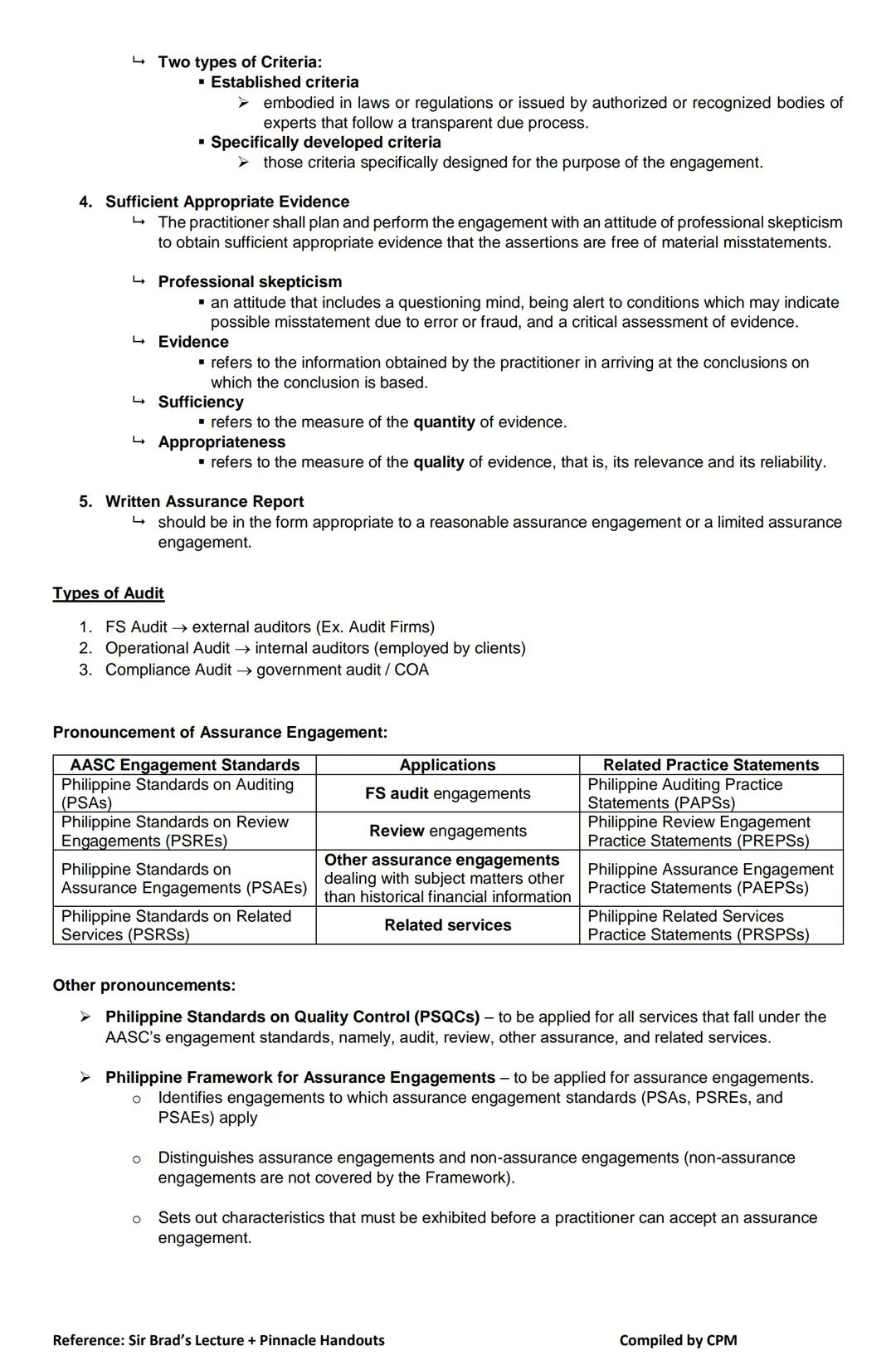

The fourth element of assurance engagements is sufficient appropriate evidence. Practitioners must approach engagements with professional skepticism - a questioning mindset that's alert to potential misstatements. The evidence gathered must be both sufficient (enough quantity) and appropriate (good quality, relevant and reliable).

The fifth element is a written assurance report that matches the type of engagement being performed.

Auditors perform three main types of audits:

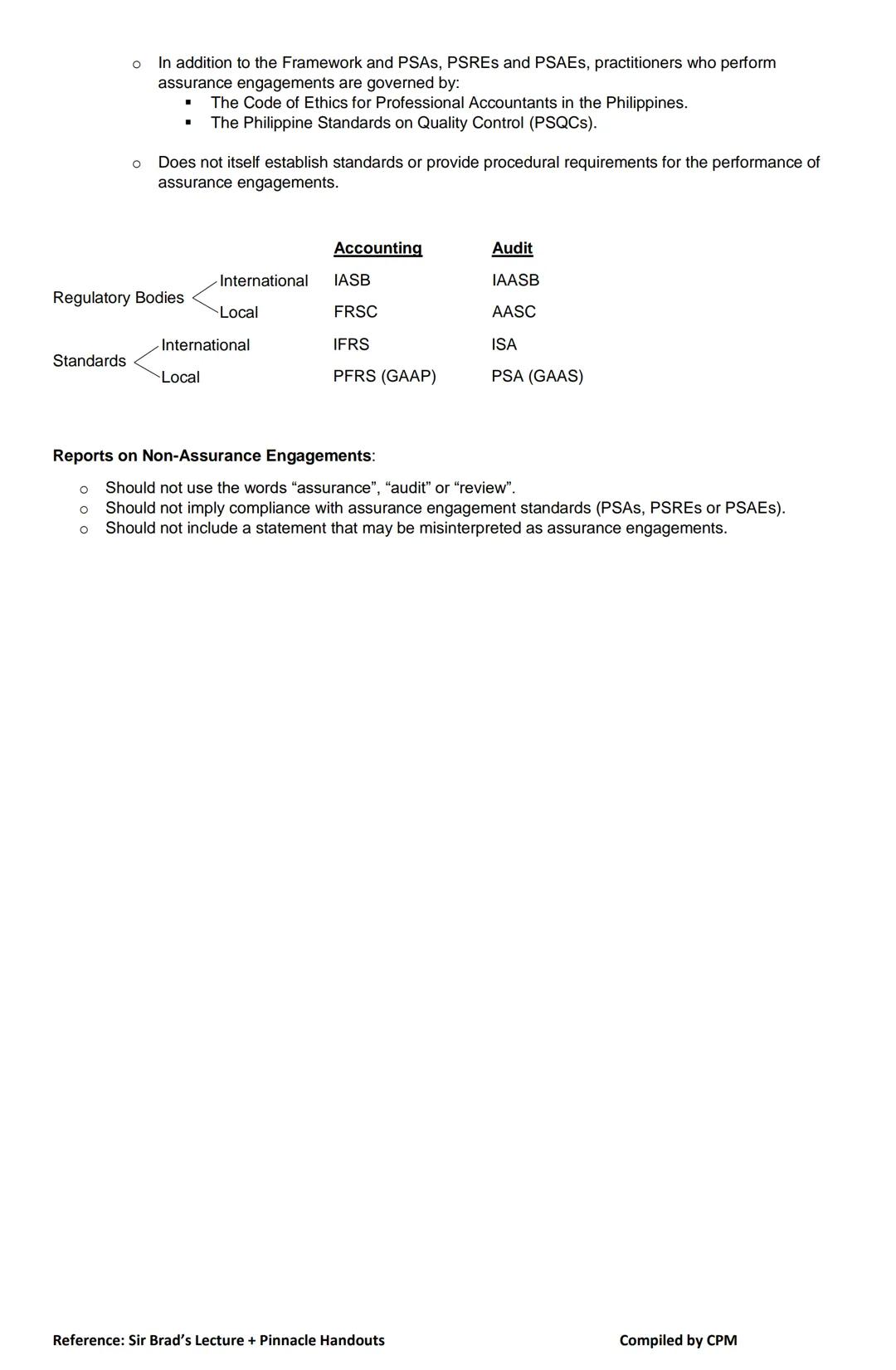

The profession is governed by several key standards:

Important Distinction: Reports on non-assurance engagements should never use words like "assurance," "audit," or "review," and shouldn't imply compliance with assurance standards. This helps users understand exactly what level of confidence they can place in the information.

All these services fall under the Philippine Standards on Quality Control (PSQCs) and the Philippine Framework for Assurance Engagements, which set the foundation for how practitioners should approach their work.

