Management Services (MS) is a critical area that provides essential... Show more

Sign up to see the contentIt's free!

Access to all documents

Improve your grades

Join milions of students

Subjects

Triangle Congruence and Similarity Theorems

Triangle Properties and Classification

Linear Equations and Graphs

Geometric Angle Relationships

Trigonometric Functions and Identities

Equation Solving Techniques

Circle Geometry Fundamentals

Division Operations and Methods

Basic Differentiation Rules

Exponent and Logarithm Properties

Show all topics

Human Organ Systems

Reproductive Cell Cycles

Biological Sciences Subdisciplines

Cellular Energy Metabolism

Autotrophic Energy Processes

Inheritance Patterns and Principles

Biomolecular Structure and Organization

Cell Cycle and Division Mechanics

Cellular Organization and Development

Biological Structural Organization

Show all topics

Chemical Sciences and Applications

Atomic Structure and Composition

Molecular Electron Structure Representation

Atomic Electron Behavior

Matter Properties and Water

Mole Concept and Calculations

Gas Laws and Behavior

Periodic Table Organization

Chemical Thermodynamics Fundamentals

Chemical Bond Types and Properties

Show all topics

European Renaissance and Enlightenment

European Cultural Movements 800-1920

American Revolution Era 1763-1797

American Civil War 1861-1865

Global Imperial Systems

Mongol and Chinese Dynasties

U.S. Presidents and World Leaders

Historical Sources and Documentation

World Wars Era and Impact

World Religious Systems

Show all topics

Classic and Contemporary Novels

Literary Character Analysis

Rhetorical Theory and Practice

Classic Literary Narratives

Reading Analysis and Interpretation

Narrative Structure and Techniques

English Language Components

Influential English-Language Authors

Basic Sentence Structure

Narrative Voice and Perspective

Show all topics

381

•

Jan 31, 2026

•

studywithnessa

@studywithnessa

Management Services (MS) is a critical area that provides essential... Show more

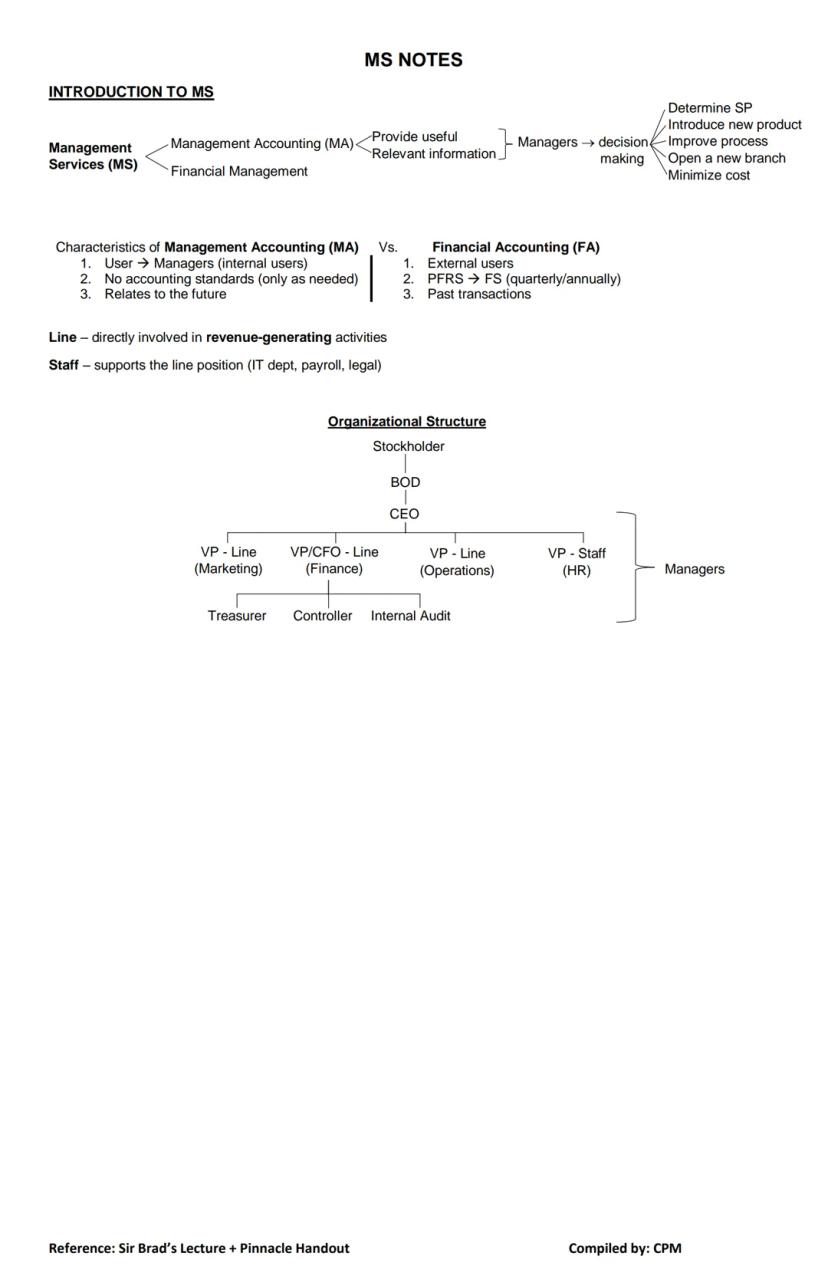

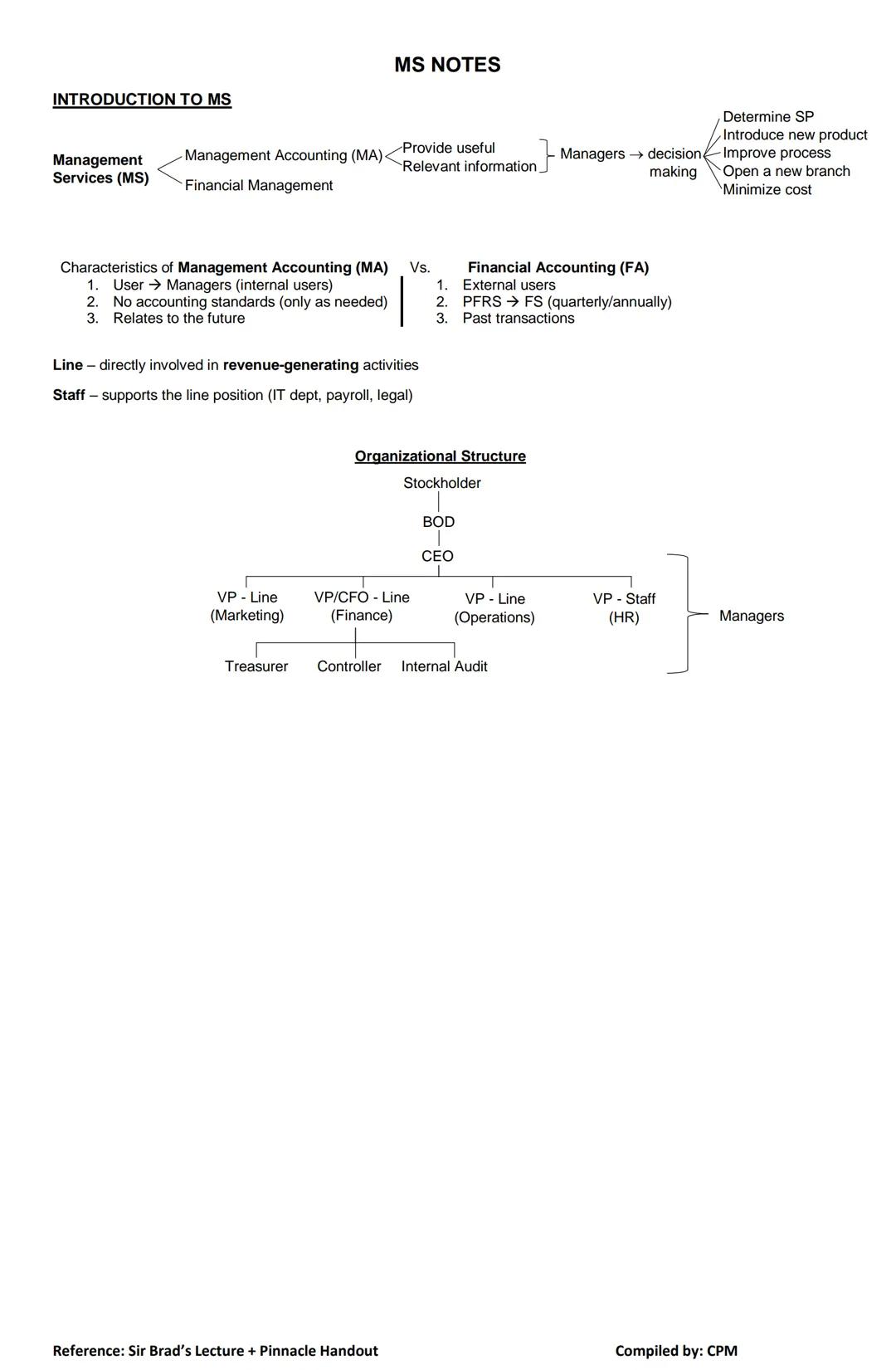

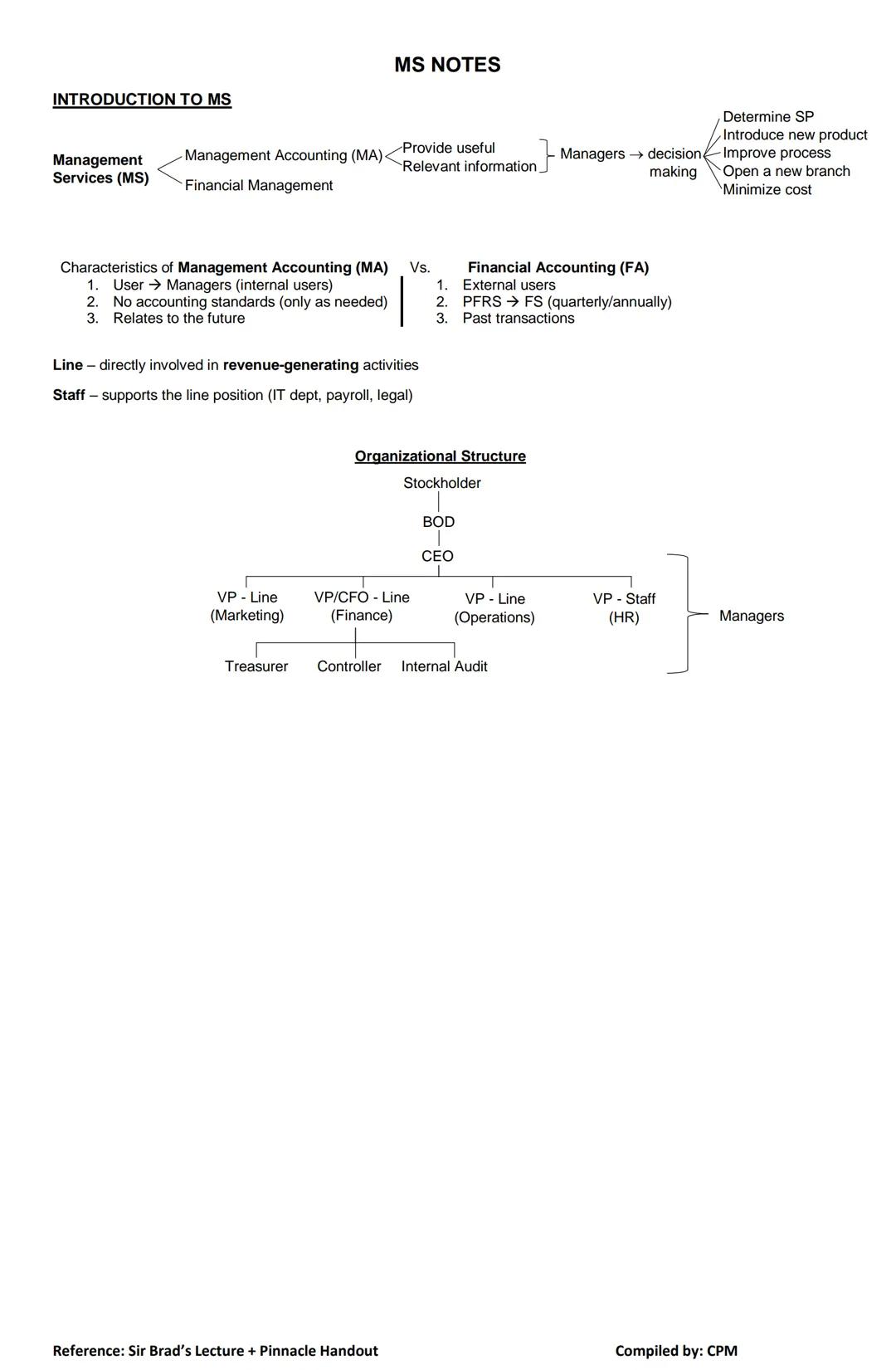

Management Services (MS) is all about providing relevant information to help managers make better decisions. While financial accounting focuses on reporting past transactions to external users, management accounting targets internal users with forward-looking data.

The key distinction between management accounting and financial accounting is their purpose and audience. Management accounting serves internal managers making operational decisions without strict accounting standards, while financial accounting follows PFRS standards for external reporting of historical information.

In organizations, positions are classified as either line or staff. Line positions directly generate revenue, while staff positions provide support functions like IT, payroll, and legal services. The organizational structure typically flows from stockholders to the Board of Directors to the CEO, then to various Vice Presidents overseeing functional departments.

Real-world application: Understanding your company's organizational structure helps you identify who makes decisions and how management accounting information flows through the organization.

