Intellectual property rights, banking regulations, data privacy, and other business... Show more

Sign up to see the contentIt's free!

Access to all documents

Improve your grades

Join milions of students

Subjects

Triangle Congruence and Similarity Theorems

Triangle Properties and Classification

Linear Equations and Graphs

Geometric Angle Relationships

Trigonometric Functions and Identities

Equation Solving Techniques

Circle Geometry Fundamentals

Division Operations and Methods

Basic Differentiation Rules

Exponent and Logarithm Properties

Show all topics

Human Organ Systems

Reproductive Cell Cycles

Biological Sciences Subdisciplines

Cellular Energy Metabolism

Autotrophic Energy Processes

Inheritance Patterns and Principles

Biomolecular Structure and Organization

Cell Cycle and Division Mechanics

Cellular Organization and Development

Biological Structural Organization

Show all topics

Chemical Sciences and Applications

Atomic Structure and Composition

Molecular Electron Structure Representation

Atomic Electron Behavior

Matter Properties and Water

Mole Concept and Calculations

Gas Laws and Behavior

Periodic Table Organization

Chemical Thermodynamics Fundamentals

Chemical Bond Types and Properties

Show all topics

European Renaissance and Enlightenment

European Cultural Movements 800-1920

American Revolution Era 1763-1797

American Civil War 1861-1865

Global Imperial Systems

Mongol and Chinese Dynasties

U.S. Presidents and World Leaders

Historical Sources and Documentation

World Wars Era and Impact

World Religious Systems

Show all topics

Classic and Contemporary Novels

Literary Character Analysis

Rhetorical Theory and Practice

Classic Literary Narratives

Reading Analysis and Interpretation

Narrative Structure and Techniques

English Language Components

Influential English-Language Authors

Basic Sentence Structure

Narrative Voice and Perspective

Show all topics

307

•

Feb 6, 2026

•

studywithnessa

@studywithnessa

Intellectual property rights, banking regulations, data privacy, and other business... Show more

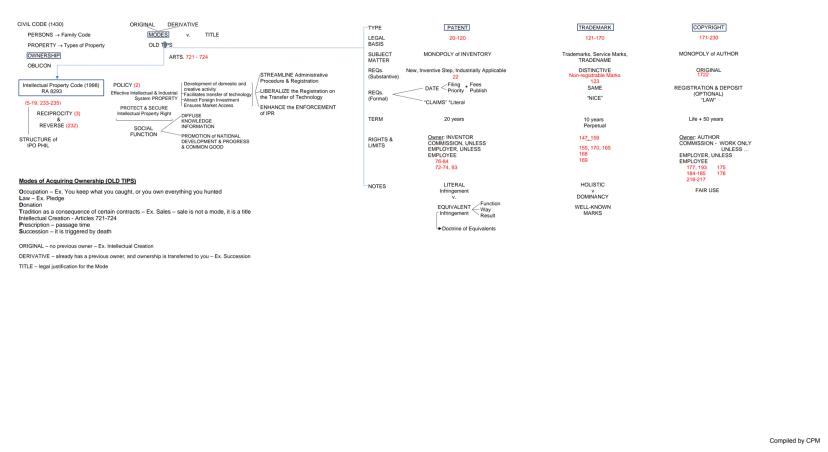

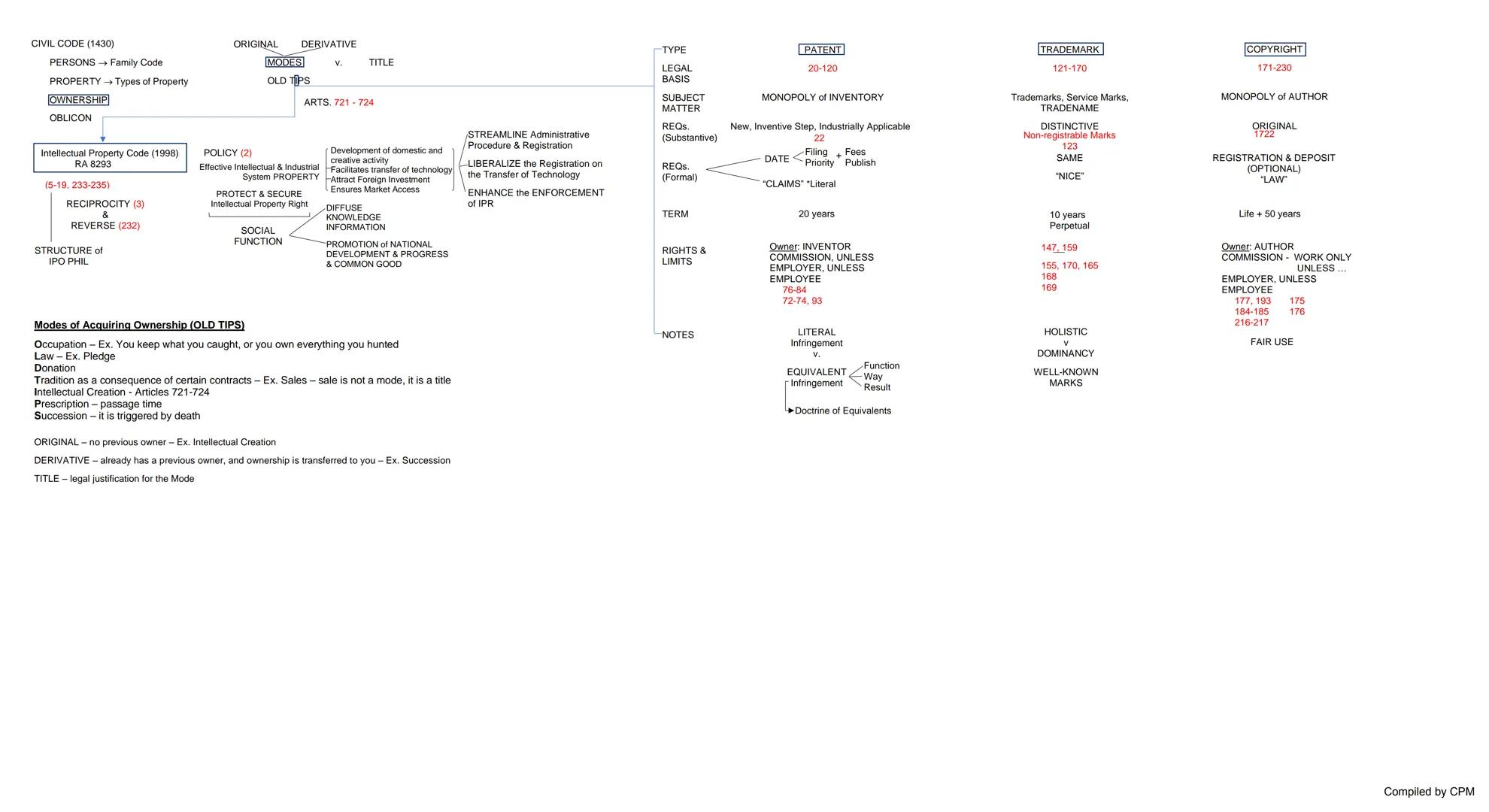

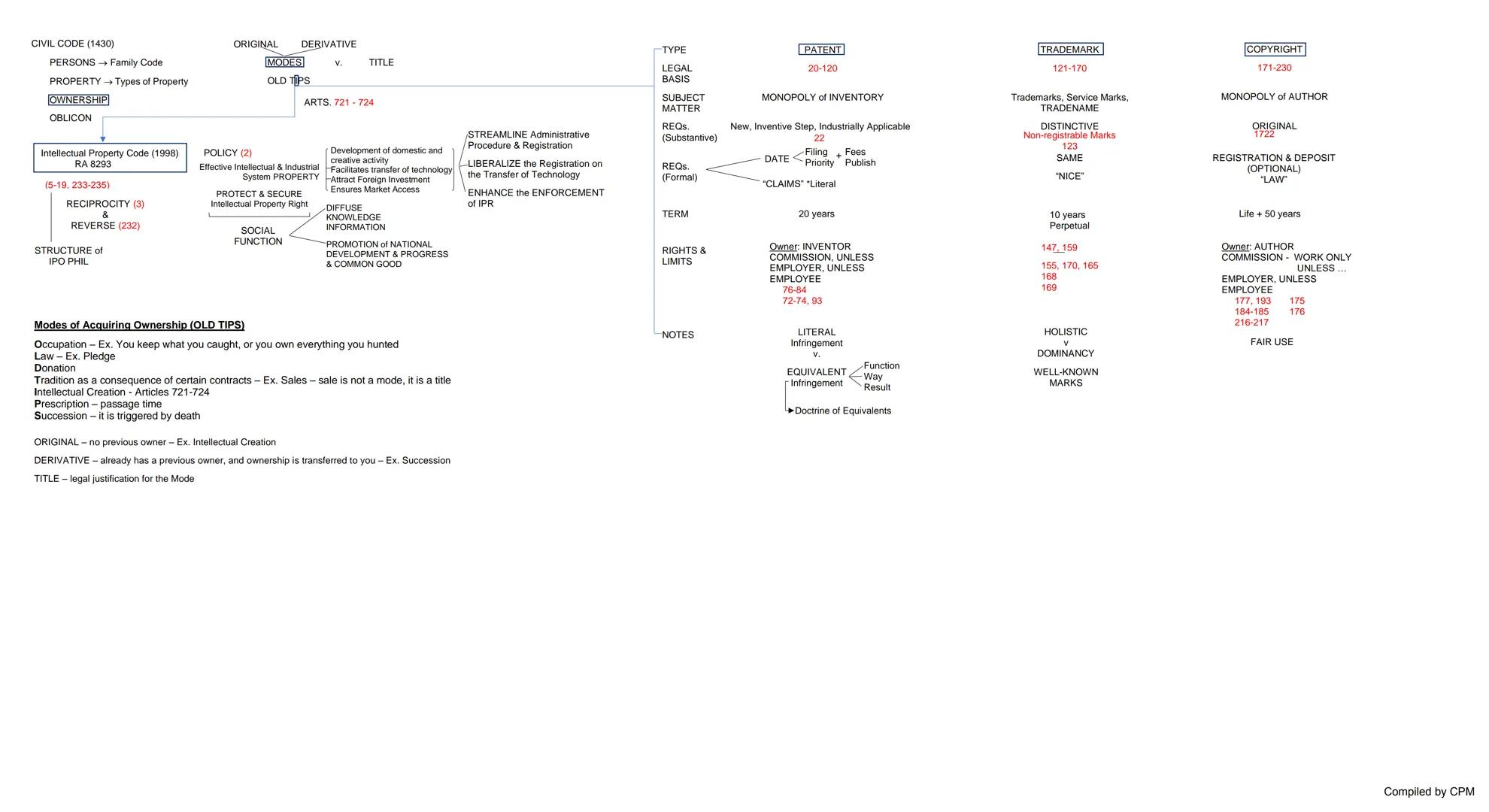

Intellectual property rights protect the creations of the human mind and grant exclusive ownership to creators. The Philippine intellectual property system aims to protect and secure intellectual property rights while promoting national development and the common good.

Intellectual property is categorized as either original (no previous owner, like a new creation) or derivative (transferred from a previous owner). Understanding the difference between a mode of acquiring ownership and a title is important—title is the legal justification, while mode is the actual means of transfer.

There are various ways to acquire ownership (OLD TIPS):

💡 Intellectual property doesn't just protect creators—it plays a critical social function by facilitating technology transfer, attracting foreign investment, and ensuring market access for innovations.