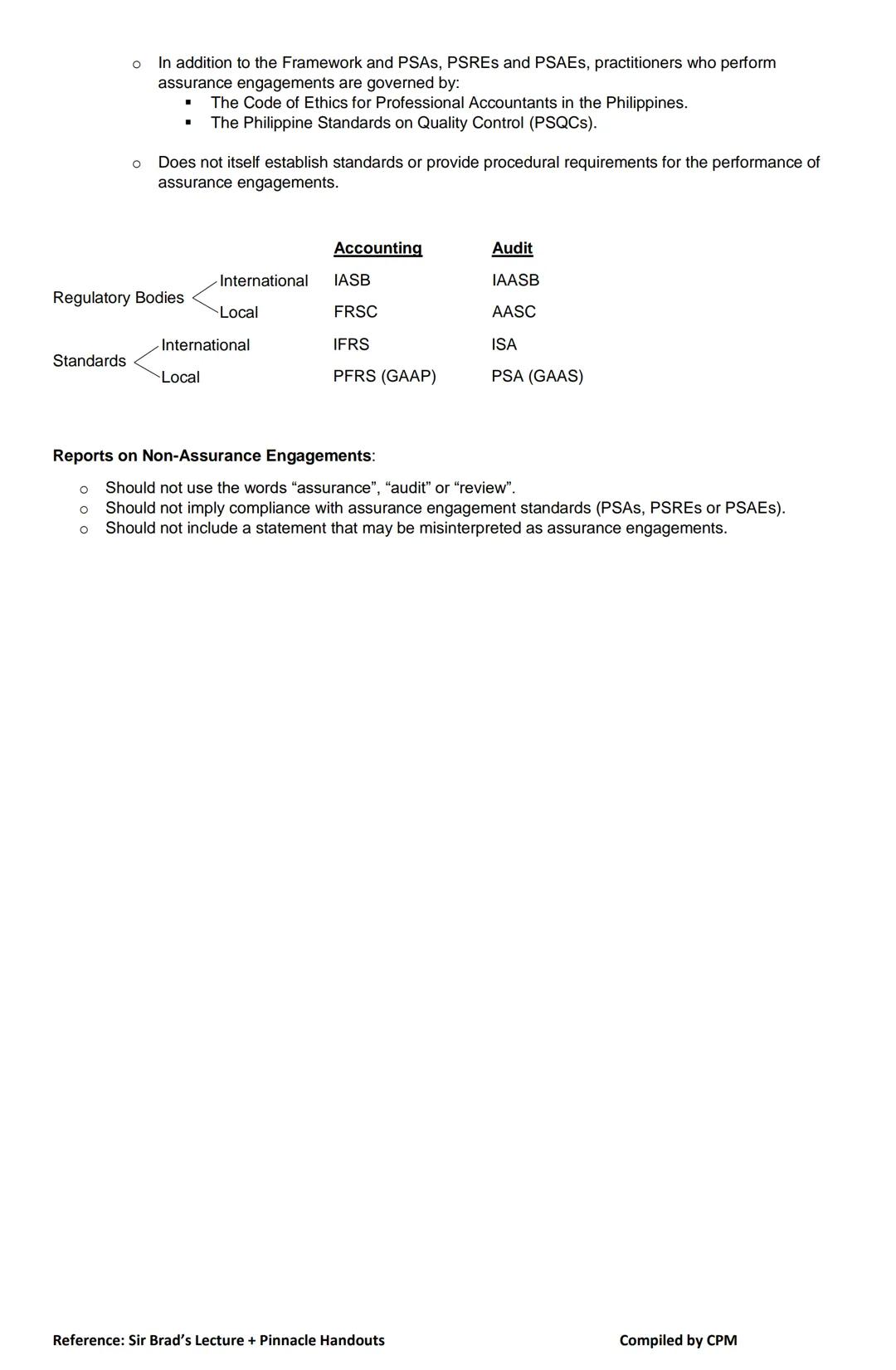

Understanding the regulatory landscape is crucial for auditors. The profession is structured with international and local regulatory bodies that create the standards auditors must follow.

At the international level, the International Accounting Standards Board (IASB) develops accounting standards, while the International Auditing and Assurance Standards Board (IAASB) creates auditing standards. These international bodies produce IFRS (accounting) and ISAs (auditing) respectively.

The local equivalents in the Philippines are the Financial Reporting Standards Council (FRSC) for accounting standards and the Auditing and Assurance Standards Council (AASC) for auditing standards. They issue PFRS (Philippine Financial Reporting Standards, also known as GAAP) and PSA (Philippine Standards on Auditing, or GAAS).

All auditors must also follow:

Pro Tip: Remember that the Philippine Framework for Assurance Engagements doesn't establish specific standards by itself—it provides the conceptual foundation that all the standards are built upon. Think of it as the constitution of auditing.

When performing work that isn't an assurance engagement, practitioners should be careful with their language. Reports should never use words that might confuse users into thinking they're getting assurance when they're not—terms like "audit," "review," or "assurance" should be avoided in non-assurance reports.

