Accounting is all about tracking, organizing, and understanding business finances.... Show more

Sign up to see the contentIt's free!

Access to all documents

Improve your grades

Join milions of students

Subjects

Triangle Congruence and Similarity Theorems

Triangle Properties and Classification

Linear Equations and Graphs

Geometric Angle Relationships

Trigonometric Functions and Identities

Equation Solving Techniques

Circle Geometry Fundamentals

Division Operations and Methods

Basic Differentiation Rules

Exponent and Logarithm Properties

Show all topics

Human Organ Systems

Reproductive Cell Cycles

Biological Sciences Subdisciplines

Cellular Energy Metabolism

Autotrophic Energy Processes

Inheritance Patterns and Principles

Biomolecular Structure and Organization

Cell Cycle and Division Mechanics

Cellular Organization and Development

Biological Structural Organization

Show all topics

Chemical Sciences and Applications

Atomic Structure and Composition

Molecular Electron Structure Representation

Atomic Electron Behavior

Matter Properties and Water

Mole Concept and Calculations

Gas Laws and Behavior

Periodic Table Organization

Chemical Thermodynamics Fundamentals

Chemical Bond Types and Properties

Show all topics

European Renaissance and Enlightenment

European Cultural Movements 800-1920

American Revolution Era 1763-1797

American Civil War 1861-1865

Global Imperial Systems

Mongol and Chinese Dynasties

U.S. Presidents and World Leaders

Historical Sources and Documentation

World Wars Era and Impact

World Religious Systems

Show all topics

Classic and Contemporary Novels

Literary Character Analysis

Rhetorical Theory and Practice

Classic Literary Narratives

Reading Analysis and Interpretation

Narrative Structure and Techniques

English Language Components

Influential English-Language Authors

Basic Sentence Structure

Narrative Voice and Perspective

Show all topics

612

•

Feb 1, 2026

•

studywithnessa

@studywithnessa

Accounting is all about tracking, organizing, and understanding business finances.... Show more

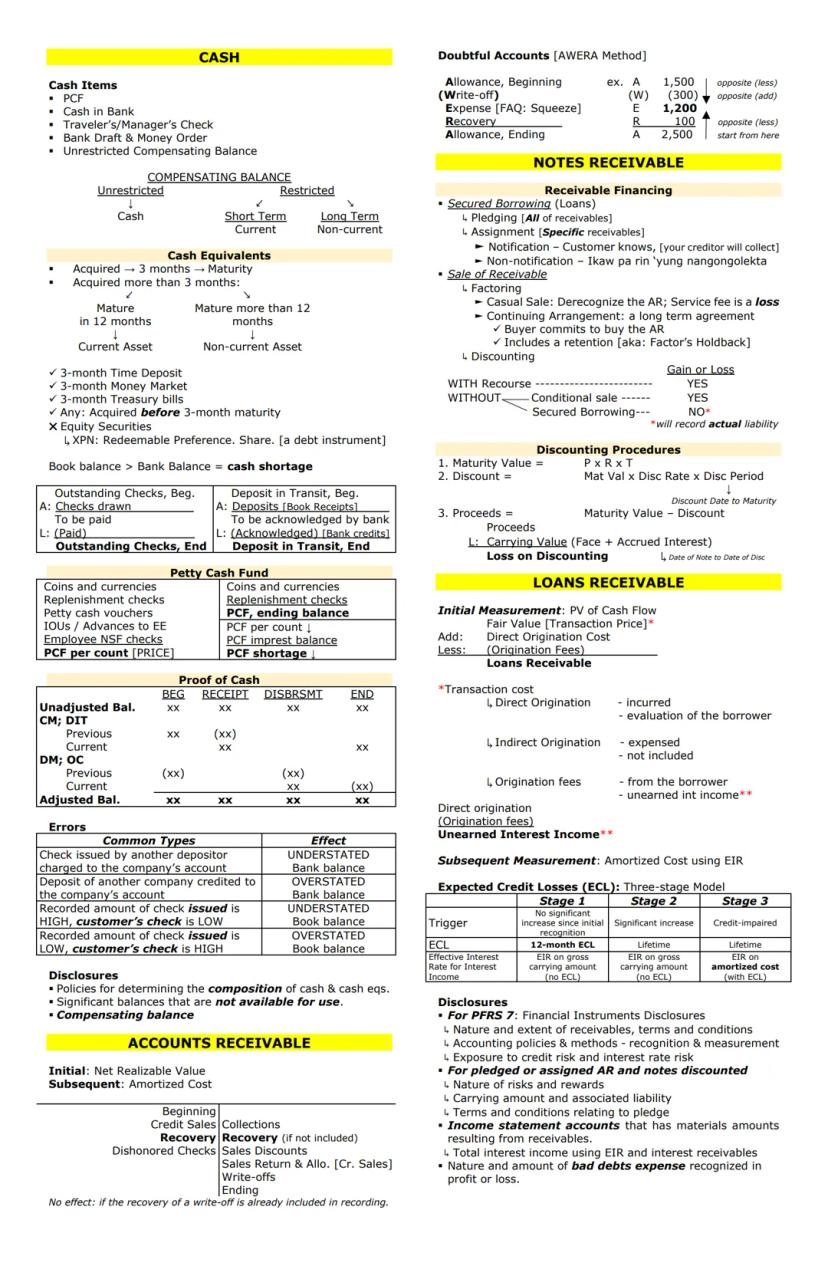

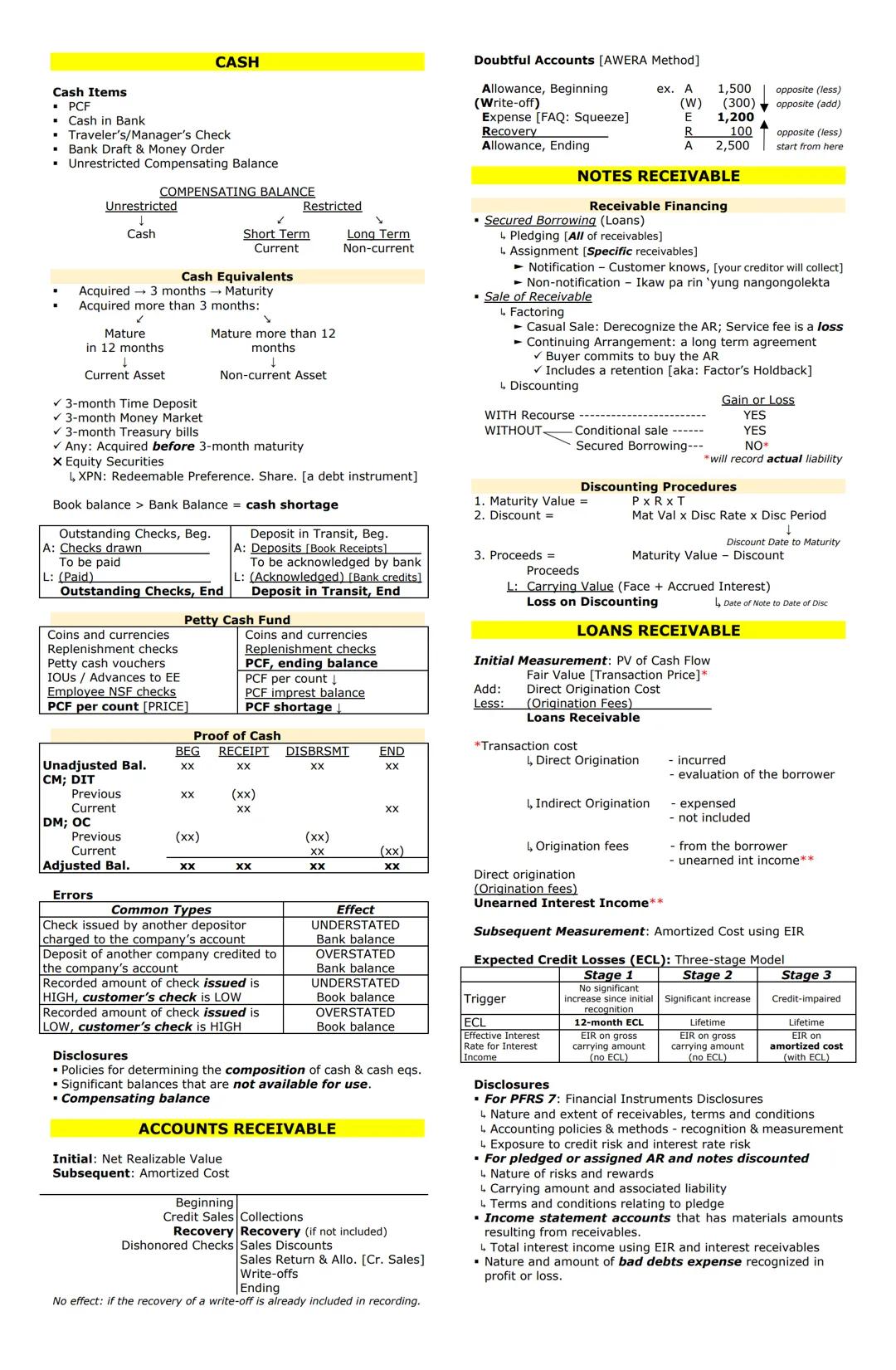

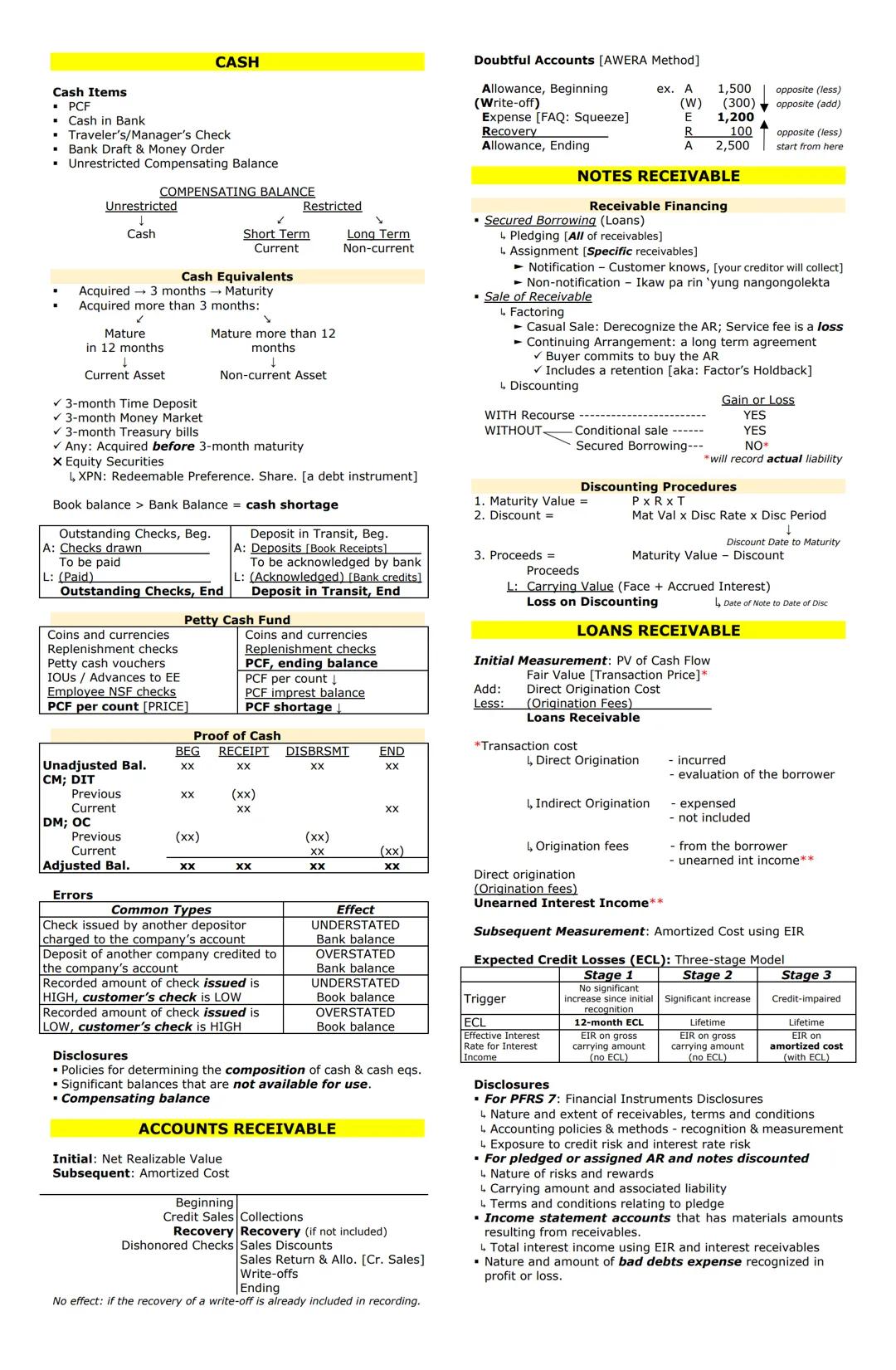

Ever wondered what actually counts as "cash" in accounting? Cash includes physical currency (PCF), bank deposits, traveler's checks, bank drafts, and unrestricted compensating balances. A compensating balance is money you must keep in your account—if it's unrestricted, it counts as cash; if restricted, it's either a current or non-current asset depending on the timeframe.

Cash equivalents are investments that can be quickly converted to cash. They must mature within 3 months of acquisition to qualify. This includes 3-month time deposits, money market funds, and treasury bills. Important to note: equity securities are never cash equivalents, even if they're highly liquid.

When managing receivables, the Allowance for Doubtful Accounts method (AWERA) helps track potential uncollectible accounts. The basic formula works like this:

For Notes Receivable, you'll encounter different financing arrangements:

💡 When discounting a note, remember that proceeds equal the maturity value minus the discount. The discount is calculated using: Maturity Value × Discount Rate × Discount Period.

Proof of Cash reconciliations help identify errors between bank and book records. Common errors include:

For expected credit losses on loans, the three-stage model is used:

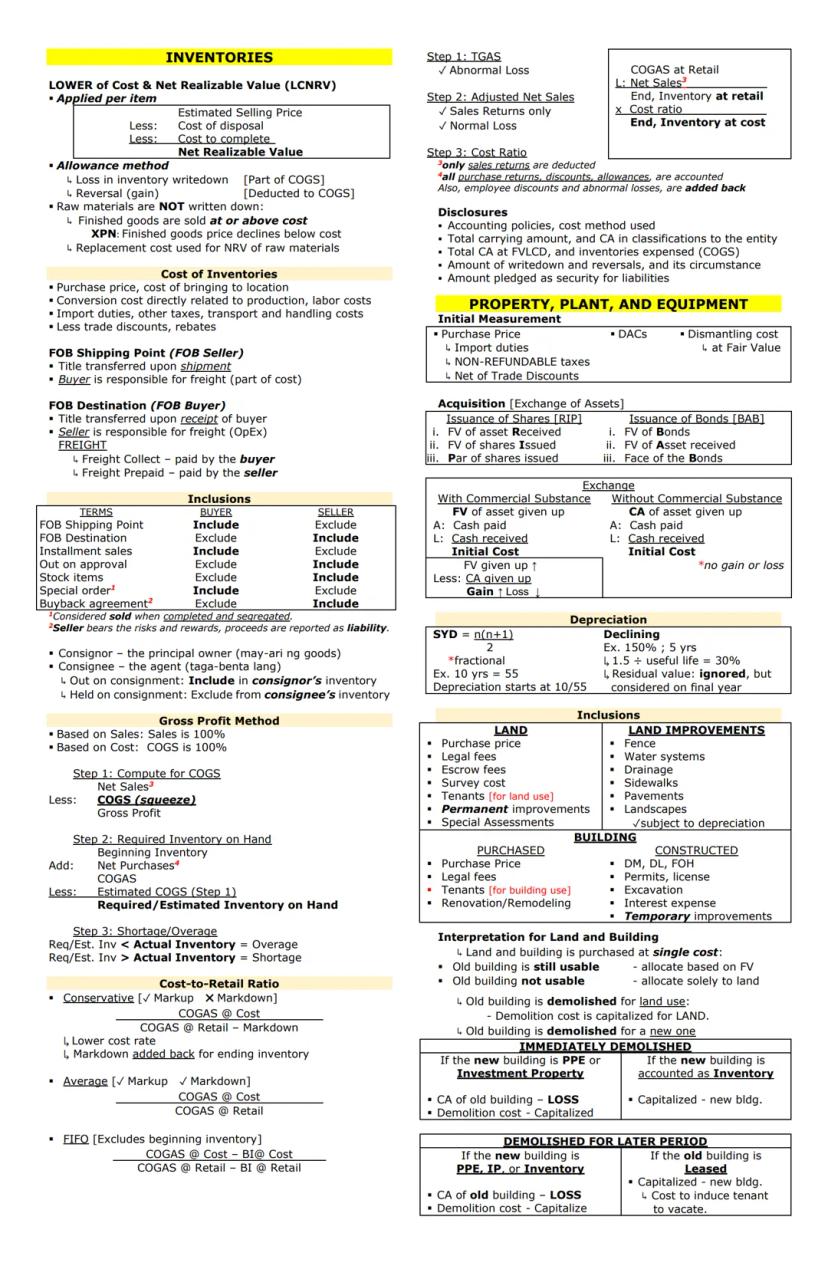

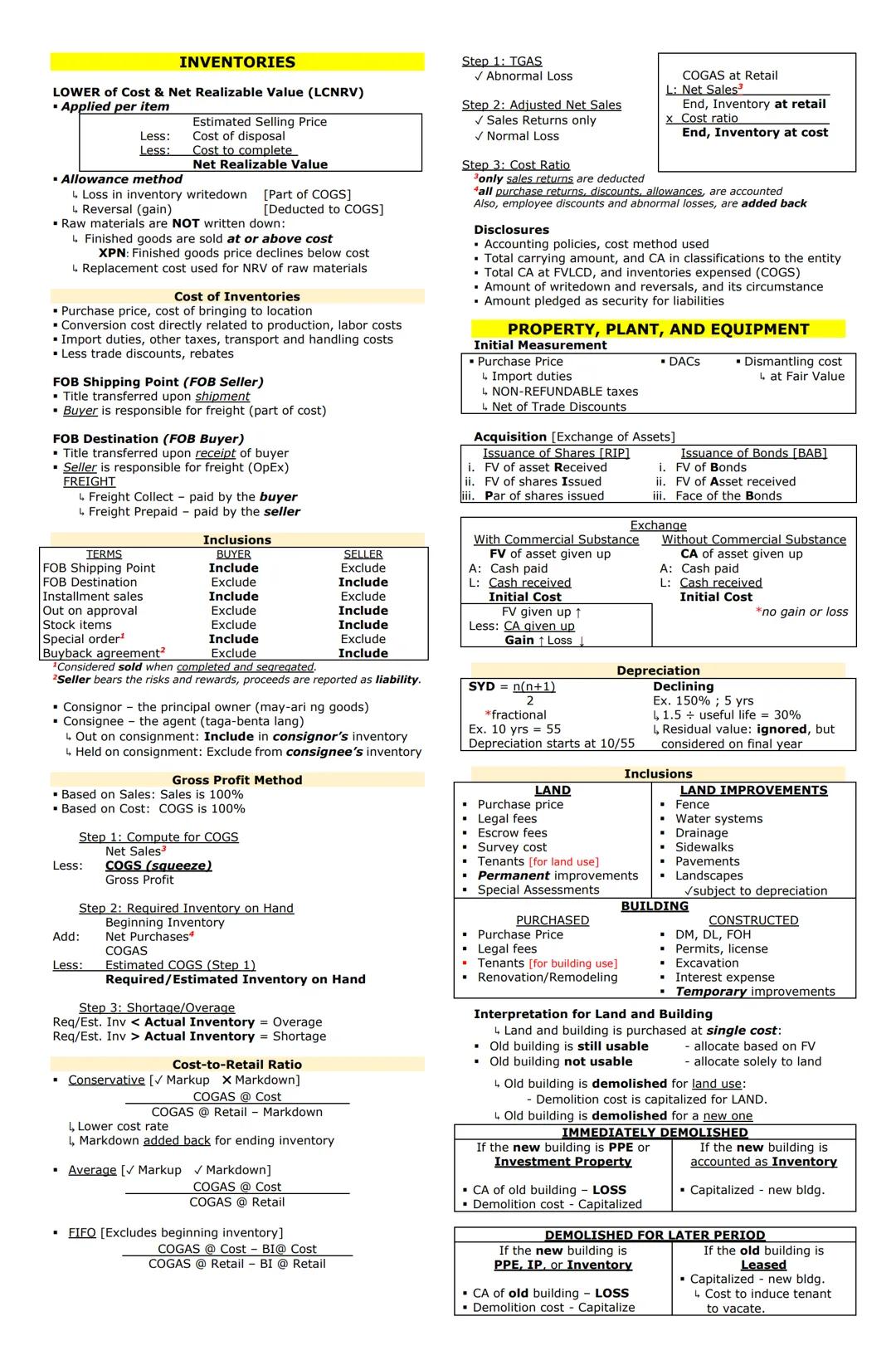

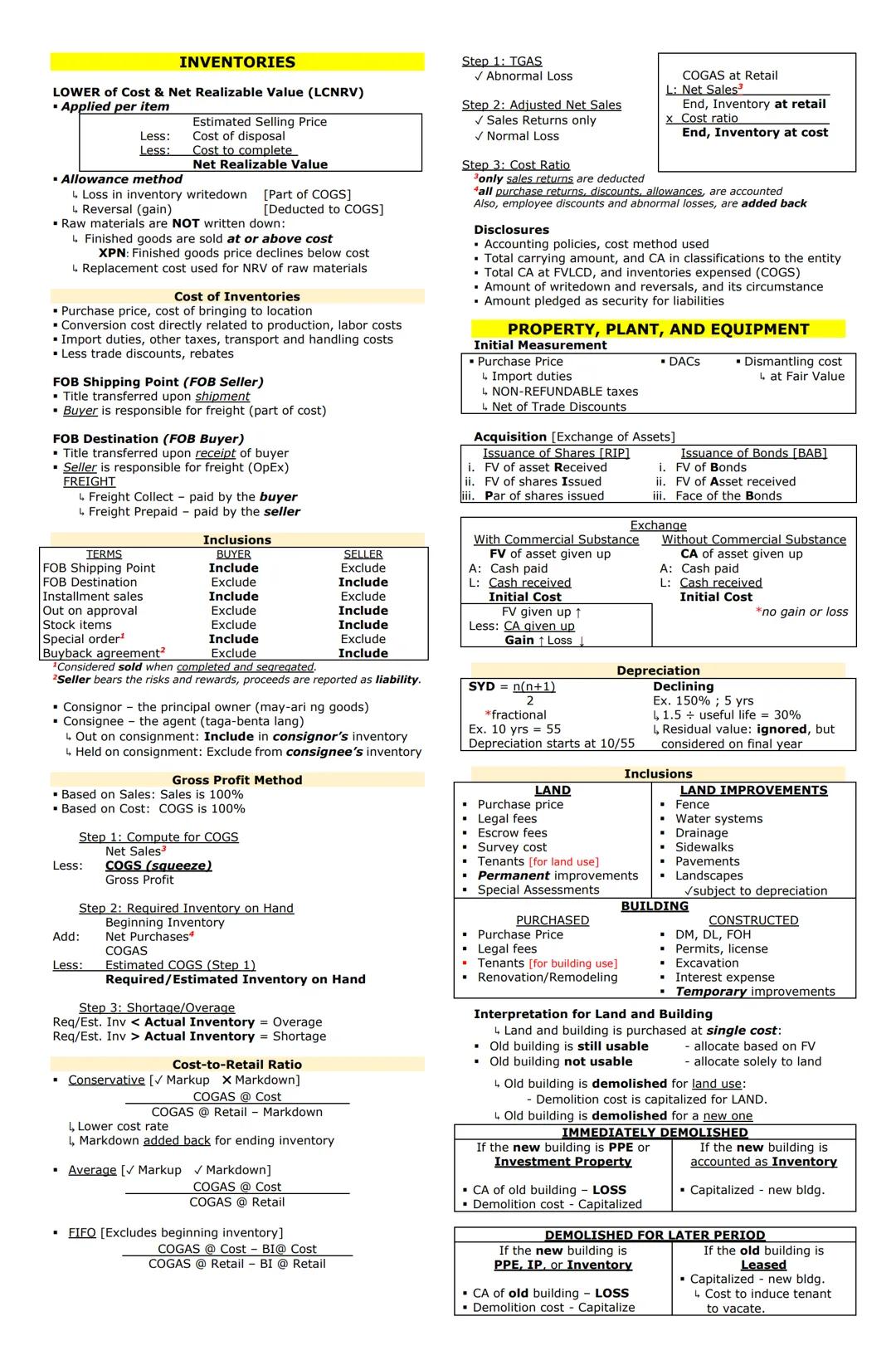

Inventory valuation is crucial for accurate financial reporting. The Lower of Cost and Net Realizable Value (LCNRV) principle requires you to value inventory at whichever is lower—its cost or what you can sell it for minus completion and selling costs.

When determining inventory cost, include purchase price, import duties, transport costs, and handling fees, but subtract trade discounts and rebates. Remember that shipping terms dramatically affect who records inventory when:

| Terms | Who Records Inventory |

|---|---|

| FOB Shipping Point | Buyer (goods in transit) |

| FOB Destination | Seller (goods in transit) |

| Consignment | Consignor (owner), not consignee |

The Gross Profit Method is super helpful for estimating inventory when a physical count isn't possible:

💡 When using the Retail Inventory Method, the conservative approach adds markdowns back for ending inventory, resulting in a lower cost rate.