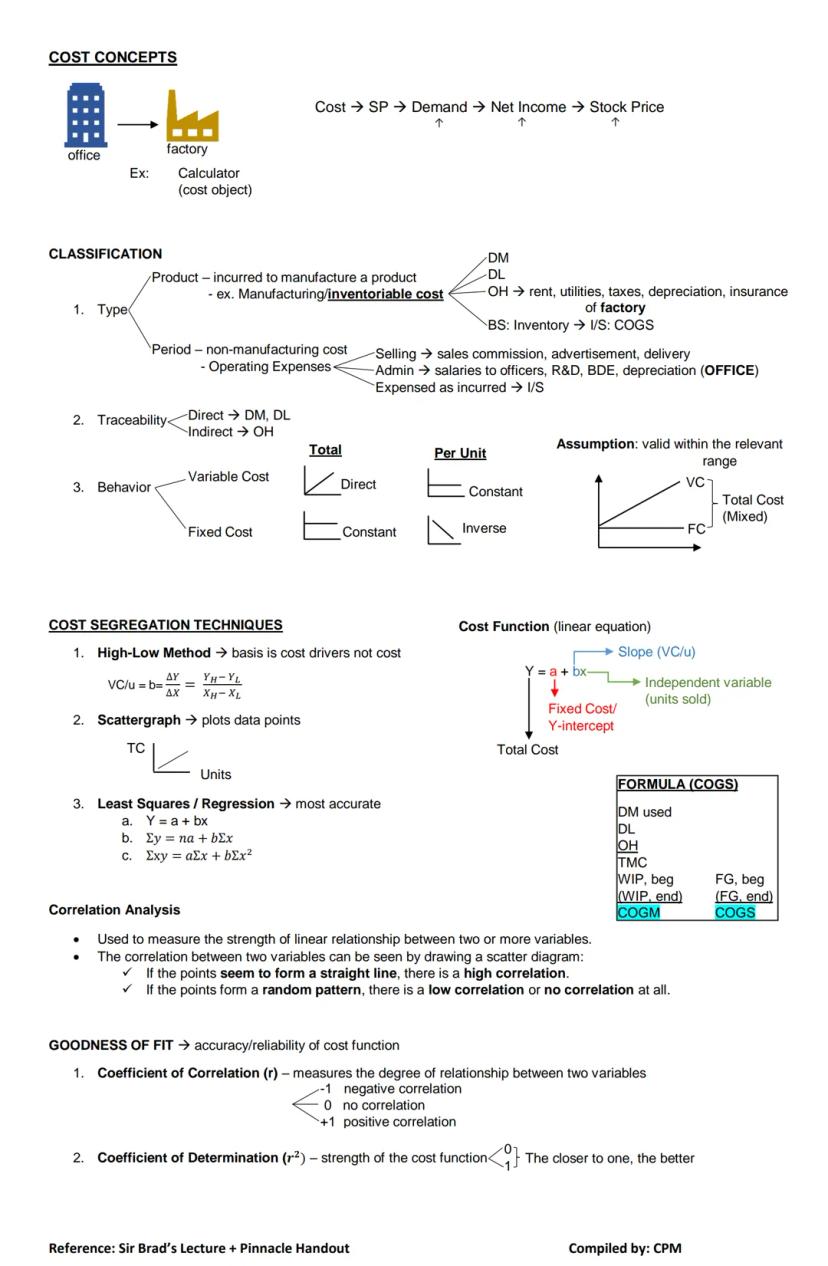

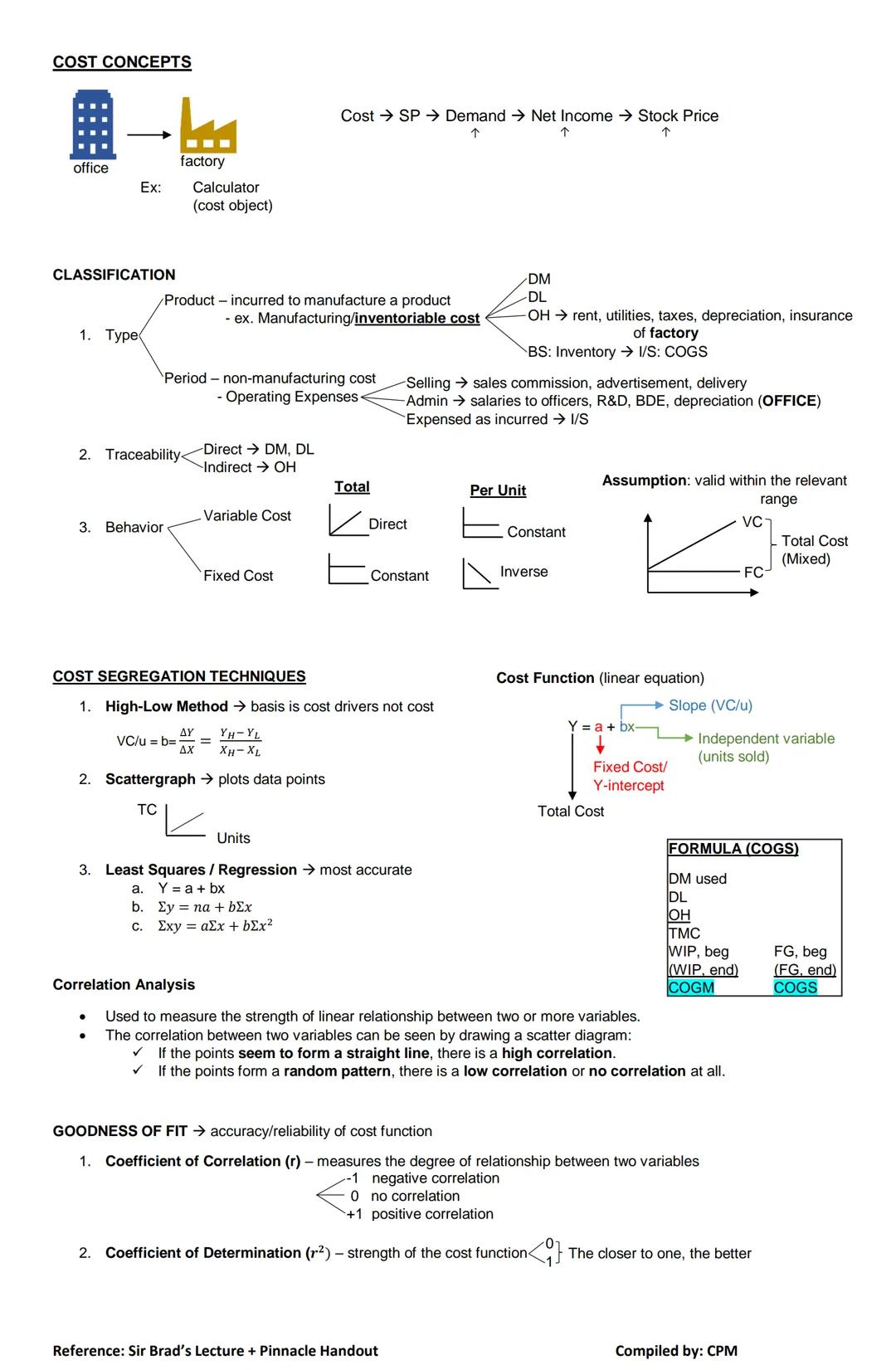

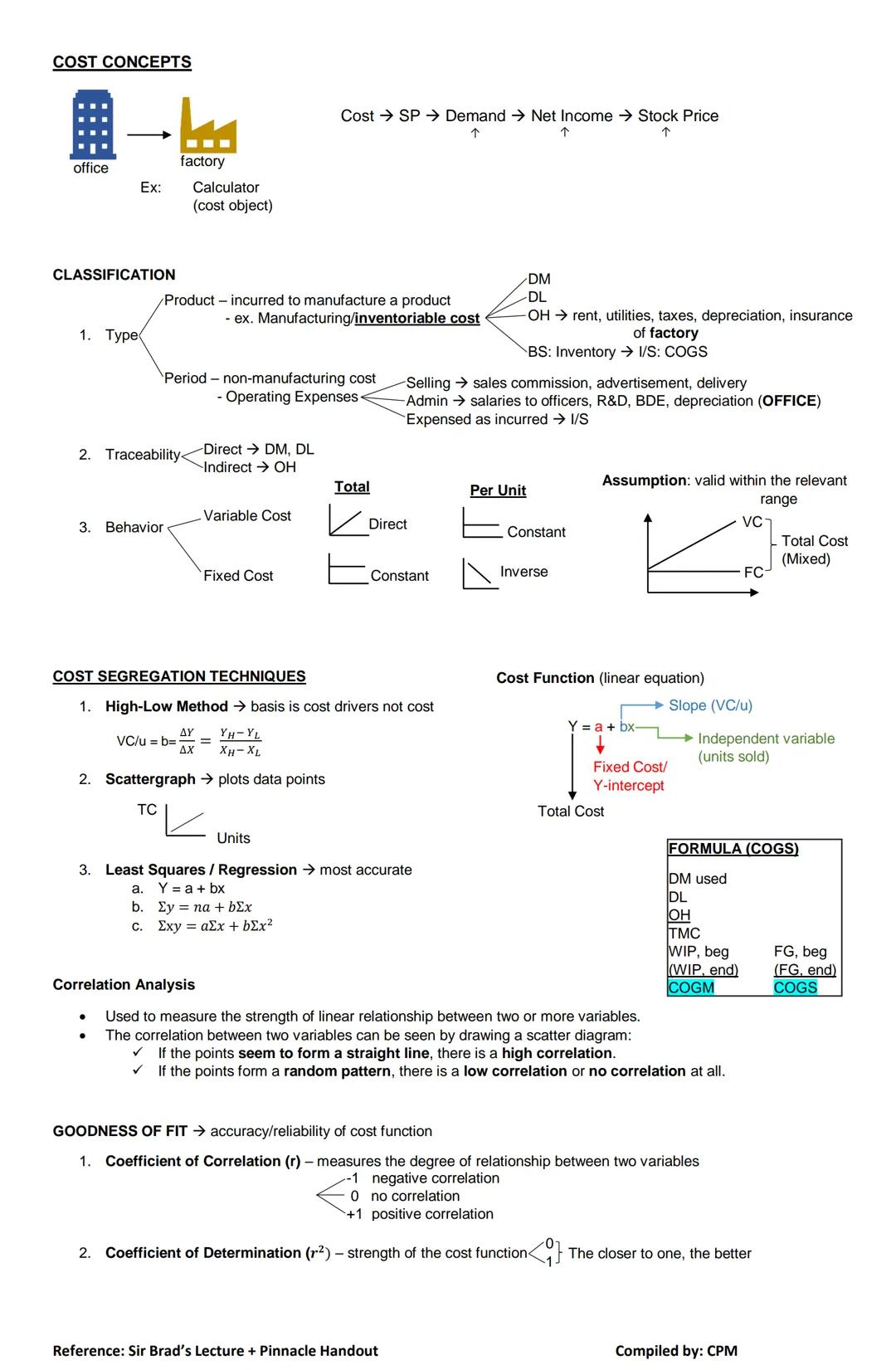

Every business needs to understand its costs to set prices, forecast demand, and ultimately generate net income. Costs can be attached to any cost object (like a product, department, or project) and are classified in several important ways.

By type, costs can be product costs or period costs . Product costs appear as inventory on the balance sheet until sold, while period costs are expensed immediately.

By behavior, costs can be variable (changing with activity level) or fixed (remaining constant regardless of volume). The relationship between total cost and volume is only valid within a relevant range of activity.

To separate mixed costs into fixed and variable components, businesses use techniques like:

Pro tip: When analyzing cost behavior, always check your cost function's reliability using the coefficient of determination (r²). The closer to 1, the stronger your cost prediction will be!