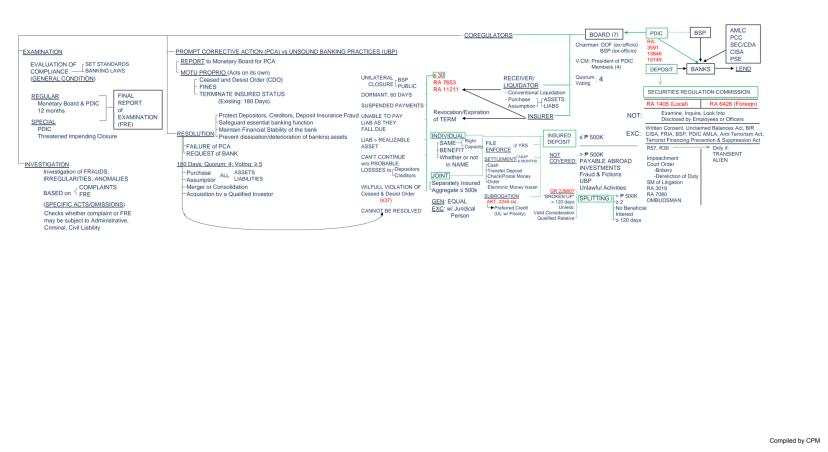

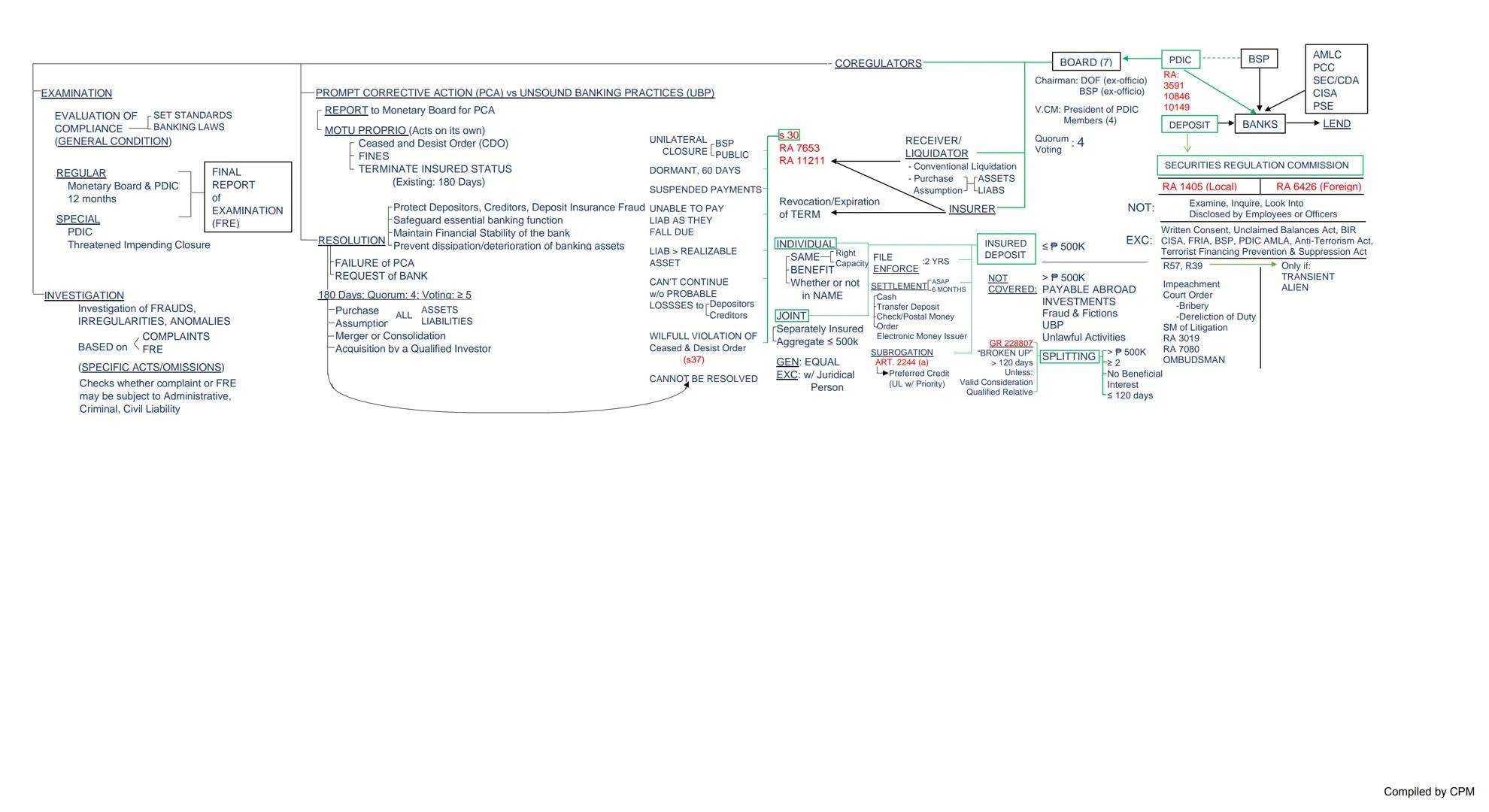

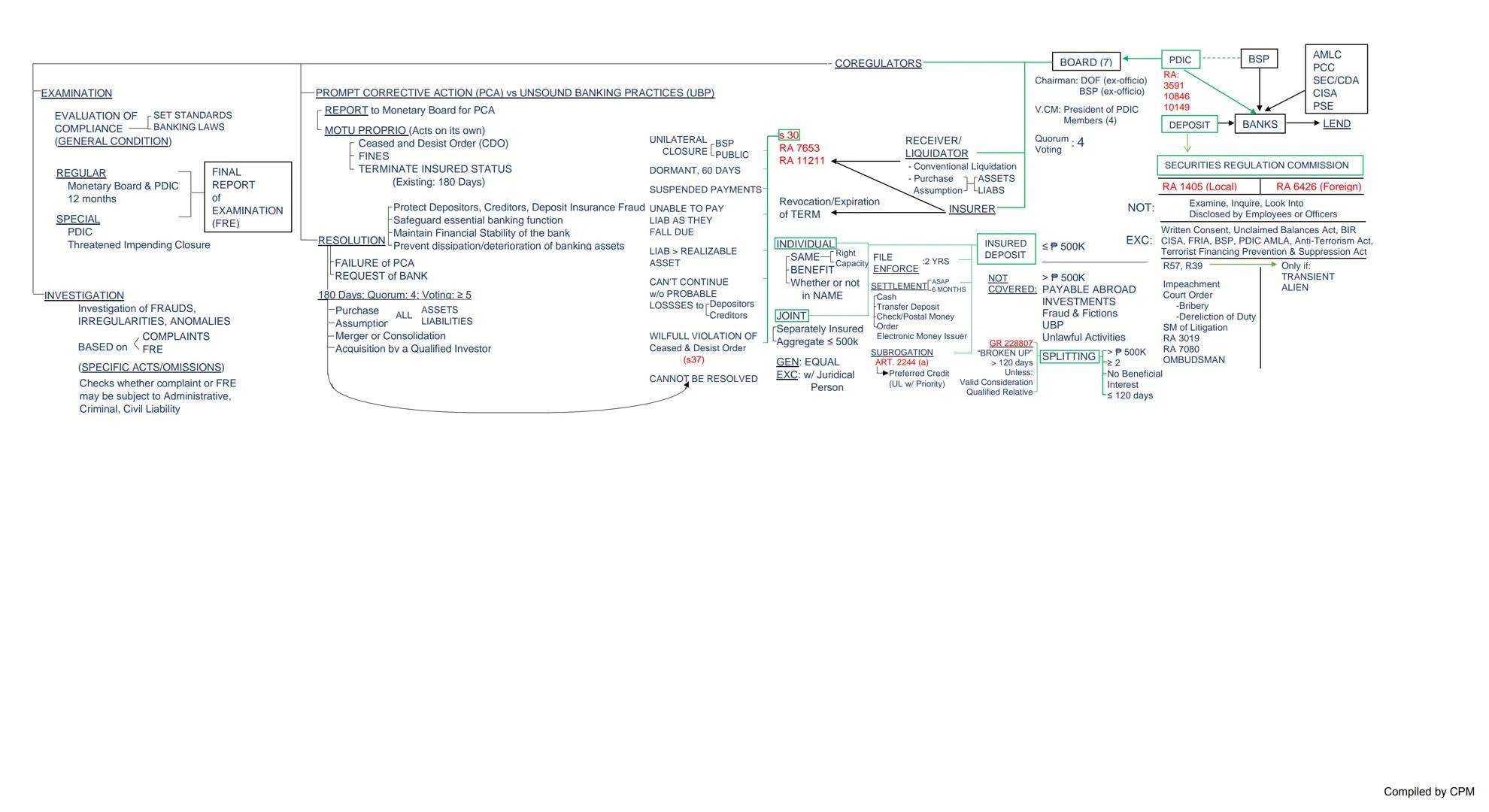

Banks undergo various examinations to ensure they comply with banking laws and protect depositors. These examinations can be regular (conducted by the Monetary Board and PDIC every 12 months) or special (conducted by PDIC when closure is threatened).

The examination process includes investigating potential fraud and irregularities, resulting in a Final Report of Examination (FRE). This report may lead to Prompt Corrective Action (PCA) against unsound banking practices through cease and desist orders or fines.

If PCA fails, or if a bank experiences serious financial problems, more serious actions may be taken. A bank may be considered for closure if it has:

The banking regulatory framework involves several co-regulators, including the Anti-Money Laundering Council (AMLC), Philippine Competition Commission (PCC), PDIC, BSP, SEC, and others working together to ensure the stability of the financial system.

⚠️ When a bank fails, the PDIC ensures depositors are protected up to ₱500,000 per depositor, making it critical to understand how your deposits are insured and the priority of claims.