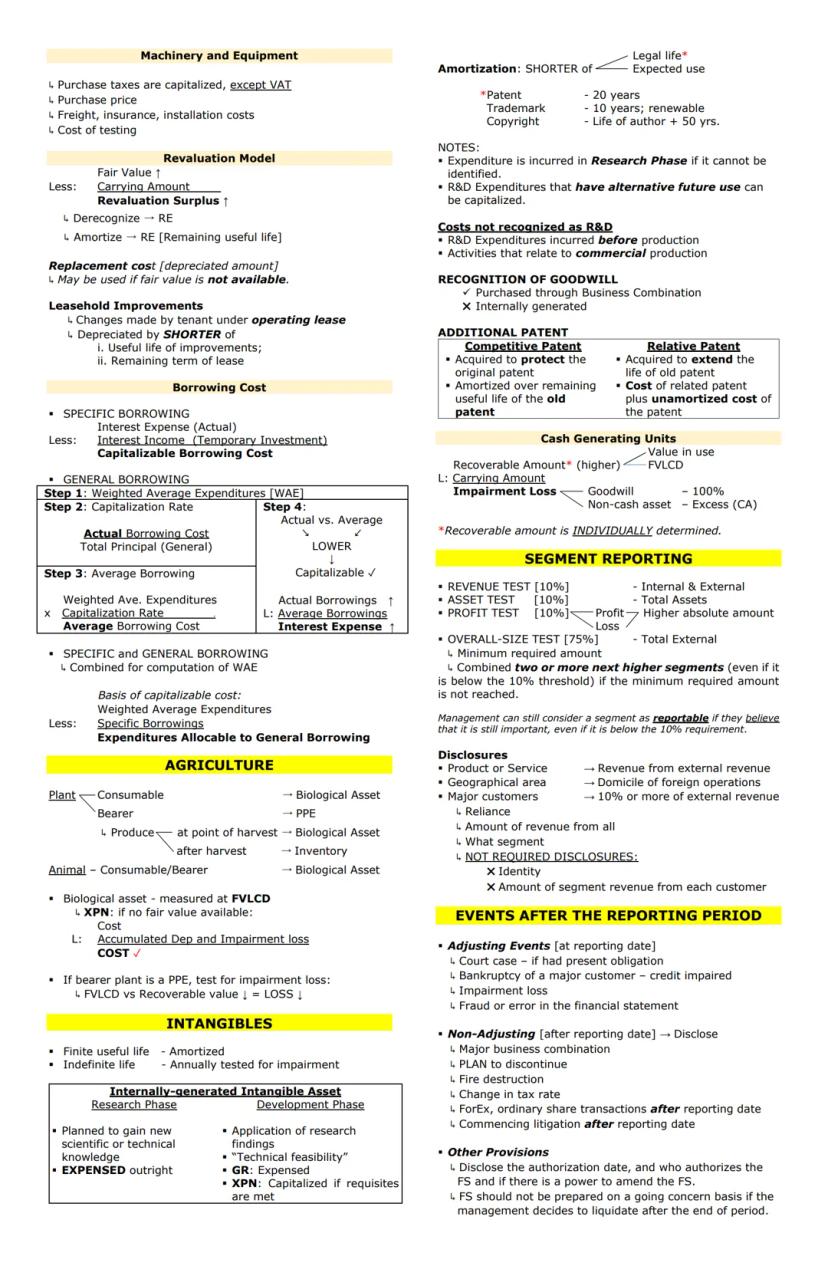

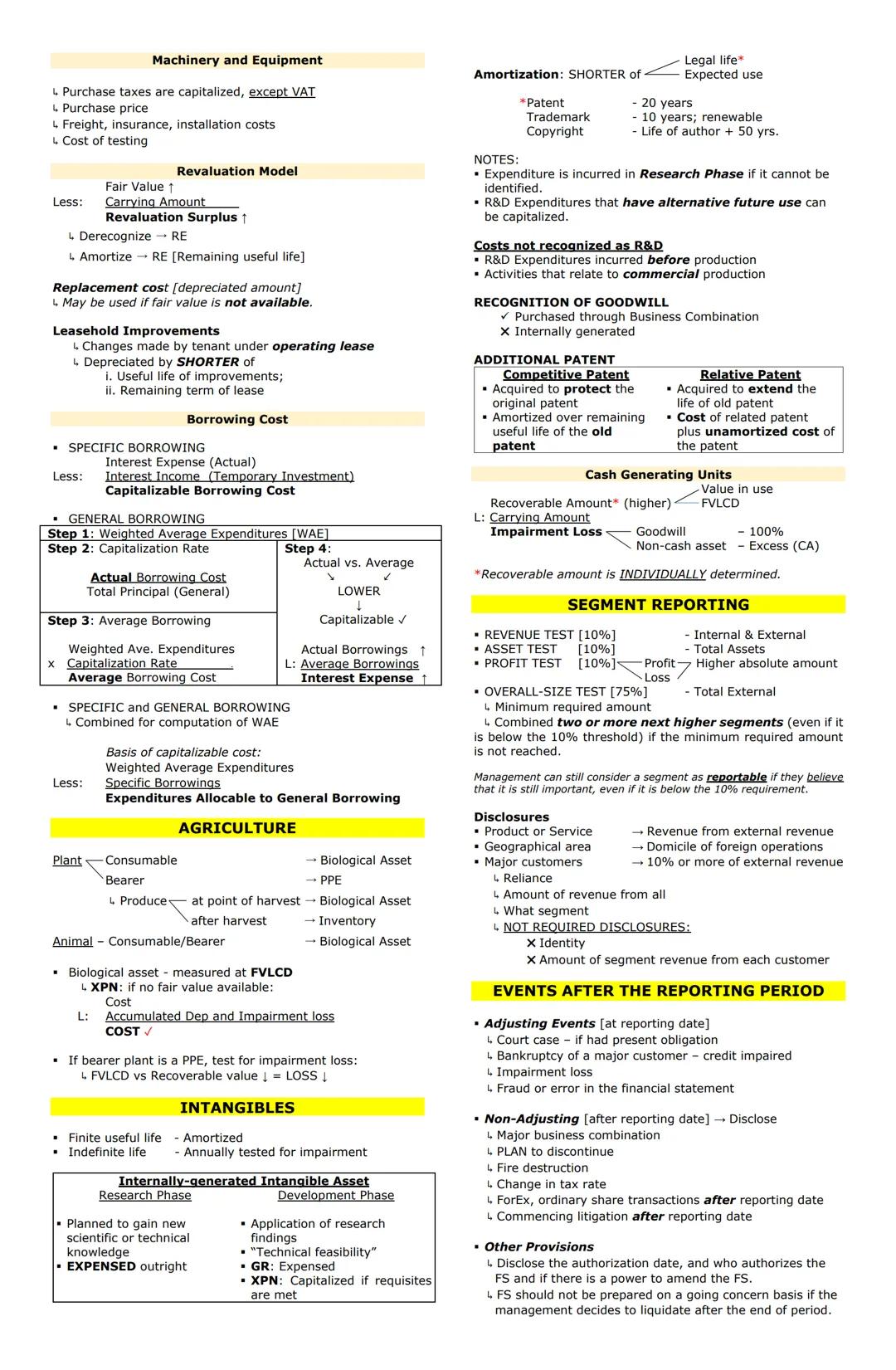

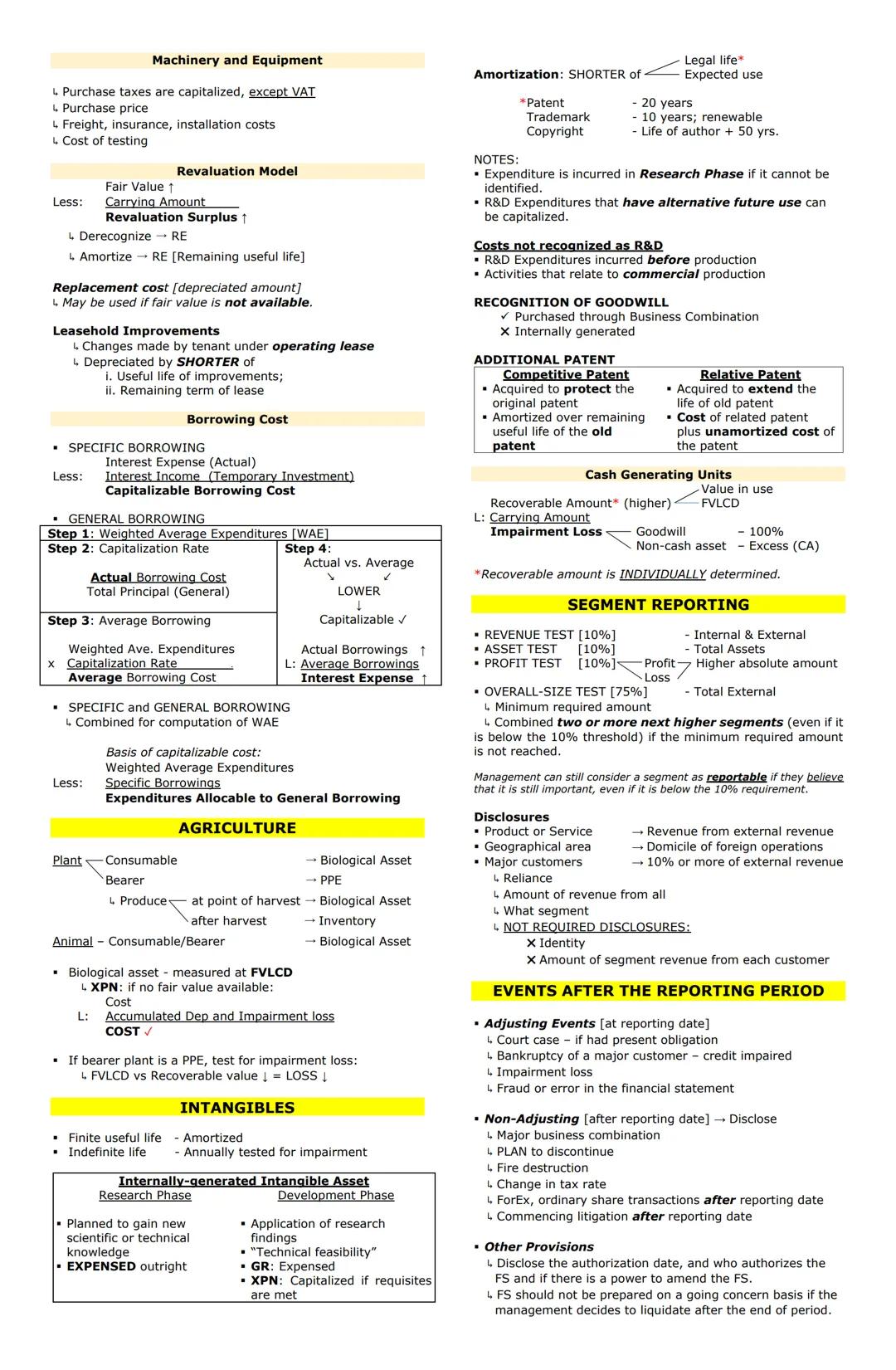

For Property, Plant, and Equipment (PPE), initial measurement includes purchase price, import duties, non-refundable taxes (minus trade discounts), and dismantling costs. When acquiring assets through exchange, use fair value if the exchange has commercial substance.

For land and buildings purchased together, allocation depends on intended use:

Depreciation methods vary by asset type:

For land improvements (fences, sidewalks, drainage systems), remember they're subject to depreciation, unlike land itself which is never depreciated.

When purchasing machinery and equipment, capitalize all costs needed to prepare the asset for use—this includes purchase price, freight, installation, and testing costs. Just remember that VAT is typically not capitalized.

The revaluation model allows you to increase an asset's value to its fair value. The difference between fair value and carrying amount creates a revaluation surplus in equity. This surplus can be:

Leasehold improvements are changes made by a tenant to a leased property. These improvements are depreciated over the shorter of:

When a company borrows money to construct an asset, borrowing costs should be capitalized as part of the asset's cost. For specific borrowings, capitalize the actual interest expense minus any income earned from temporarily investing those funds. For general borrowings, use the weighted average expenditures and capitalization rate to determine the capitalizable amount.

💡 When dealing with both specific and general borrowings, combine them for weighted average expenditure calculations, then subtract specific borrowings to find the amount allocable to general borrowing.

For agricultural assets, classification is important:

Intangible assets with finite useful lives (like patents and trademarks) are amortized, while those with indefinite lives are tested annually for impairment. For internally-generated intangibles:

When testing assets for impairment, group them into Cash Generating Units and compare the recoverable amount (higher of value in use or FVLCD) to the carrying amount. Any impairment loss first reduces goodwill, then is allocated to other assets proportionally.

For segment reporting, a segment is reportable if it meets any of these thresholds:

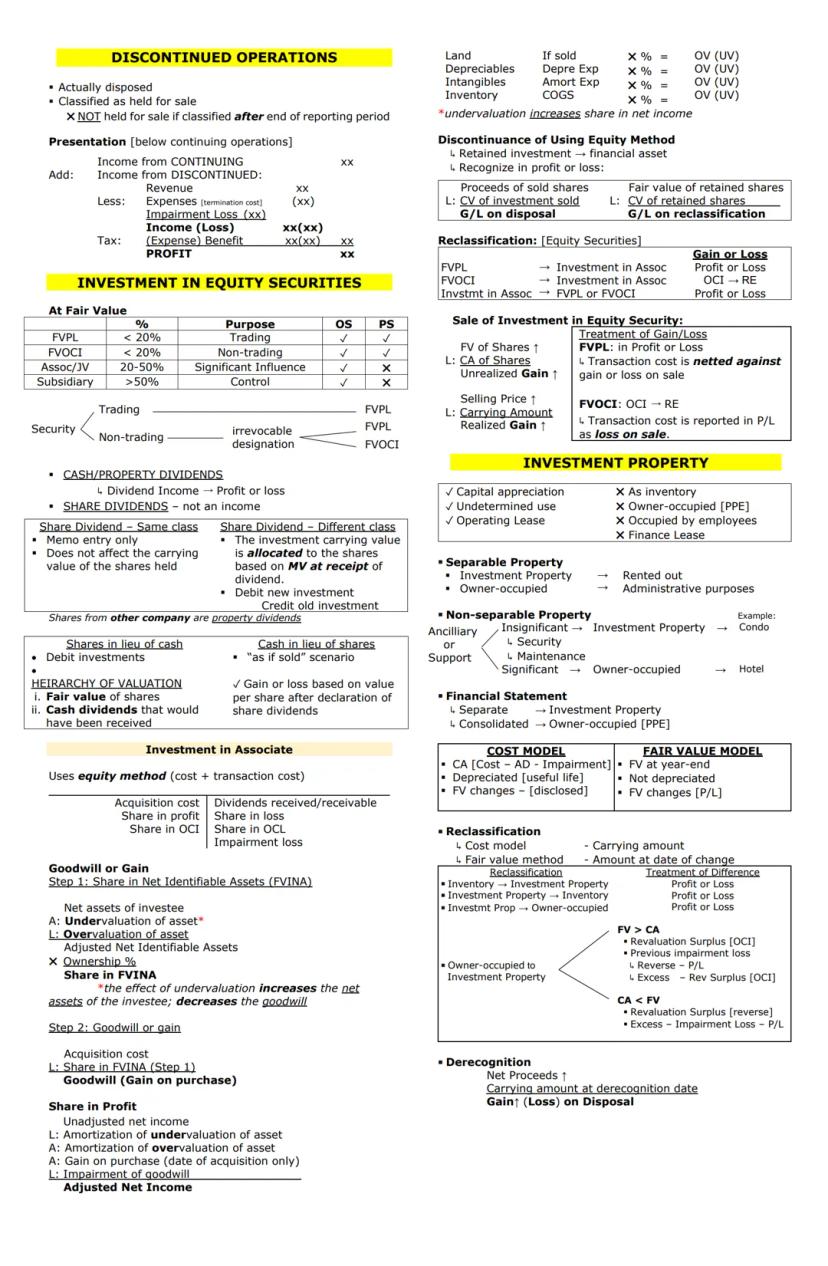

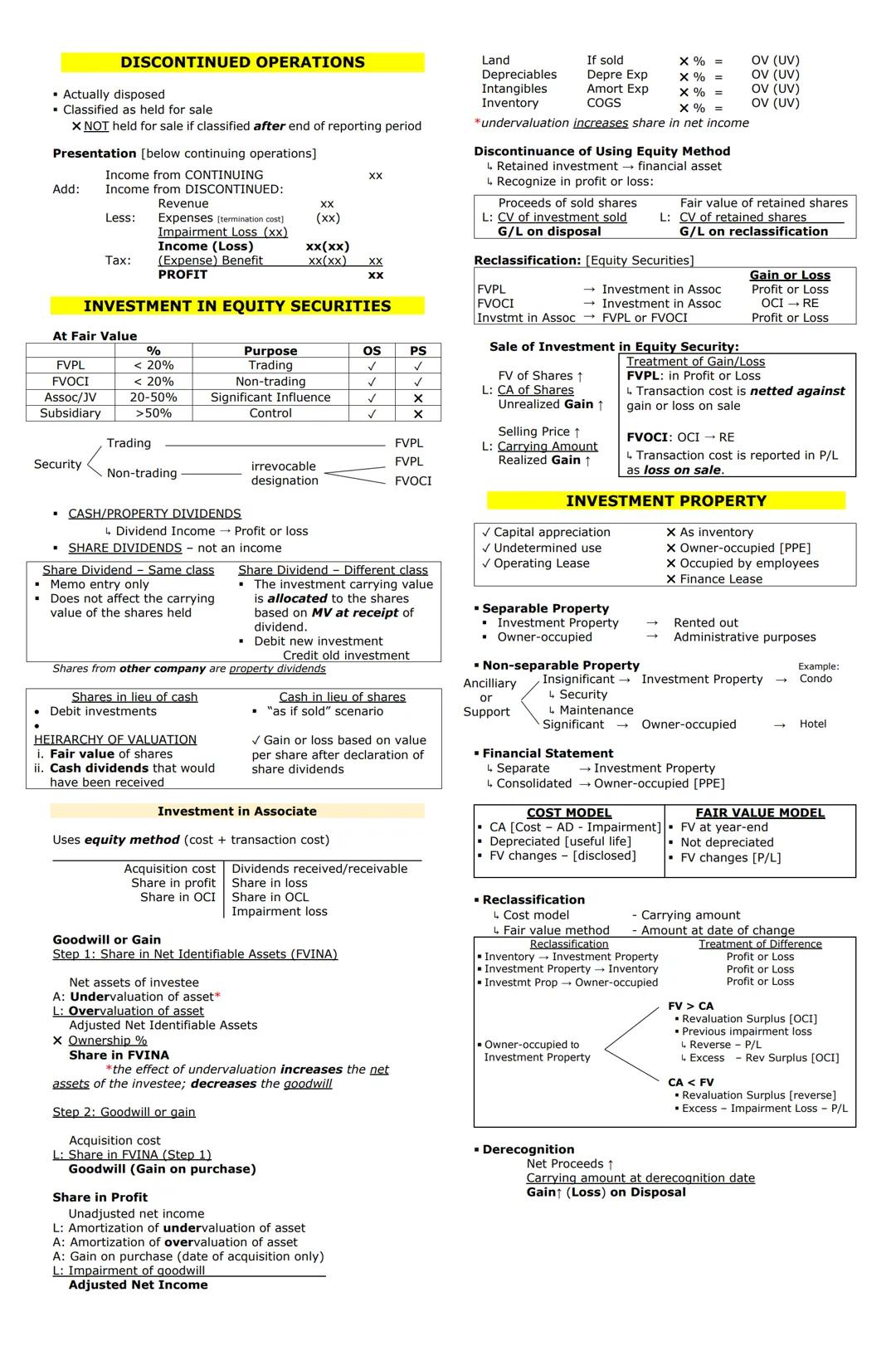

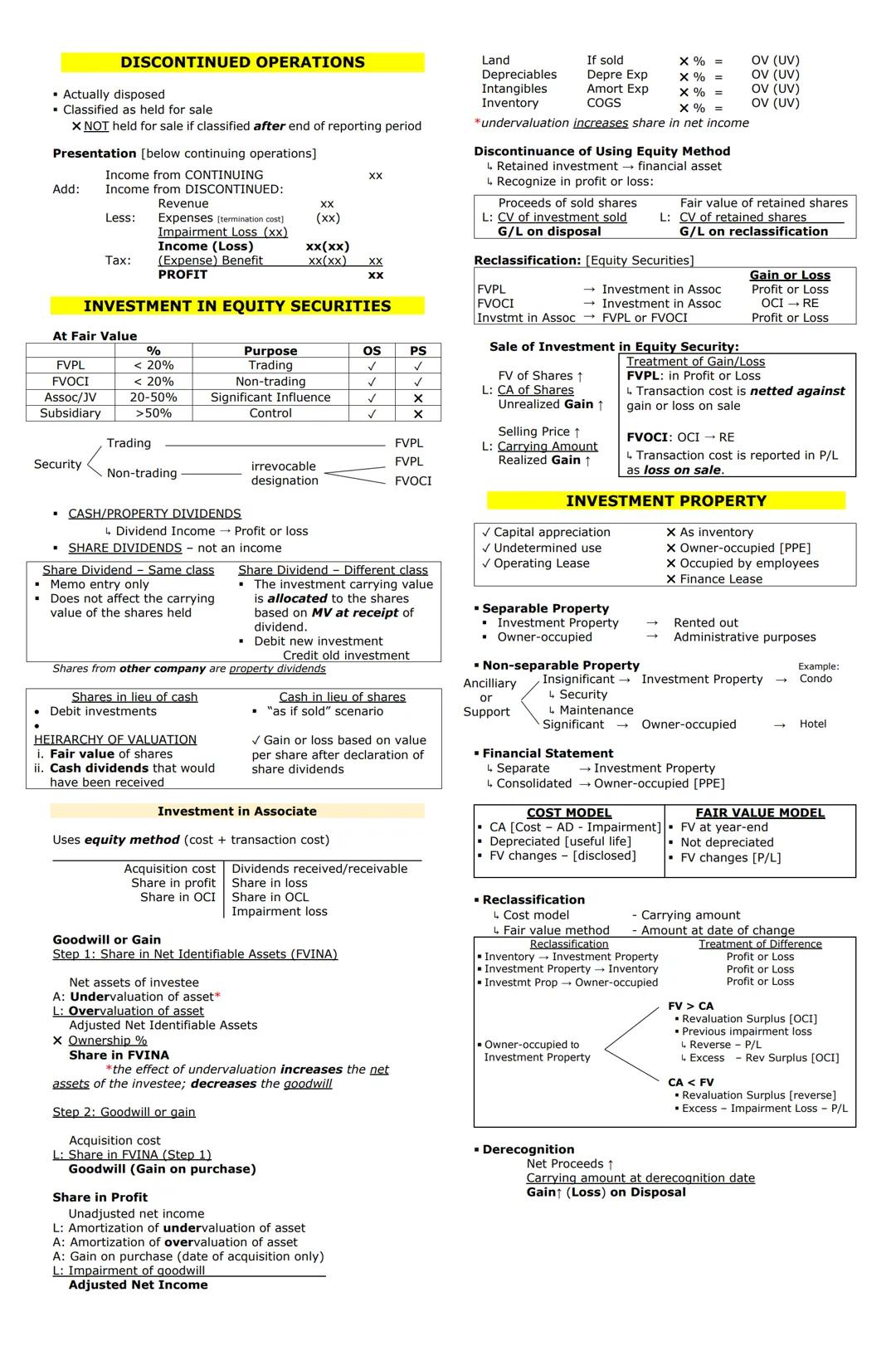

Discontinued operations represent a major business component that has been disposed of or is classified as "held for sale." When reporting discontinued operations, present their results separately from continuing operations in the income statement.