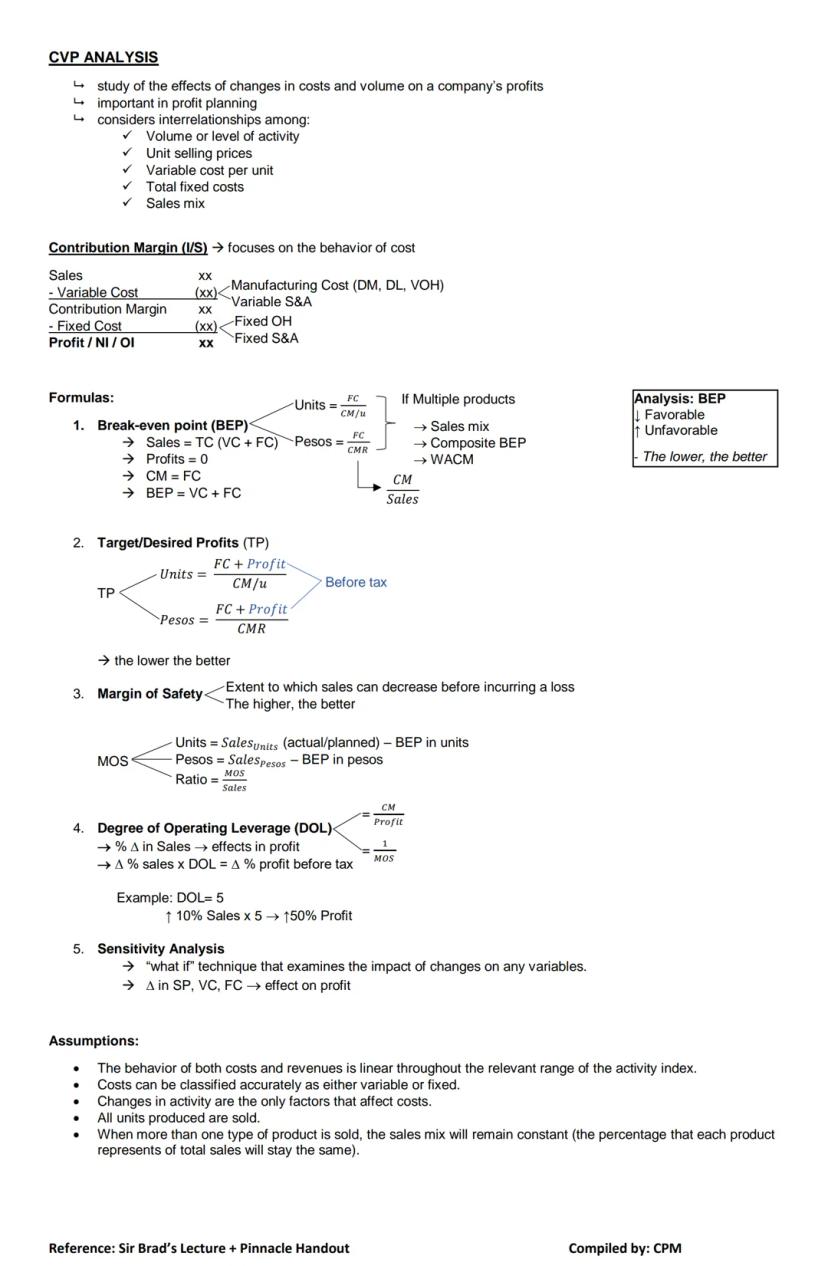

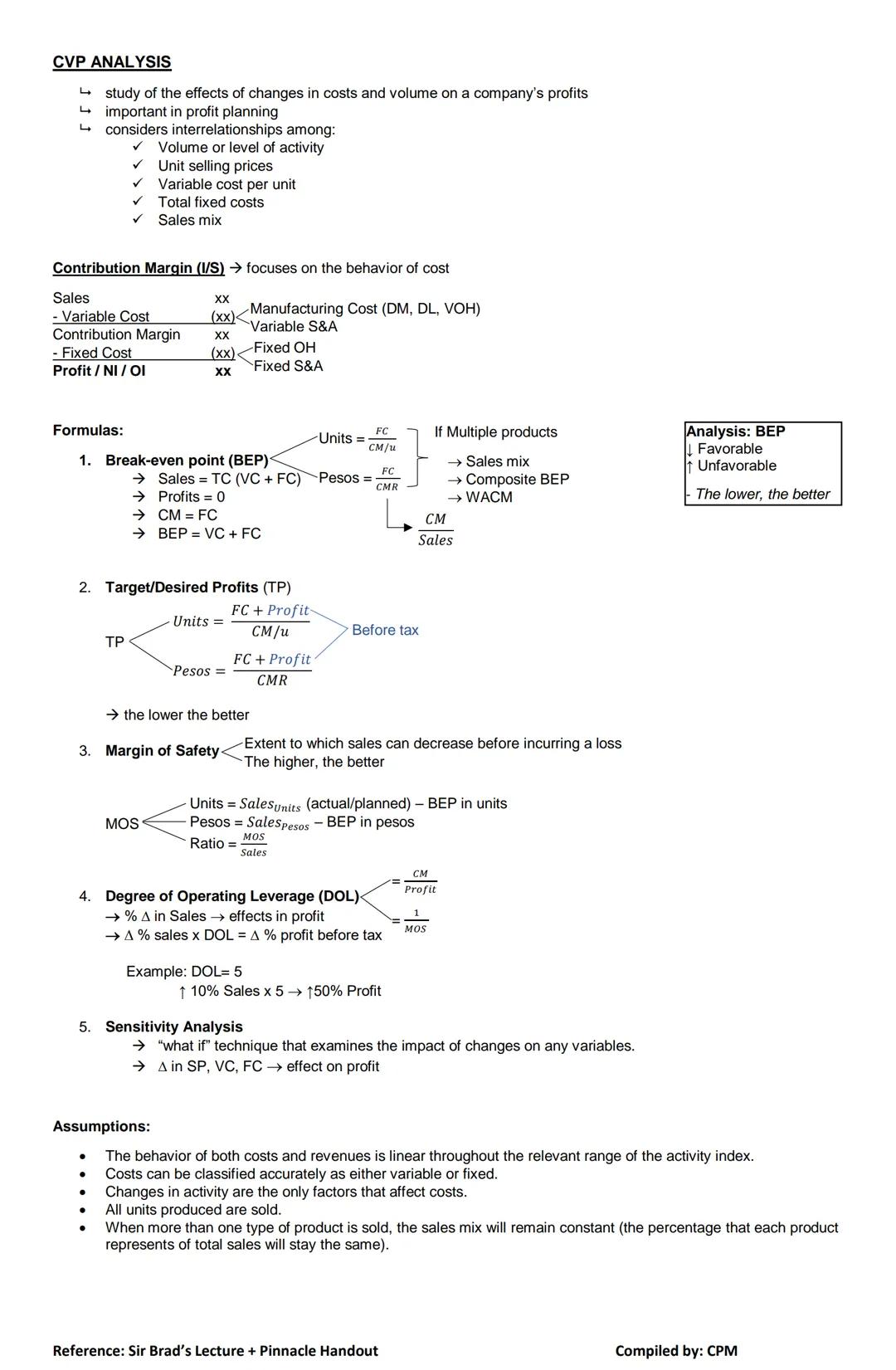

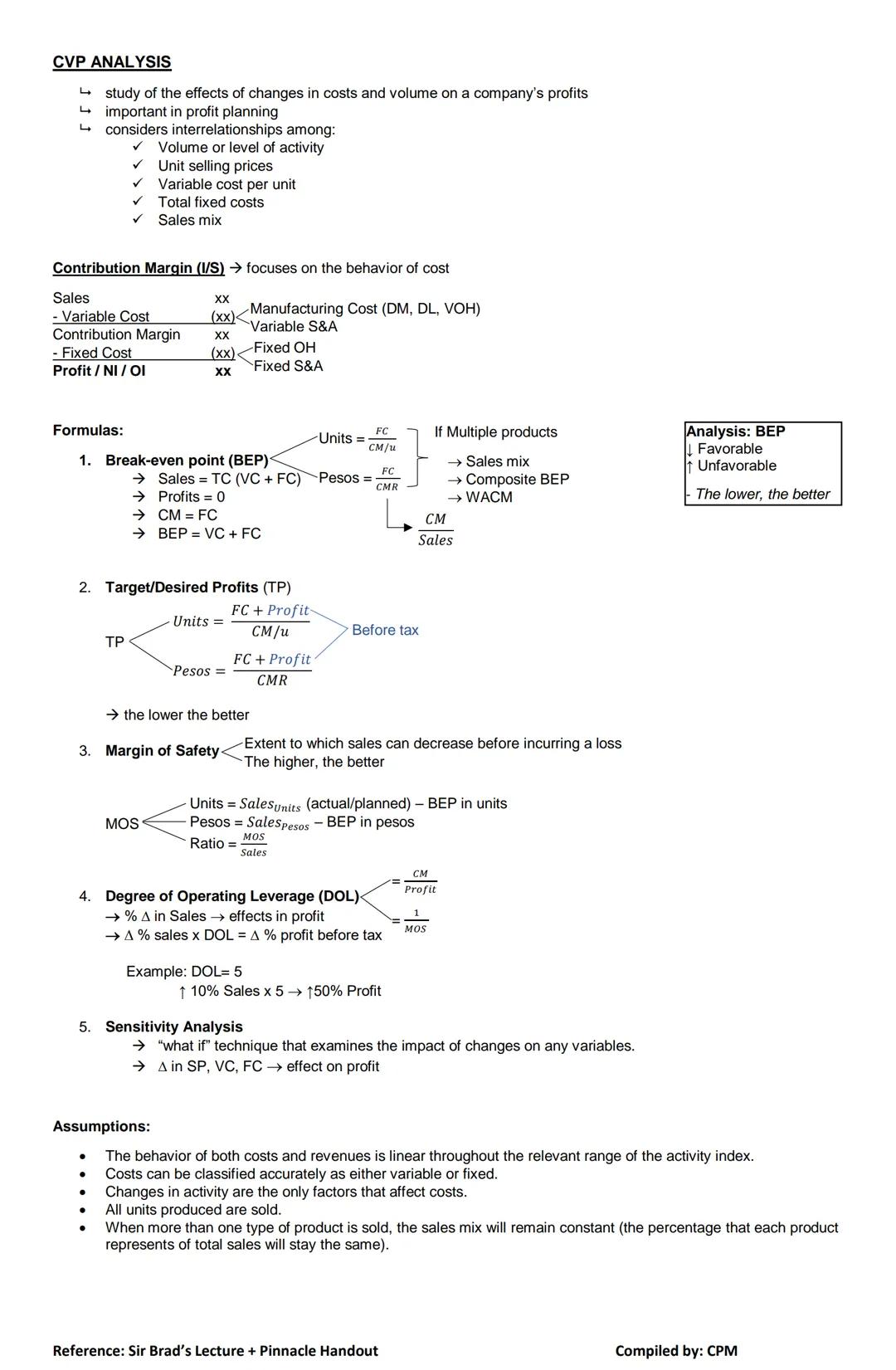

Cost-Volume-Profit (CVP) analysis studies how changes in costs and volume affect a company's profits. This powerful tool helps managers make decisions about pricing, production levels, and sales mix.

The contribution margin approach organizes costs by behavior rather than function. This format shows sales minus variable costs equals contribution margin, minus fixed costs equals profit. The contribution margin represents how much each sales dollar contributes to covering fixed costs and generating profit.

Key CVP formulas include:

The degree of operating leverage (DOL) measures how sensitive profits are to changes in sales. A higher DOL means profits will change more dramatically with sales changes. For example, with a DOL of 5, a 10% increase in sales translates to a 50% increase in profit!

Important note: CVP analysis assumes linear relationships between costs and activity, accurate cost classification, and consistent sales mix. These assumptions should be verified before making significant decisions.