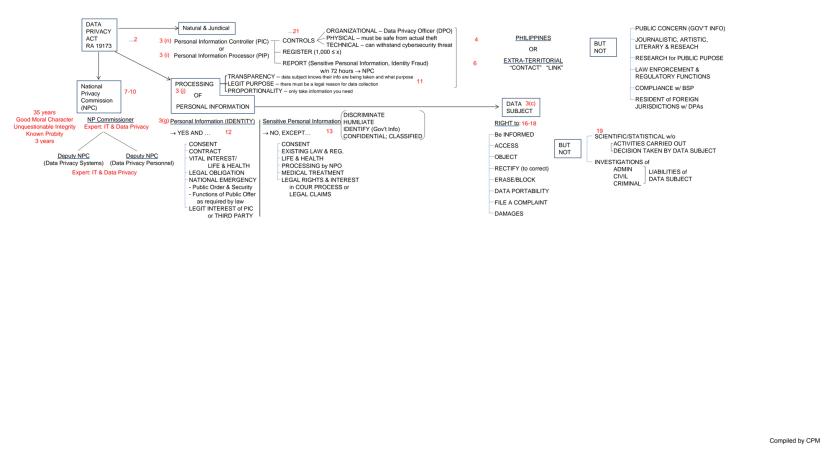

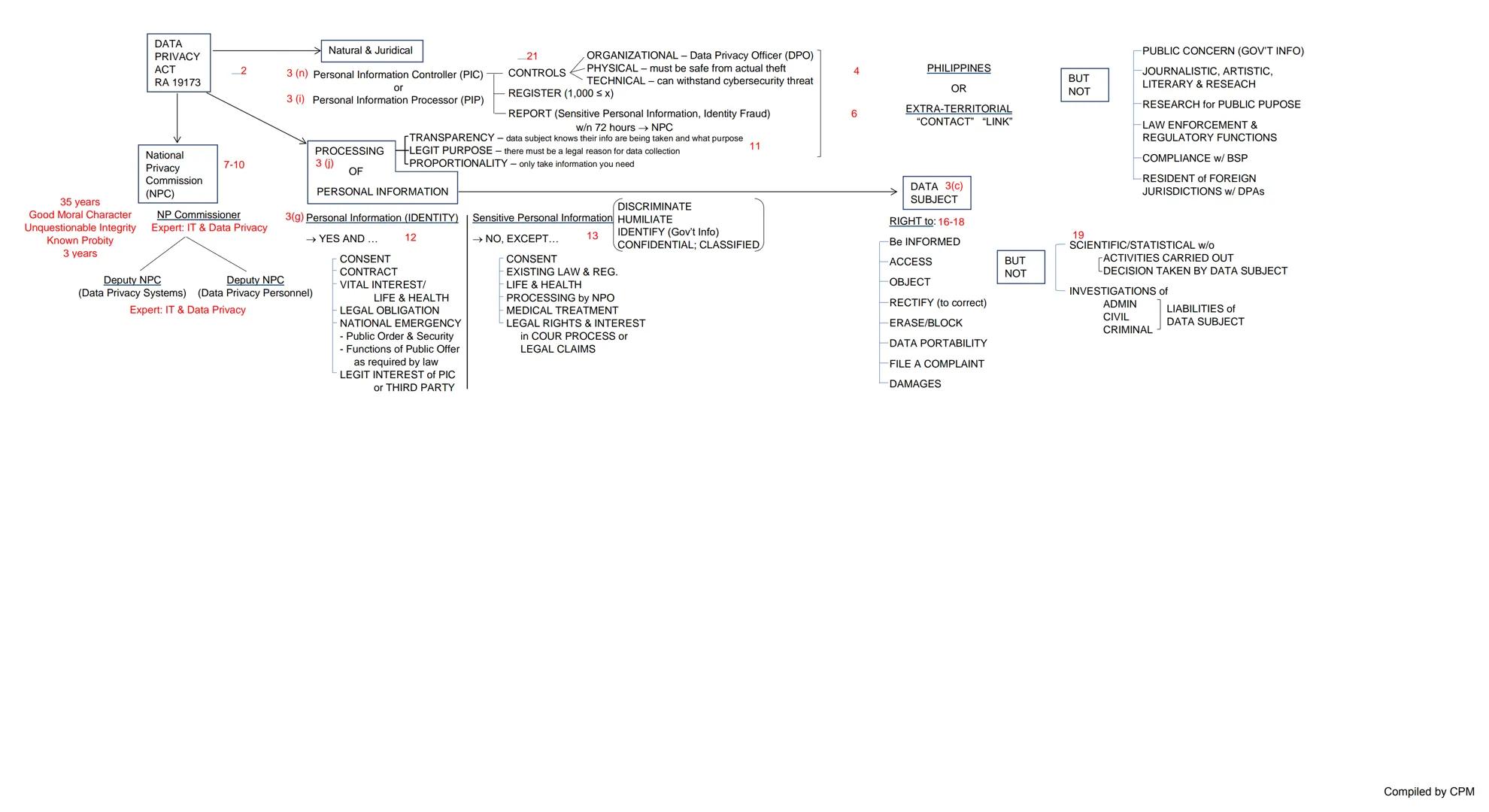

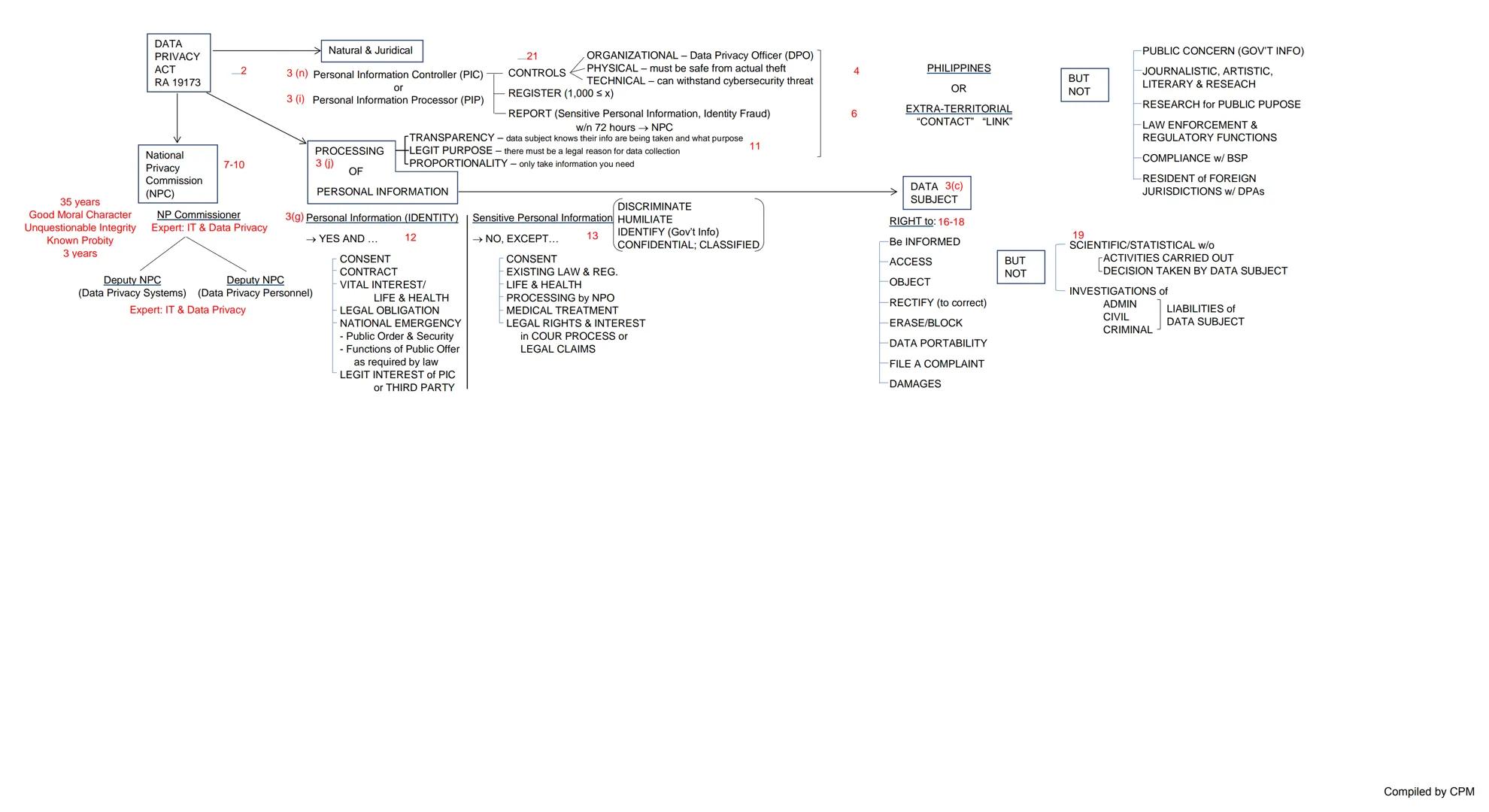

The Data Privacy Act (RA 10173) protects individuals' personal information in the Philippines. The law applies to both natural and juridical persons who control or process personal information, requiring appropriate organizational, physical, and technical controls.

The National Privacy Commission (NPC) oversees implementation, led by a Privacy Commissioner who must have 35+ years of experience, good moral character, and expertise in IT and data privacy. Two Deputy Commissioners assist with data privacy systems and personnel.

Personal information processing requires consent from the data subject unless it falls under specific exceptions like:

The law gives data subjects important rights, including:

🔐 Organizations must report data breaches involving sensitive personal information within 72 hours to the NPC—a crucial requirement that helps protect individuals from identity fraud.