Investments in equity securities fall into several categories depending on the level of influence:

| Classification | Ownership % | Purpose | Measurement |

|---|---|---|---|

| FVPL | <20% | Trading | Fair Value through Profit/Loss |

| FVOCI | <20% | Non-trading | Fair Value through Other Comprehensive Income |

| Associate/JV | 20-50% | Significant influence | Equity method |

| Subsidiary | >50% | Control | Consolidated |

When investing in equity securities, remember these key points:

For investments in associates , use the equity method:

💡 When an associate's assets are under or overvalued, adjust your share of their profits by the amortization of these valuation differences.

If you discontinue using the equity method, recognize any gain or loss:

Investment property is property held for capital appreciation or rental income, not for:

You can measure investment property using either:

When reclassifying property , the difference between carrying amount and fair value is generally recognized in profit or loss.

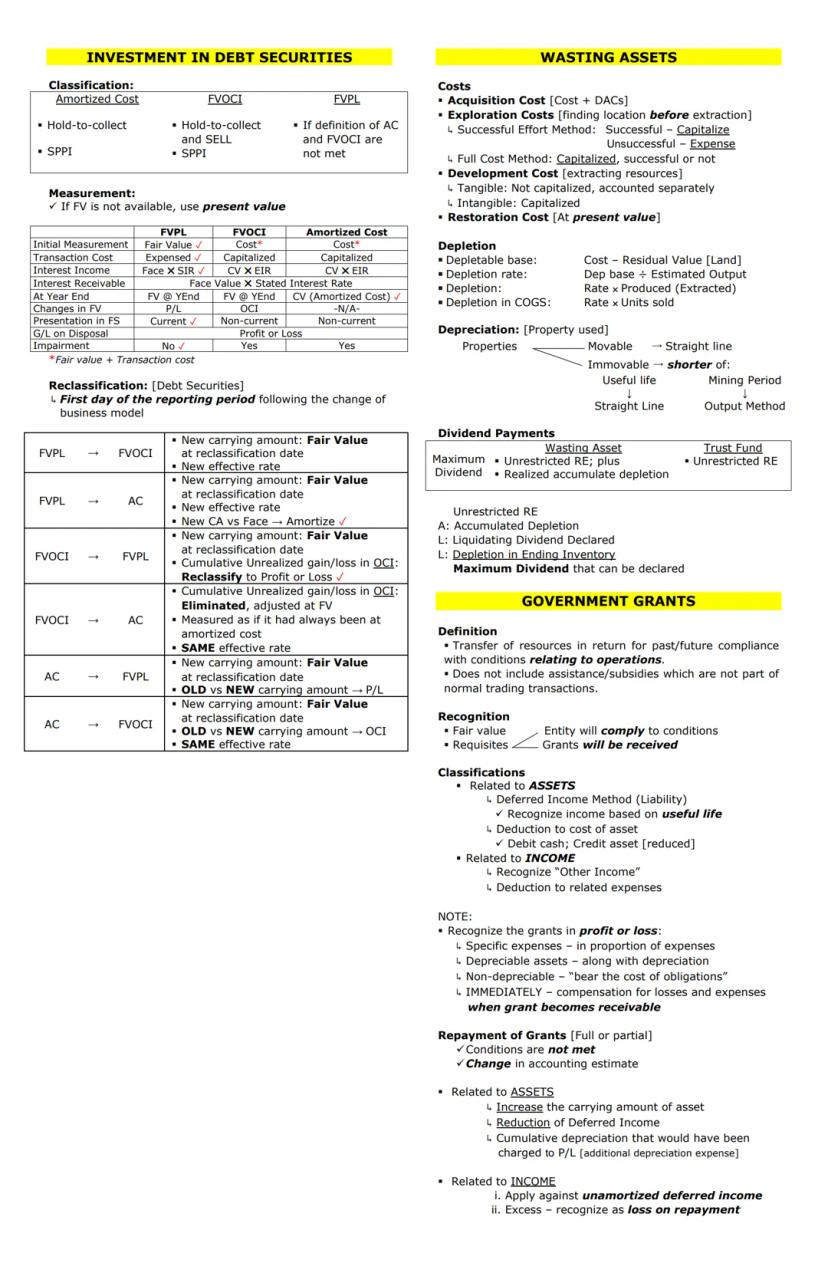

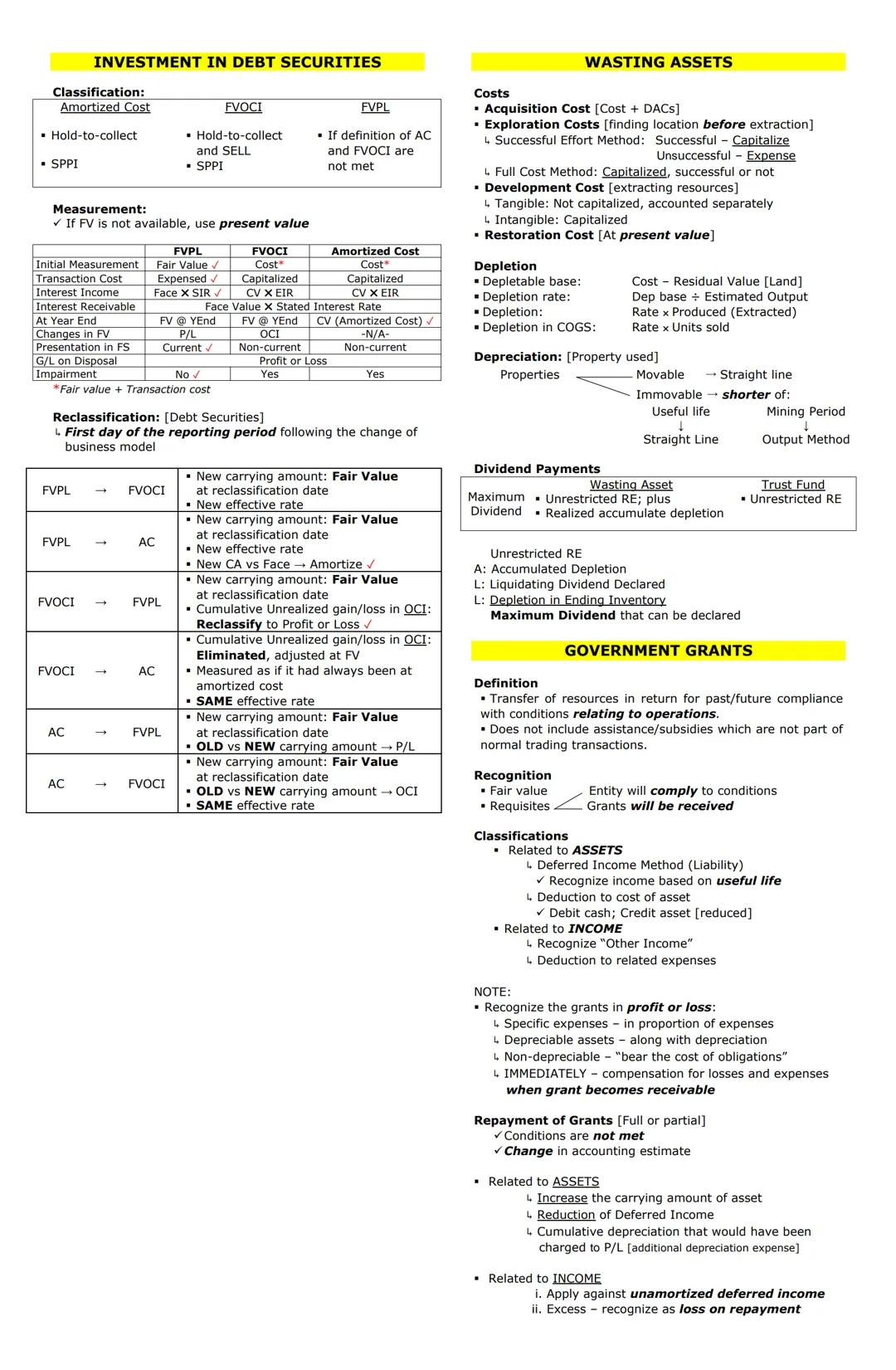

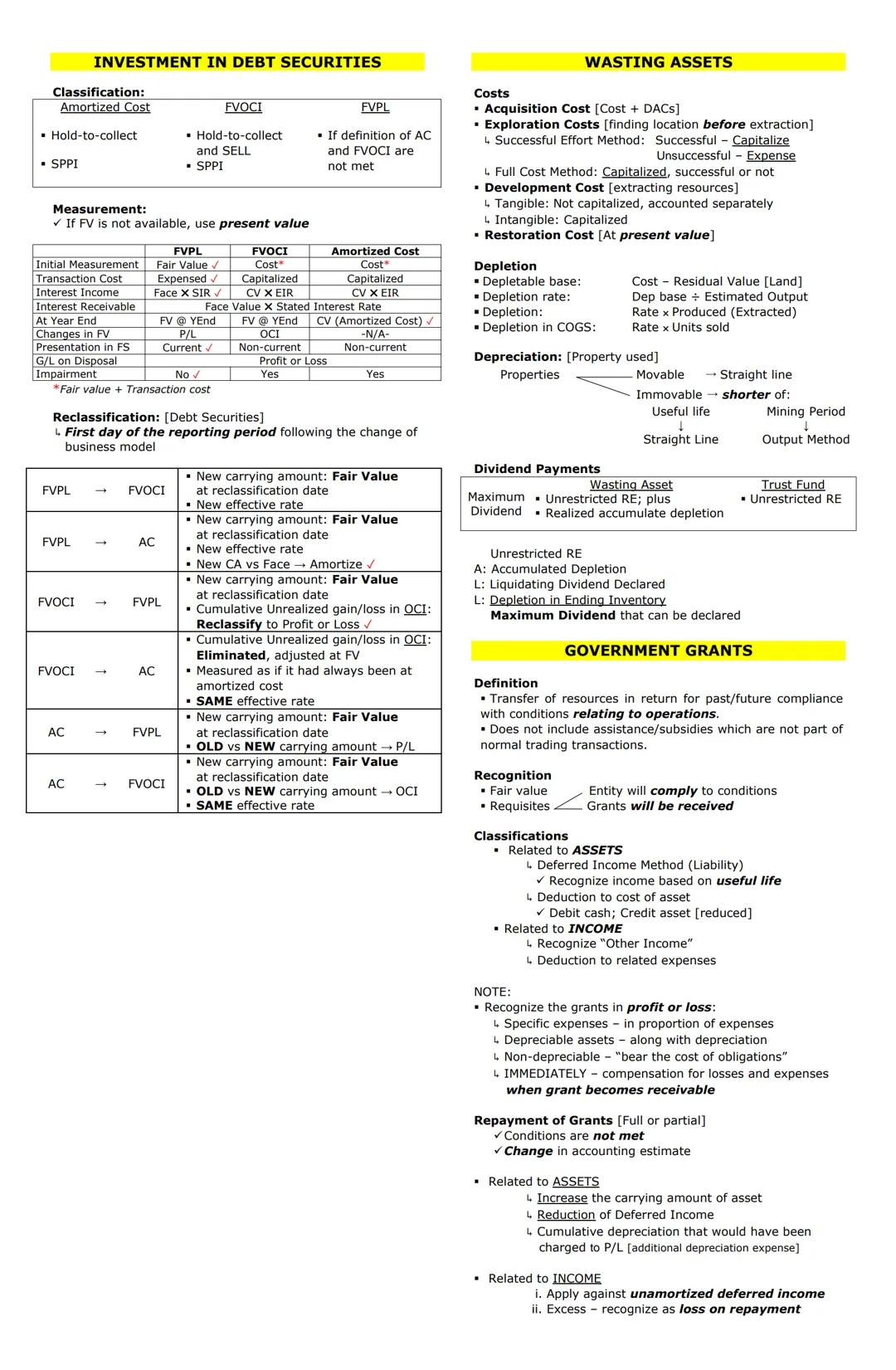

Debt securities are classified into three categories, each with different accounting treatments:

| Classification | Business Model | Cash Flow Characteristic | Measurement |

|---|---|---|---|

| Amortized Cost | Hold-to-collect | SPPI* | Cost + EIR** |

| FVOCI | Hold-to-collect and sell | SPPI | Fair Value through OCI |

| FVPL | Other | Other | Fair Value through P/L |

*SPPI = Solely Payments of Principal and Interest **EIR = Effective Interest Rate

When accounting for debt securities, remember:

Reclassification between categories is permitted only when your business model changes:

💡 When reclassifying from FVOCI to FVPL, cumulative unrealized gains or losses in OCI are reclassified to profit or loss.

For natural resource accounting, different costs are treated as follows:

Depletion accounts for using up natural resources:

Government grants are transfers of resources from the government that require compliance with certain conditions. They're recognized at fair value when there's reasonable assurance that:

Grants related to assets can be accounted for as:

Grants related to income can be:

If you have to repay a government grant, treat the repayment as a change in accounting estimate.