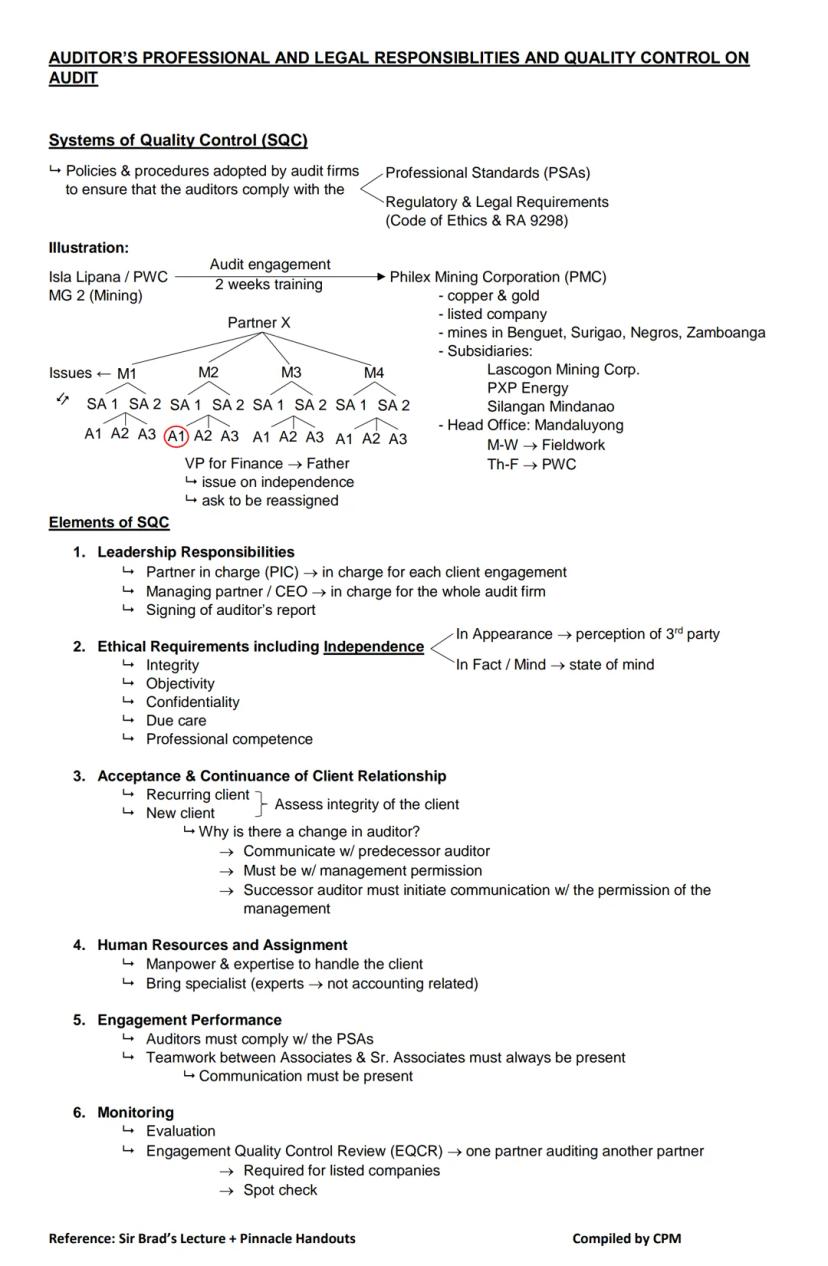

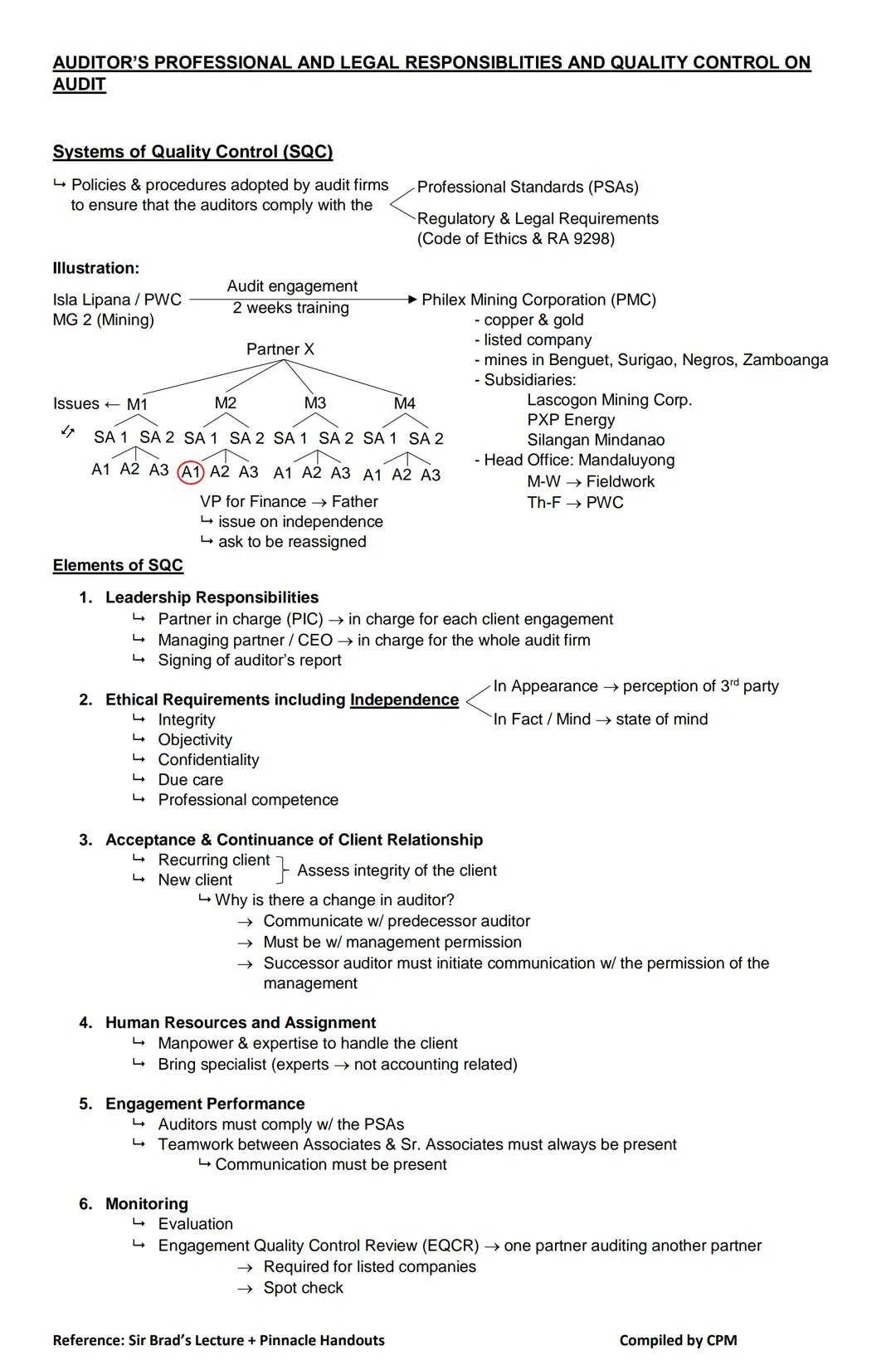

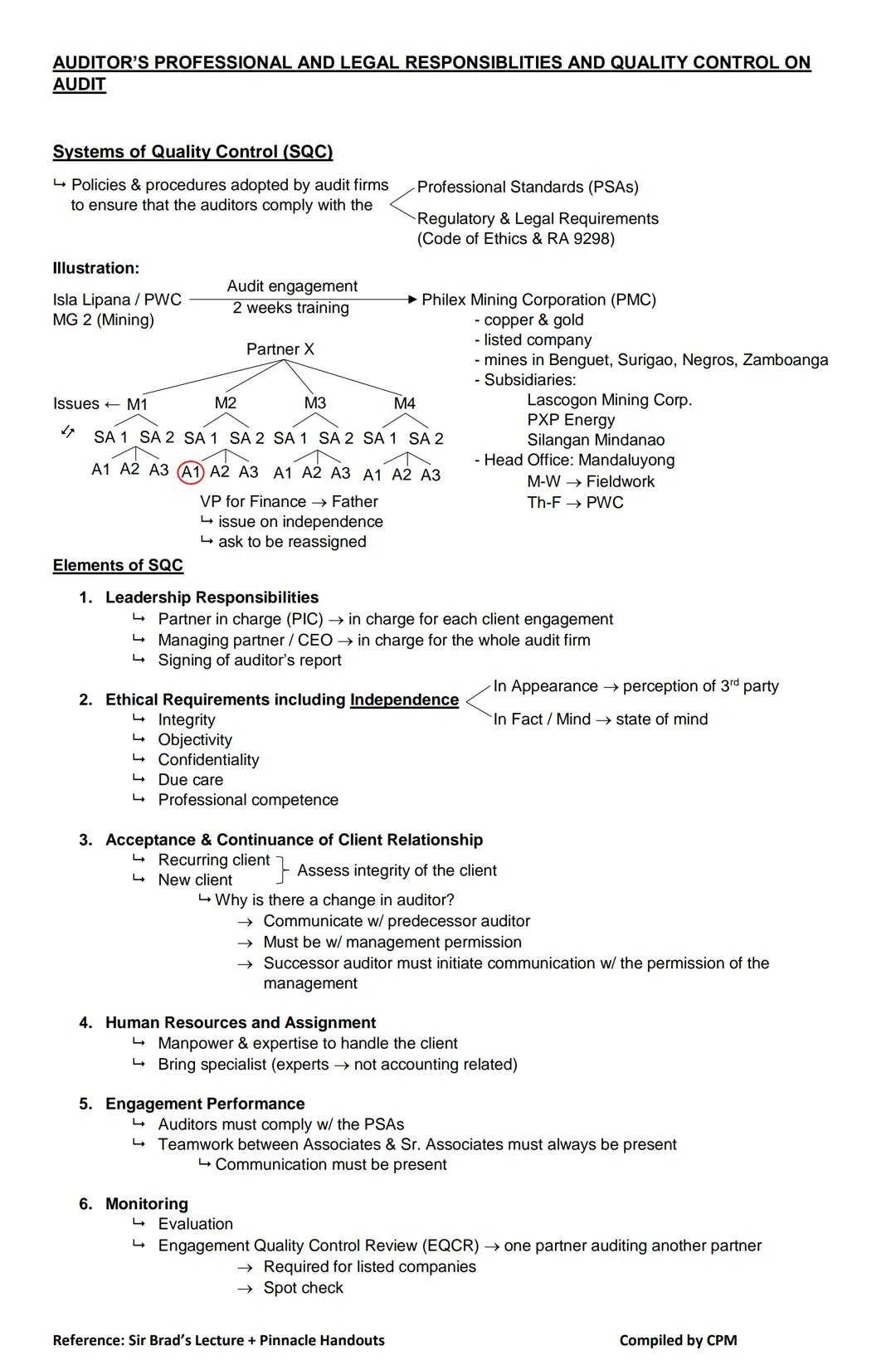

Audit firms must implement a System of Quality Control (SQC) with policies and procedures ensuring compliance with professional standards, regulatory requirements, and ethical codes. This system is crucial for maintaining audit quality.

For example, if an auditor from PWC is assigned to audit Philex Mining Corporation (a company with copper and gold mines across the Philippines), they need a strong SQC in place. If that auditor's father happens to be the VP for Finance at Philex, independence issues arise, and the auditor should request reassignment.

A proper SQC has six essential elements:

Leadership Responsibilities - Partners in charge oversee each engagement, while managing partners oversee the firm's overall quality

Ethical Requirements - Auditors must maintain integrity, objectivity, confidentiality, due care, and professional competence while preserving independence both in fact (state of mind) and appearance (perception)

Acceptance & Continuance of Client Relationships - Firms must assess client integrity and, for new clients, communicate with predecessor auditors (with management permission)

Human Resources and Assignment - Having sufficient personnel with expertise to handle clients, including specialists when needed

Engagement Performance - Compliance with professional standards and maintaining communication within the audit team

Monitoring - Regular evaluation of the firm's quality control system, including Engagement Quality Control Reviews (EQCR) where partners review other partners' work

Real-World Application: For listed companies, an Engagement Quality Control Review is required—this means one partner reviews another partner's work as a quality check before the audit report is issued.

These quality controls help ensure audits are performed consistently and professionally, regardless of which team members are assigned to an engagement.