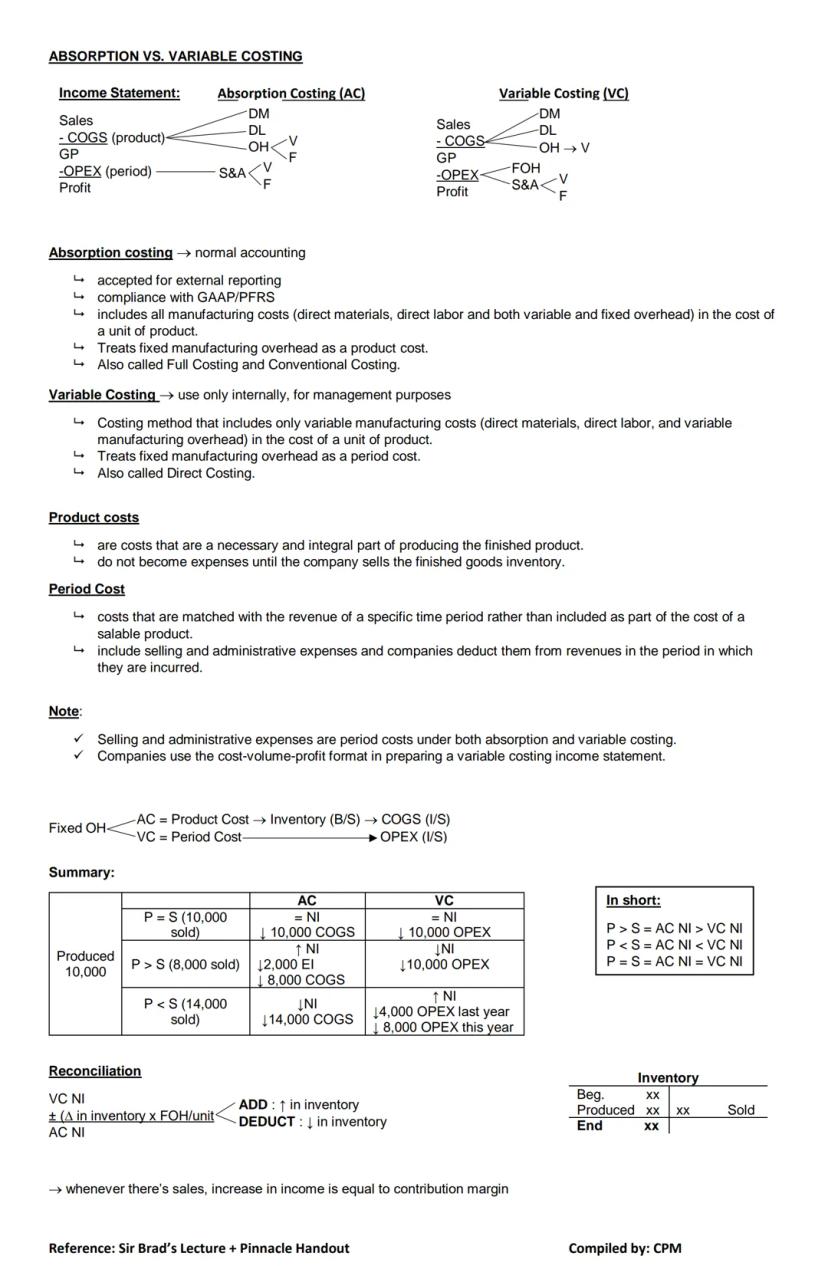

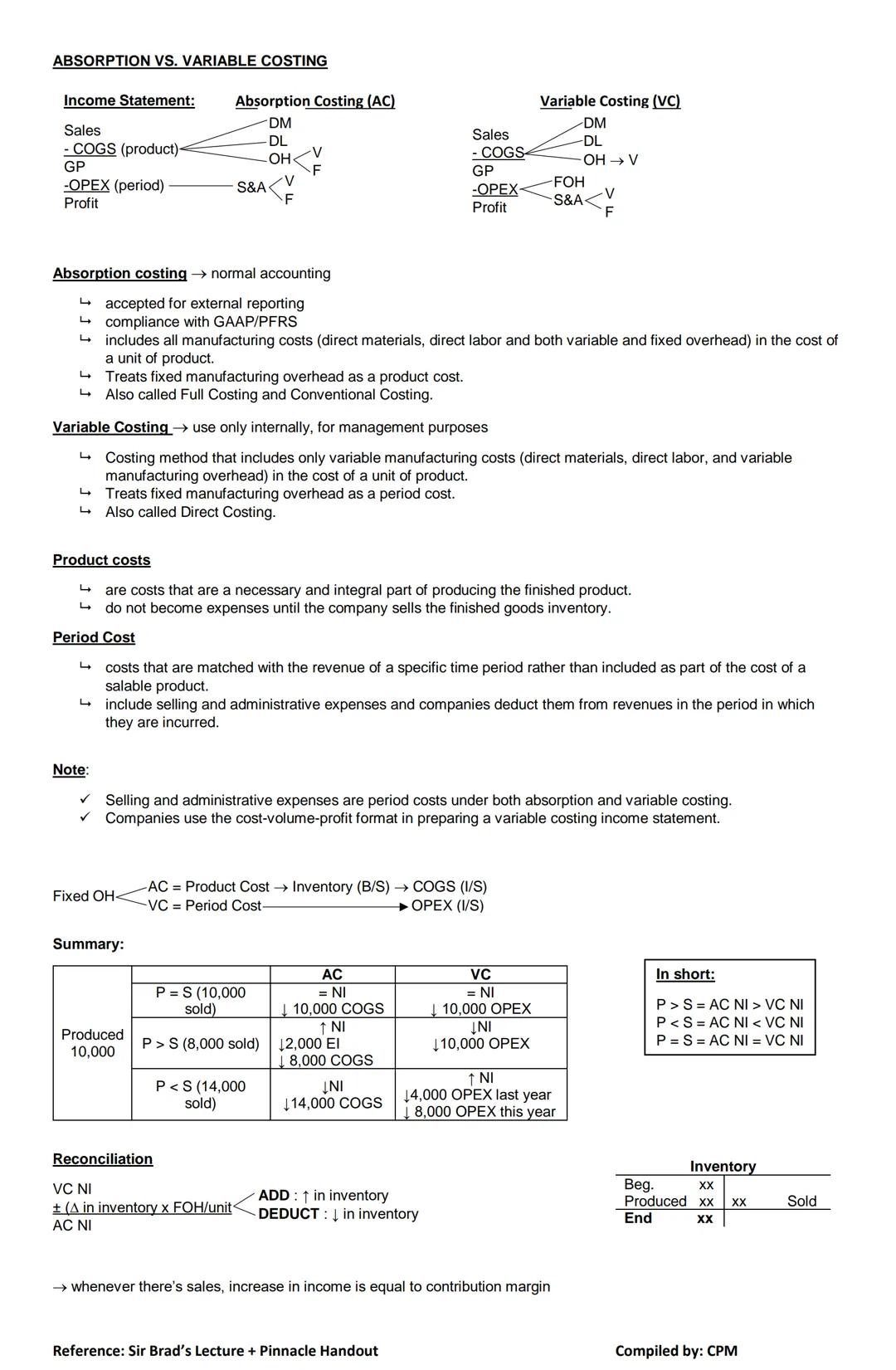

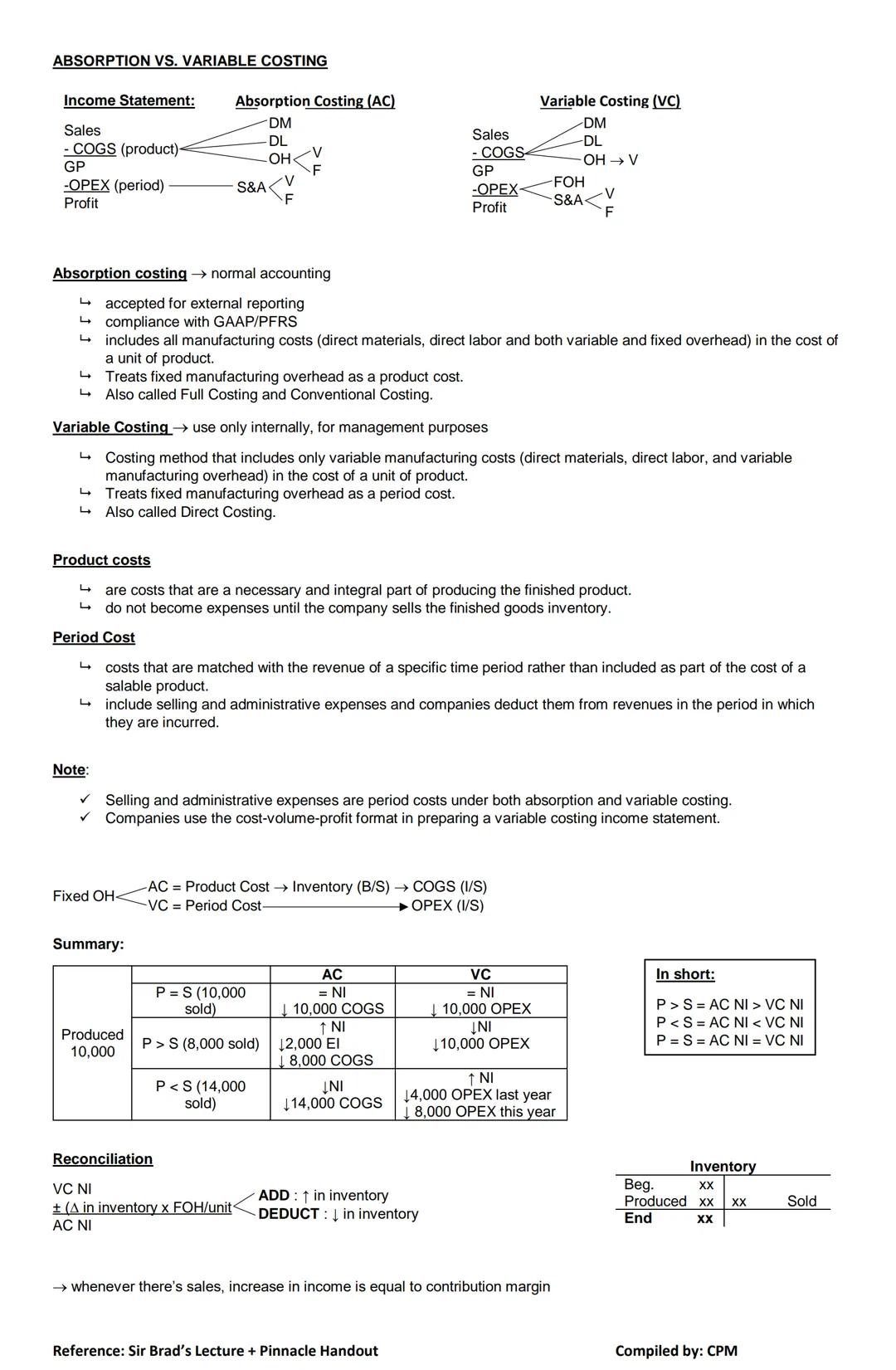

Two major costing methods treat fixed manufacturing overhead very differently. Absorption costing (the standard for external reporting) treats fixed overhead as a product cost, while variable costing (used for internal decisions) treats it as a period cost.

The key distinction is how fixed overhead is handled:

This difference causes net income to vary between the methods when production doesn't equal sales:

You can reconcile the income difference by multiplying the change in inventory by the fixed overhead rate. For example, if inventory increased by 2,000 units and fixed overhead is $5 per unit, absorption costing income would be $10,000 higher.

Decision-making tip: Variable costing provides clearer information for short-term decisions since it separates fixed and variable costs. This alignment with CVP analysis helps managers make better incremental decisions about pricing and production levels.

Variable costing offers several compelling advantages over absorption costing for internal management decisions, even though it's not accepted for external financial reporting.

One key benefit is that net income under variable costing directly correlates with sales volume rather than production levels. This prevents the income distortion that happens with absorption costing when companies overproduce to artificially inflate profits.

The variable costing approach aligns perfectly with cost-volume-profit analysis since both focus on separating fixed and variable costs. This consistency makes incremental analysis for decision-making more straightforward and accurate.

Perhaps most importantly, variable costing provides managers with a clearer view of cost behavior patterns. By presenting fixed and variable costs separately on the income statement, it becomes easier to predict how costs will change with different activity levels and make better operational decisions.

Management insight: Variable costing helps prevent the "production for inventory" trap where managers might be tempted to overproduce just to boost short-term reported profits under absorption costing.

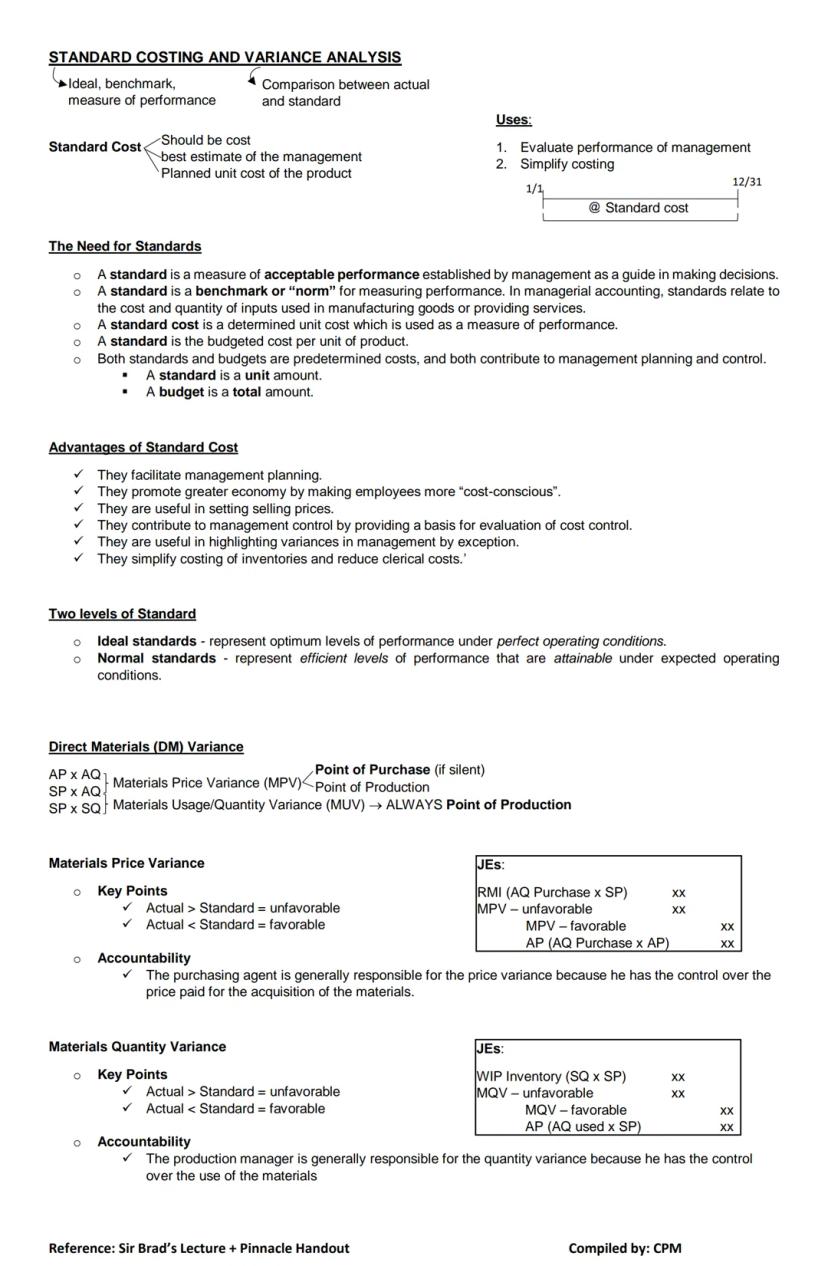

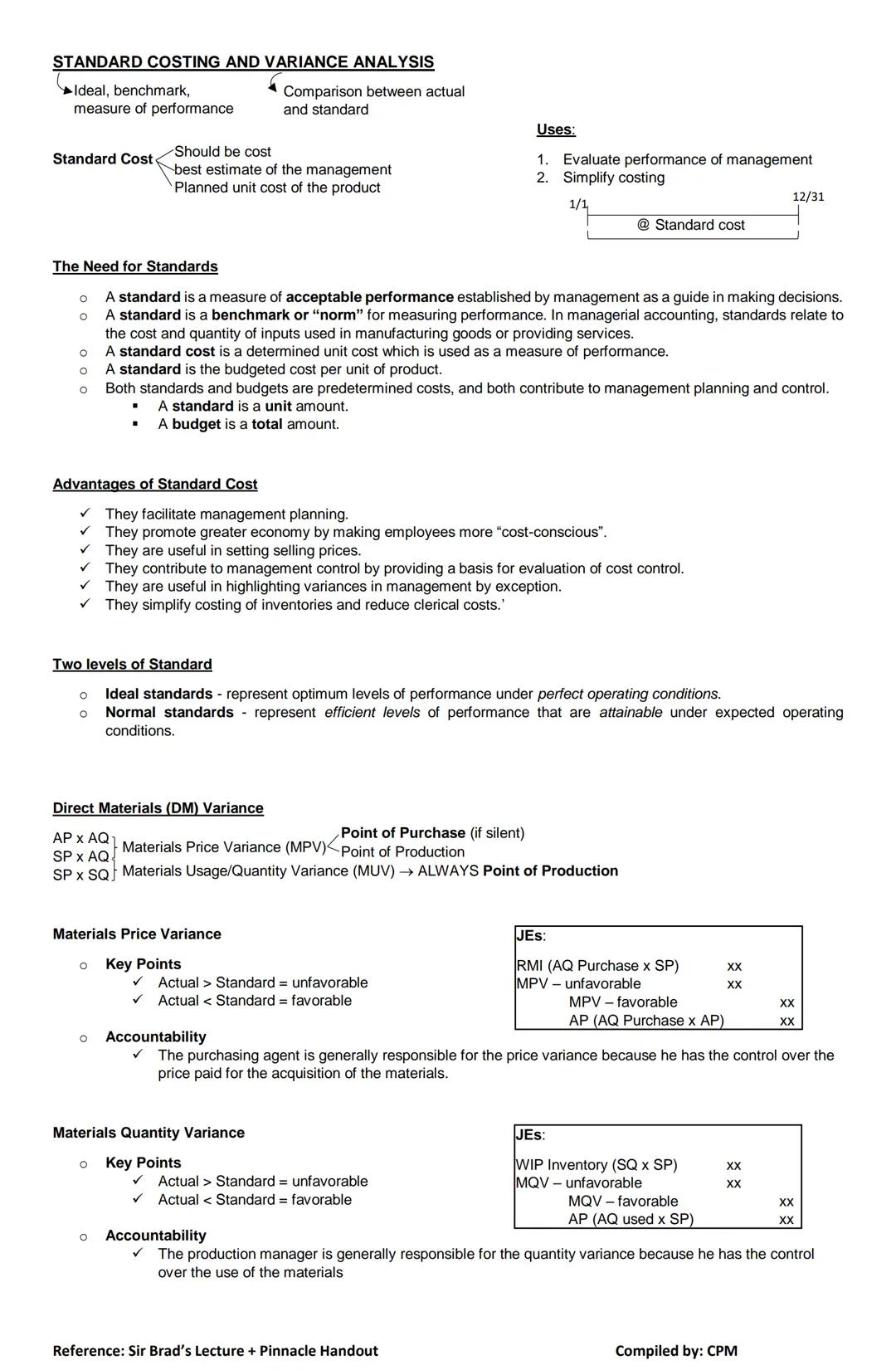

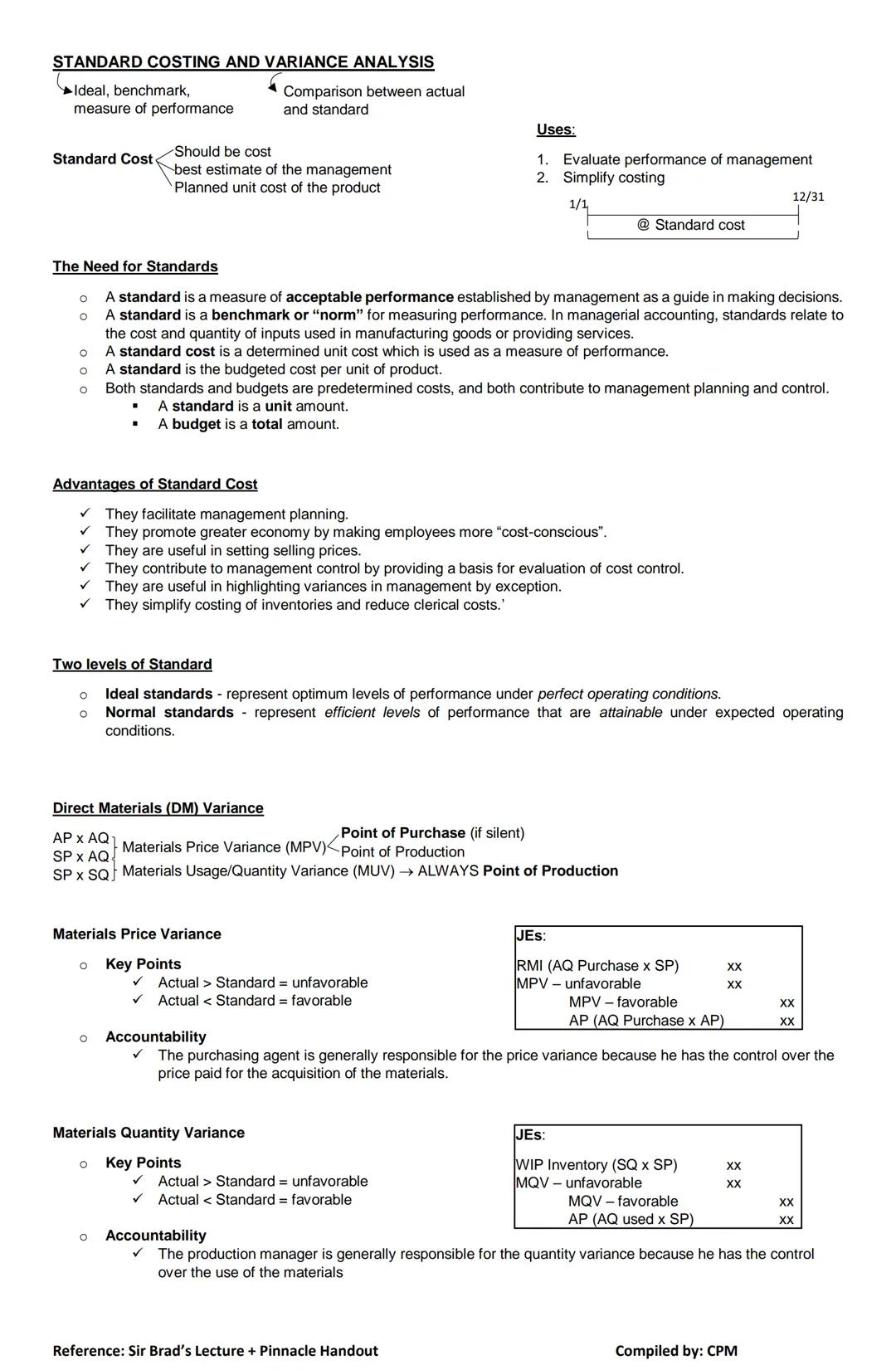

Standard costing establishes benchmark costs for production that serve as ideal or "should-be" costs against which actual performance is measured. This approach simplifies costing and provides a powerful tool for performance evaluation.