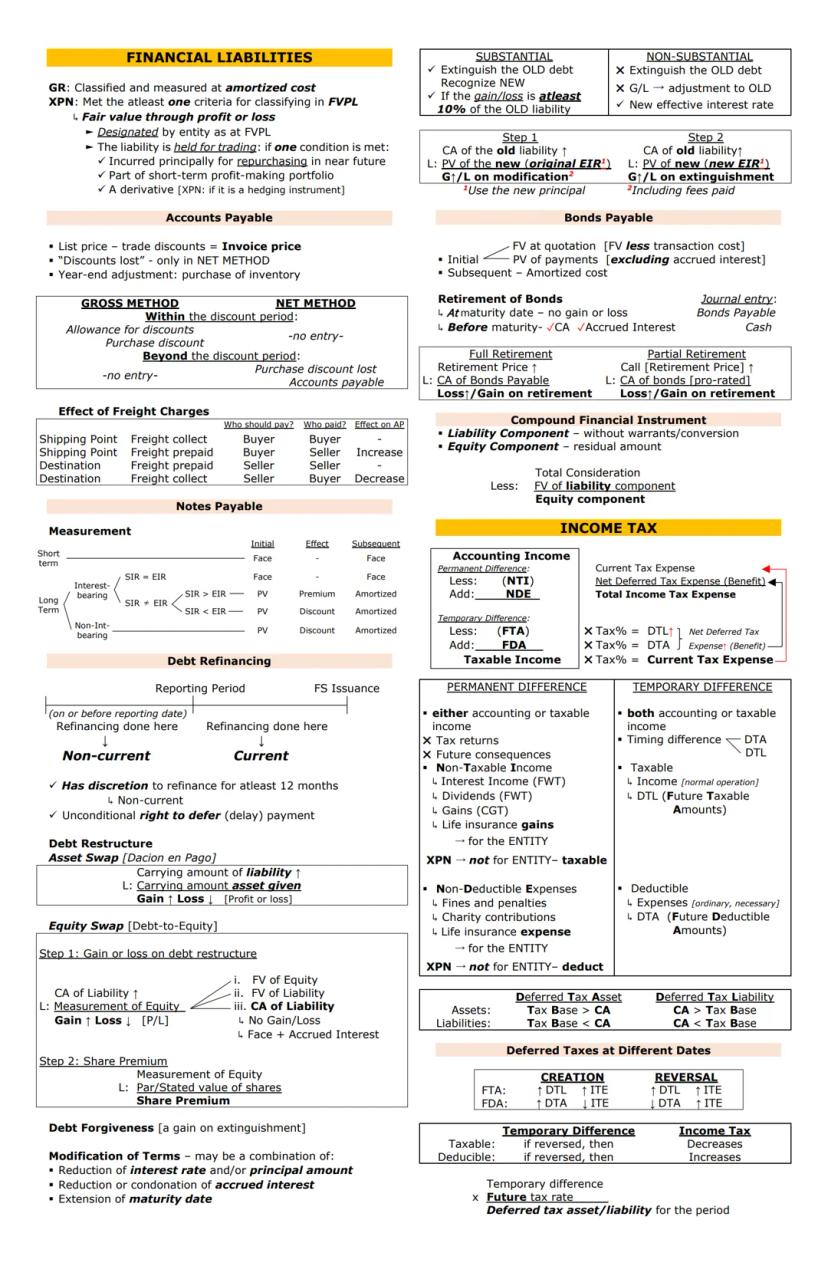

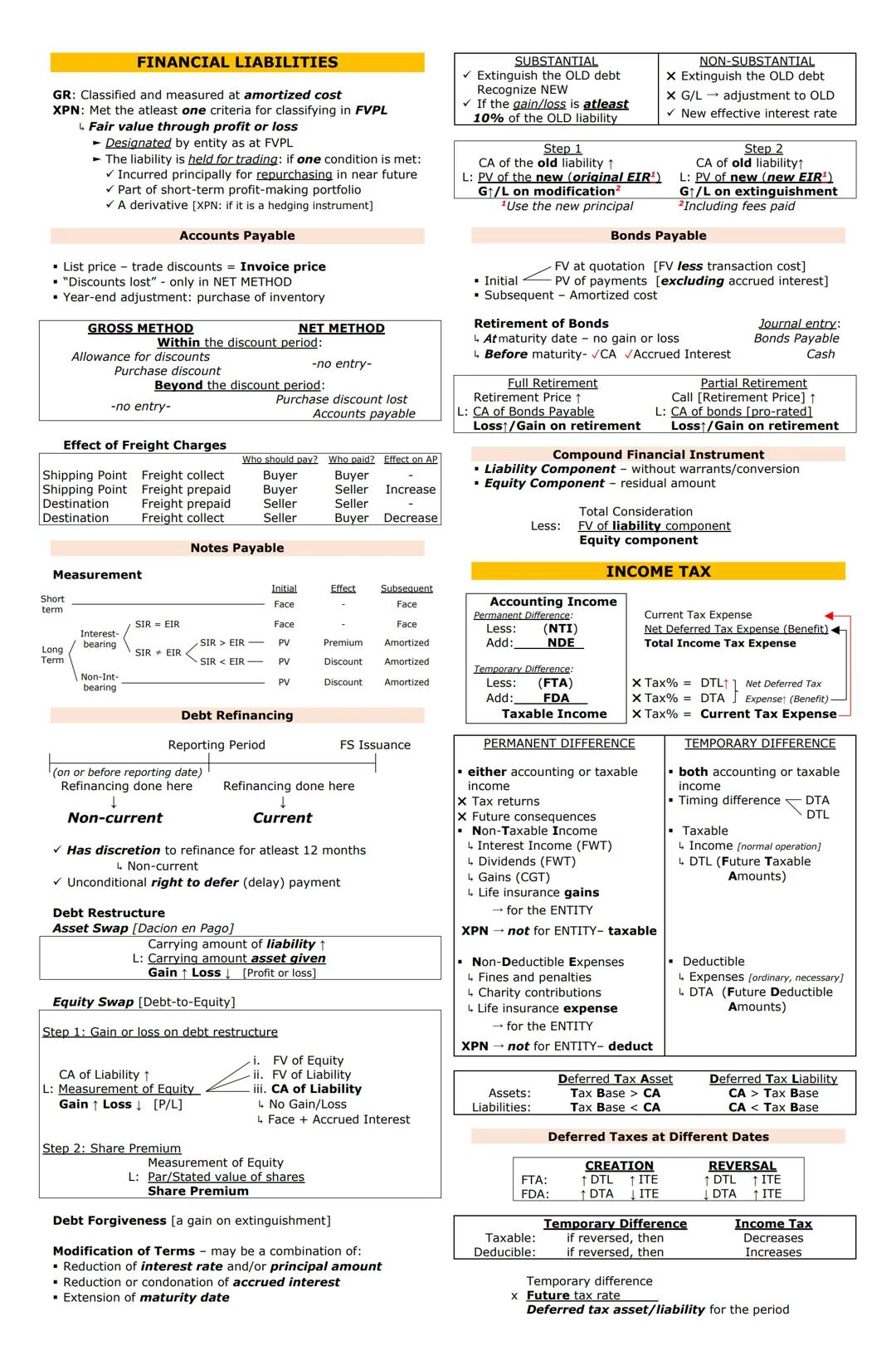

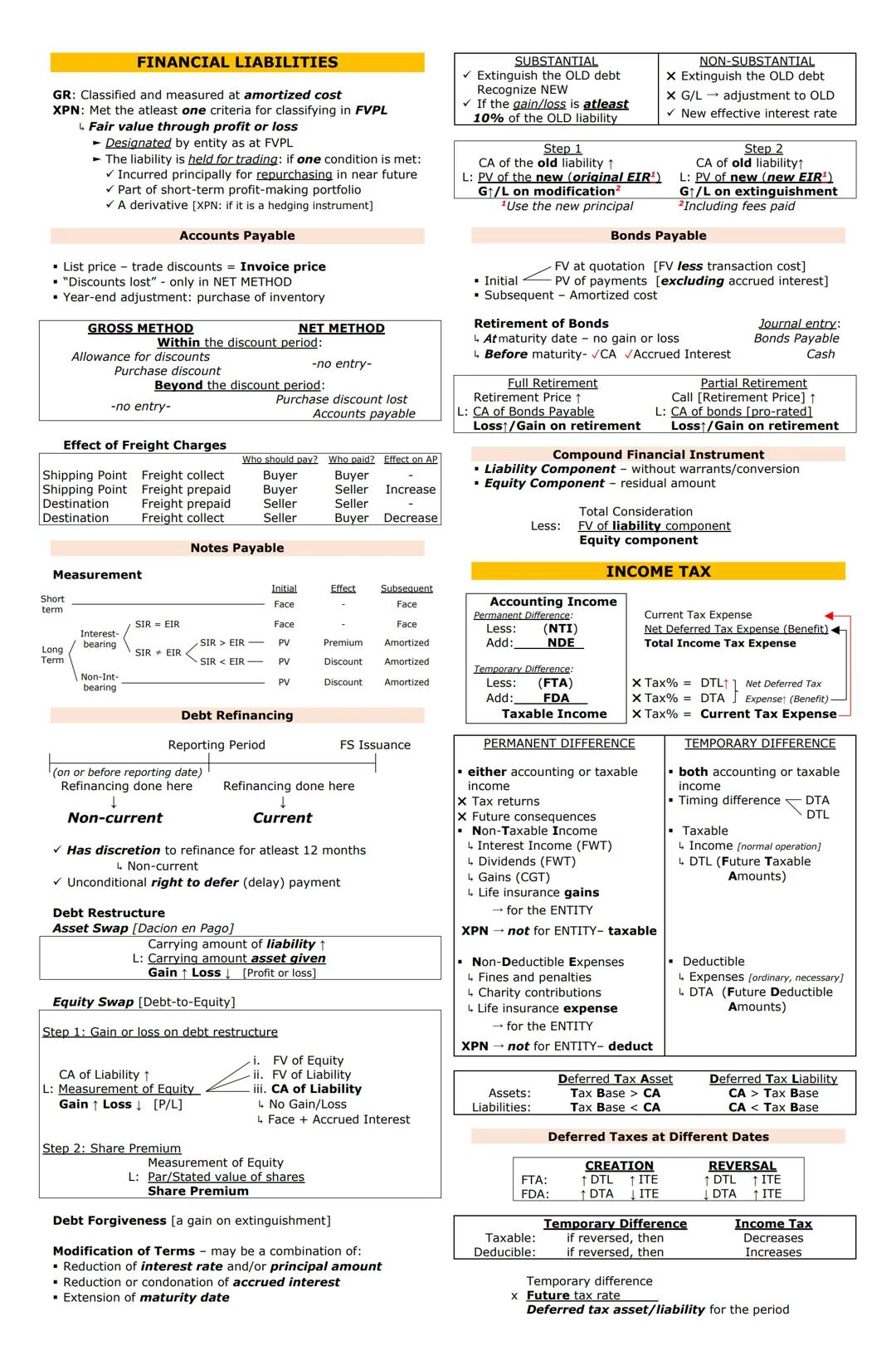

Financial liabilities are generally measured at amortized cost, except when designated at fair value through profit or loss (FVPL) or held for trading. When accounting for Accounts Payable, you can use either:

When dealing with debt modifications, determine if they're substantial or non-substantial:

For bonds payable:

💡 For compound financial instruments (like convertible bonds), separate the liability component and equity component. The equity component is the residual amount after determining the liability component's fair value.

Income tax accounting recognizes both current and deferred taxes:

Temporary differences create either:

Permanent differences affect current tax but don't create deferred taxes because they never reverse.

For debt refinancing, classification depends on when refinancing occurs:

When restructuring debt, you might encounter:

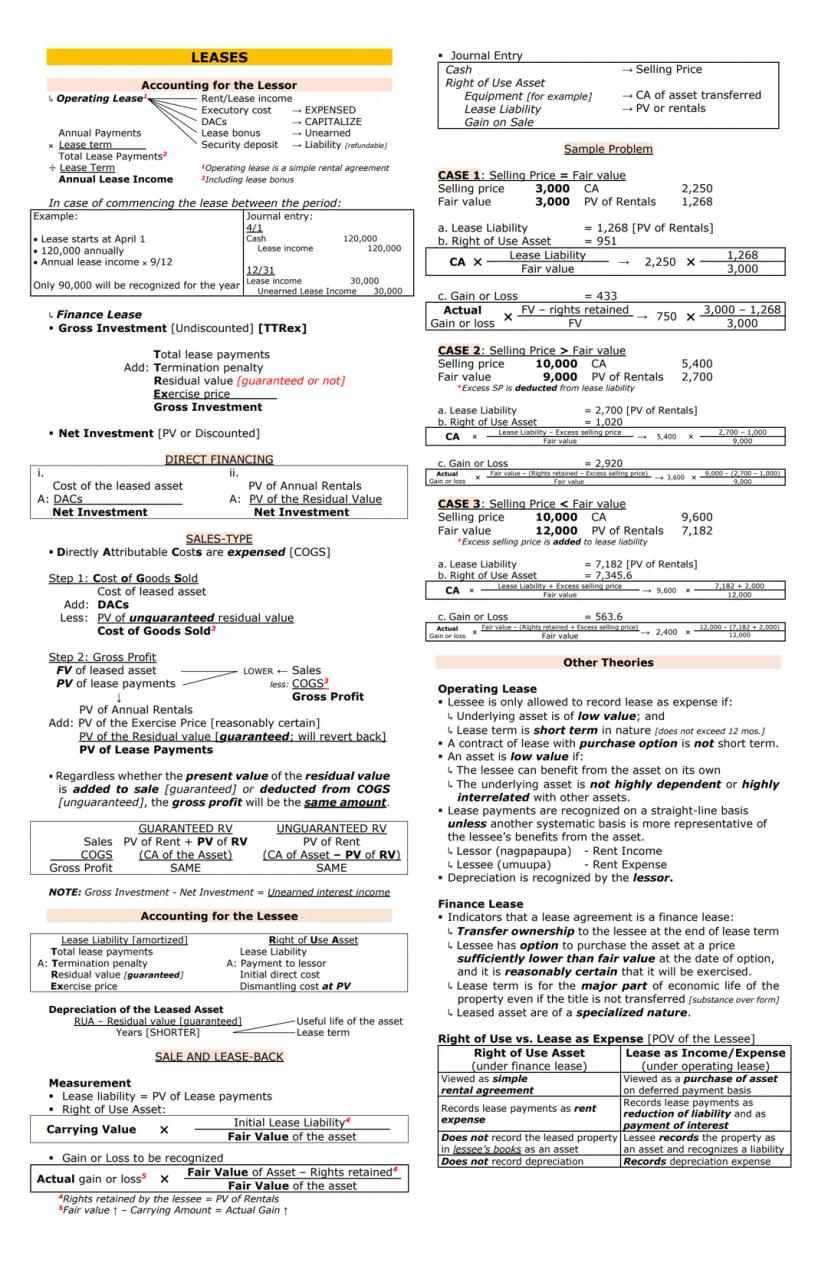

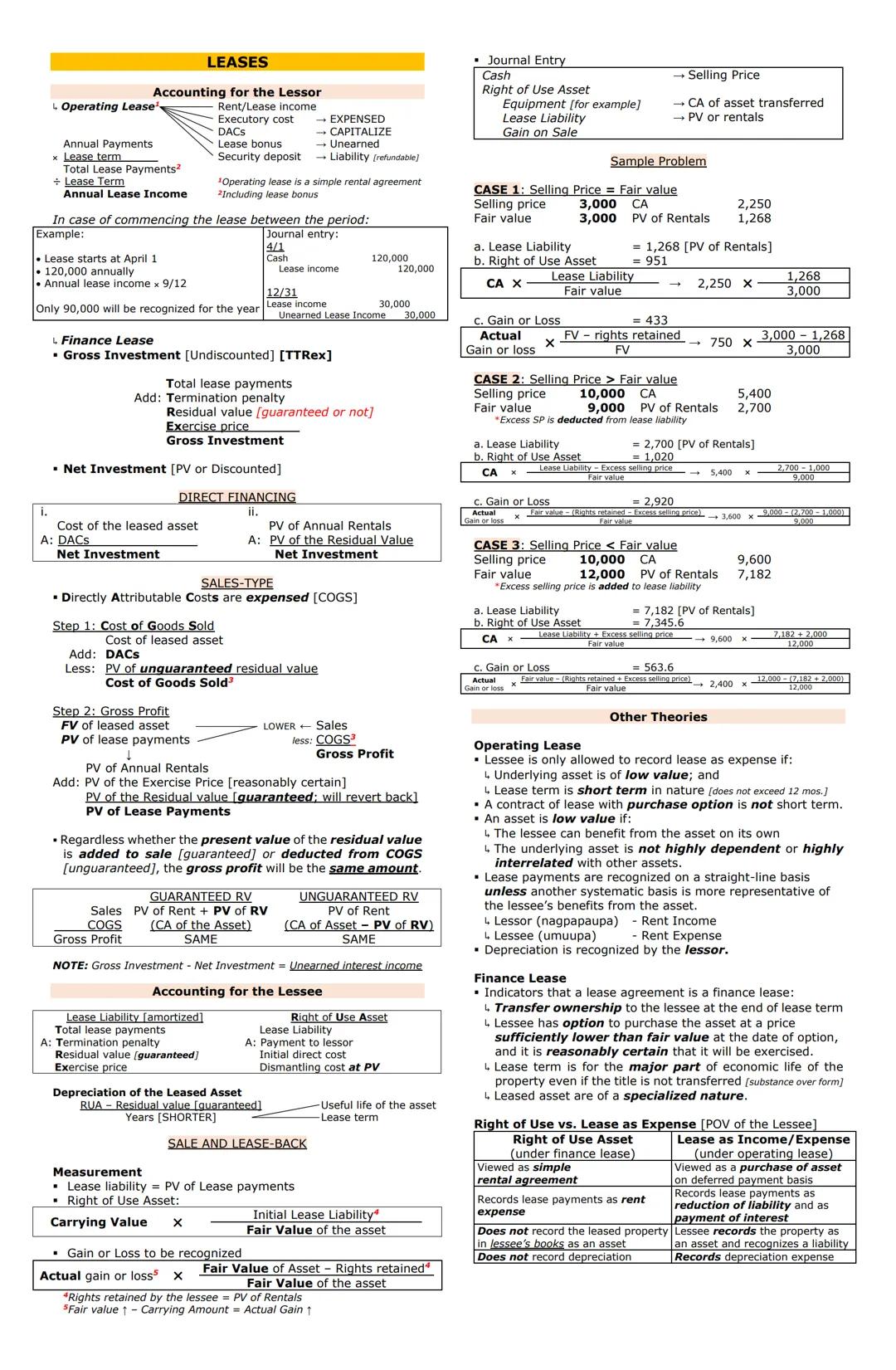

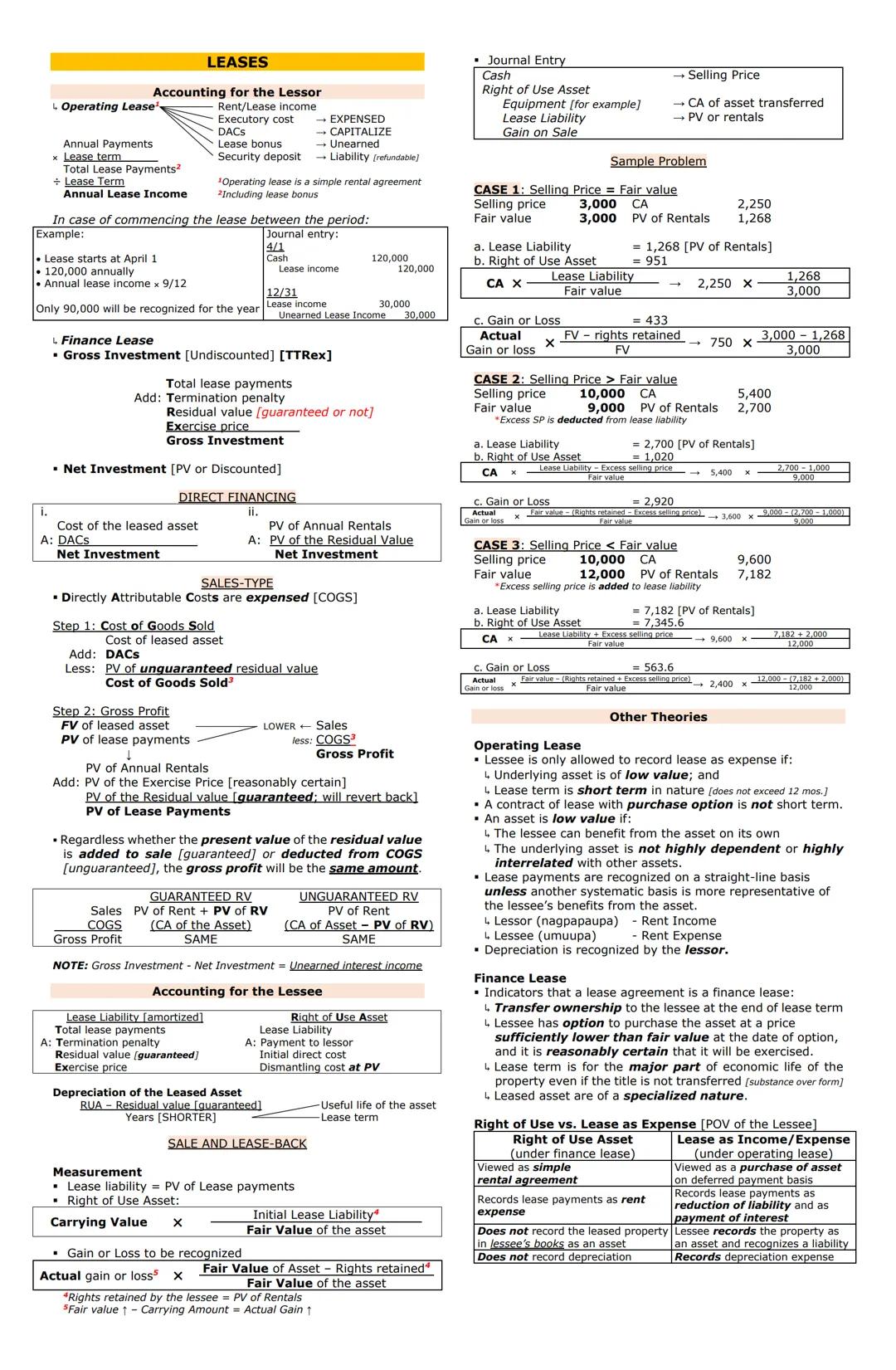

Leases are contracts that convey the right to use an asset for a period of time in exchange for payment. For lessors (property owners), leases are classified as either operating or finance.

In an operating lease:

For a finance lease, the lessor records:

Finance leases fall into two categories:

💡 For a sales-type lease, the gross profit will be the same whether the residual value is guaranteed or unguaranteed, but the components of the calculation will differ.

For lessees (tenants), finance leases require recording:

Depreciation of the leased asset is calculated over the shorter of:

In a sale and leaseback transaction, measurement depends on whether the transaction is at fair value:

Operating leases can only be recorded as expenses (not RUA) if:

Indicators that a lease is a finance lease include:

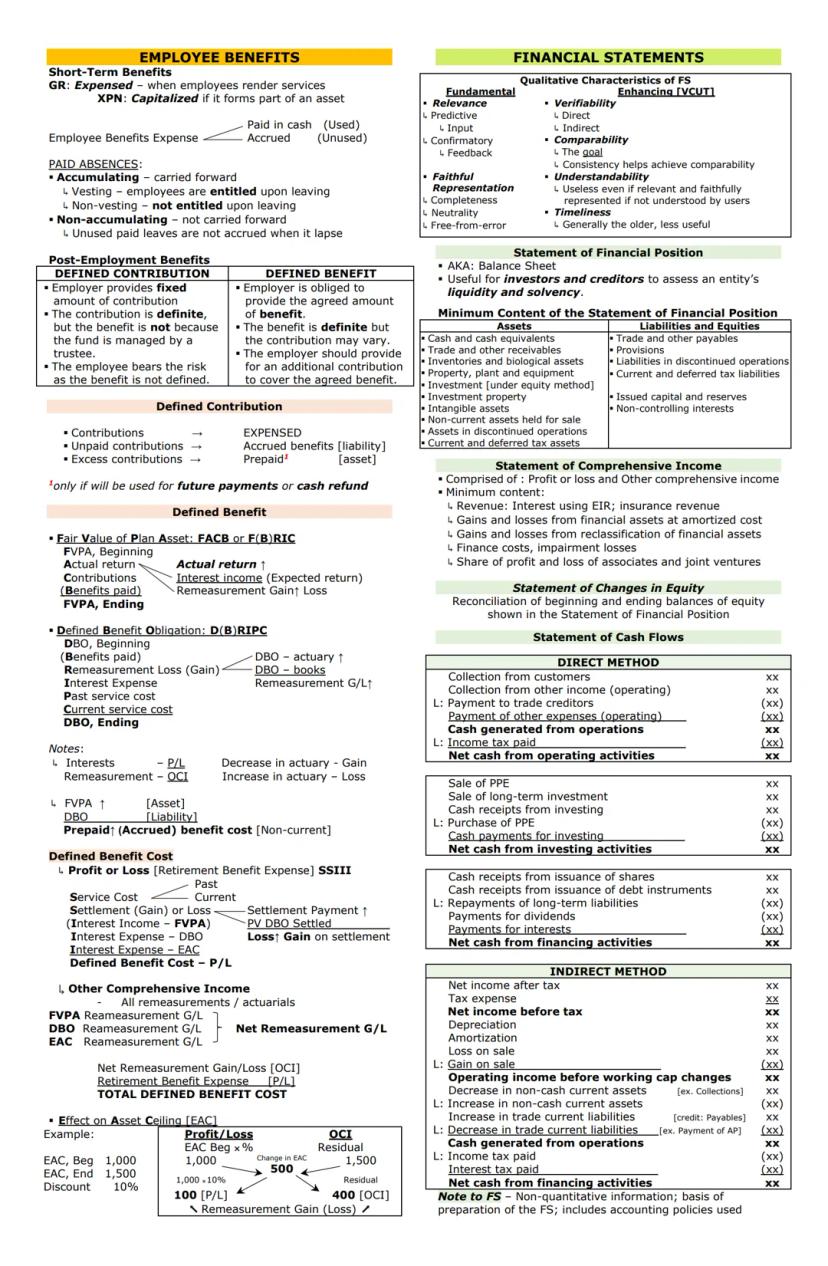

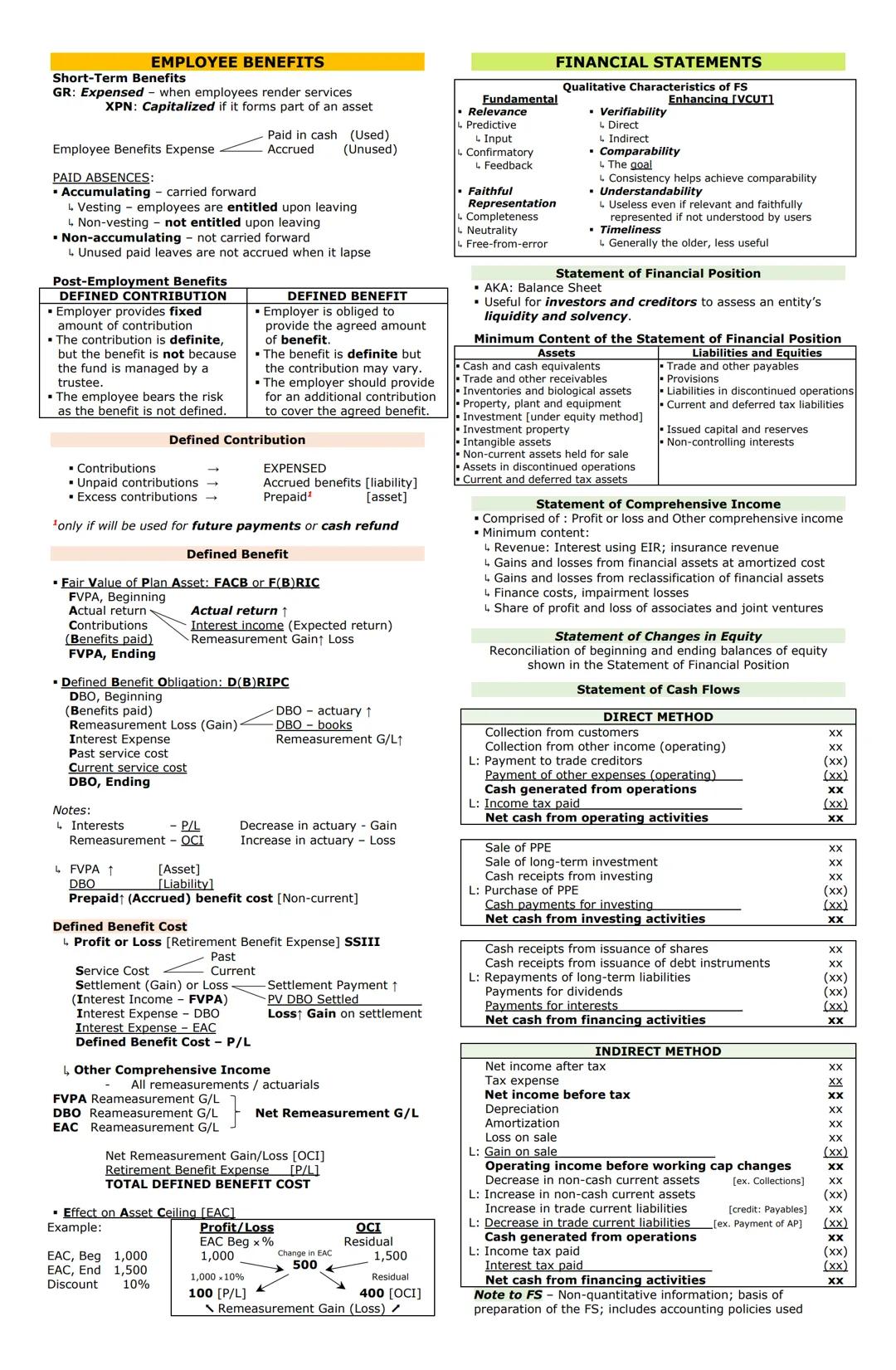

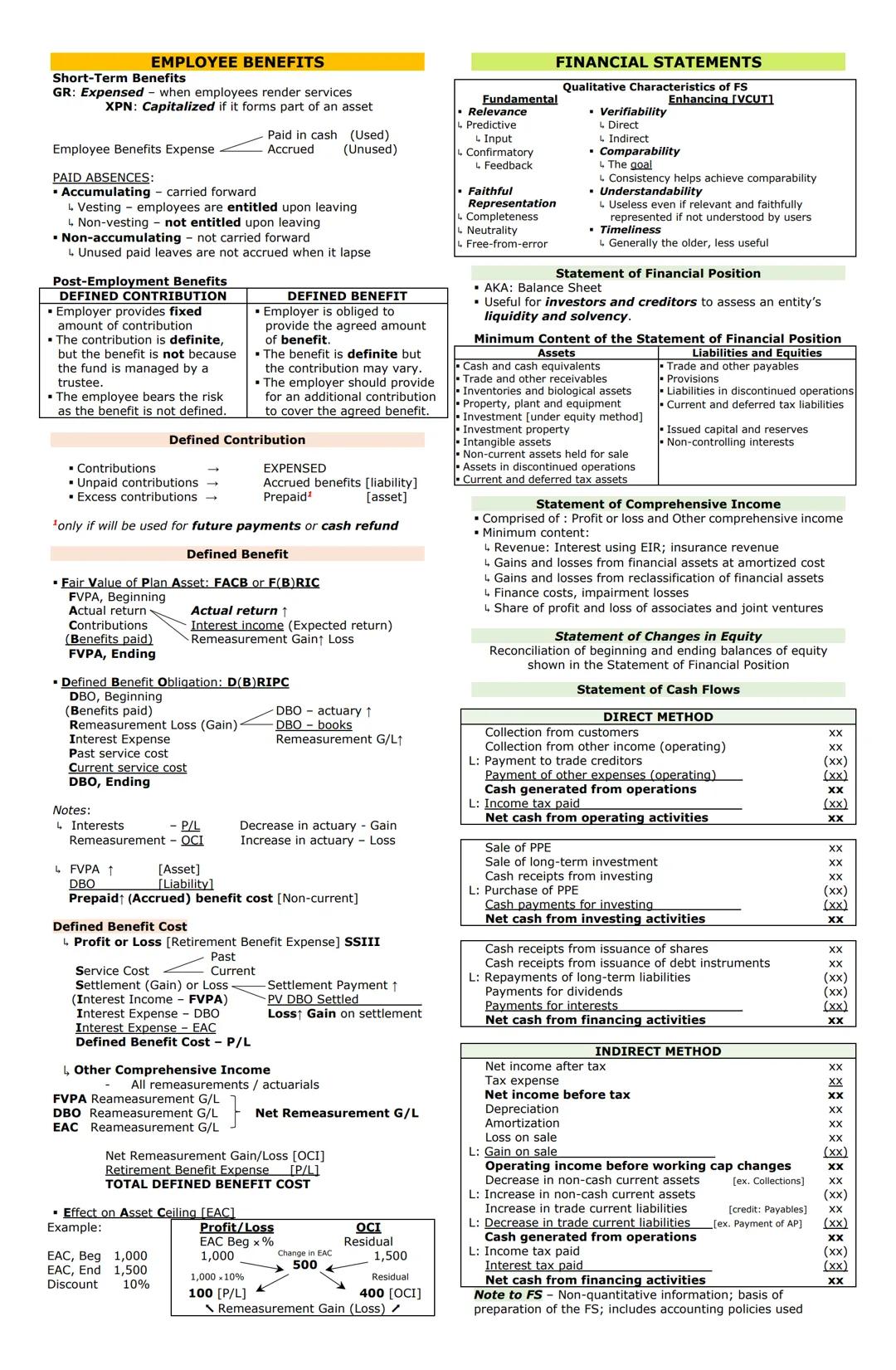

Employee benefits include all forms of compensation provided to employees. Short-term benefits (like salaries, wages, and paid absences) are generally expensed when employees provide services, unless they qualify for capitalization as part of an asset's cost.

For paid absences, the accounting treatment depends on their nature:

Post-employment benefits fall into two categories:

For defined benefit plans, accounting involves:

The defined benefit cost includes components recognized in:

💡 Interest components and service costs affect profit/loss, while all remeasurements (actuarial changes) go to OCI.