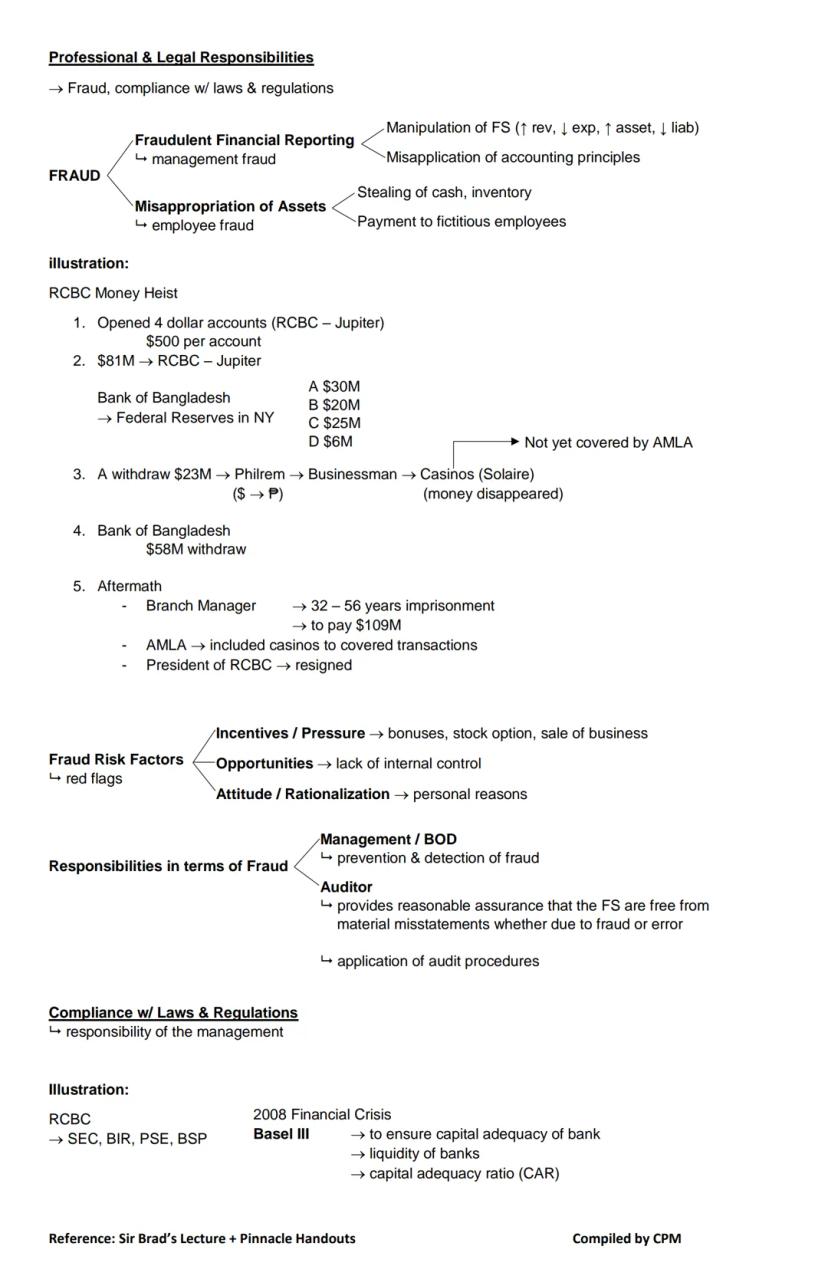

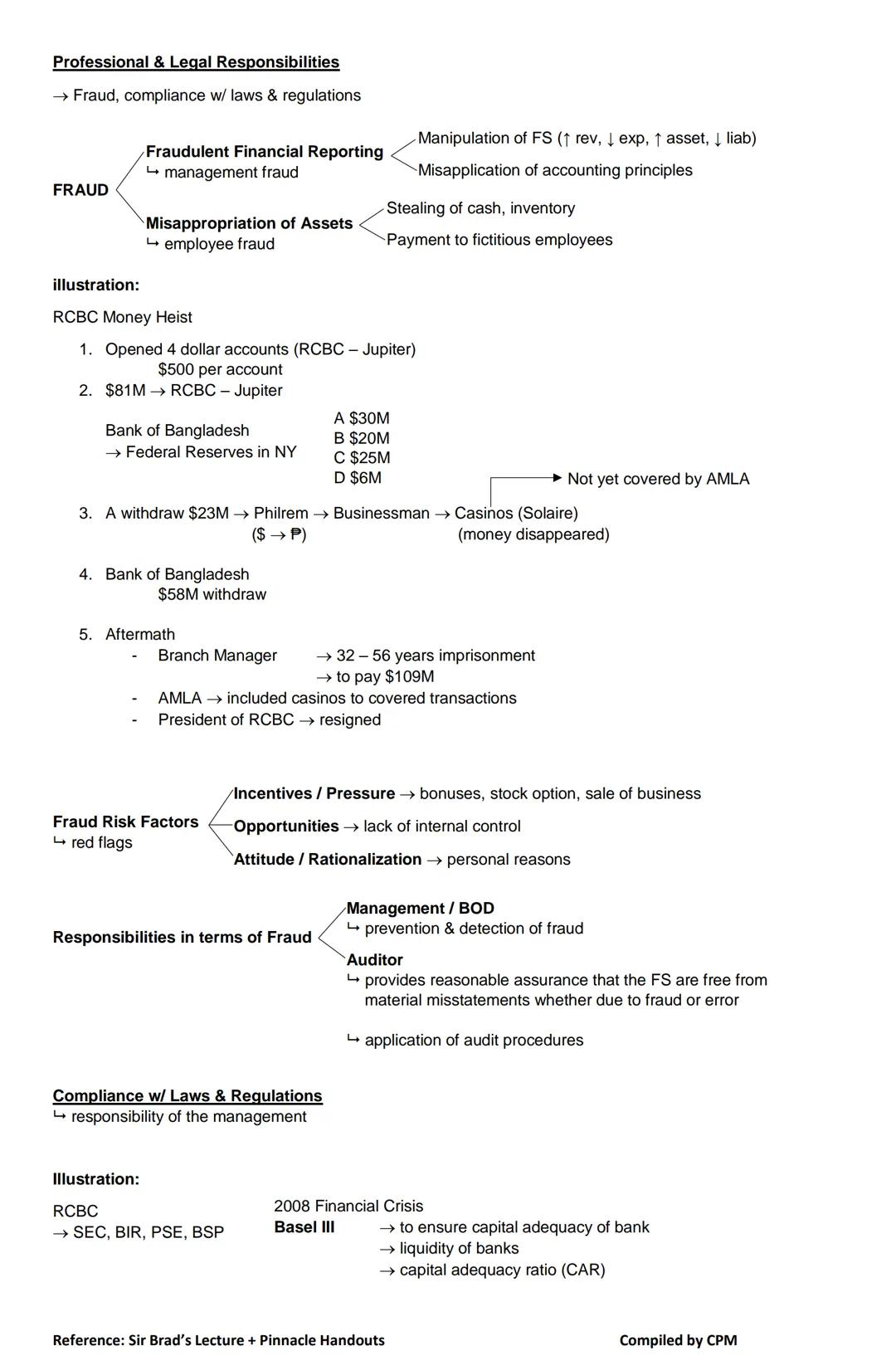

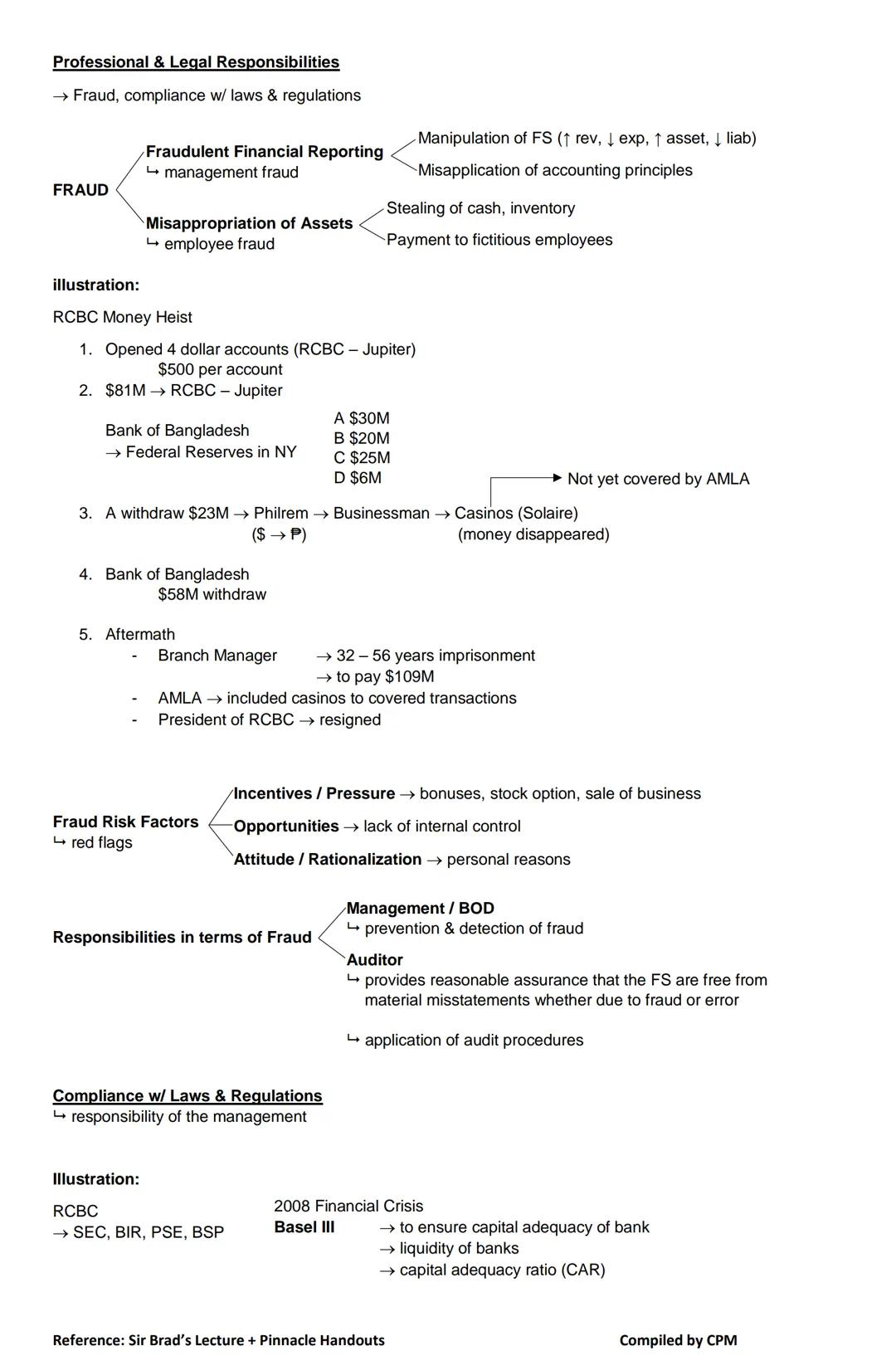

Auditors have significant responsibilities when it comes to fraud. There are two main types: Fraudulent Financial Reporting (management fraud) involving manipulation of financial statements, and Misappropriation of Assets (employee fraud) like stealing inventory or creating fictitious employees.

The RCBC money heist illustrates fraud's complexity: $81 million was stolen from the Bank of Bangladesh through RCBC accounts, then laundered through a money remittance company and casinos . This led to imprisonment for the branch manager, the resignation of RCBC's president, and changes to money laundering regulations.

Three key fraud risk factors (red flags) auditors watch for include:

It's crucial to understand the division of responsibility:

Important Distinction: Auditors don't guarantee they'll find all fraud—they provide "reasonable assurance," not absolute certainty. This is why understanding risk factors is so important.

Similarly, with laws and regulations, management bears primary responsibility for compliance, though auditors apply procedures to identify potential non-compliance that could materially affect the financial statements.