Standards serve as predetermined unit costs that help with planning, cost control, pricing decisions, and highlighting exceptions that need management attention. While ideal standards represent perfect conditions, most companies use normal standards that account for expected operating conditions.

Direct materials variances analyze differences between standard and actual material costs:

When actual costs exceed standards, the variance is unfavorable; when actual costs are less than standards, the variance is favorable. For materials, the purchasing agent typically controls price variances, while production managers are responsible for usage variances.

Accounting tip: Materials price variances are typically recorded at the point of purchase, while usage variances are recorded at the point of production. This separation of responsibility helps identify exactly where cost control issues are occurring.

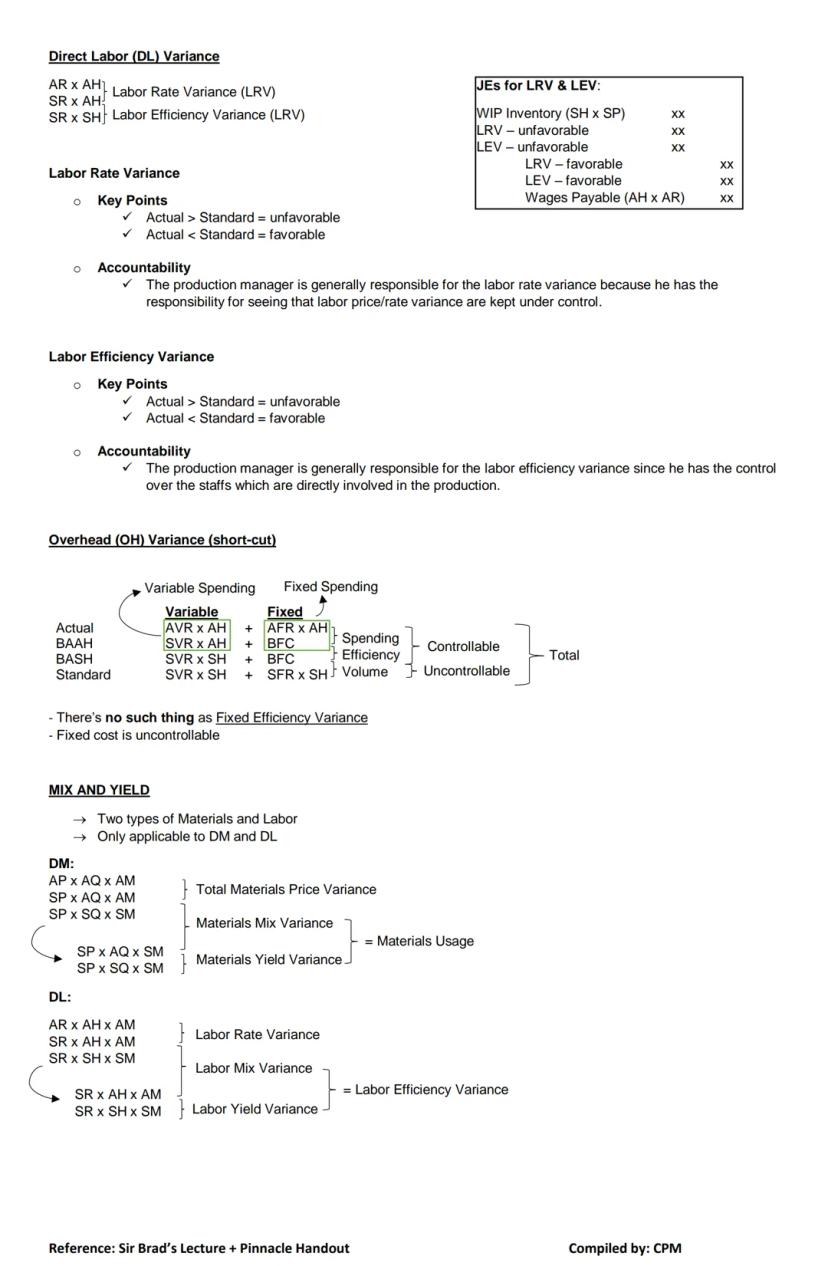

Direct labor performance is evaluated using similar variance concepts as materials, but with different terminology:

Production managers are typically responsible for both variances since they control worker assignments and efficiency. When actual costs exceed standards, the variance is unfavorable; when actual costs are less than standards, it's favorable.

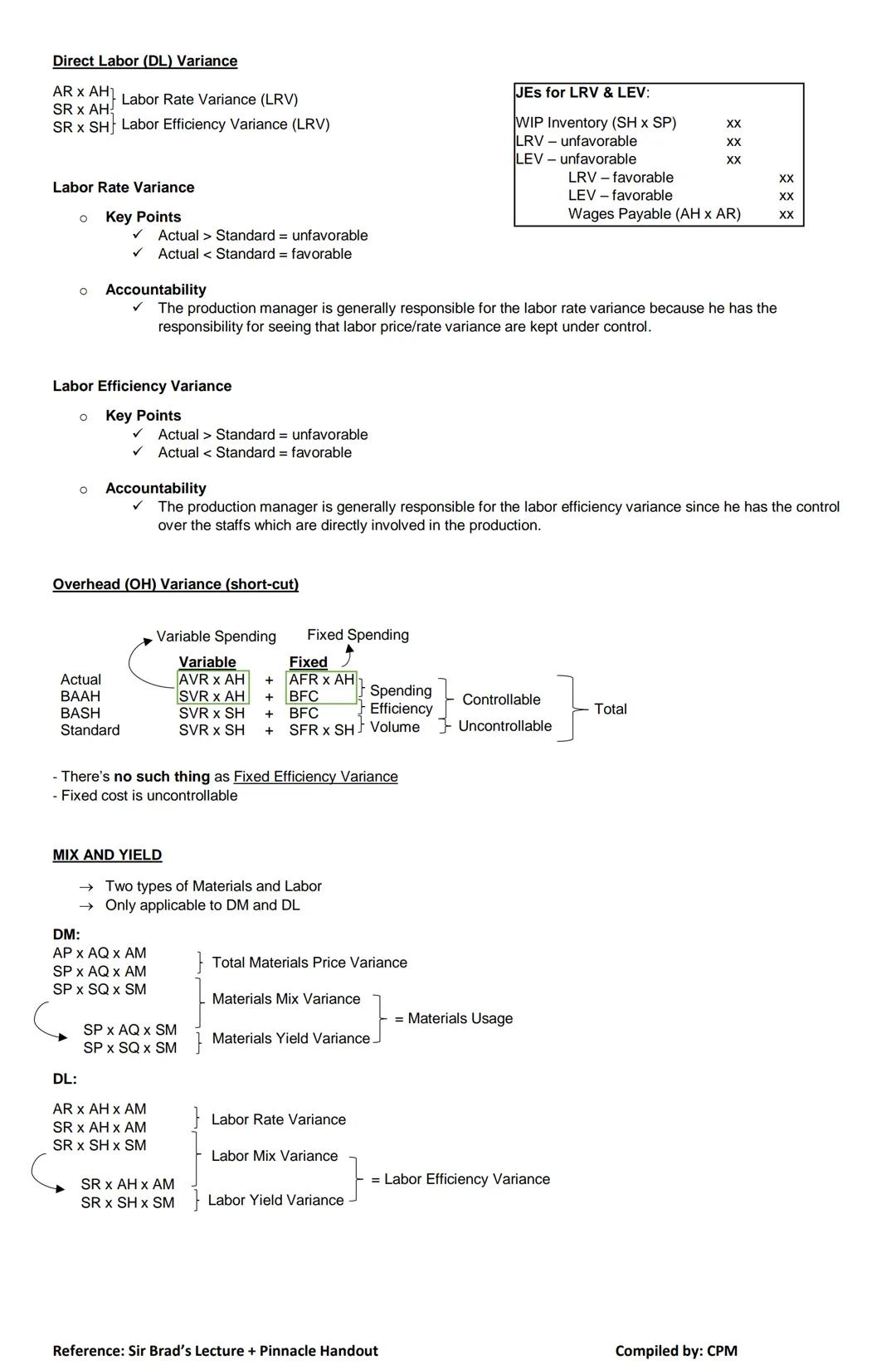

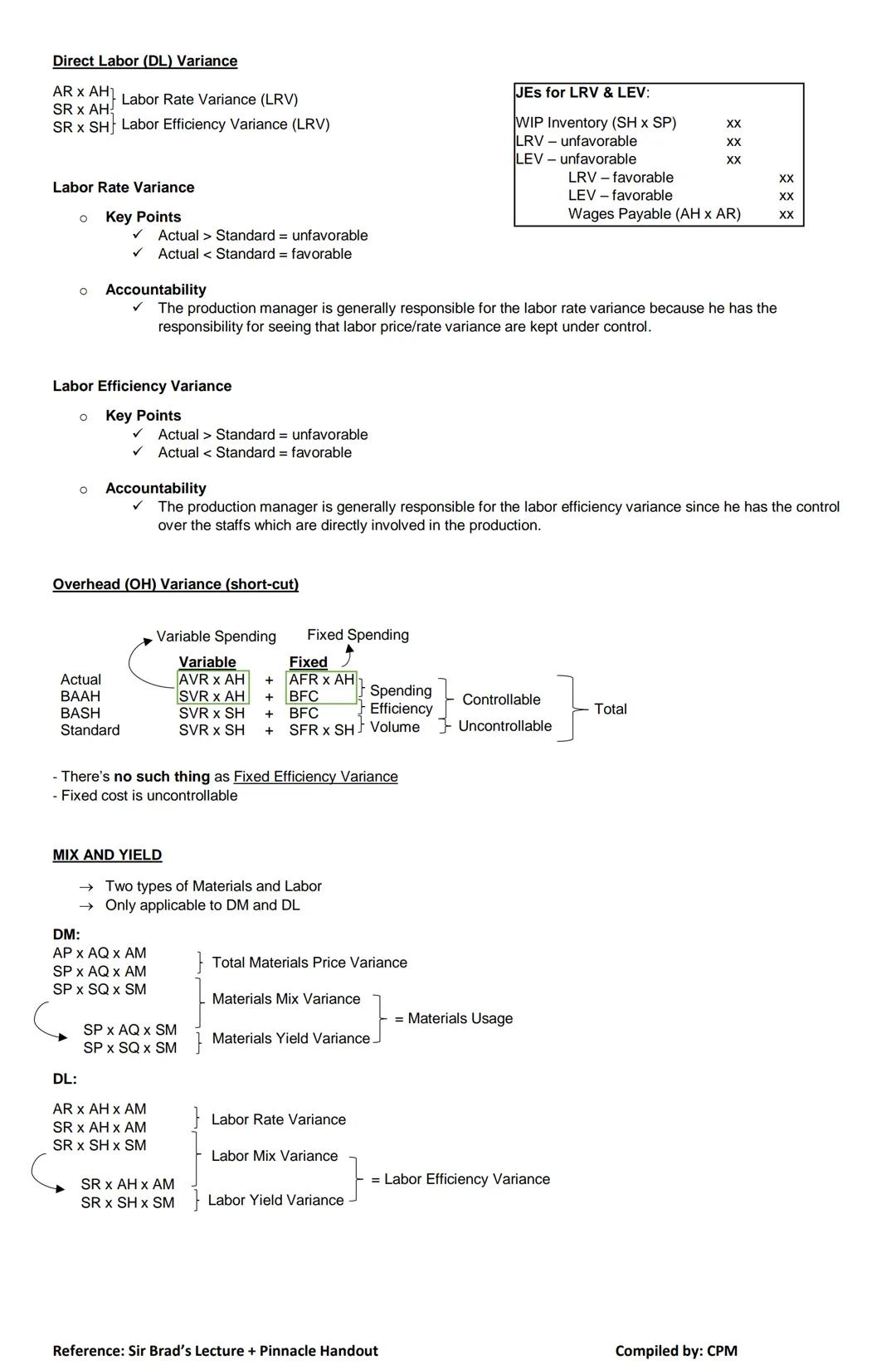

Factory overhead analysis gets more complex with multiple approaches:

When materials or labor use multiple types, additional mix and yield variances can be calculated. The mix variance shows the impact of using a different proportion of inputs, while the yield variance shows the effect of getting more or less output from those inputs.

Management insight: Variance analysis follows the principle of "management by exception," allowing managers to focus their attention on the most significant deviations from standards rather than reviewing all cost data.