Financial statements provide information about an entity's financial position, performance, and changes in financial position. The qualitative characteristics that make financial information useful include:

The complete set of financial statements includes:

The Statement of Cash Flows can be prepared using either:

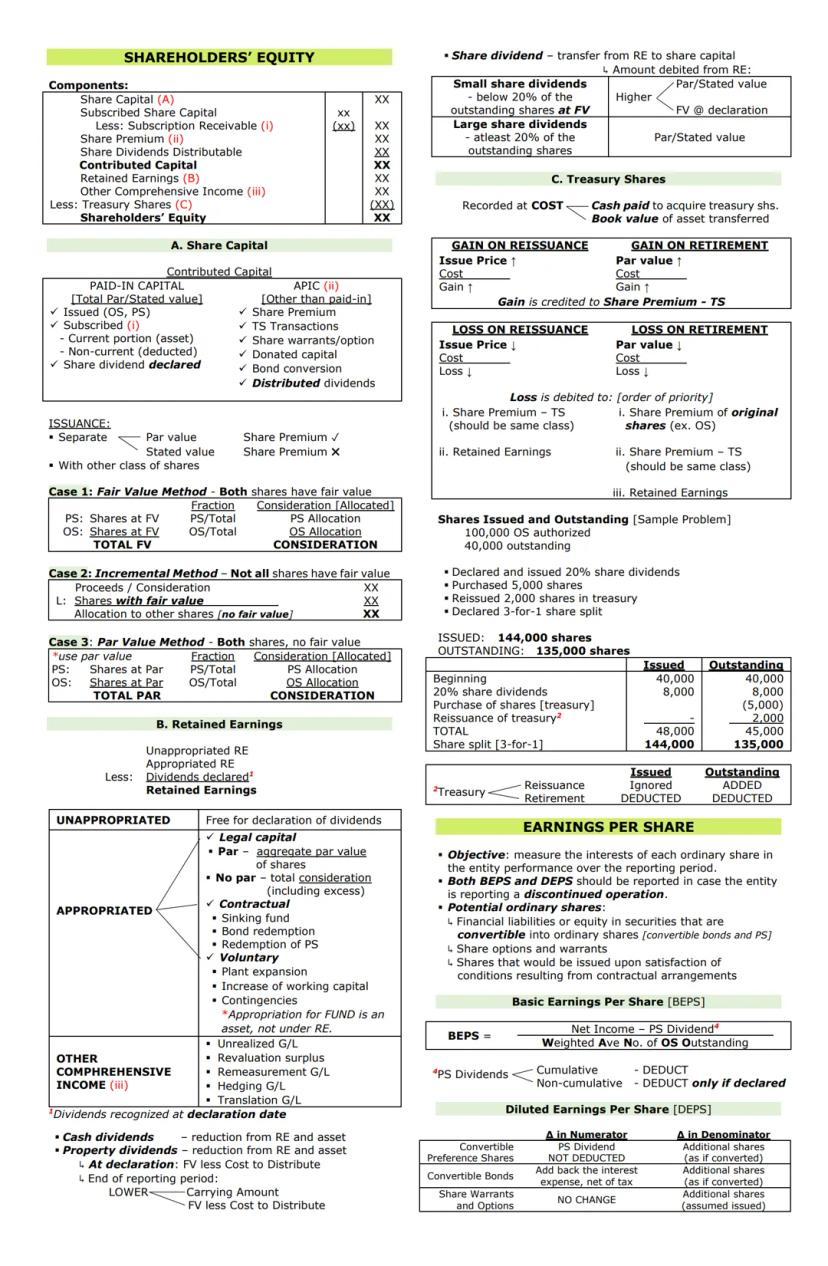

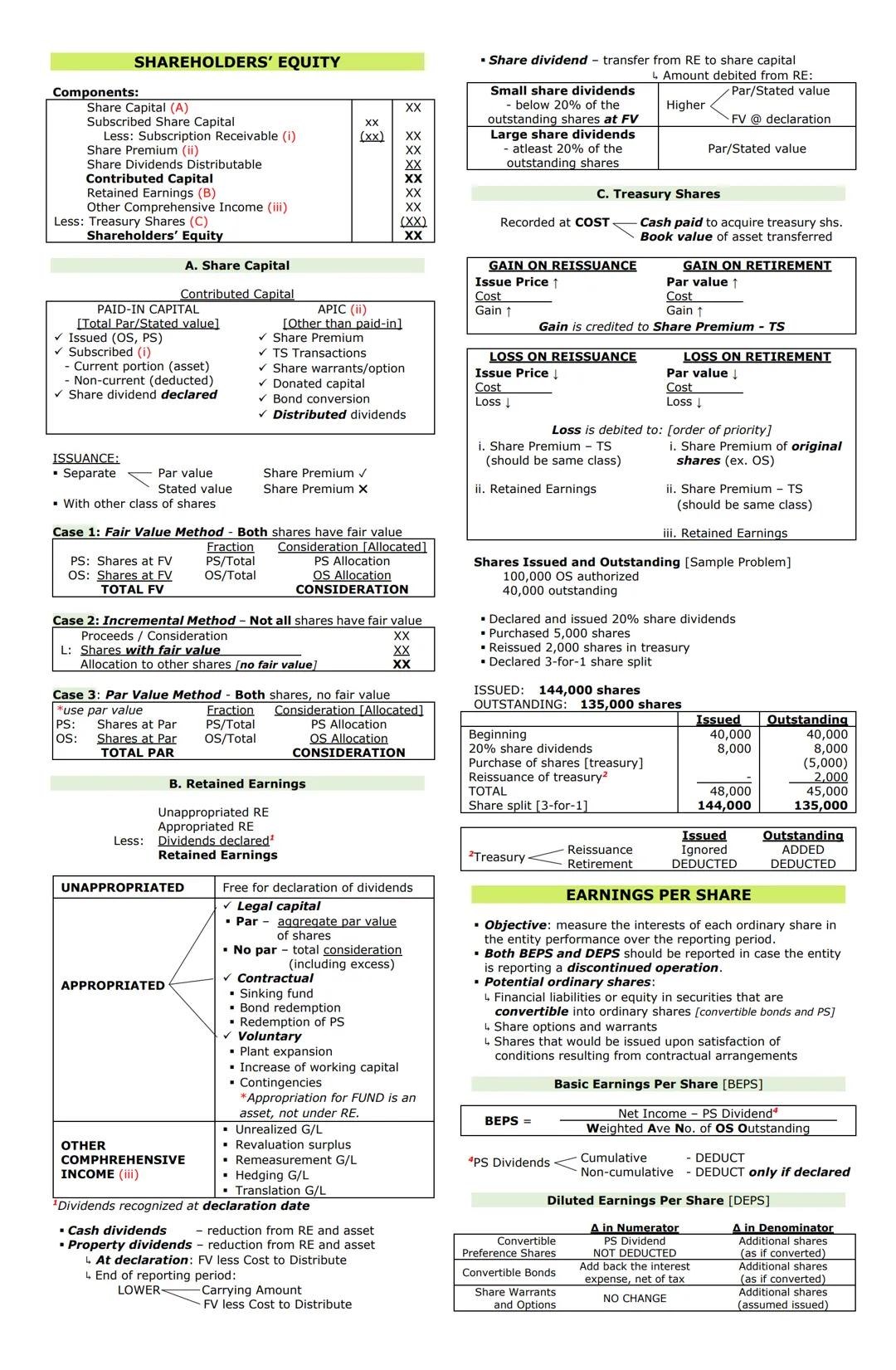

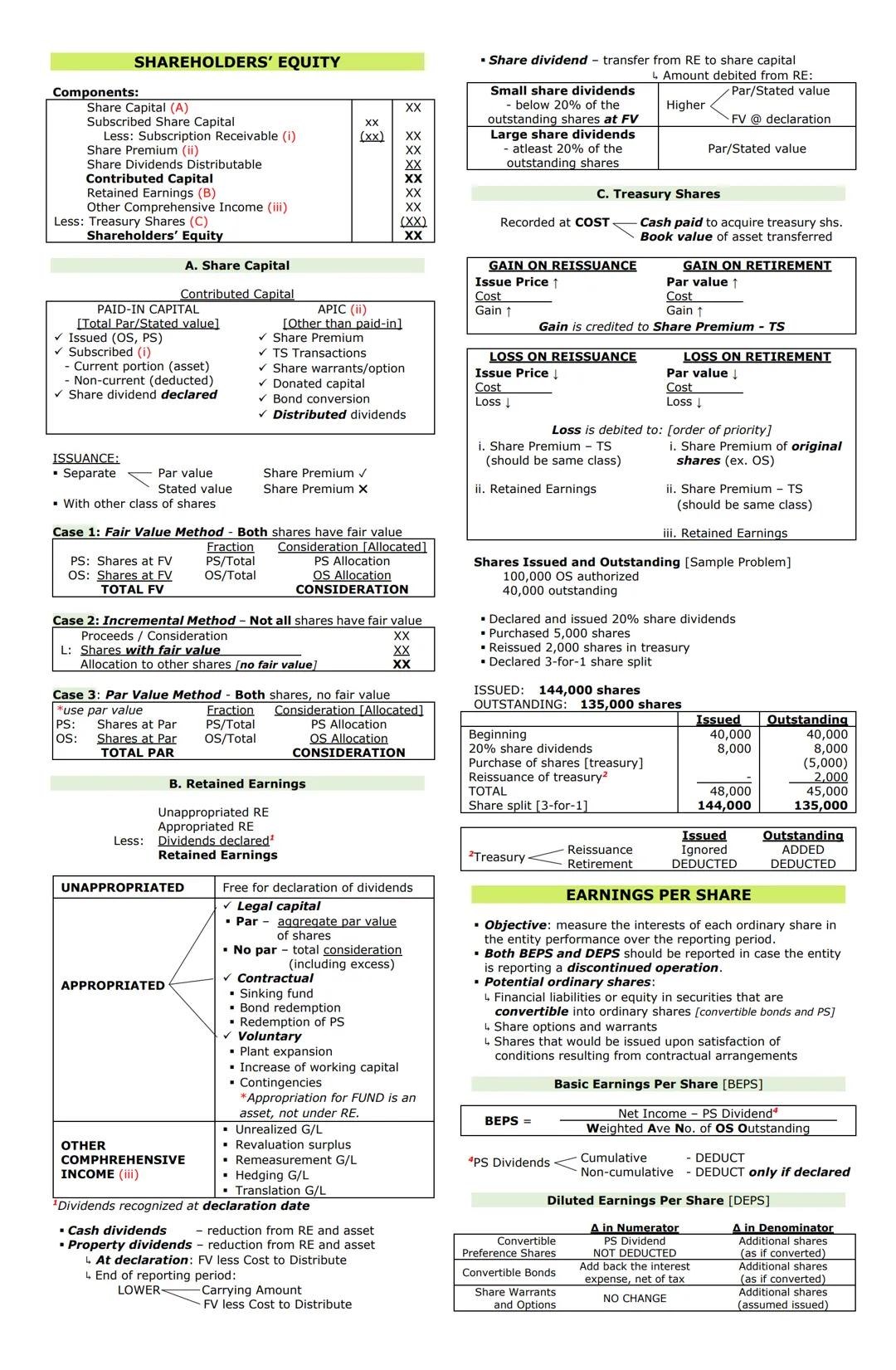

Shareholders' equity represents the residual interest in assets after deducting liabilities. Its components include:

When a company issues share dividends (additional shares instead of cash), the amount transferred from retained earnings depends on the size:

Treasury shares are recorded at cost and reduce total shareholders' equity. When reissuing treasury shares:

💡 When calculating shares outstanding, remember: Issued shares - Treasury shares = Outstanding shares. For share splits, multiply all share counts by the split ratio.