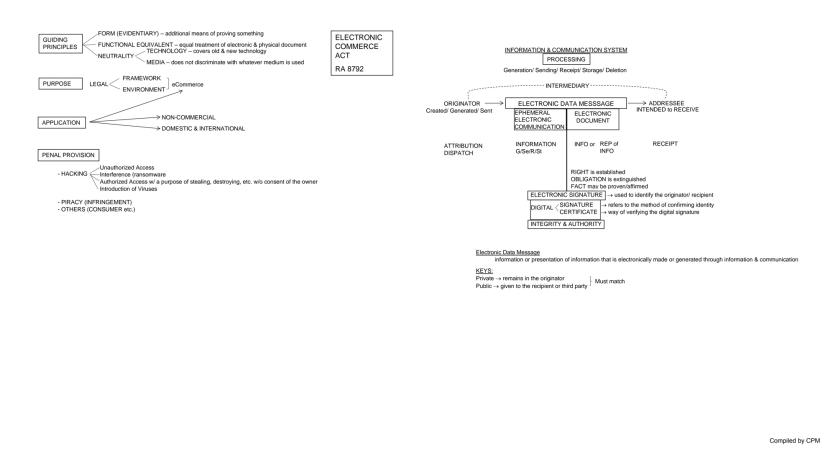

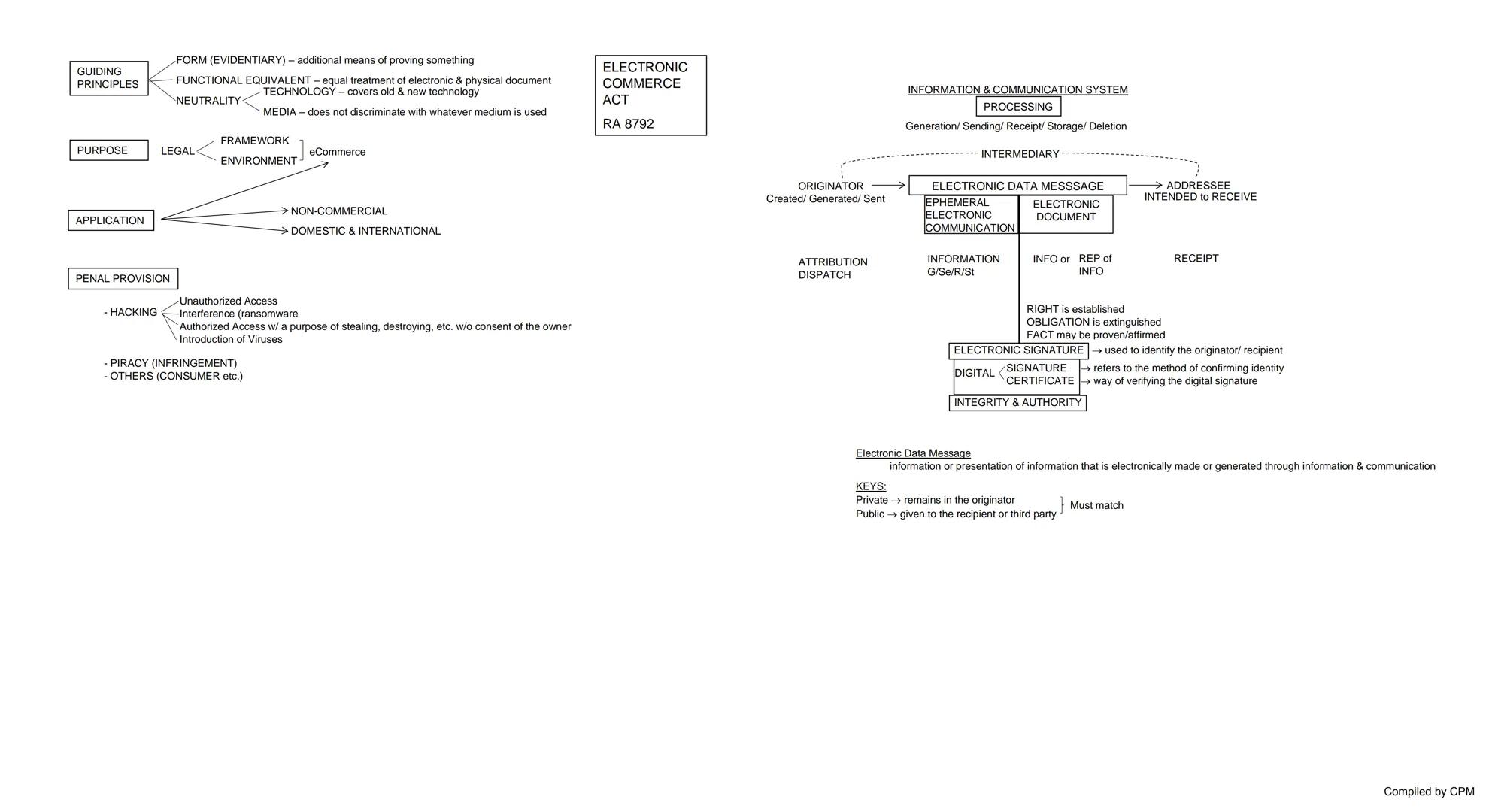

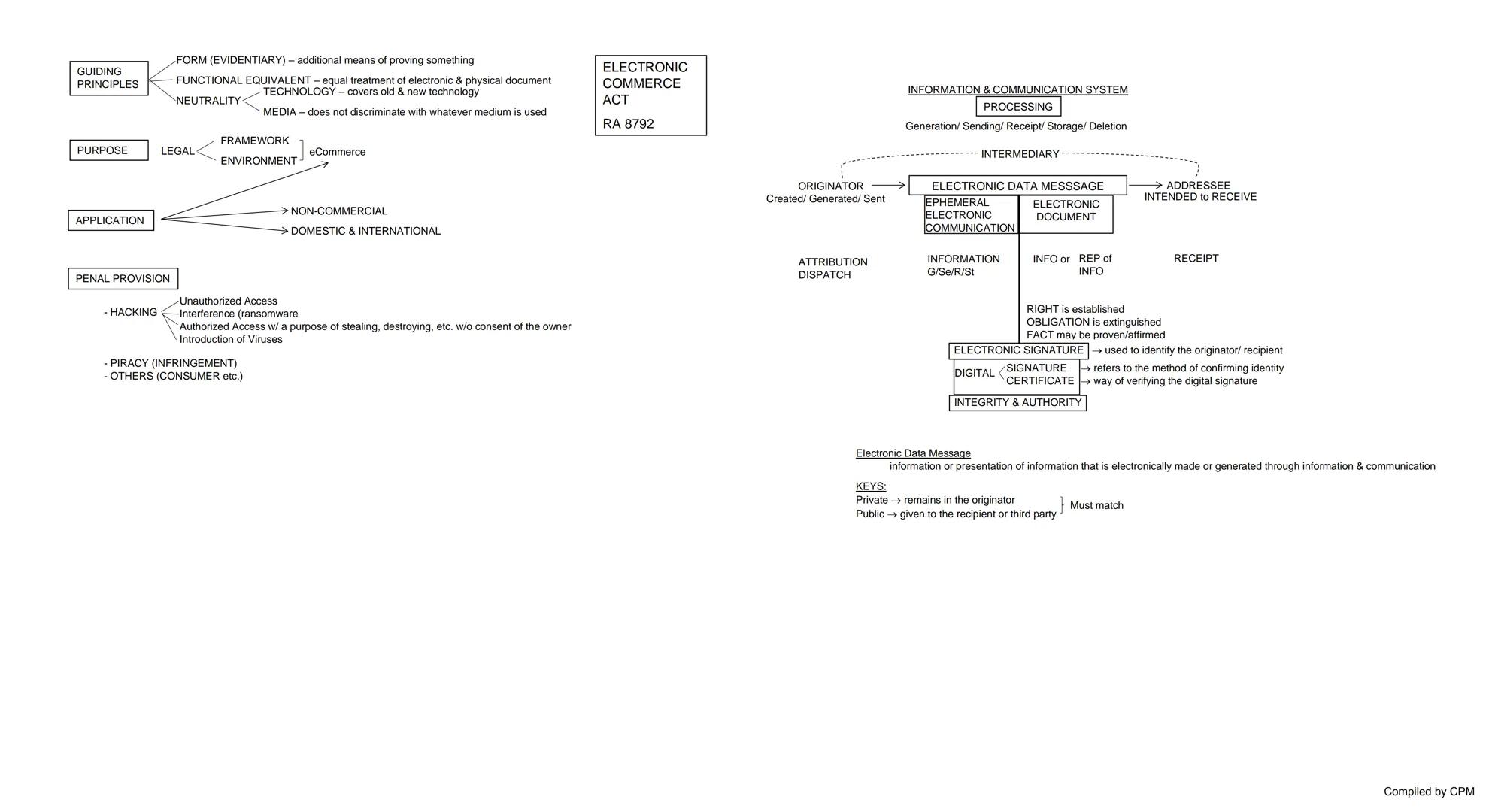

The Electronic Commerce Act (RA 8792) establishes a legal framework for electronic transactions in the Philippines. The law is guided by four key principles: form equivalence (electronic documents are legally valid), functional equivalence (electronic documents are treated the same as physical ones), technology neutrality (covering both old and new technology), and media neutrality (not discriminating based on medium).

The law applies to both commercial and non-commercial transactions, domestically and internationally. It establishes penalties for hacking, unauthorized access, interference (like ransomware), and piracy.

Key concepts include:

The law recognizes that electronic communications can be used to establish rights, extinguish obligations, and prove facts—giving legal validity to digital transactions.

📱 Electronic transactions are now foundational to business operations—understanding the legal framework protects you when conducting business online or through digital means.