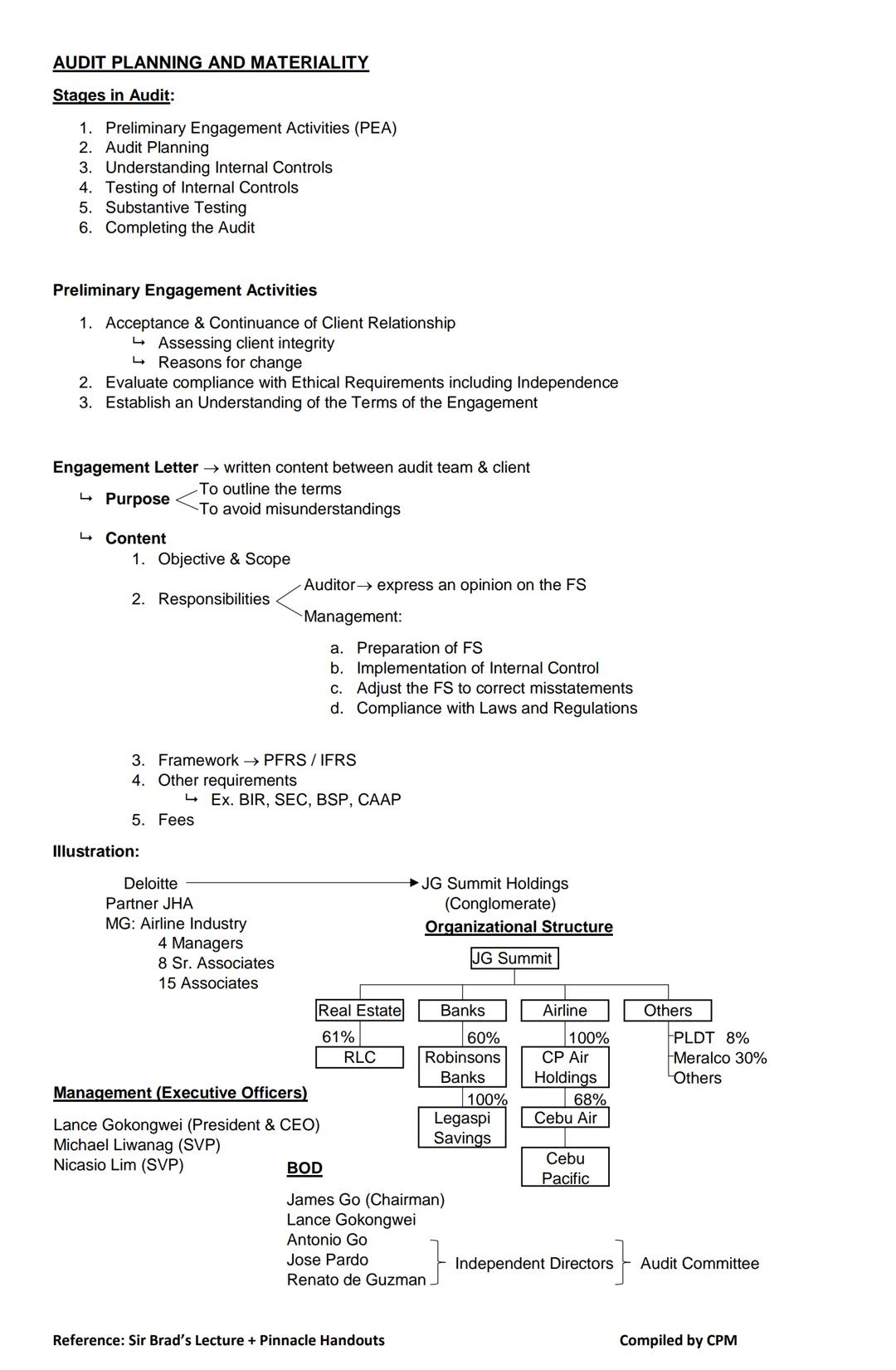

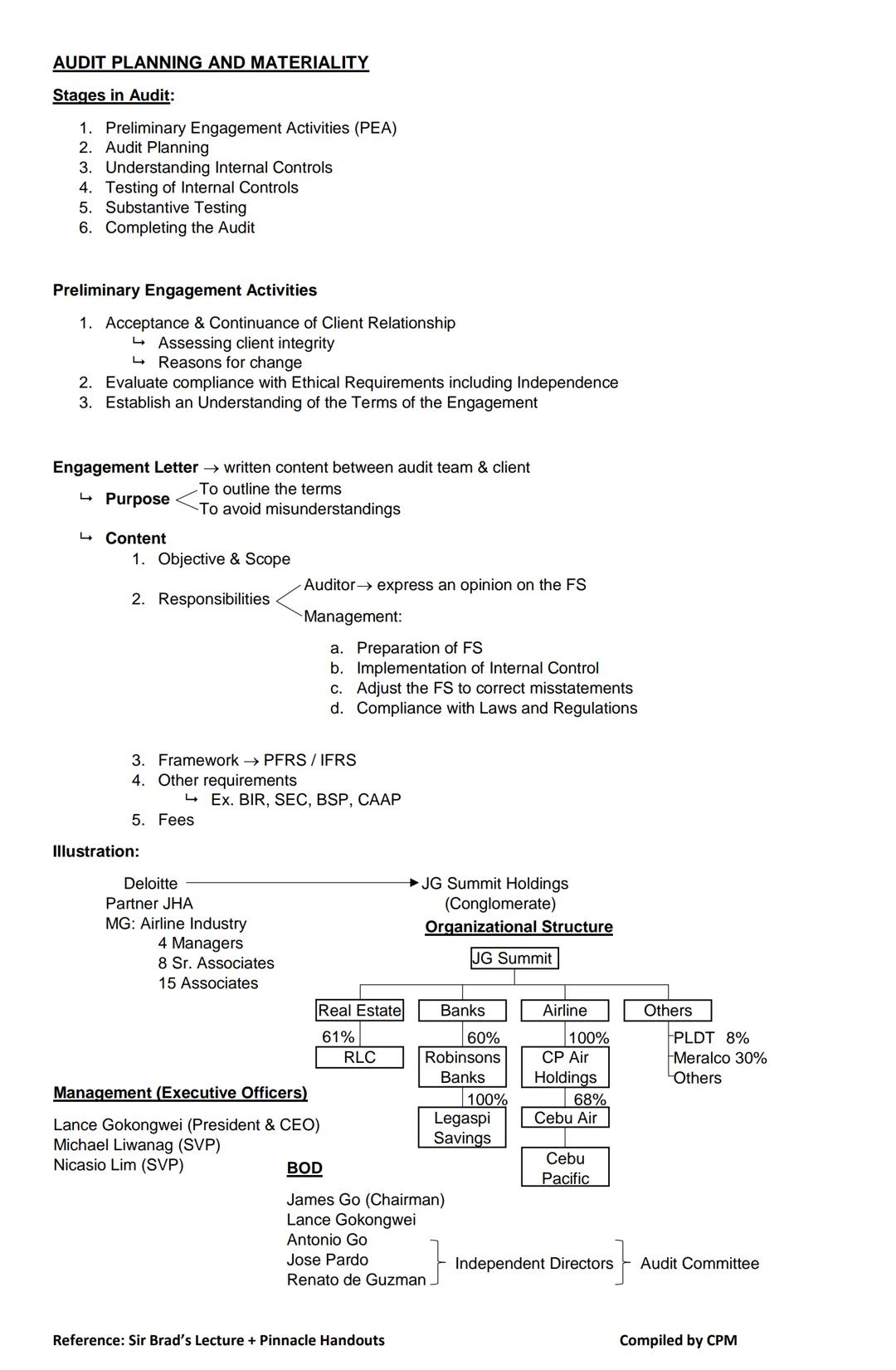

The audit process follows six key stages: Preliminary Engagement Activities, Audit Planning, Understanding Internal Controls, Testing Internal Controls, Substantive Testing, and Completing the Audit. Let's focus on the first two.

Preliminary Engagement Activities include:

The Engagement Letter is crucial—it's a written agreement between the audit team and client that outlines:

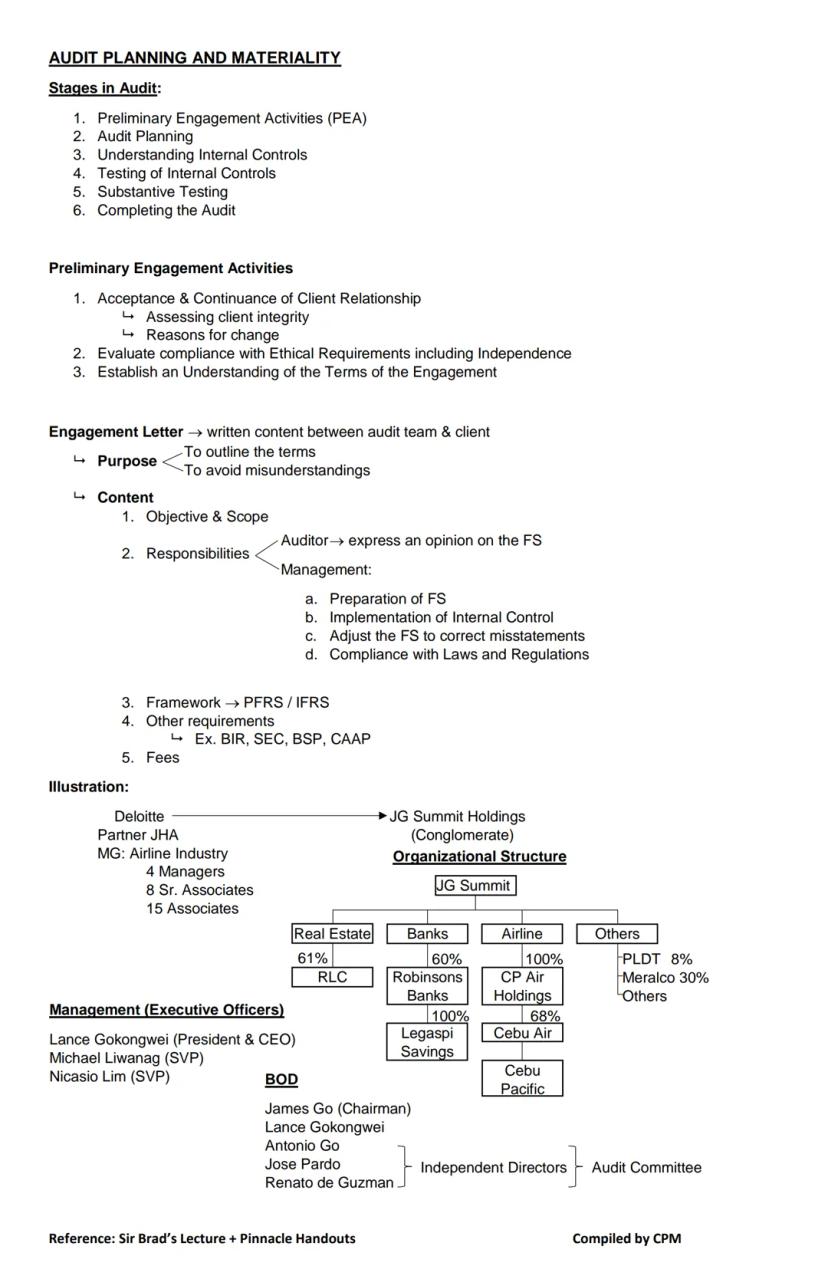

When planning an audit for a complex organization like JG Summit Holdings (with subsidiaries in real estate, banking, airlines, and other industries), auditors must understand the organizational structure and management team. The audit committee, often composed of independent directors, provides additional oversight.

Planning Insight: Understanding the client's organizational structure is essential for determining audit scope. For conglomerates like JG Summit, auditors need to know which subsidiaries require auditing and how they relate to each other.

The engagement letter sets expectations from the beginning, helping prevent misunderstandings and establishing clear boundaries between what the auditor will and won't do.

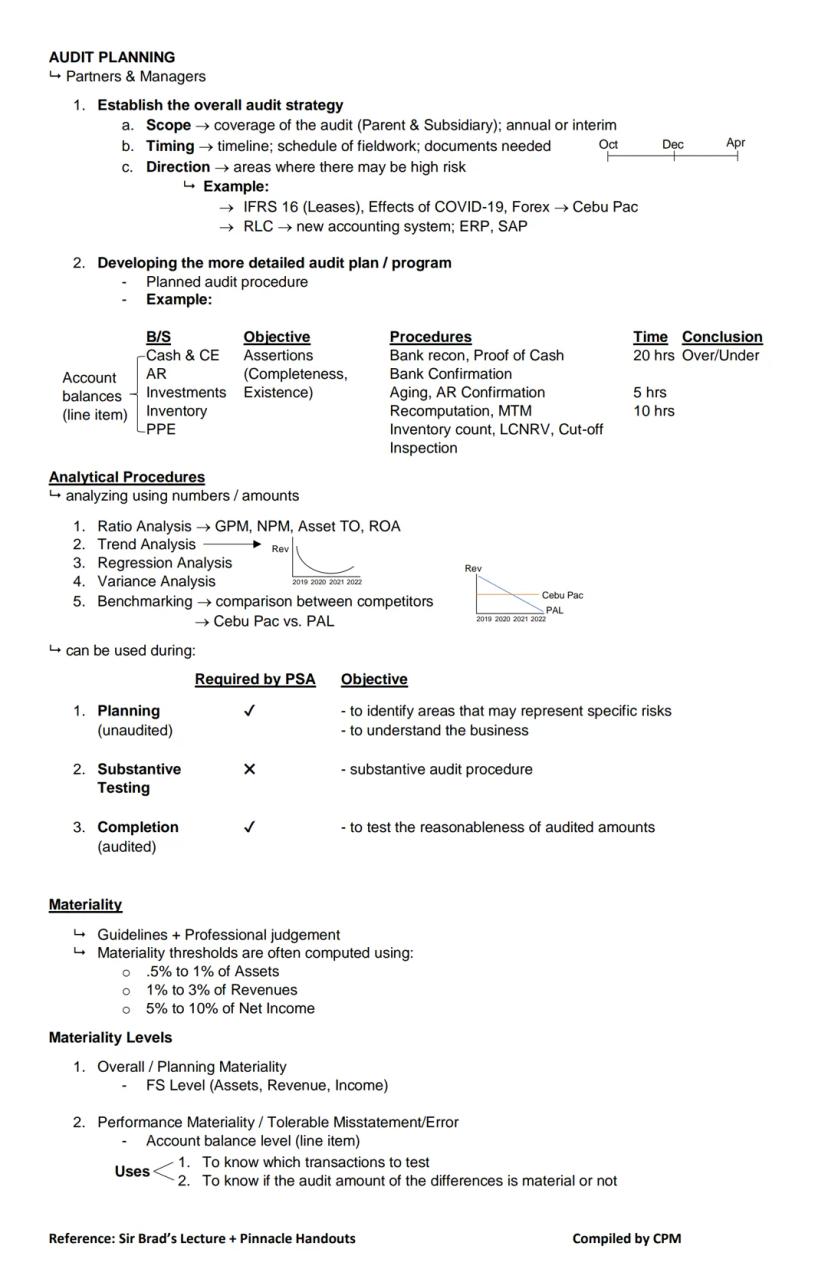

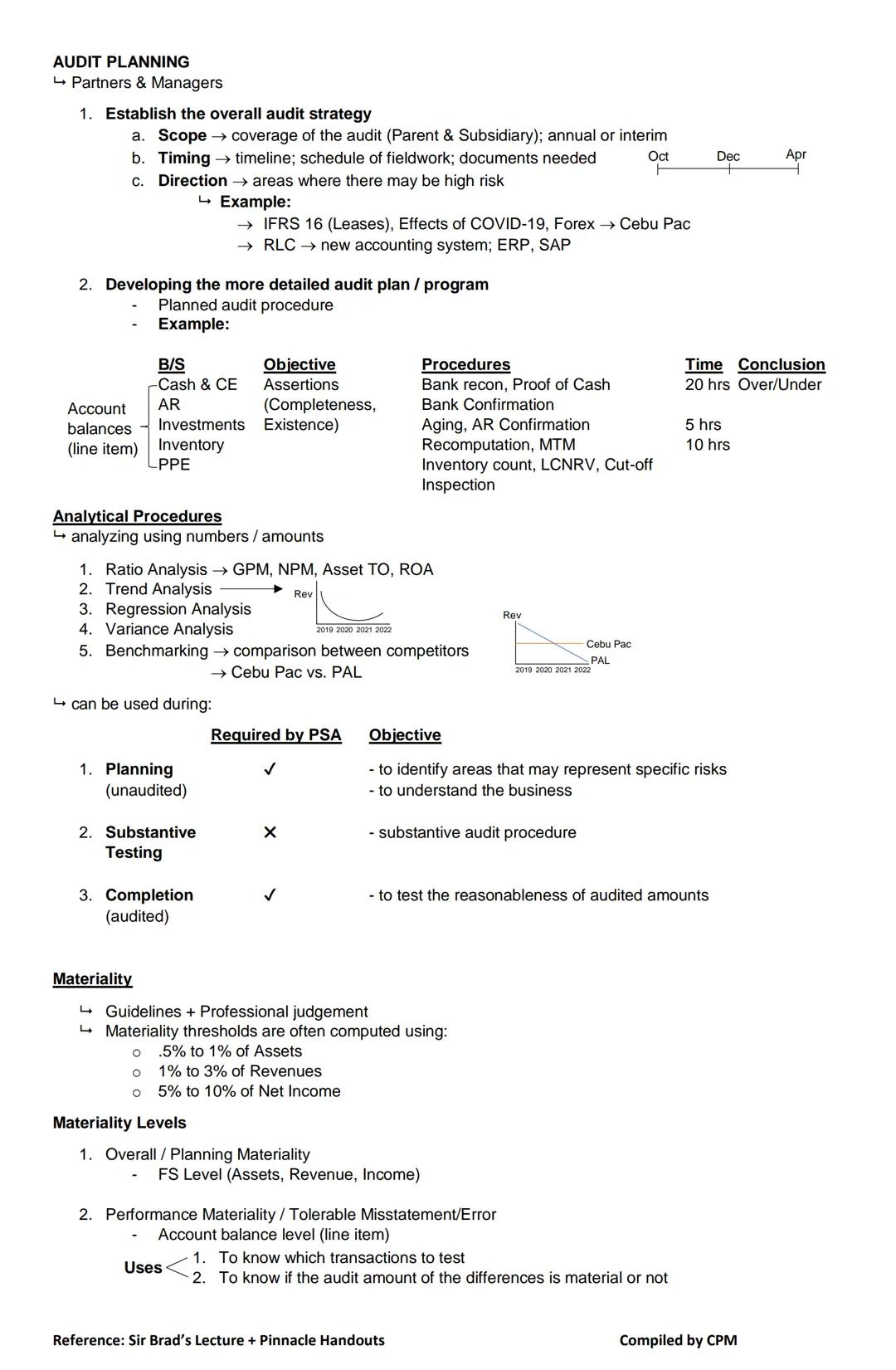

Audit planning is primarily the responsibility of partners and managers, who must:

Establish the overall audit strategy by determining:

Develop a detailed audit plan/program with specific procedures for each financial statement area, including time budgets and planned conclusions

Analytical procedures are powerful planning tools that analyze numerical relationships through:

PSA requires analytical procedures during planning and completion phases, while they're optional but useful during substantive testing.