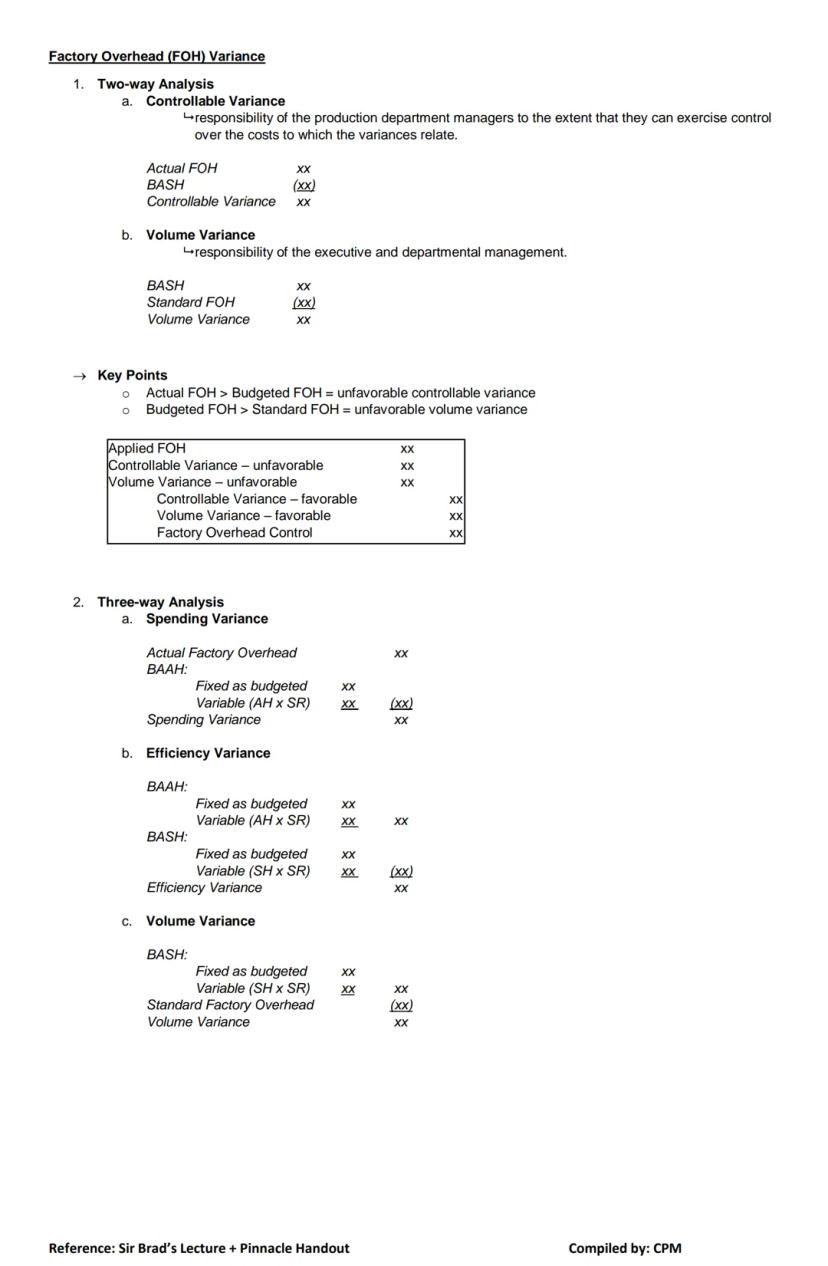

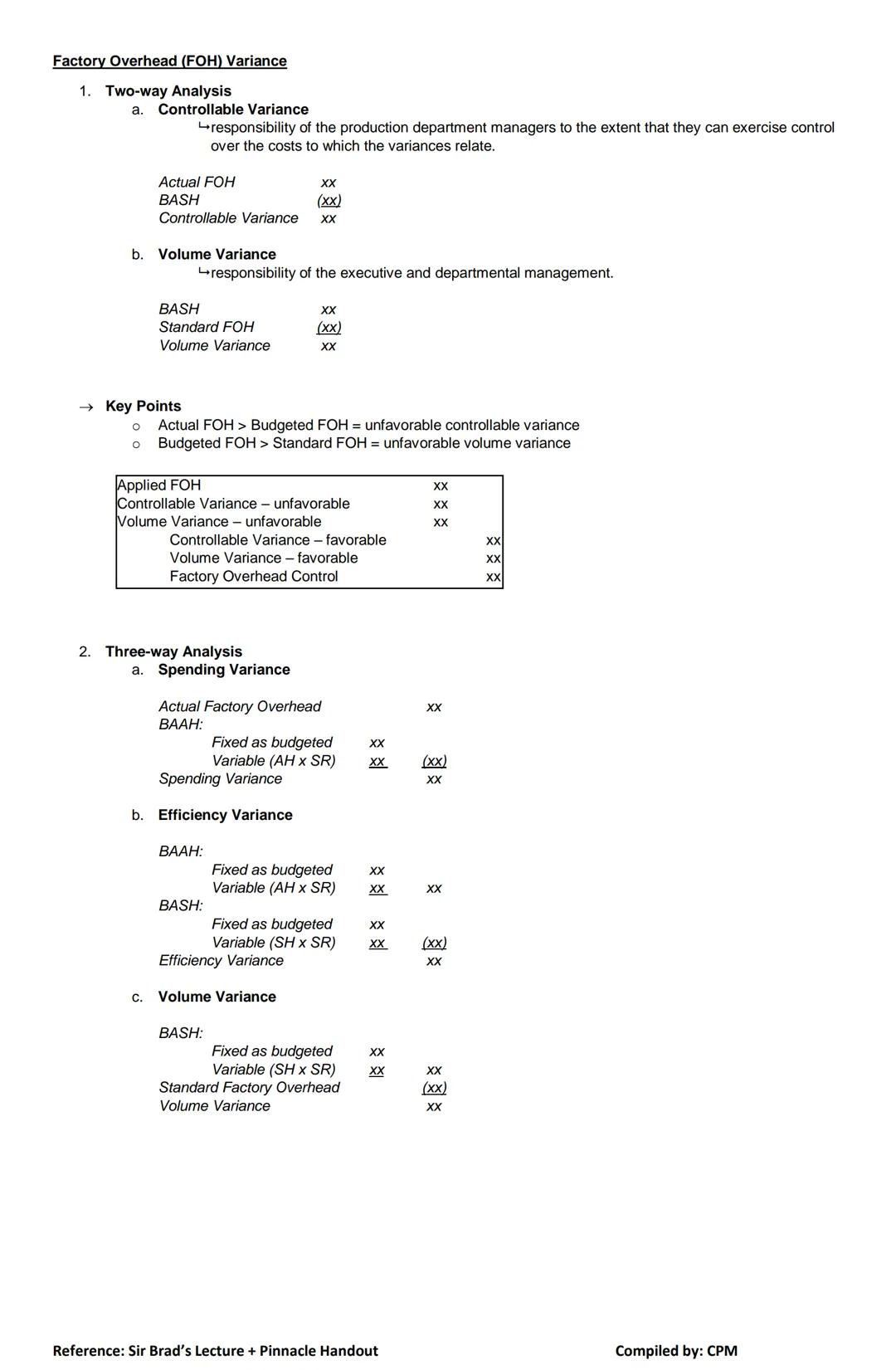

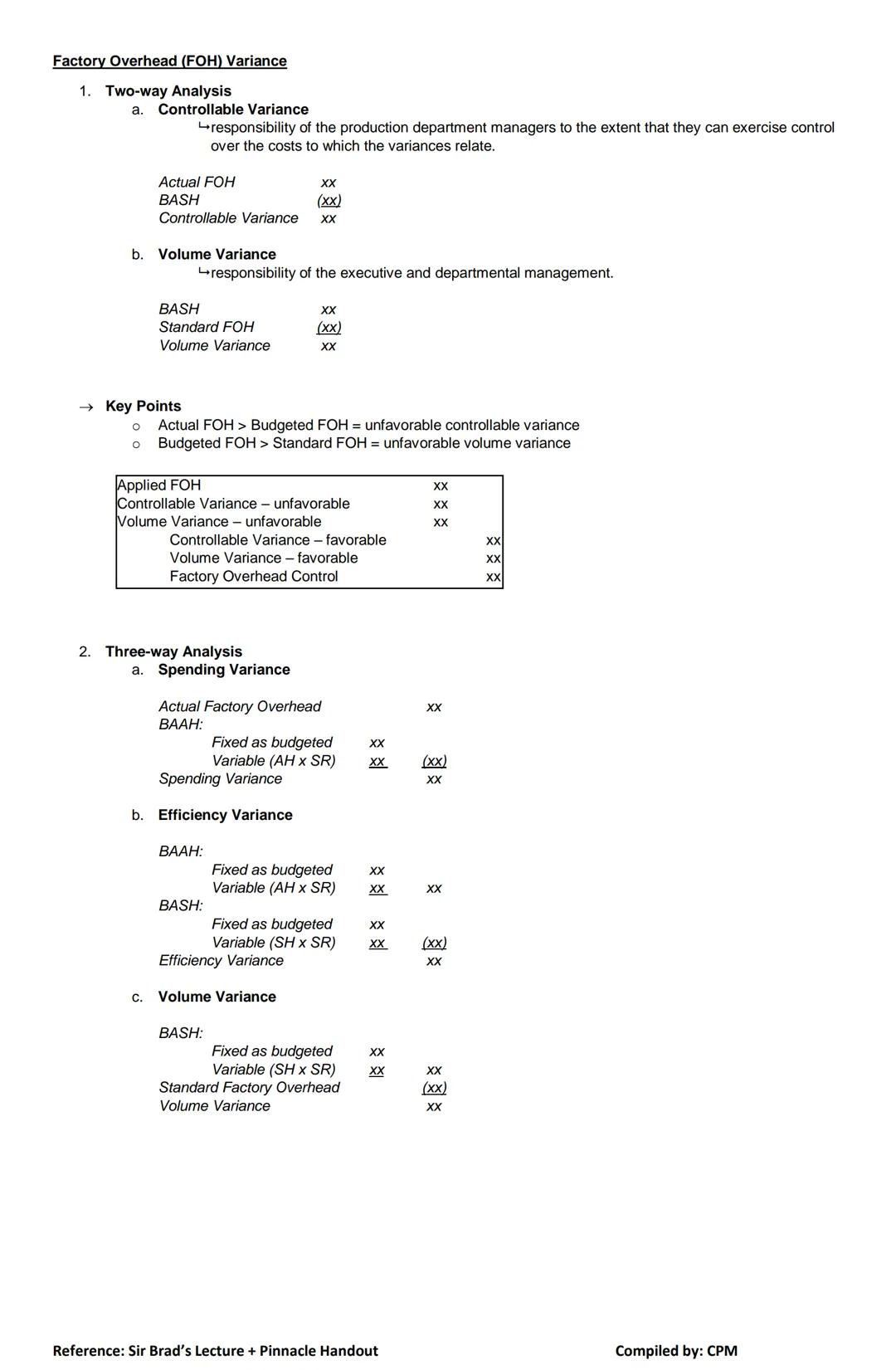

Factory overhead (FOH) variances require more complex analysis because overhead includes both fixed and variable elements. The most basic approach is the two-way analysis, which separates:

Controllable Variance: The difference between actual overhead and budgeted overhead at actual hours (BAAH). This variance is the responsibility of production managers who can control these costs.

Volume Variance: The difference between budgeted overhead at actual hours and standard overhead. This variance typically results from producing more or less than planned capacity and is the responsibility of executive management.

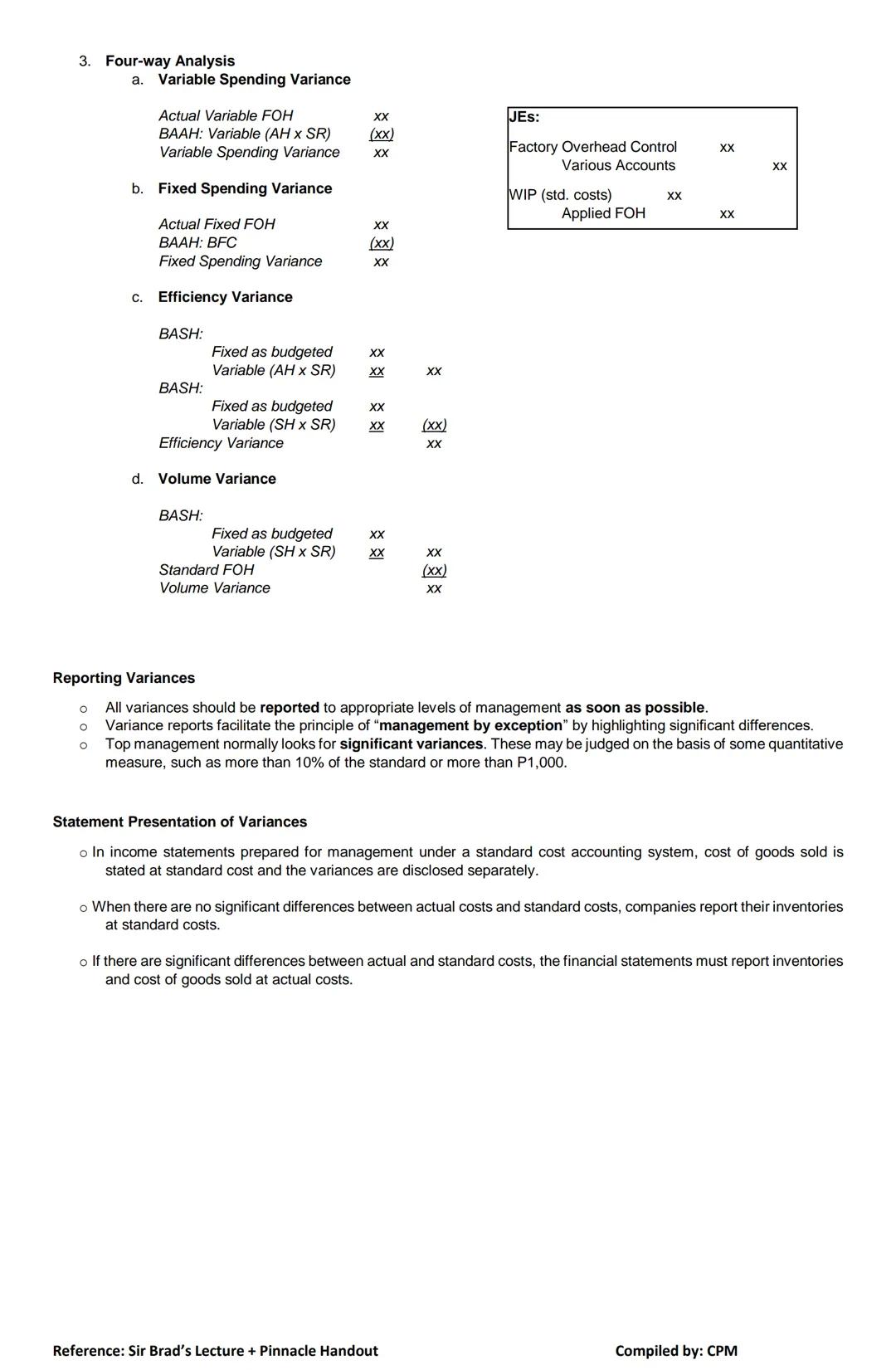

The three-way analysis provides more detailed insight by separating:

For even more precision, the four-way analysis further divides the spending variance into variable and fixed components, giving managers clearer responsibility assignments.