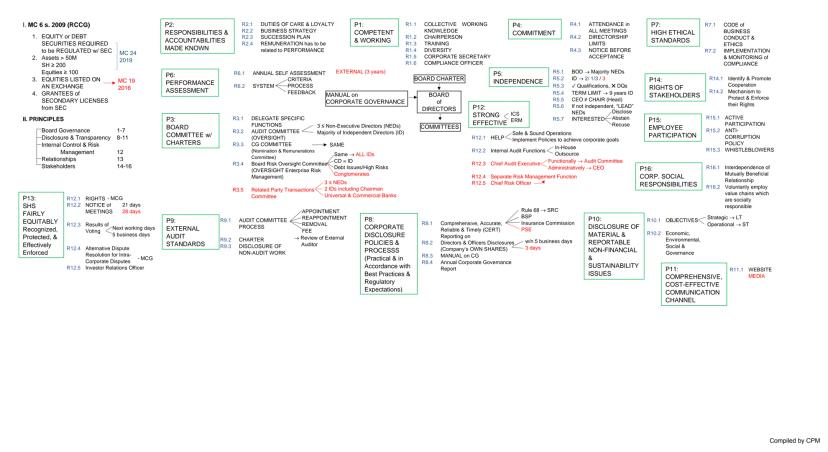

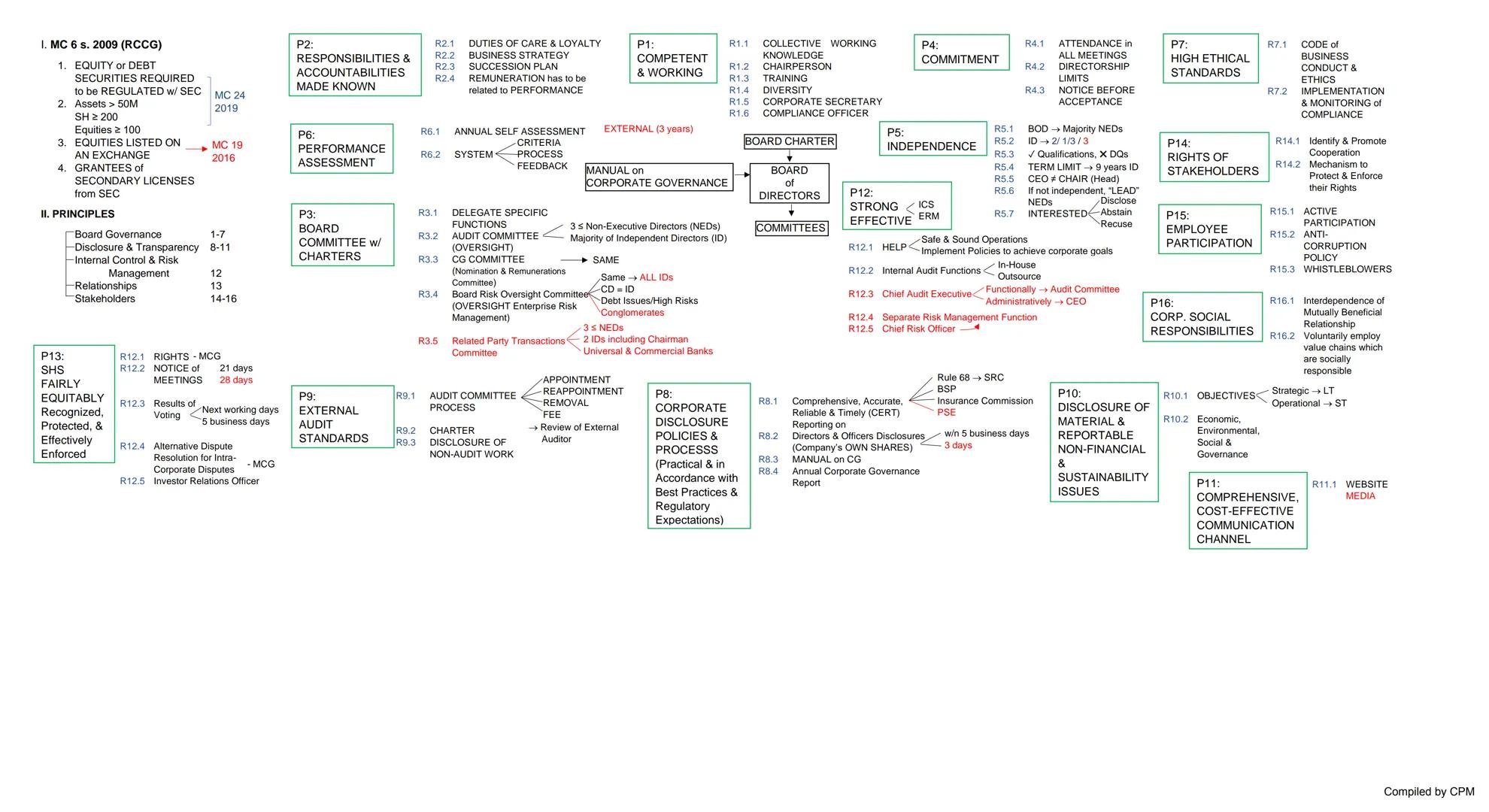

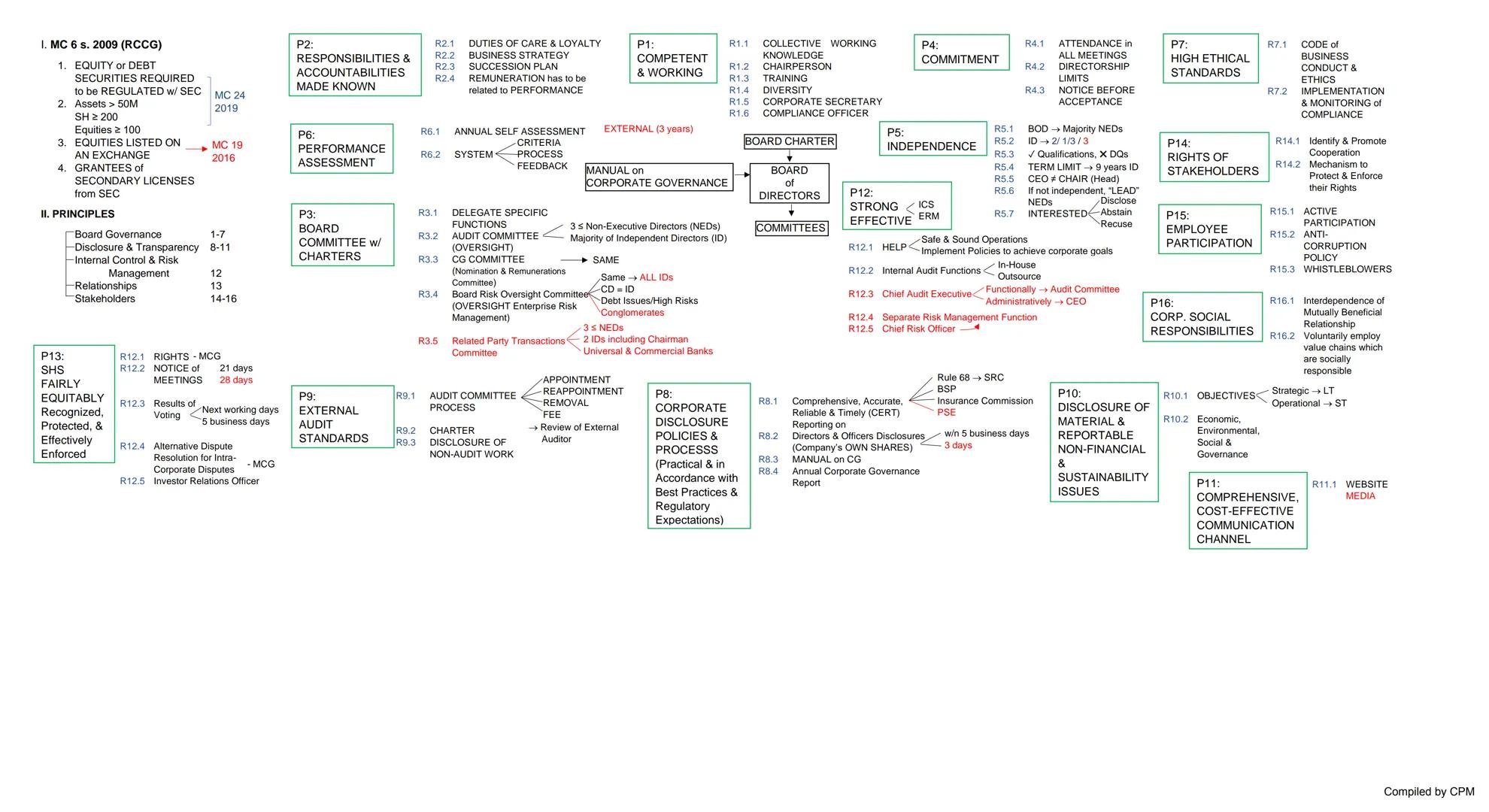

Corporate governance provides the framework for how companies are directed and controlled. In the Philippines, the Code of Corporate Governance (RCCG) applies to corporations with:

The code establishes key principles around board governance, disclosure and transparency, internal control and risk management, and stakeholder relationships. The board of directors must be competent and working (P1), with clear responsibilities and accountabilities (P2).

Board committees should have formal charters (P3) and directors must show commitment (P4) and independence (P5). Regular performance assessment (P6) and high ethical standards (P7) are required.

Companies must implement corporate disclosure policies (P8), maintain external audit standards (P9), and report on non-financial and sustainability issues (P10). They should establish comprehensive communication channels (P11), develop strong internal controls (P12), and ensure shareholders' rights are protected (P13).

👥 Good corporate governance isn't just about compliance—it creates trust with stakeholders and improves company performance by ensuring decisions are made with proper oversight.

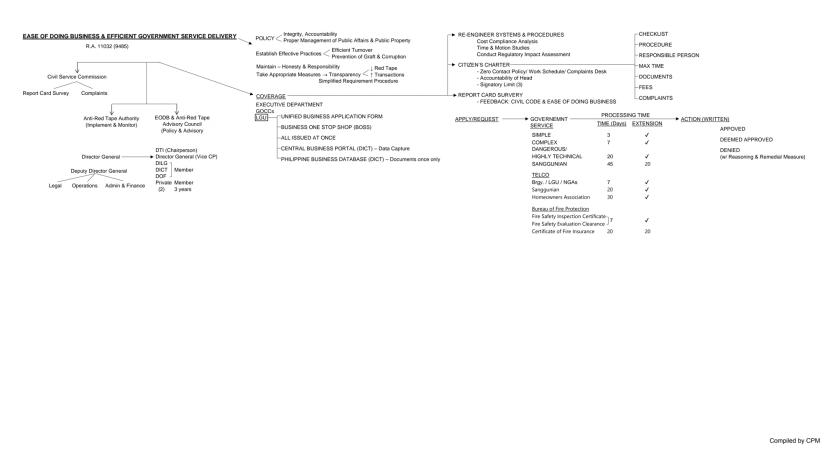

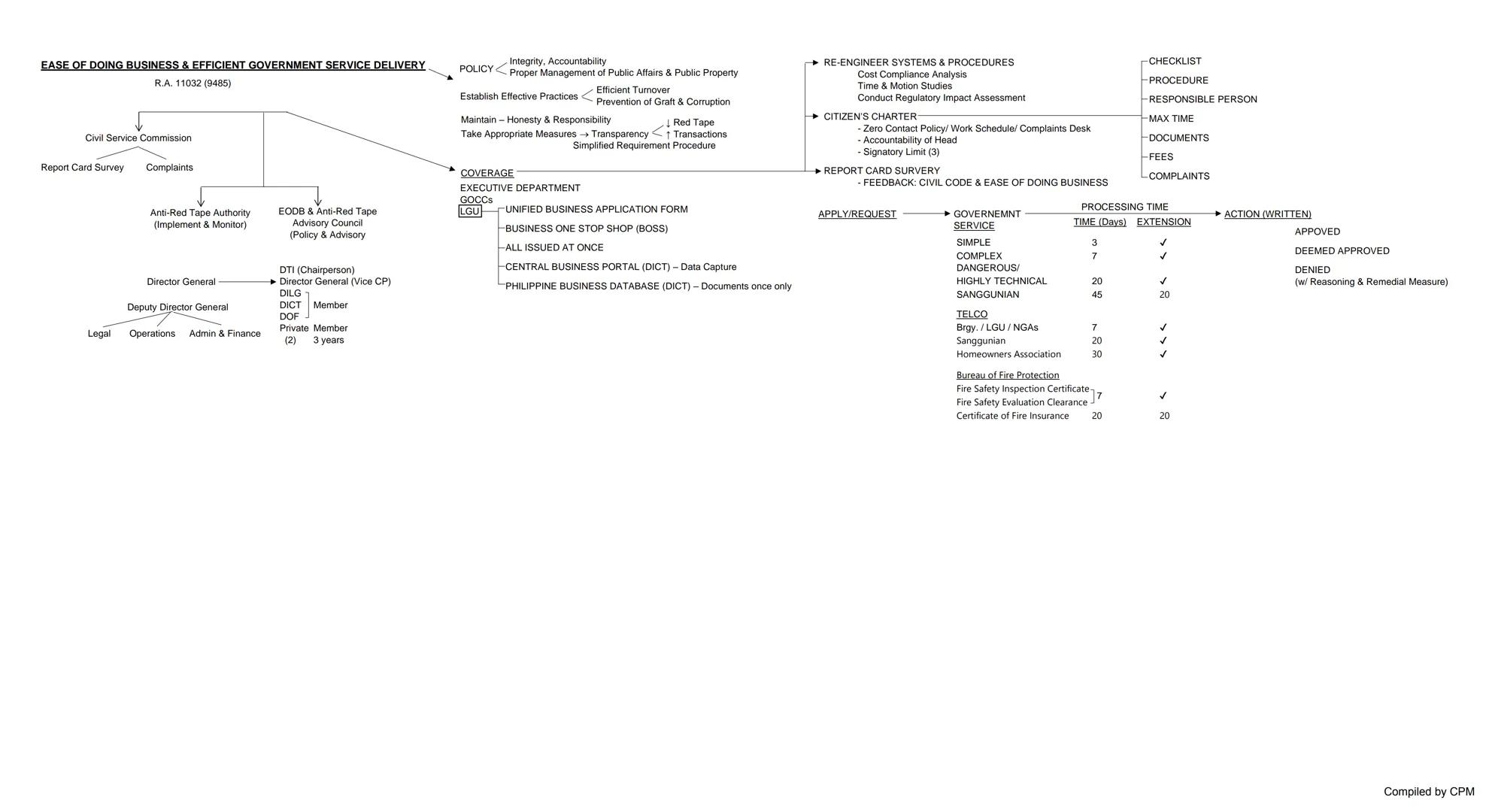

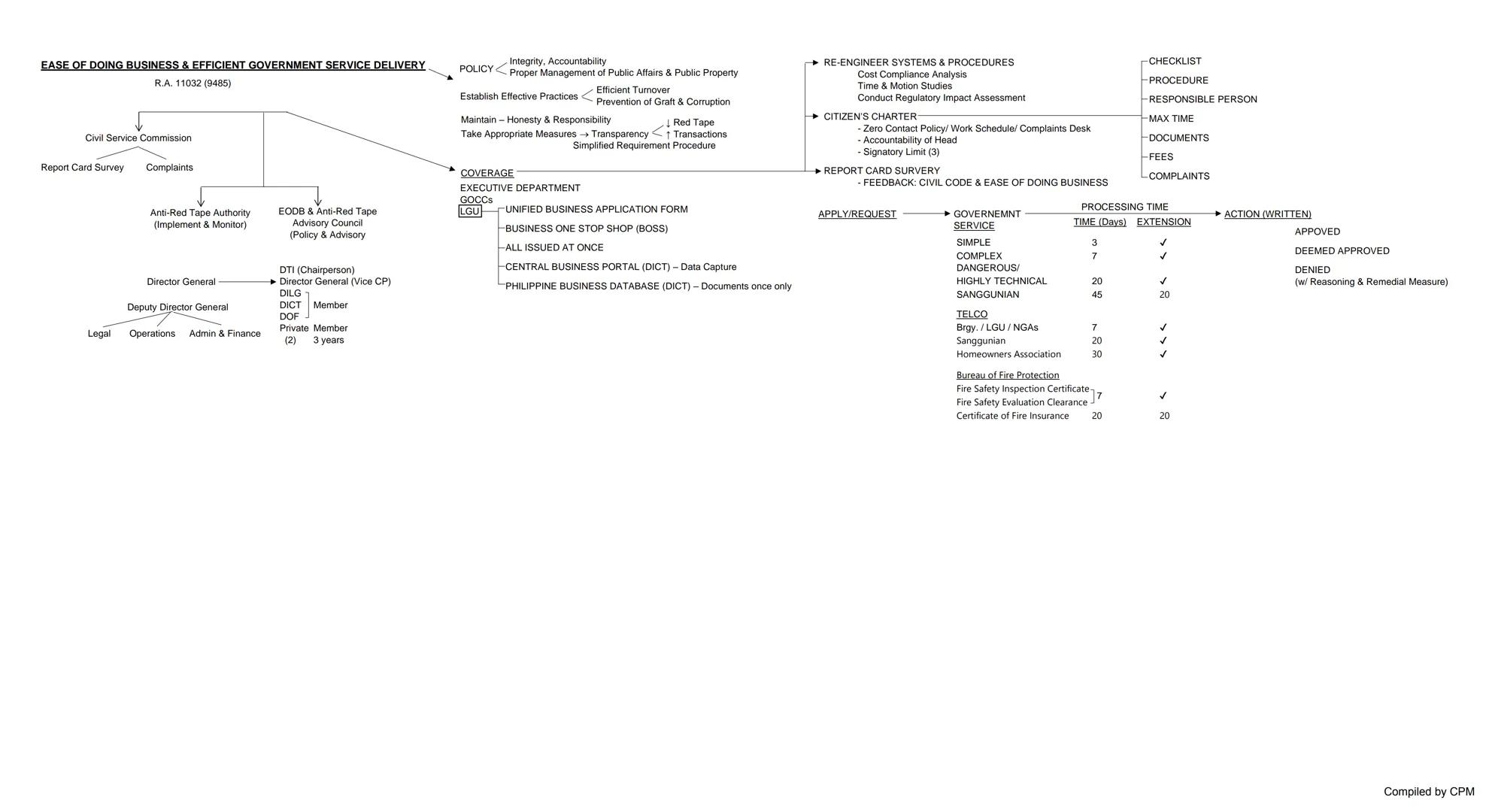

The Ease of Doing Business and Efficient Government Service Delivery Act (RA 11032) aims to reduce bureaucratic red tape and improve government service delivery. The law promotes integrity and accountability in public service and establishes measures for transparency in government transactions.