Materiality is a critical concept that helps auditors decide what matters. Materiality thresholds are typically calculated as:

Two key materiality levels are:

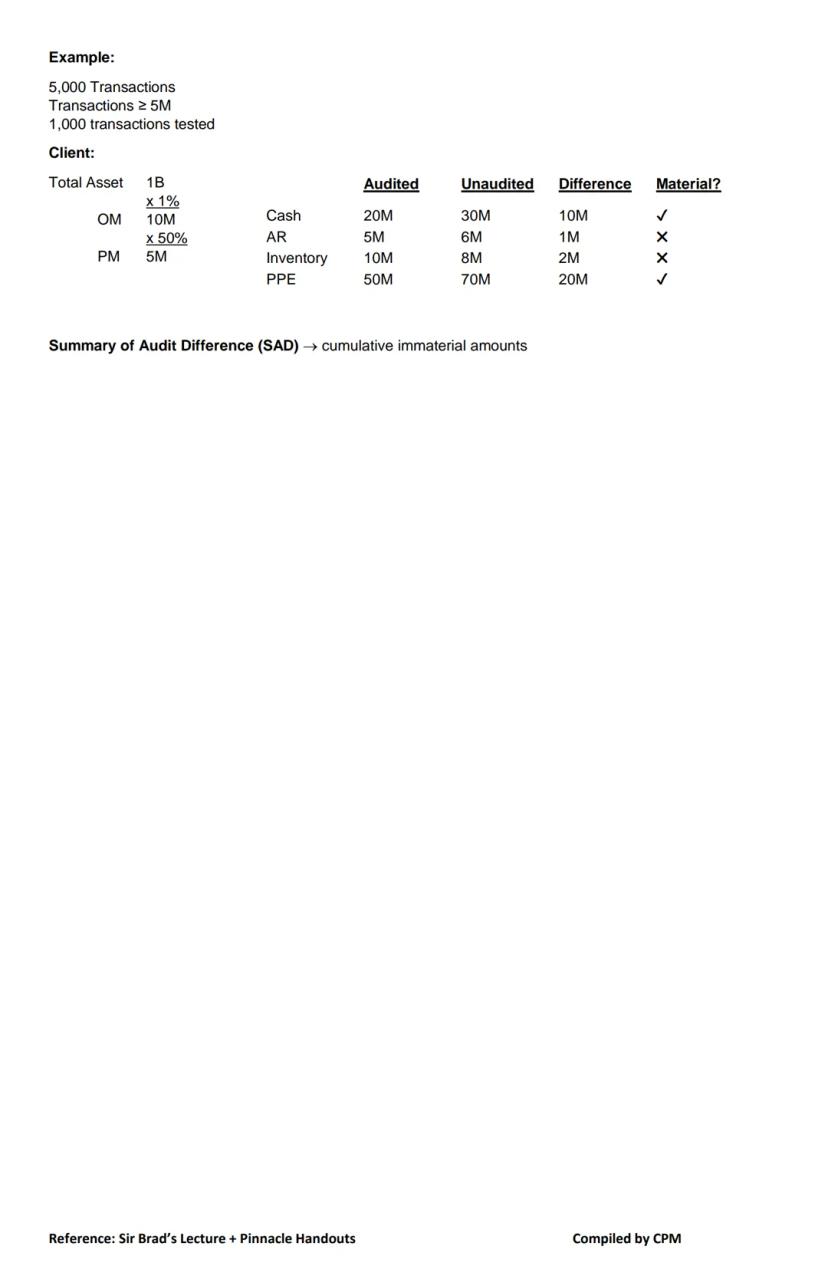

Practical Application: If a company has total assets of 1 billion pesos, overall materiality might be set at 10 million (1%). Differences between recorded and audited amounts are compared to performance materiality (5 million) to determine if they're significant enough to require adjustment.

Immaterial differences are tracked in a Summary of Audit Differences (SAD) to ensure they don't collectively become material.

Applying materiality involves thoughtful analysis of financial data. For a company with 1 billion pesos in total assets, you might set overall materiality at 10 million pesos (1% of assets) and performance materiality at 5 million pesos (50% of overall materiality).

When comparing audited versus unaudited amounts for individual accounts, you'll flag differences that exceed performance materiality:

The Summary of Audit Differences (SAD) tracks all discrepancies, even immaterial ones, because collectively they might become significant. This cumulative approach ensures no material misstatement slips through the cracks.

Materiality helps auditors focus testing efforts efficiently. From 5,000 total transactions, they might decide to test only transactions above 5M pesos or select a sample of 1,000 transactions based on risk assessment.

Decision Point: Always remember that materiality isn't just about numbers—it also involves professional judgment about what would influence users' decisions. Different industries and circumstances may require different materiality considerations.

Properly applying materiality concepts ensures the audit focuses on what truly matters to financial statement users while maintaining efficiency in the audit process.

Our AI companion is specifically built for the needs of students. Based on the millions of content pieces we have on the platform we can provide truly meaningful and relevant answers to students. But its not only about answers, the companion is even more about guiding students through their daily learning challenges, with personalised study plans, quizzes or content pieces in the chat and 100% personalisation based on the students skills and developments.

You can download the app in the Google Play Store and in the Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

studywithnessa

@studywithnessa

Ready to dive into auditing? This guide breaks down the essentials of audit practice, from career paths in accounting firms to the fundamental principles governing audit engagements. Whether you're studying for exams or curious about what auditors actually do, you'll... Show more

Access to all documents

Improve your grades

Join milions of students

Ever wondered what auditors actually do? Certified Public Accountants (CPAs) can work in several environments, including public practice at audit firms, private companies, academic institutions, or government agencies like the Commission on Audit.

The "Big 5" audit firms in the Philippines include SGV (EY), Isla Lipana (PWC), Manabat San Agustin (KPMG), P&A , and Navarro Amper (Deloitte). These firms are organized by market groups that specialize in specific industries like manufacturing, mining, telecommunications, and banking.

A typical career path in auditing starts as an Associate , progressing to Senior Associate, then through various director levels before potentially becoming a Partner. Partners typically oversee multiple managers, who in turn supervise senior associates and associates in a pyramid structure.

Reality Check: The auditing profession exists largely because of the "expectation gap" - company management wants to present attractive financial statements (with higher assets and revenues), while users need reliable information. Recent scandals at Celadon Group and 2GO demonstrate why independent auditors are crucial for verifying financial information.

The audit process helps reduce information risk by providing assurance that financial statements fairly represent a company's performance and position, giving stakeholders more confidence in the data they're using to make decisions.

Access to all documents

Improve your grades

Join milions of students

Auditors provide both assurance and non-assurance services, but the difference matters! Assurance services involve expressing an independent opinion, while non-assurance services don't provide any guarantees about the information.

Assurance services can be either financial or non-financial, but absolute assurance is impossible due to inherent limitations like the need for judgment, testing limitations, and the fact that most evidence is persuasive rather than conclusive.

Two main types of assurance engagements exist:

The hierarchy of services is important to understand:

Quick Tip: Remember that ASSURANCE > ATTESTATION > AUDIT. These terms are often used interchangeably but have different scopes of service. An audit is always an attestation, which is always an assurance service - but not vice versa!

Non-assurance services include tax preparation, consulting and advisory services like cybersecurity and digital transformation - all valuable but distinct from the assurance work that is the core of auditing.

Access to all documents

Improve your grades

Join milions of students

Every assurance engagement requires five key elements to function properly. First, there must be a three-party relationship involving:

Second, there must be an appropriate subject matter - information that can be evaluated against criteria. Good subject matter must be identifiable, consistently measurable, and capable of being examined with evidence. This could include financial performance, non-financial metrics, physical characteristics, systems, or even behavior like corporate governance.

Third, the engagement needs suitable criteria - the benchmarks used to evaluate the subject matter. IFRS (International Financial Reporting Standards) is a common example for financial statements. For criteria to be suitable, they must demonstrate five key characteristics:

Remember This: Criteria can be either "established" (from laws or recognized expert bodies) or "specifically developed" for a particular engagement. The distinction matters because specifically developed criteria may require more explanation in your report.

The next two elements will be covered in the following page.

Access to all documents

Improve your grades

Join milions of students

The fourth element of assurance engagements is sufficient appropriate evidence. Practitioners must approach engagements with professional skepticism - a questioning mindset that's alert to potential misstatements. The evidence gathered must be both sufficient (enough quantity) and appropriate (good quality, relevant and reliable).

The fifth element is a written assurance report that matches the type of engagement being performed.

Auditors perform three main types of audits:

The profession is governed by several key standards:

Important Distinction: Reports on non-assurance engagements should never use words like "assurance," "audit," or "review," and shouldn't imply compliance with assurance standards. This helps users understand exactly what level of confidence they can place in the information.

All these services fall under the Philippine Standards on Quality Control (PSQCs) and the Philippine Framework for Assurance Engagements, which set the foundation for how practitioners should approach their work.

Access to all documents

Improve your grades

Join milions of students

Understanding the regulatory landscape is crucial for auditors. The profession is structured with international and local regulatory bodies that create the standards auditors must follow.

At the international level, the International Accounting Standards Board (IASB) develops accounting standards, while the International Auditing and Assurance Standards Board (IAASB) creates auditing standards. These international bodies produce IFRS (accounting) and ISAs (auditing) respectively.

The local equivalents in the Philippines are the Financial Reporting Standards Council (FRSC) for accounting standards and the Auditing and Assurance Standards Council (AASC) for auditing standards. They issue PFRS (Philippine Financial Reporting Standards, also known as GAAP) and PSA (Philippine Standards on Auditing, or GAAS).

All auditors must also follow:

Pro Tip: Remember that the Philippine Framework for Assurance Engagements doesn't establish specific standards by itself—it provides the conceptual foundation that all the standards are built upon. Think of it as the constitution of auditing.