Reporting tip: Significant variances (typically those exceeding 10% of standard or a specific dollar amount) should be reported to appropriate management levels immediately to enable timely corrective action.

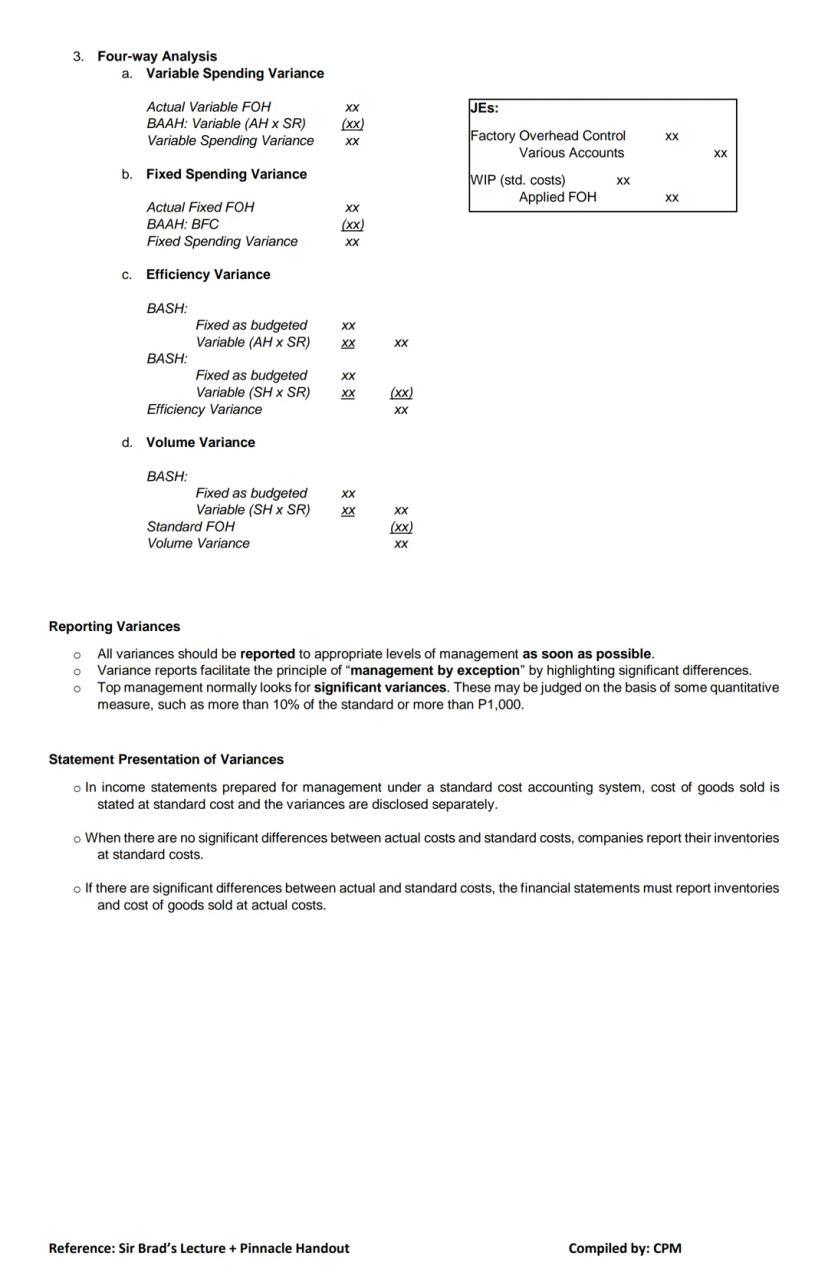

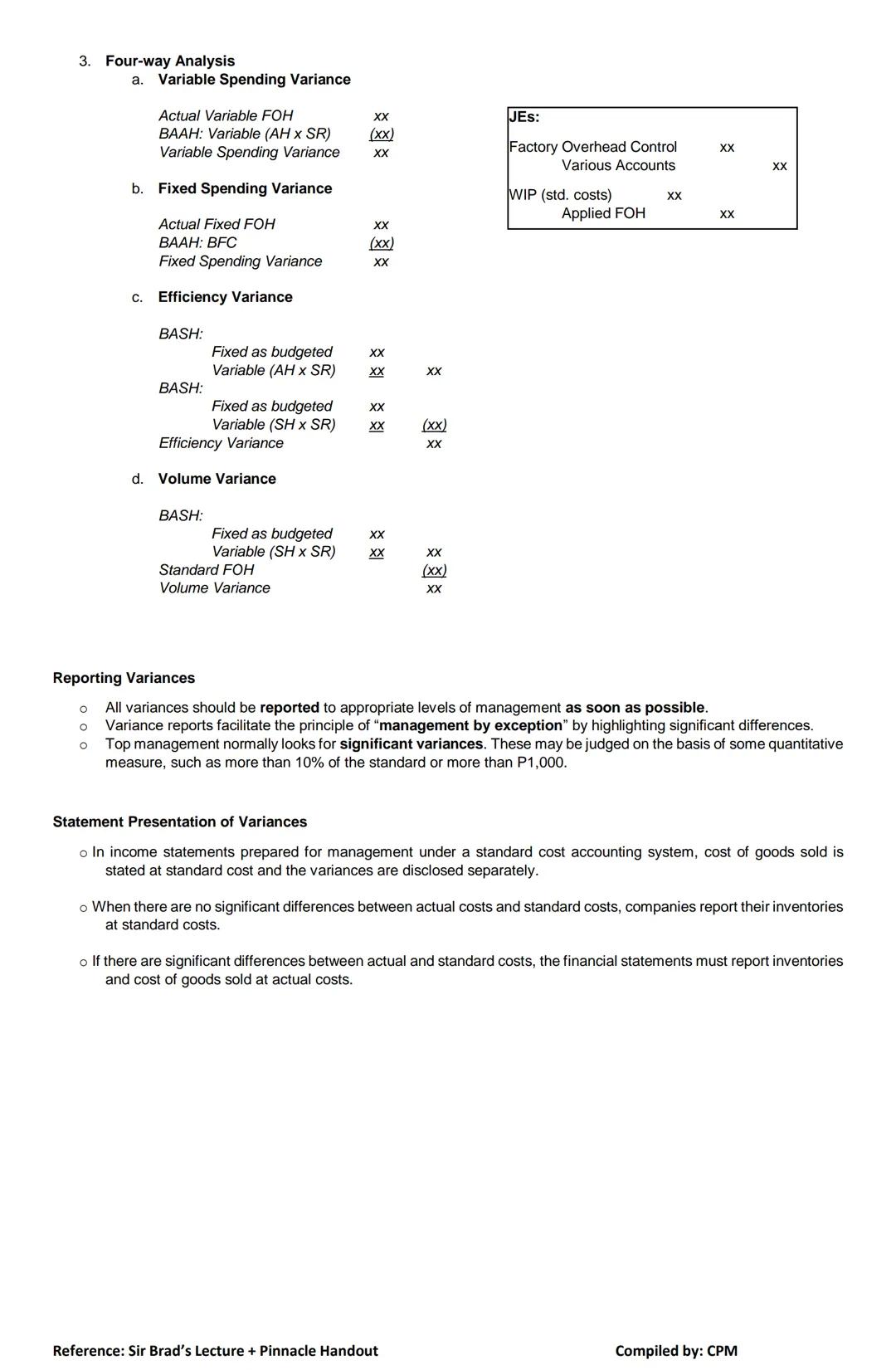

The four-way analysis of factory overhead provides the most detailed breakdown of variances:

Variable Spending Variance: Compares actual variable overhead to what should have been spent at actual hours, highlighting price differences in variable overhead items

Fixed Spending Variance: Shows how actual fixed overhead differs from budgeted fixed costs, often revealing budget preparation errors

Efficiency Variance: Measures the impact of labor efficiency on variable overhead, showing how using more or fewer labor hours affects overhead costs

Volume Variance: Indicates how capacity utilization affects the absorption of fixed overhead costs

Variance reports should be provided to management promptly to facilitate management by exception - focusing attention on significant deviations rather than reviewing all cost data. Companies typically define significance using a threshold like "more than 10% of standard" or "more than $1,000."

For financial statement purposes, minor variances are typically allocated to cost of goods sold. However, when variances are significant, inventories and cost of goods sold must be reported at actual costs rather than standard costs.

Analysis insight: When examining variances, look for patterns rather than isolated occurrences. Consistently unfavorable variances in the same area often indicate systemic problems requiring process changes rather than just tighter controls.