The Anti-Red Tape Authority (ARTA) implements and monitors compliance across the Executive Department, GOCCs, and LGUs, supported by an Advisory Council that provides policy guidance. Key reforms include:

For specific services, the law sets clear timelines: Barangay/LGU permits (7 days), Sanggunian approvals (20 days), and Fire Safety certificates (7 days).

⏱️ When government agencies fail to process applications within the prescribed period, applications are deemed automatically approved—a powerful incentive for agencies to improve efficiency!

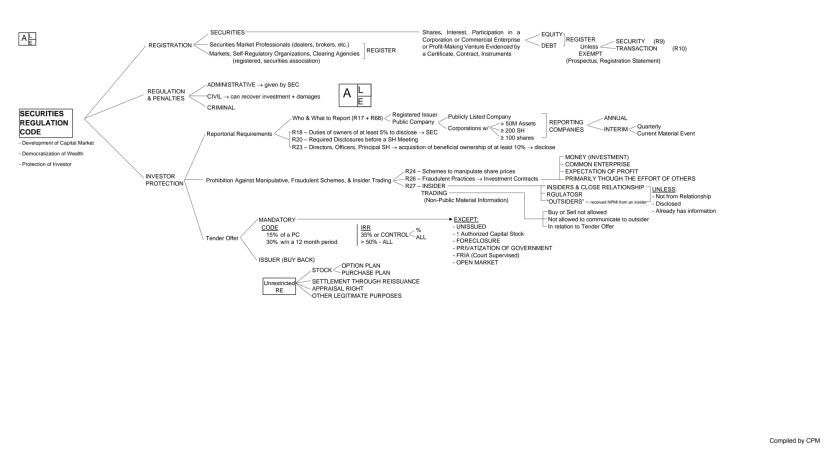

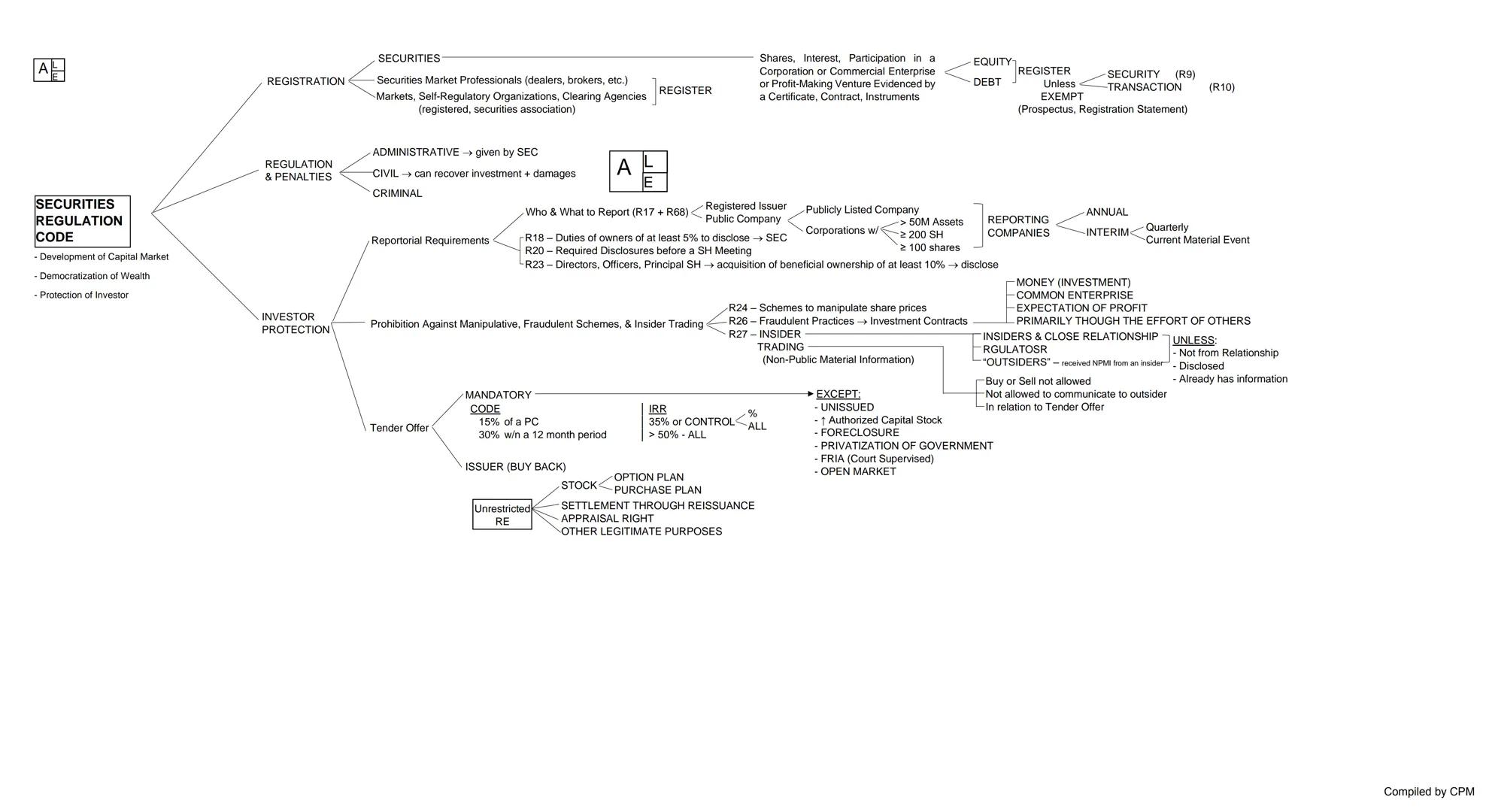

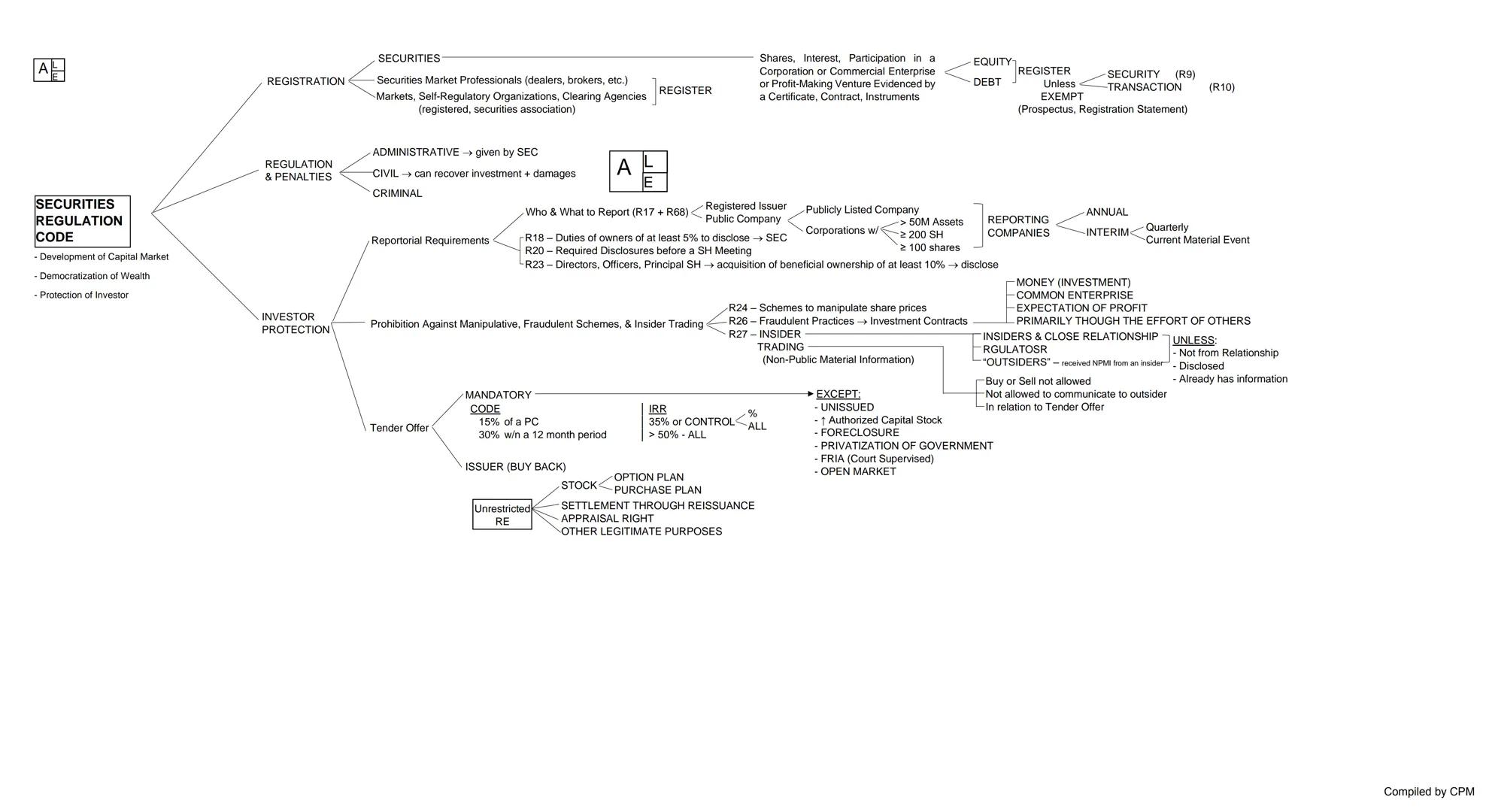

The Securities Regulation Code aims to develop the capital market, democratize wealth, and protect investors in the Philippines. The SEC requires the registration of securities, securities market professionals, and markets unless they qualify for exemptions.

Securities represent shares, interests, or participation in corporations or profit-making ventures, categorized as either equity or debt. The Howey Test identifies an investment contract as having: (1) an investment of money, (2) in a common enterprise, (3) with expectation of profit, (4) primarily through others' efforts.

The code provides investor protection through several mechanisms:

The code also regulates tender offers, which become mandatory when acquiring 15% of a public company or 35% within a 12-month period, ensuring minority shareholders receive fair treatment.

📊 Understanding securities regulations is crucial for investors—they provide safeguards against fraud and ensure transparency in capital markets, helping you make informed investment decisions.