When performing work that isn't an assurance engagement, practitioners should be careful with their language. Reports should never use words that might confuse users into thinking they're getting assurance when they're not—terms like "audit," "review," or "assurance" should be avoided in non-assurance reports.

Access to all documents

Improve your grades

Join milions of students

Audit firms must implement a System of Quality Control (SQC) with policies and procedures ensuring compliance with professional standards, regulatory requirements, and ethical codes. This system is crucial for maintaining audit quality.

For example, if an auditor from PWC is assigned to audit Philex Mining Corporation (a company with copper and gold mines across the Philippines), they need a strong SQC in place. If that auditor's father happens to be the VP for Finance at Philex, independence issues arise, and the auditor should request reassignment.

A proper SQC has six essential elements:

Leadership Responsibilities - Partners in charge oversee each engagement, while managing partners oversee the firm's overall quality

Ethical Requirements - Auditors must maintain integrity, objectivity, confidentiality, due care, and professional competence while preserving independence both in fact (state of mind) and appearance (perception)

Acceptance & Continuance of Client Relationships - Firms must assess client integrity and, for new clients, communicate with predecessor auditors (with management permission)

Human Resources and Assignment - Having sufficient personnel with expertise to handle clients, including specialists when needed

Engagement Performance - Compliance with professional standards and maintaining communication within the audit team

Monitoring - Regular evaluation of the firm's quality control system, including Engagement Quality Control Reviews (EQCR) where partners review other partners' work

Real-World Application: For listed companies, an Engagement Quality Control Review is required—this means one partner reviews another partner's work as a quality check before the audit report is issued.

These quality controls help ensure audits are performed consistently and professionally, regardless of which team members are assigned to an engagement.

Access to all documents

Improve your grades

Join milions of students

Auditors have significant responsibilities when it comes to fraud. There are two main types: Fraudulent Financial Reporting (management fraud) involving manipulation of financial statements, and Misappropriation of Assets (employee fraud) like stealing inventory or creating fictitious employees.

The RCBC money heist illustrates fraud's complexity: $81 million was stolen from the Bank of Bangladesh through RCBC accounts, then laundered through a money remittance company and casinos . This led to imprisonment for the branch manager, the resignation of RCBC's president, and changes to money laundering regulations.

Three key fraud risk factors (red flags) auditors watch for include:

It's crucial to understand the division of responsibility:

Important Distinction: Auditors don't guarantee they'll find all fraud—they provide "reasonable assurance," not absolute certainty. This is why understanding risk factors is so important.

Similarly, with laws and regulations, management bears primary responsibility for compliance, though auditors apply procedures to identify potential non-compliance that could materially affect the financial statements.

Access to all documents

Improve your grades

Join milions of students

The audit process follows six key stages: Preliminary Engagement Activities, Audit Planning, Understanding Internal Controls, Testing Internal Controls, Substantive Testing, and Completing the Audit. Let's focus on the first two.

Preliminary Engagement Activities include:

The Engagement Letter is crucial—it's a written agreement between the audit team and client that outlines:

When planning an audit for a complex organization like JG Summit Holdings (with subsidiaries in real estate, banking, airlines, and other industries), auditors must understand the organizational structure and management team. The audit committee, often composed of independent directors, provides additional oversight.

Planning Insight: Understanding the client's organizational structure is essential for determining audit scope. For conglomerates like JG Summit, auditors need to know which subsidiaries require auditing and how they relate to each other.

The engagement letter sets expectations from the beginning, helping prevent misunderstandings and establishing clear boundaries between what the auditor will and won't do.

Access to all documents

Improve your grades

Join milions of students

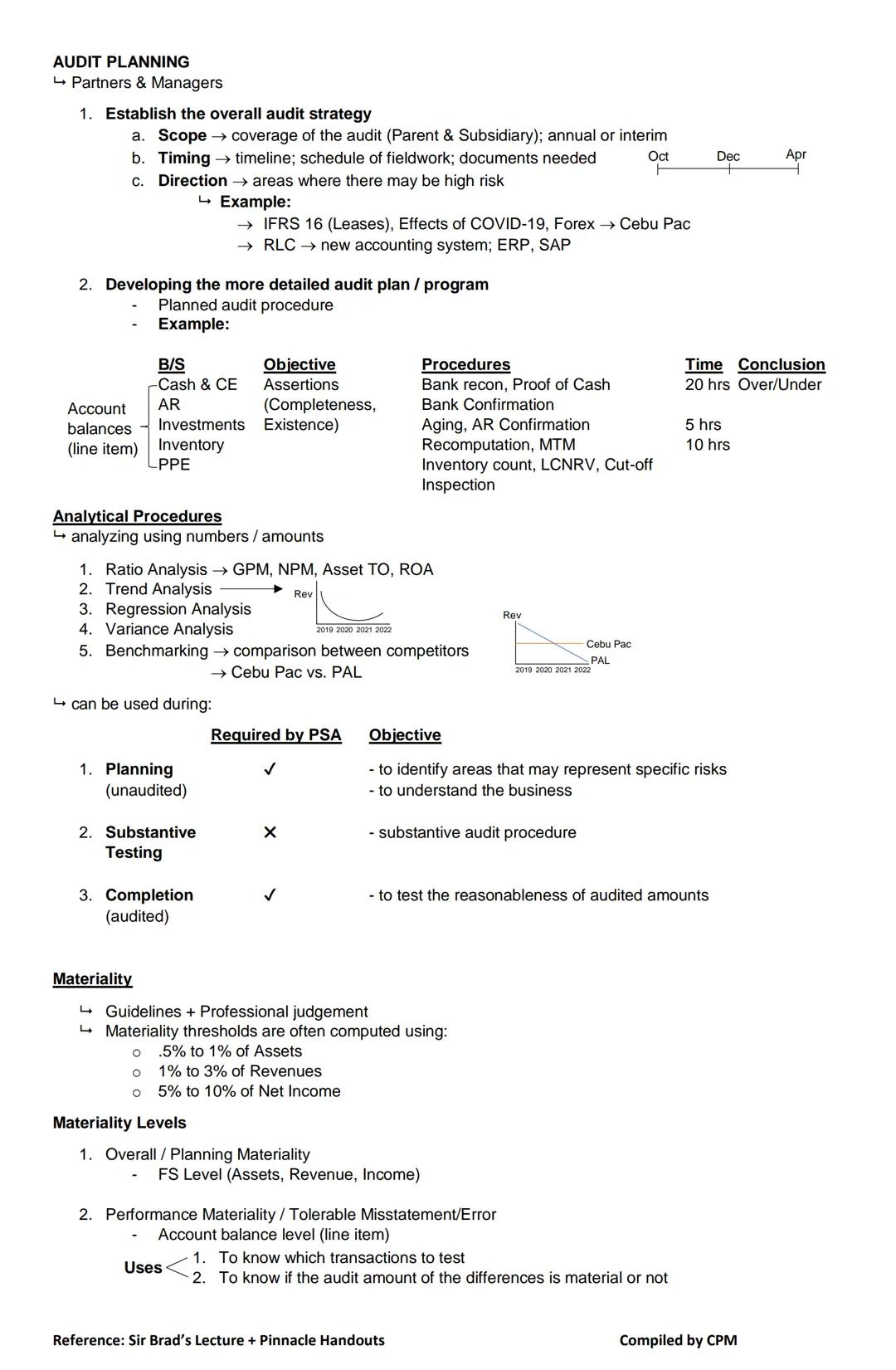

Audit planning is primarily the responsibility of partners and managers, who must:

Establish the overall audit strategy by determining:

Develop a detailed audit plan/program with specific procedures for each financial statement area, including time budgets and planned conclusions

Analytical procedures are powerful planning tools that analyze numerical relationships through:

PSA requires analytical procedures during planning and completion phases, while they're optional but useful during substantive testing.

Materiality is a critical concept that helps auditors decide what matters. Materiality thresholds are typically calculated as:

Two key materiality levels are:

Practical Application: If a company has total assets of 1 billion pesos, overall materiality might be set at 10 million (1%). Differences between recorded and audited amounts are compared to performance materiality (5 million) to determine if they're significant enough to require adjustment.

Immaterial differences are tracked in a Summary of Audit Differences (SAD) to ensure they don't collectively become material.

Access to all documents

Improve your grades

Join milions of students

Applying materiality involves thoughtful analysis of financial data. For a company with 1 billion pesos in total assets, you might set overall materiality at 10 million pesos (1% of assets) and performance materiality at 5 million pesos (50% of overall materiality).

When comparing audited versus unaudited amounts for individual accounts, you'll flag differences that exceed performance materiality:

The Summary of Audit Differences (SAD) tracks all discrepancies, even immaterial ones, because collectively they might become significant. This cumulative approach ensures no material misstatement slips through the cracks.

Materiality helps auditors focus testing efforts efficiently. From 5,000 total transactions, they might decide to test only transactions above 5M pesos or select a sample of 1,000 transactions based on risk assessment.

Decision Point: Always remember that materiality isn't just about numbers—it also involves professional judgment about what would influence users' decisions. Different industries and circumstances may require different materiality considerations.

Properly applying materiality concepts ensures the audit focuses on what truly matters to financial statement users while maintaining efficiency in the audit process.

Our AI companion is specifically built for the needs of students. Based on the millions of content pieces we have on the platform we can provide truly meaningful and relevant answers to students. But its not only about answers, the companion is even more about guiding students through their daily learning challenges, with personalised study plans, quizzes or content pieces in the chat and 100% personalisation based on the students skills and developments.

You can download the app in the Google Play Store and in the Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

10

Smart Tools NEW

Transform this note into: ✓ 50+ Practice Questions ✓ Interactive Flashcards ✓ Full Practice Test ✓ Essay Outlines

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user