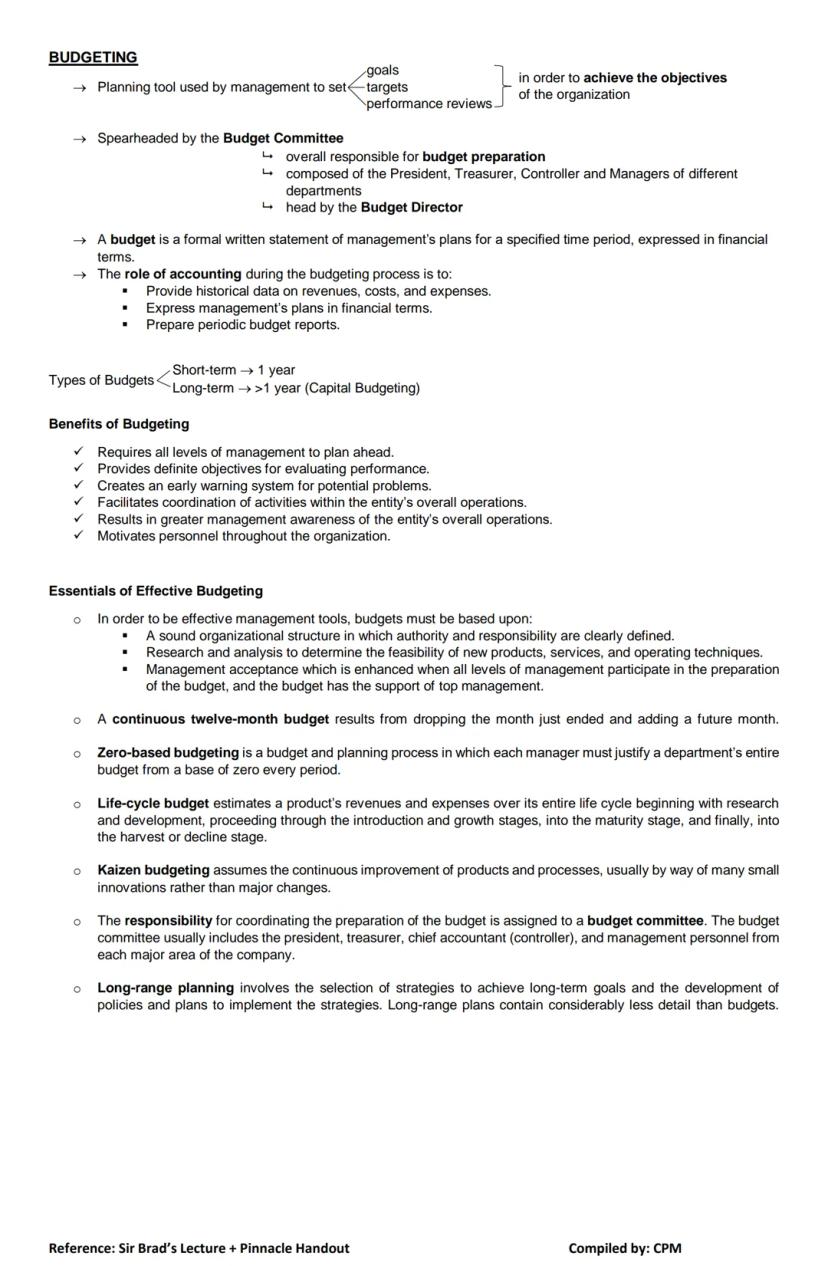

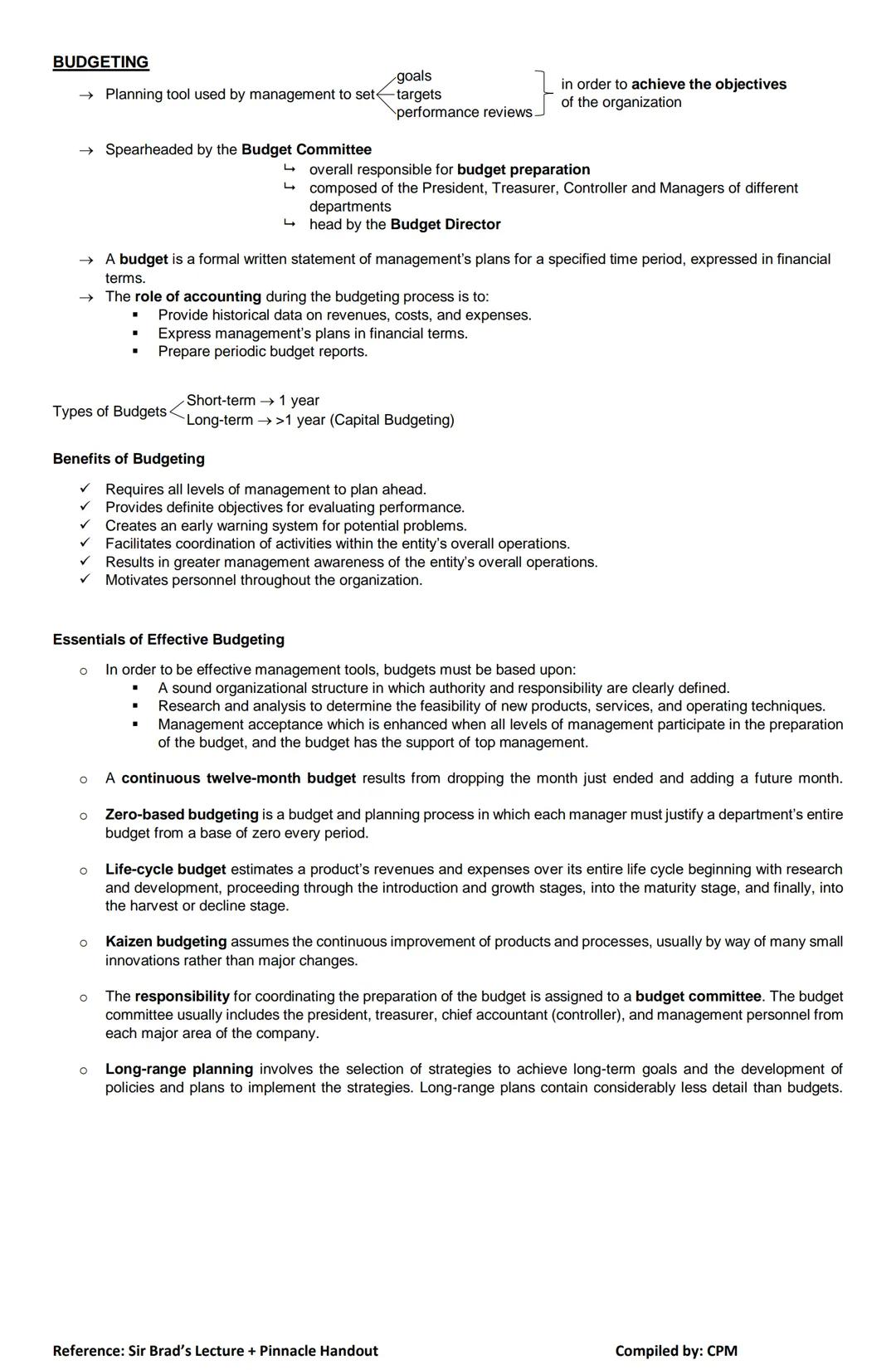

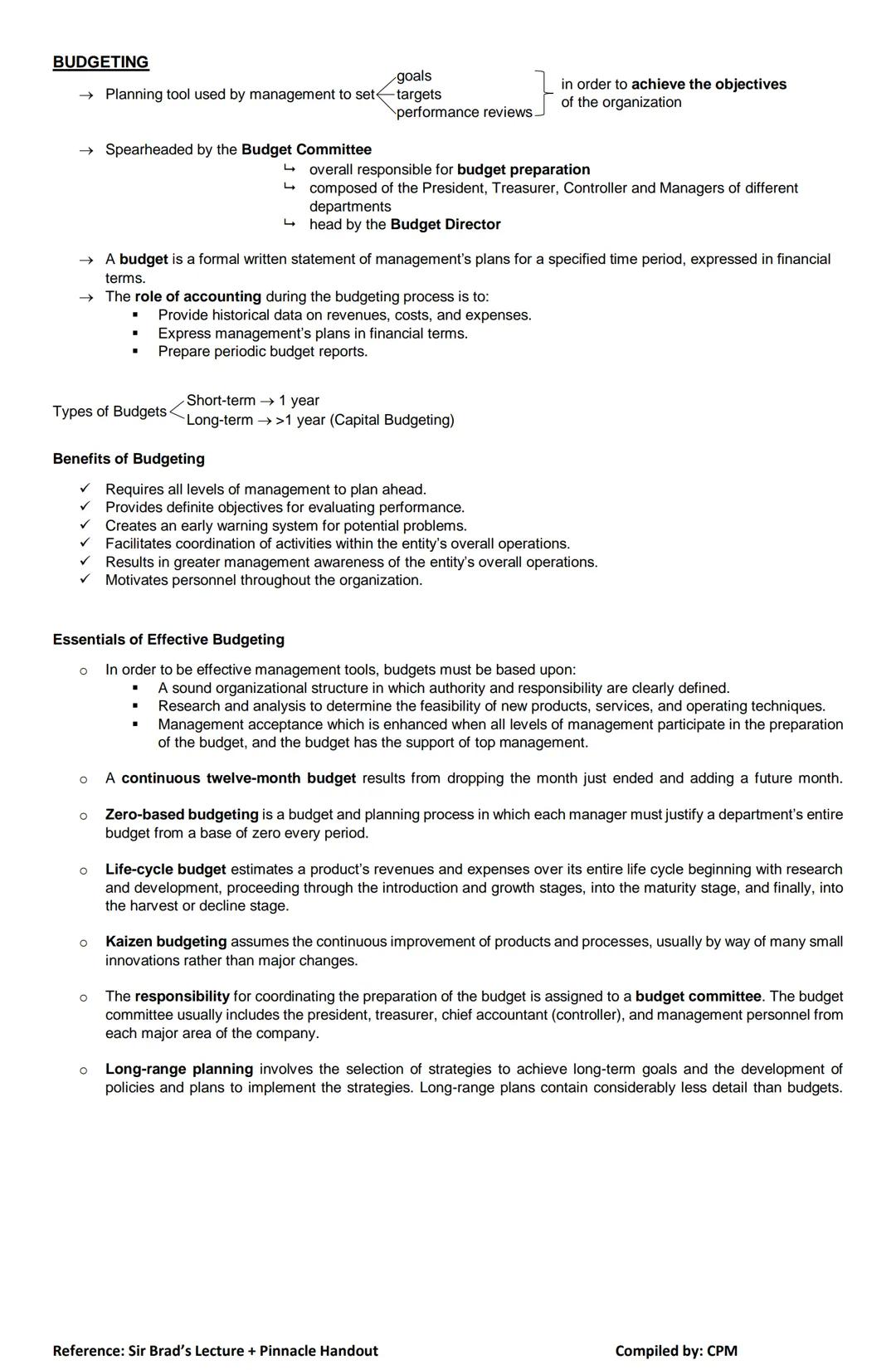

Budgeting is a formal planning process that translates management's goals into financial terms. The process is typically led by a budget committee composed of key executives and department heads, with a budget director coordinating the effort.

Budgets serve multiple important functions:

For budgeting to be effective, companies need a clear organizational structure with defined responsibilities, thorough research to support assumptions, and buy-in from all management levels. The most successful budgeting processes involve participation from those who will be held accountable for the results.

Several budgeting approaches exist:

Implementation tip: The most successful budgeting systems balance top-down strategic guidance with bottom-up operational input. This approach ensures alignment with company goals while benefiting from the detailed knowledge of front-line managers.

Our AI companion is specifically built for the needs of students. Based on the millions of content pieces we have on the platform we can provide truly meaningful and relevant answers to students. But its not only about answers, the companion is even more about guiding students through their daily learning challenges, with personalised study plans, quizzes or content pieces in the chat and 100% personalisation based on the students skills and developments.

You can download the app in the Google Play Store and in the Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

studywithnessa

@studywithnessa

Management Services (MS) is a critical area that provides essential information for internal decision-making. Unlike financial accounting which focuses on external reporting, MS helps managers make strategic choices about pricing, production, process improvements, and resource allocation to maximize company performance.

Access to all documents

Improve your grades

Join milions of students

Management Services (MS) is all about providing relevant information to help managers make better decisions. While financial accounting focuses on reporting past transactions to external users, management accounting targets internal users with forward-looking data.

The key distinction between management accounting and financial accounting is their purpose and audience. Management accounting serves internal managers making operational decisions without strict accounting standards, while financial accounting follows PFRS standards for external reporting of historical information.

In organizations, positions are classified as either line or staff. Line positions directly generate revenue, while staff positions provide support functions like IT, payroll, and legal services. The organizational structure typically flows from stockholders to the Board of Directors to the CEO, then to various Vice Presidents overseeing functional departments.

Real-world application: Understanding your company's organizational structure helps you identify who makes decisions and how management accounting information flows through the organization.

Access to all documents

Improve your grades

Join milions of students

Every business needs to understand its costs to set prices, forecast demand, and ultimately generate net income. Costs can be attached to any cost object (like a product, department, or project) and are classified in several important ways.

By type, costs can be product costs or period costs . Product costs appear as inventory on the balance sheet until sold, while period costs are expensed immediately.

By behavior, costs can be variable (changing with activity level) or fixed (remaining constant regardless of volume). The relationship between total cost and volume is only valid within a relevant range of activity.

To separate mixed costs into fixed and variable components, businesses use techniques like:

Pro tip: When analyzing cost behavior, always check your cost function's reliability using the coefficient of determination (r²). The closer to 1, the stronger your cost prediction will be!

Access to all documents

Improve your grades

Join milions of students

Cost-Volume-Profit (CVP) analysis studies how changes in costs and volume affect a company's profits. This powerful tool helps managers make decisions about pricing, production levels, and sales mix.

The contribution margin approach organizes costs by behavior rather than function. This format shows sales minus variable costs equals contribution margin, minus fixed costs equals profit. The contribution margin represents how much each sales dollar contributes to covering fixed costs and generating profit.

Key CVP formulas include:

The degree of operating leverage (DOL) measures how sensitive profits are to changes in sales. A higher DOL means profits will change more dramatically with sales changes. For example, with a DOL of 5, a 10% increase in sales translates to a 50% increase in profit!

Important note: CVP analysis assumes linear relationships between costs and activity, accurate cost classification, and consistent sales mix. These assumptions should be verified before making significant decisions.

Access to all documents

Improve your grades

Join milions of students

Two major costing methods treat fixed manufacturing overhead very differently. Absorption costing (the standard for external reporting) treats fixed overhead as a product cost, while variable costing (used for internal decisions) treats it as a period cost.

The key distinction is how fixed overhead is handled:

This difference causes net income to vary between the methods when production doesn't equal sales:

You can reconcile the income difference by multiplying the change in inventory by the fixed overhead rate. For example, if inventory increased by 2,000 units and fixed overhead is $5 per unit, absorption costing income would be $10,000 higher.

Decision-making tip: Variable costing provides clearer information for short-term decisions since it separates fixed and variable costs. This alignment with CVP analysis helps managers make better incremental decisions about pricing and production levels.

Access to all documents

Improve your grades

Join milions of students

Variable costing offers several compelling advantages over absorption costing for internal management decisions, even though it's not accepted for external financial reporting.

One key benefit is that net income under variable costing directly correlates with sales volume rather than production levels. This prevents the income distortion that happens with absorption costing when companies overproduce to artificially inflate profits.

The variable costing approach aligns perfectly with cost-volume-profit analysis since both focus on separating fixed and variable costs. This consistency makes incremental analysis for decision-making more straightforward and accurate.

Perhaps most importantly, variable costing provides managers with a clearer view of cost behavior patterns. By presenting fixed and variable costs separately on the income statement, it becomes easier to predict how costs will change with different activity levels and make better operational decisions.

Management insight: Variable costing helps prevent the "production for inventory" trap where managers might be tempted to overproduce just to boost short-term reported profits under absorption costing.

Access to all documents

Improve your grades

Join milions of students

Standard costing establishes benchmark costs for production that serve as ideal or "should-be" costs against which actual performance is measured. This approach simplifies costing and provides a powerful tool for performance evaluation.

Standards serve as predetermined unit costs that help with planning, cost control, pricing decisions, and highlighting exceptions that need management attention. While ideal standards represent perfect conditions, most companies use normal standards that account for expected operating conditions.

Direct materials variances analyze differences between standard and actual material costs:

When actual costs exceed standards, the variance is unfavorable; when actual costs are less than standards, the variance is favorable. For materials, the purchasing agent typically controls price variances, while production managers are responsible for usage variances.

Accounting tip: Materials price variances are typically recorded at the point of purchase, while usage variances are recorded at the point of production. This separation of responsibility helps identify exactly where cost control issues are occurring.

Access to all documents

Improve your grades

Join milions of students

Direct labor performance is evaluated using similar variance concepts as materials, but with different terminology:

Production managers are typically responsible for both variances since they control worker assignments and efficiency. When actual costs exceed standards, the variance is unfavorable; when actual costs are less than standards, it's favorable.

Factory overhead analysis gets more complex with multiple approaches:

When materials or labor use multiple types, additional mix and yield variances can be calculated. The mix variance shows the impact of using a different proportion of inputs, while the yield variance shows the effect of getting more or less output from those inputs.

Management insight: Variance analysis follows the principle of "management by exception," allowing managers to focus their attention on the most significant deviations from standards rather than reviewing all cost data.

Access to all documents

Improve your grades

Join milions of students

Factory overhead (FOH) variances require more complex analysis because overhead includes both fixed and variable elements. The most basic approach is the two-way analysis, which separates:

Controllable Variance: The difference between actual overhead and budgeted overhead at actual hours (BAAH). This variance is the responsibility of production managers who can control these costs.

Volume Variance: The difference between budgeted overhead at actual hours and standard overhead. This variance typically results from producing more or less than planned capacity and is the responsibility of executive management.

The three-way analysis provides more detailed insight by separating:

For even more precision, the four-way analysis further divides the spending variance into variable and fixed components, giving managers clearer responsibility assignments.

Reporting tip: Significant variances (typically those exceeding 10% of standard or a specific dollar amount) should be reported to appropriate management levels immediately to enable timely corrective action.

Access to all documents

Improve your grades

Join milions of students

The four-way analysis of factory overhead provides the most detailed breakdown of variances:

Variable Spending Variance: Compares actual variable overhead to what should have been spent at actual hours, highlighting price differences in variable overhead items

Fixed Spending Variance: Shows how actual fixed overhead differs from budgeted fixed costs, often revealing budget preparation errors

Efficiency Variance: Measures the impact of labor efficiency on variable overhead, showing how using more or fewer labor hours affects overhead costs

Volume Variance: Indicates how capacity utilization affects the absorption of fixed overhead costs

Variance reports should be provided to management promptly to facilitate management by exception - focusing attention on significant deviations rather than reviewing all cost data. Companies typically define significance using a threshold like "more than 10% of standard" or "more than $1,000."

For financial statement purposes, minor variances are typically allocated to cost of goods sold. However, when variances are significant, inventories and cost of goods sold must be reported at actual costs rather than standard costs.

Analysis insight: When examining variances, look for patterns rather than isolated occurrences. Consistently unfavorable variances in the same area often indicate systemic problems requiring process changes rather than just tighter controls.

Access to all documents

Improve your grades

Join milions of students

Budgeting is a formal planning process that translates management's goals into financial terms. The process is typically led by a budget committee composed of key executives and department heads, with a budget director coordinating the effort.

Budgets serve multiple important functions:

For budgeting to be effective, companies need a clear organizational structure with defined responsibilities, thorough research to support assumptions, and buy-in from all management levels. The most successful budgeting processes involve participation from those who will be held accountable for the results.

Several budgeting approaches exist:

Implementation tip: The most successful budgeting systems balance top-down strategic guidance with bottom-up operational input. This approach ensures alignment with company goals while benefiting from the detailed knowledge of front-line managers.

Our AI companion is specifically built for the needs of students. Based on the millions of content pieces we have on the platform we can provide truly meaningful and relevant answers to students. But its not only about answers, the companion is even more about guiding students through their daily learning challenges, with personalised study plans, quizzes or content pieces in the chat and 100% personalisation based on the students skills and developments.

You can download the app in the Google Play Store and in the Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

10

Smart Tools NEW

Transform this note into: ✓ 50+ Practice Questions ✓ Interactive Flashcards ✓ Full Practice Test ✓ Essay Outlines

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user