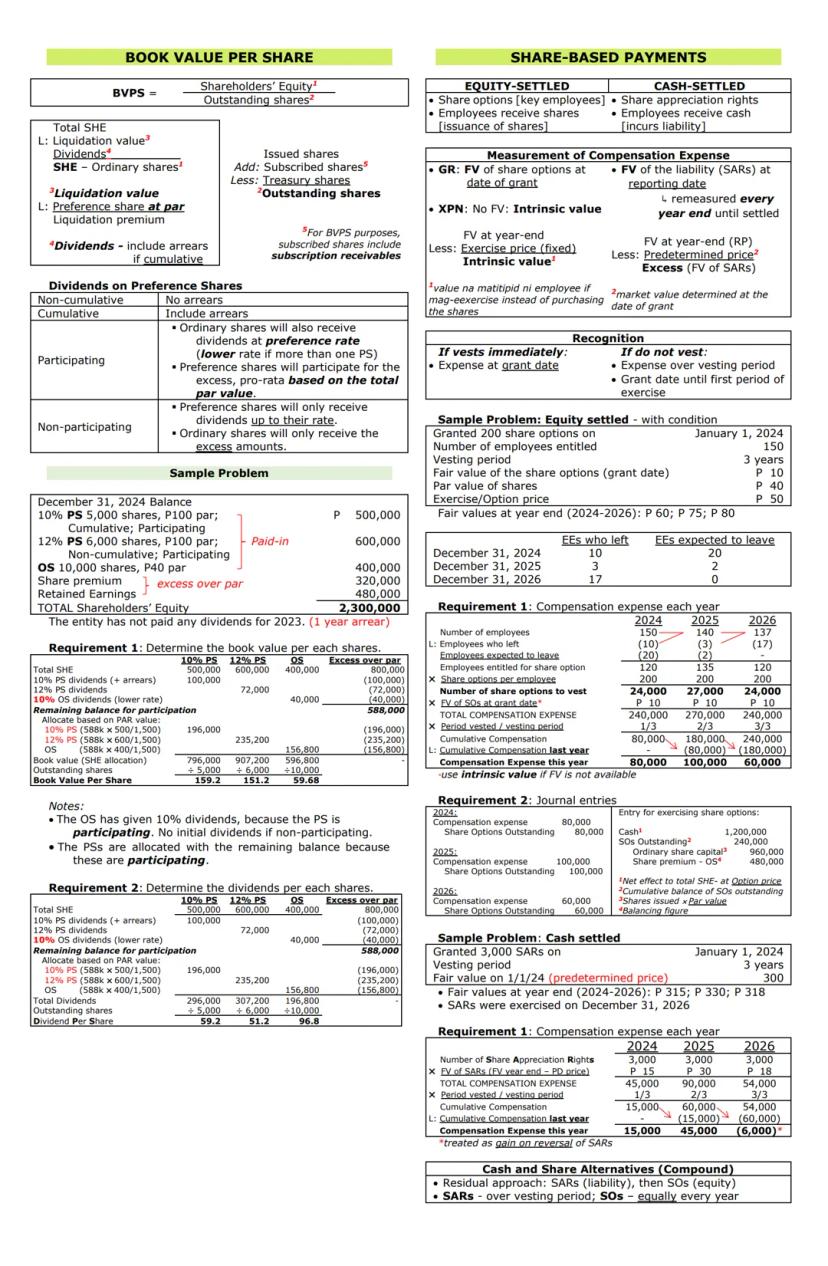

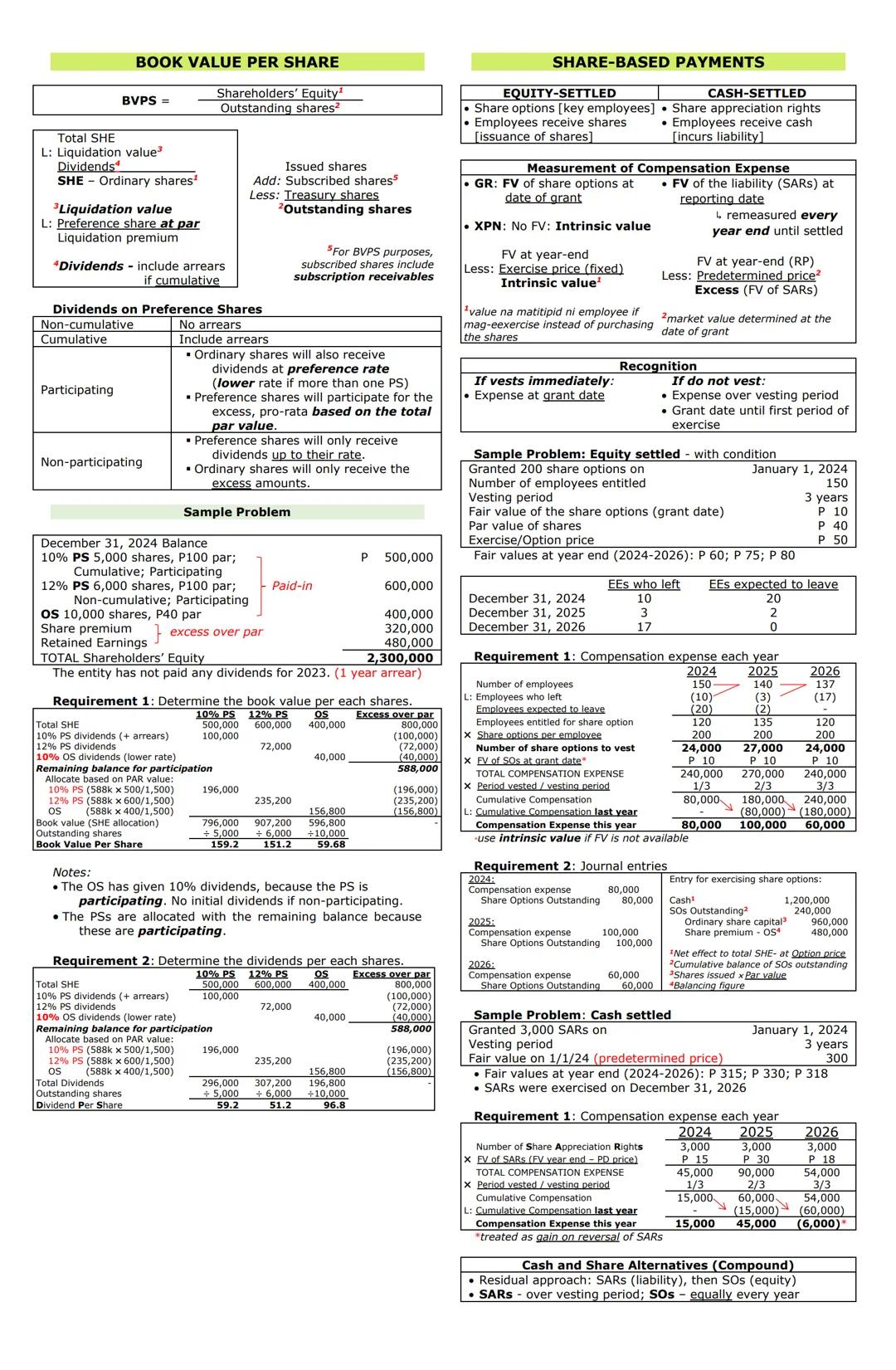

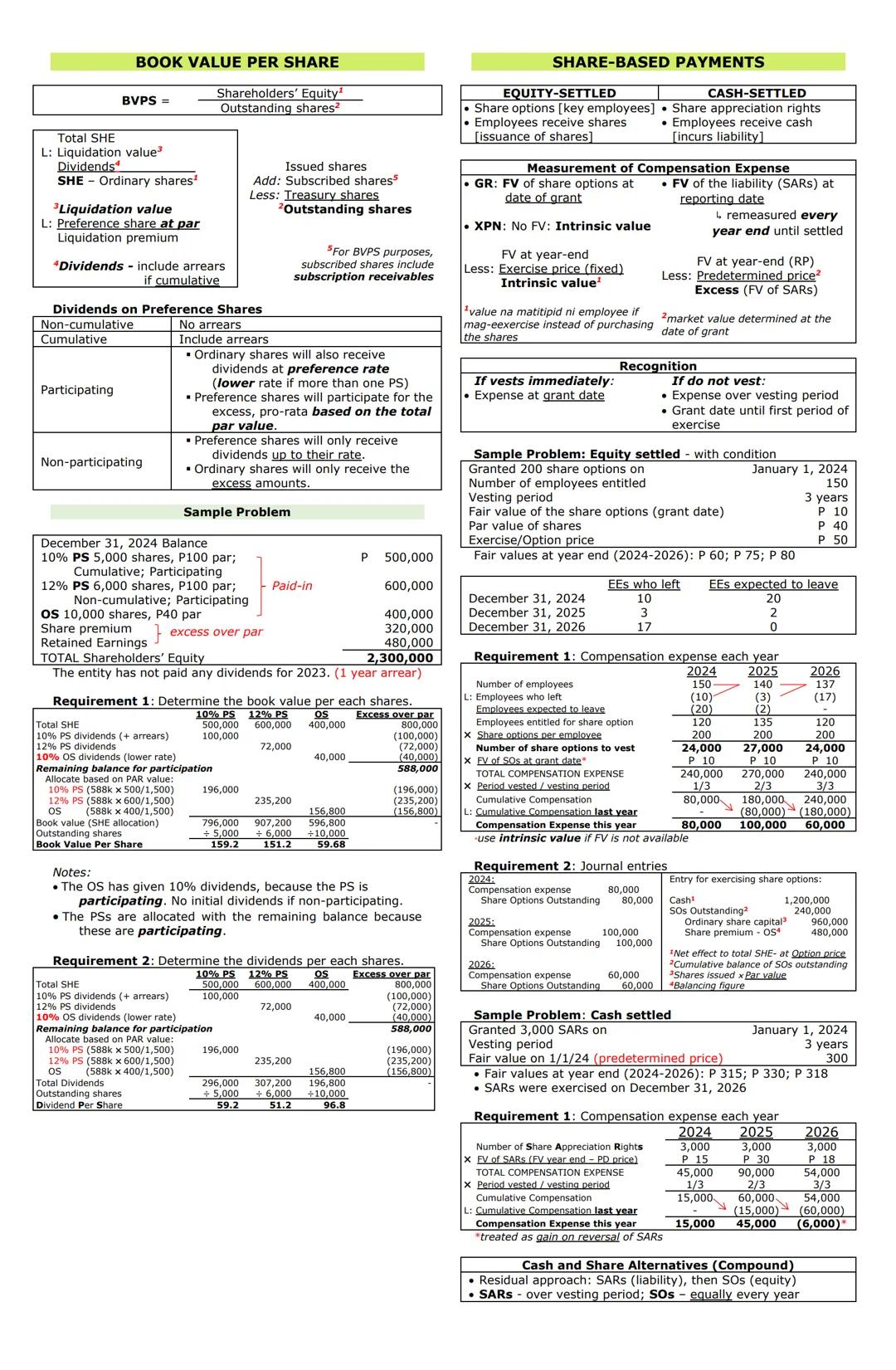

For companies with preference shares, calculating Book Value Per Share requires:

Earnings Per Share (EPS) measures each ordinary share's interest in company performance:

Share-based payments compensate employees with equity instruments or cash based on share prices:

When accounting for these plans, recognize compensation expense over the vesting period, adjusting for expected forfeitures and actual outcomes.

Book Value Per Share (BVPS) tells you the net asset value behind each share. The formula is:

BVPS = Shareholders' Equity ÷ Outstanding Shares

For companies with preference shares, you must adjust the equity:

When dealing with participating preference shares, remember:

For example, if a company has 10% participating preference shares and 12% non-participating preference shares:

💡 For book value calculations, subscription receivables are included in outstanding shares, but for calculating dividends, they may be excluded depending on company policy.

Share-based payments are transactions where entities issue equity instruments or incur liabilities based on share prices. There are two main types:

For equity-settled plans, follow these steps:

For cash-settled plans:

When options are exercised, record:

If employees have a choice between cash and shares (compound instruments), use the residual approach: measure the liability component first, then the equity component.

Our AI companion is specifically built for the needs of students. Based on the millions of content pieces we have on the platform we can provide truly meaningful and relevant answers to students. But its not only about answers, the companion is even more about guiding students through their daily learning challenges, with personalised study plans, quizzes or content pieces in the chat and 100% personalisation based on the students skills and developments.

You can download the app in the Google Play Store and in the Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

studywithnessa

@studywithnessa

Accounting is all about tracking, organizing, and understanding business finances. This summary covers key accounting topics from cash management to shareholders' equity, breaking down complex concepts into easy-to-understand explanations. Whether you're preparing for tests or wanting to strengthen your accounting... Show more

Access to all documents

Improve your grades

Join milions of students

Ever wondered what actually counts as "cash" in accounting? Cash includes physical currency (PCF), bank deposits, traveler's checks, bank drafts, and unrestricted compensating balances. A compensating balance is money you must keep in your account—if it's unrestricted, it counts as cash; if restricted, it's either a current or non-current asset depending on the timeframe.

Cash equivalents are investments that can be quickly converted to cash. They must mature within 3 months of acquisition to qualify. This includes 3-month time deposits, money market funds, and treasury bills. Important to note: equity securities are never cash equivalents, even if they're highly liquid.

When managing receivables, the Allowance for Doubtful Accounts method (AWERA) helps track potential uncollectible accounts. The basic formula works like this:

For Notes Receivable, you'll encounter different financing arrangements:

💡 When discounting a note, remember that proceeds equal the maturity value minus the discount. The discount is calculated using: Maturity Value × Discount Rate × Discount Period.

Proof of Cash reconciliations help identify errors between bank and book records. Common errors include:

For expected credit losses on loans, the three-stage model is used:

Access to all documents

Improve your grades

Join milions of students

Inventory valuation is crucial for accurate financial reporting. The Lower of Cost and Net Realizable Value (LCNRV) principle requires you to value inventory at whichever is lower—its cost or what you can sell it for minus completion and selling costs.

When determining inventory cost, include purchase price, import duties, transport costs, and handling fees, but subtract trade discounts and rebates. Remember that shipping terms dramatically affect who records inventory when:

| Terms | Who Records Inventory |

|---|---|

| FOB Shipping Point | Buyer (goods in transit) |

| FOB Destination | Seller (goods in transit) |

| Consignment | Consignor (owner), not consignee |

The Gross Profit Method is super helpful for estimating inventory when a physical count isn't possible:

💡 When using the Retail Inventory Method, the conservative approach adds markdowns back for ending inventory, resulting in a lower cost rate.

For Property, Plant, and Equipment (PPE), initial measurement includes purchase price, import duties, non-refundable taxes (minus trade discounts), and dismantling costs. When acquiring assets through exchange, use fair value if the exchange has commercial substance.

For land and buildings purchased together, allocation depends on intended use:

Depreciation methods vary by asset type:

For land improvements (fences, sidewalks, drainage systems), remember they're subject to depreciation, unlike land itself which is never depreciated.

Access to all documents

Improve your grades

Join milions of students

When purchasing machinery and equipment, capitalize all costs needed to prepare the asset for use—this includes purchase price, freight, installation, and testing costs. Just remember that VAT is typically not capitalized.

The revaluation model allows you to increase an asset's value to its fair value. The difference between fair value and carrying amount creates a revaluation surplus in equity. This surplus can be:

Leasehold improvements are changes made by a tenant to a leased property. These improvements are depreciated over the shorter of:

When a company borrows money to construct an asset, borrowing costs should be capitalized as part of the asset's cost. For specific borrowings, capitalize the actual interest expense minus any income earned from temporarily investing those funds. For general borrowings, use the weighted average expenditures and capitalization rate to determine the capitalizable amount.

💡 When dealing with both specific and general borrowings, combine them for weighted average expenditure calculations, then subtract specific borrowings to find the amount allocable to general borrowing.

For agricultural assets, classification is important:

Intangible assets with finite useful lives (like patents and trademarks) are amortized, while those with indefinite lives are tested annually for impairment. For internally-generated intangibles:

When testing assets for impairment, group them into Cash Generating Units and compare the recoverable amount (higher of value in use or FVLCD) to the carrying amount. Any impairment loss first reduces goodwill, then is allocated to other assets proportionally.

For segment reporting, a segment is reportable if it meets any of these thresholds:

Access to all documents

Improve your grades

Join milions of students

Discontinued operations represent a major business component that has been disposed of or is classified as "held for sale." When reporting discontinued operations, present their results separately from continuing operations in the income statement.

Investments in equity securities fall into several categories depending on the level of influence:

| Classification | Ownership % | Purpose | Measurement |

|---|---|---|---|

| FVPL | <20% | Trading | Fair Value through Profit/Loss |

| FVOCI | <20% | Non-trading | Fair Value through Other Comprehensive Income |

| Associate/JV | 20-50% | Significant influence | Equity method |

| Subsidiary | >50% | Control | Consolidated |

When investing in equity securities, remember these key points:

For investments in associates , use the equity method:

💡 When an associate's assets are under or overvalued, adjust your share of their profits by the amortization of these valuation differences.

If you discontinue using the equity method, recognize any gain or loss:

Investment property is property held for capital appreciation or rental income, not for:

You can measure investment property using either:

When reclassifying property , the difference between carrying amount and fair value is generally recognized in profit or loss.

Access to all documents

Improve your grades

Join milions of students

Debt securities are classified into three categories, each with different accounting treatments:

| Classification | Business Model | Cash Flow Characteristic | Measurement |

|---|---|---|---|

| Amortized Cost | Hold-to-collect | SPPI* | Cost + EIR** |

| FVOCI | Hold-to-collect and sell | SPPI | Fair Value through OCI |

| FVPL | Other | Other | Fair Value through P/L |

*SPPI = Solely Payments of Principal and Interest **EIR = Effective Interest Rate

When accounting for debt securities, remember:

Reclassification between categories is permitted only when your business model changes:

💡 When reclassifying from FVOCI to FVPL, cumulative unrealized gains or losses in OCI are reclassified to profit or loss.

For natural resource accounting, different costs are treated as follows:

Depletion accounts for using up natural resources:

Government grants are transfers of resources from the government that require compliance with certain conditions. They're recognized at fair value when there's reasonable assurance that:

Grants related to assets can be accounted for as:

Grants related to income can be:

If you have to repay a government grant, treat the repayment as a change in accounting estimate.

Access to all documents

Improve your grades

Join milions of students

Financial liabilities are generally measured at amortized cost, except when designated at fair value through profit or loss (FVPL) or held for trading. When accounting for Accounts Payable, you can use either:

When dealing with debt modifications, determine if they're substantial or non-substantial:

For bonds payable:

💡 For compound financial instruments (like convertible bonds), separate the liability component and equity component. The equity component is the residual amount after determining the liability component's fair value.

Income tax accounting recognizes both current and deferred taxes:

Temporary differences create either:

Permanent differences affect current tax but don't create deferred taxes because they never reverse.

For debt refinancing, classification depends on when refinancing occurs:

When restructuring debt, you might encounter:

Access to all documents

Improve your grades

Join milions of students

Leases are contracts that convey the right to use an asset for a period of time in exchange for payment. For lessors (property owners), leases are classified as either operating or finance.

In an operating lease:

For a finance lease, the lessor records:

Finance leases fall into two categories:

💡 For a sales-type lease, the gross profit will be the same whether the residual value is guaranteed or unguaranteed, but the components of the calculation will differ.

For lessees (tenants), finance leases require recording:

Depreciation of the leased asset is calculated over the shorter of:

In a sale and leaseback transaction, measurement depends on whether the transaction is at fair value:

Operating leases can only be recorded as expenses (not RUA) if:

Indicators that a lease is a finance lease include:

Access to all documents

Improve your grades

Join milions of students

Employee benefits include all forms of compensation provided to employees. Short-term benefits (like salaries, wages, and paid absences) are generally expensed when employees provide services, unless they qualify for capitalization as part of an asset's cost.

For paid absences, the accounting treatment depends on their nature:

Post-employment benefits fall into two categories:

For defined benefit plans, accounting involves:

The defined benefit cost includes components recognized in:

💡 Interest components and service costs affect profit/loss, while all remeasurements (actuarial changes) go to OCI.

Financial statements provide information about an entity's financial position, performance, and changes in financial position. The qualitative characteristics that make financial information useful include:

The complete set of financial statements includes:

The Statement of Cash Flows can be prepared using either:

Access to all documents

Improve your grades

Join milions of students

Shareholders' equity represents the residual interest in assets after deducting liabilities. Its components include:

When a company issues share dividends (additional shares instead of cash), the amount transferred from retained earnings depends on the size:

Treasury shares are recorded at cost and reduce total shareholders' equity. When reissuing treasury shares:

💡 When calculating shares outstanding, remember: Issued shares - Treasury shares = Outstanding shares. For share splits, multiply all share counts by the split ratio.

For companies with preference shares, calculating Book Value Per Share requires:

Earnings Per Share (EPS) measures each ordinary share's interest in company performance:

Share-based payments compensate employees with equity instruments or cash based on share prices:

When accounting for these plans, recognize compensation expense over the vesting period, adjusting for expected forfeitures and actual outcomes.

Access to all documents

Improve your grades

Join milions of students

Book Value Per Share (BVPS) tells you the net asset value behind each share. The formula is:

BVPS = Shareholders' Equity ÷ Outstanding Shares

For companies with preference shares, you must adjust the equity:

When dealing with participating preference shares, remember:

For example, if a company has 10% participating preference shares and 12% non-participating preference shares:

💡 For book value calculations, subscription receivables are included in outstanding shares, but for calculating dividends, they may be excluded depending on company policy.

Share-based payments are transactions where entities issue equity instruments or incur liabilities based on share prices. There are two main types:

For equity-settled plans, follow these steps:

For cash-settled plans:

When options are exercised, record:

If employees have a choice between cash and shares (compound instruments), use the residual approach: measure the liability component first, then the equity component.

Our AI companion is specifically built for the needs of students. Based on the millions of content pieces we have on the platform we can provide truly meaningful and relevant answers to students. But its not only about answers, the companion is even more about guiding students through their daily learning challenges, with personalised study plans, quizzes or content pieces in the chat and 100% personalisation based on the students skills and developments.

You can download the app in the Google Play Store and in the Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

12

Smart Tools NEW

Transform this note into: ✓ 50+ Practice Questions ✓ Interactive Flashcards ✓ Full Practice Test ✓ Essay Outlines

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user