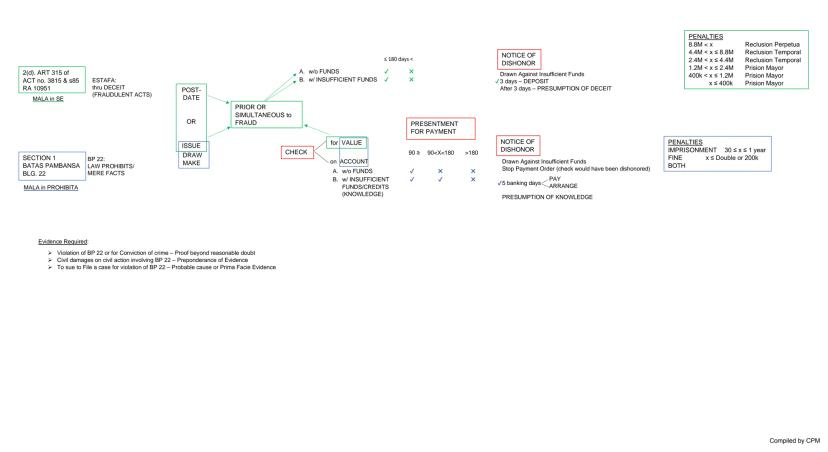

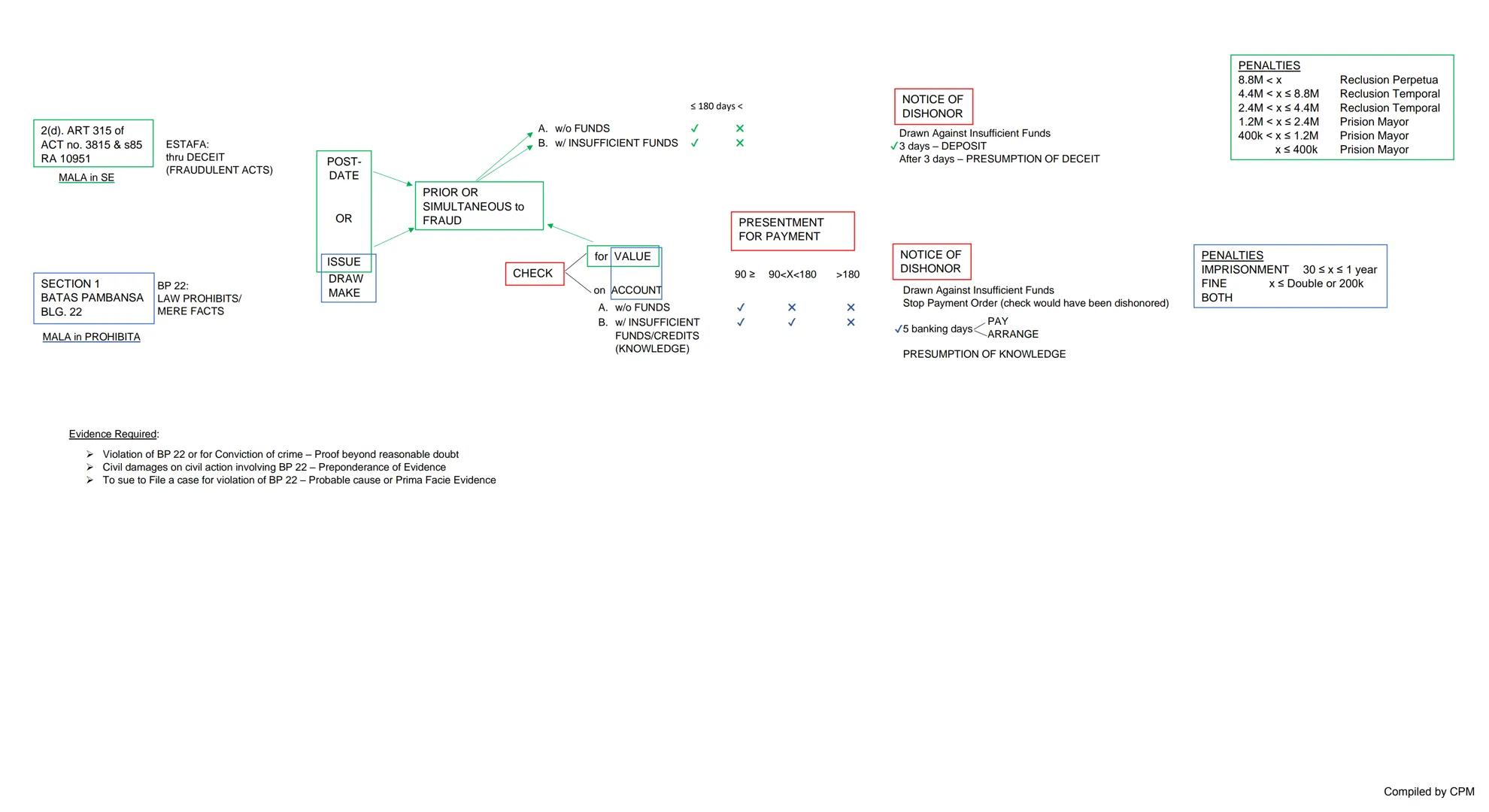

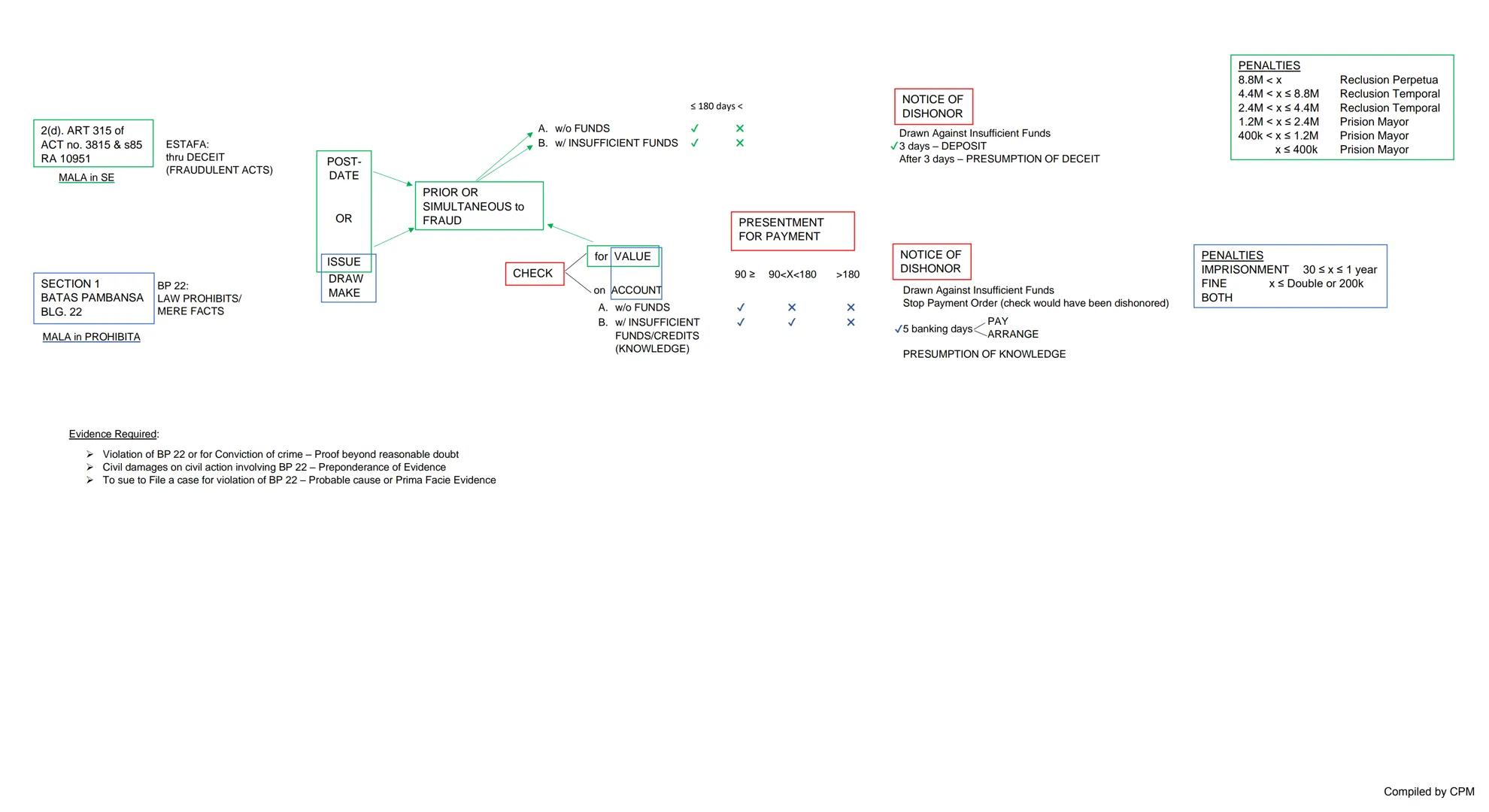

BP 22 makes it unlawful to issue checks without sufficient funds. It differs from estafa (under the Revised Penal Code), as BP 22 is mala prohibita (wrong because it's prohibited) while estafa is mala in se (inherently wrong).

For BP 22, the elements are simpler than estafa:

After receiving notice of dishonor, the issuer has 5 banking days to deposit or arrange payment for the check. Failure to do so creates a presumption of knowledge of insufficient funds.

Penalties for BP 22 include:

📝 Even if you don't intend to deceive, issuing checks without sufficient funds is still punishable under BP 22—always ensure you have adequate funds before issuing checks.

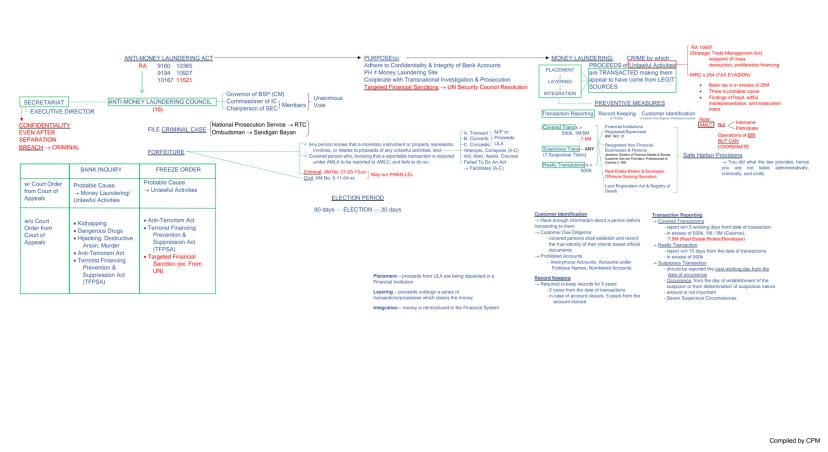

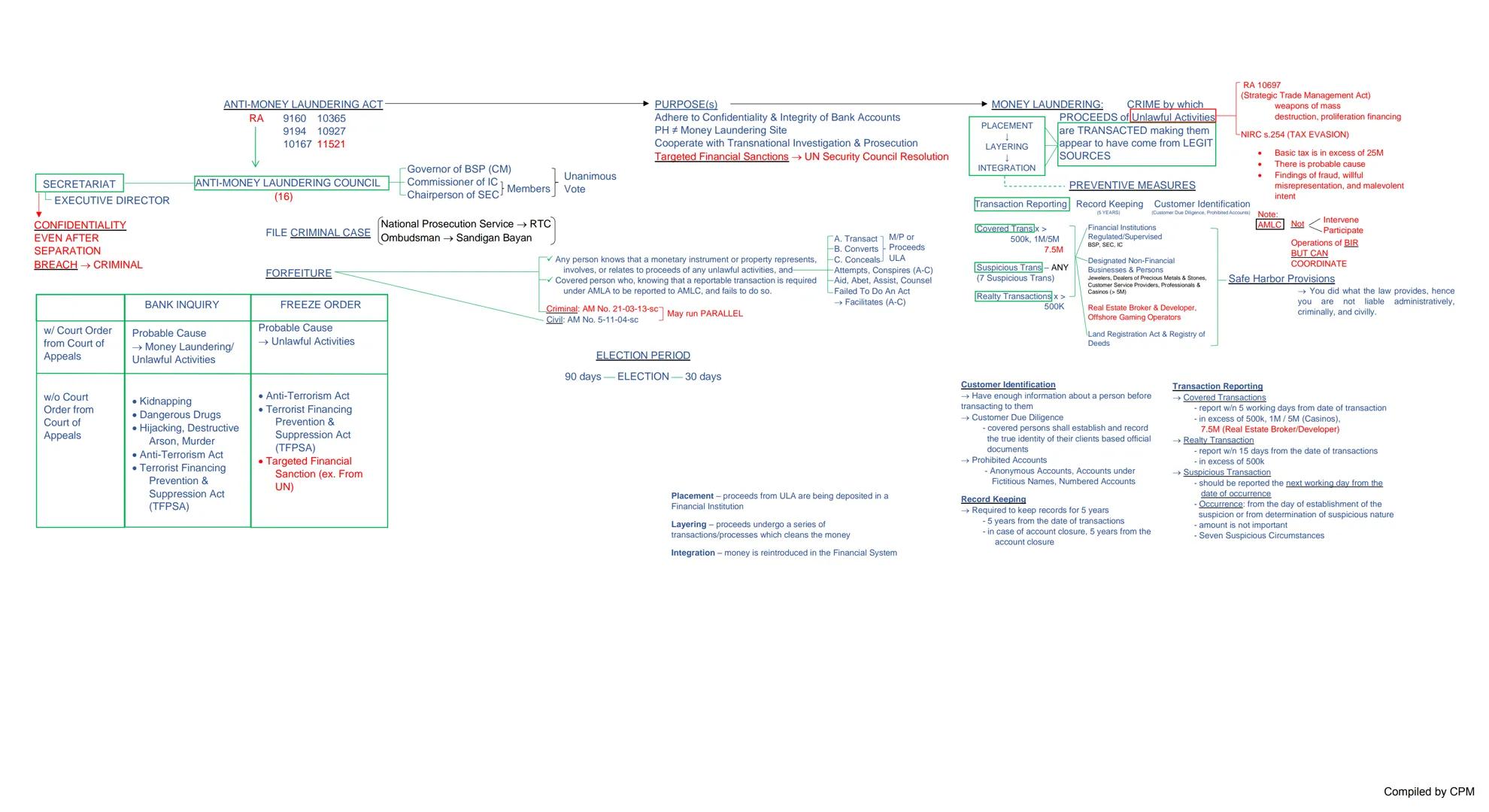

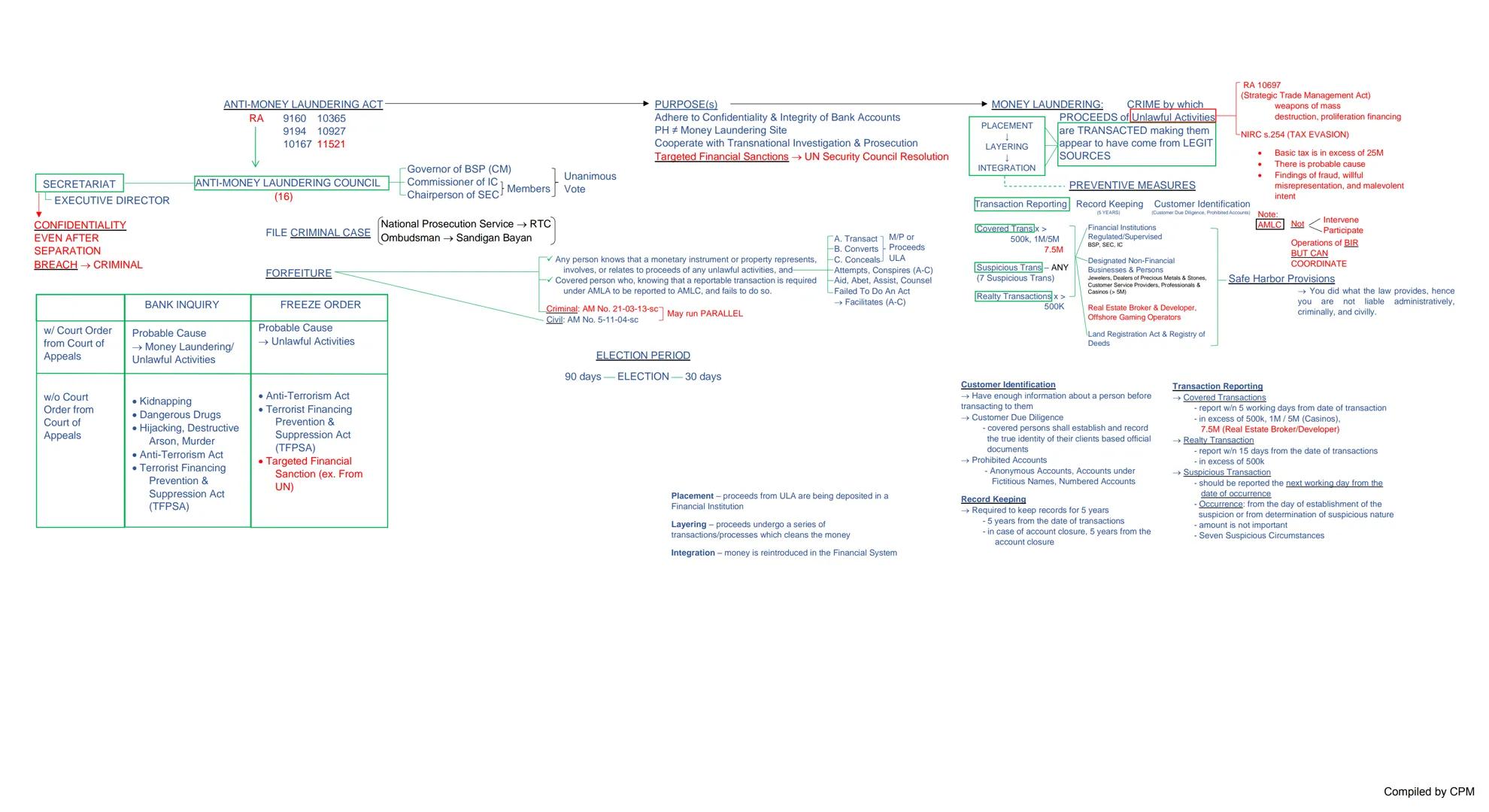

The Anti-Money Laundering Act (AMLA) aims to prevent the Philippines from becoming a money laundering site and facilitates cooperation with international investigations. The Anti-Money Laundering Council (AMLC), comprised of the BSP Governor, Insurance Commissioner, and SEC Chairperson, oversees implementation.

Money laundering involves three stages:

The law requires preventive measures from covered institutions:

The AMLC has powers to investigate, freeze accounts with court orders, and file forfeiture cases. All information handled by AMLC remains confidential even after staff separation.

🔍 Financial institutions use a risk-based approach to detect suspicious transactions—unusual patterns like "breaking up" large transactions into smaller ones under ₱500,000 are red flags for potential money laundering.

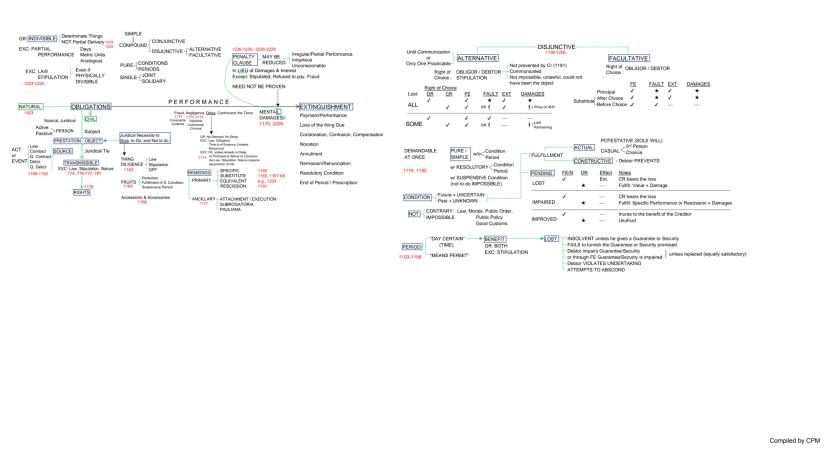

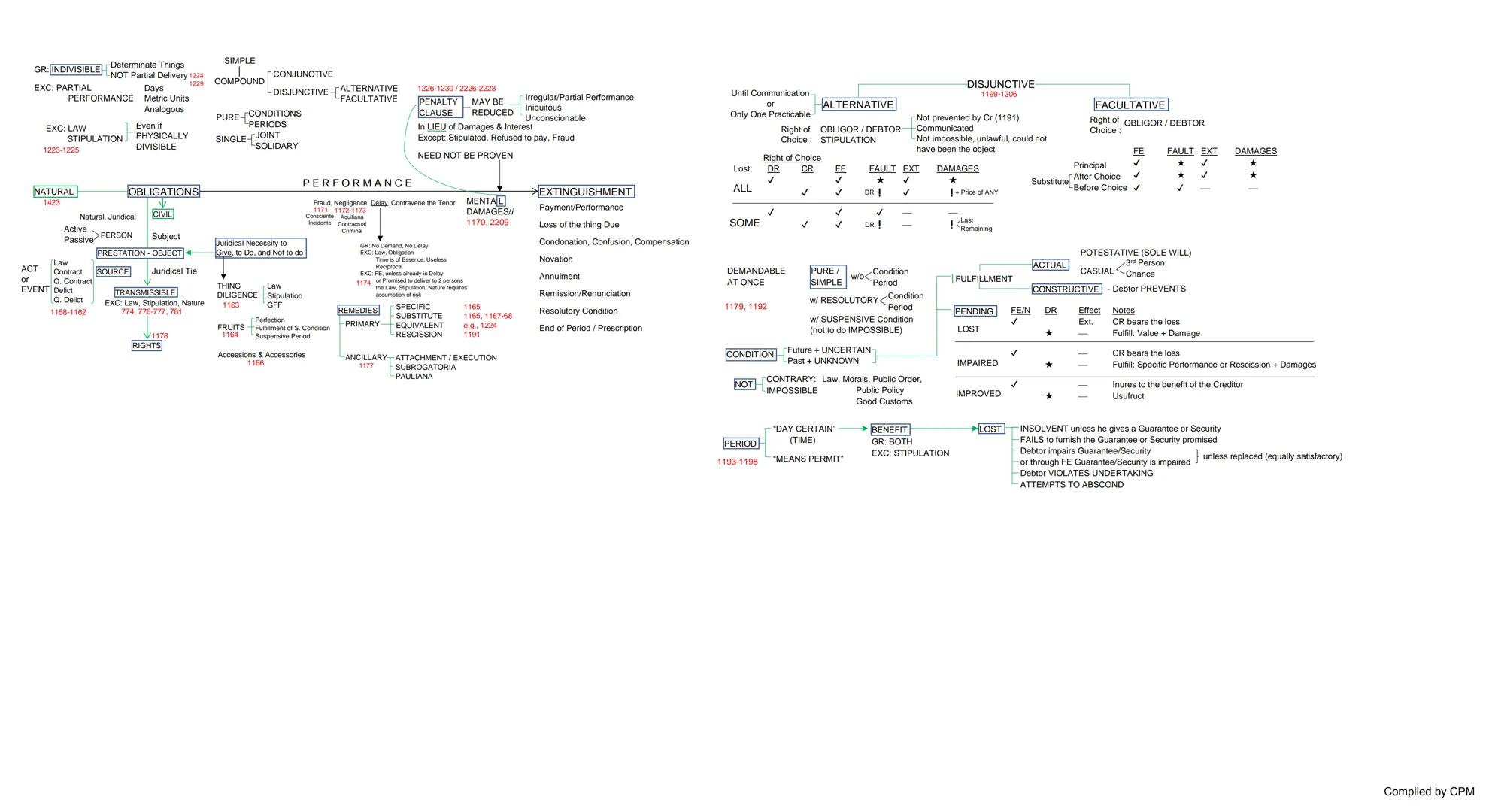

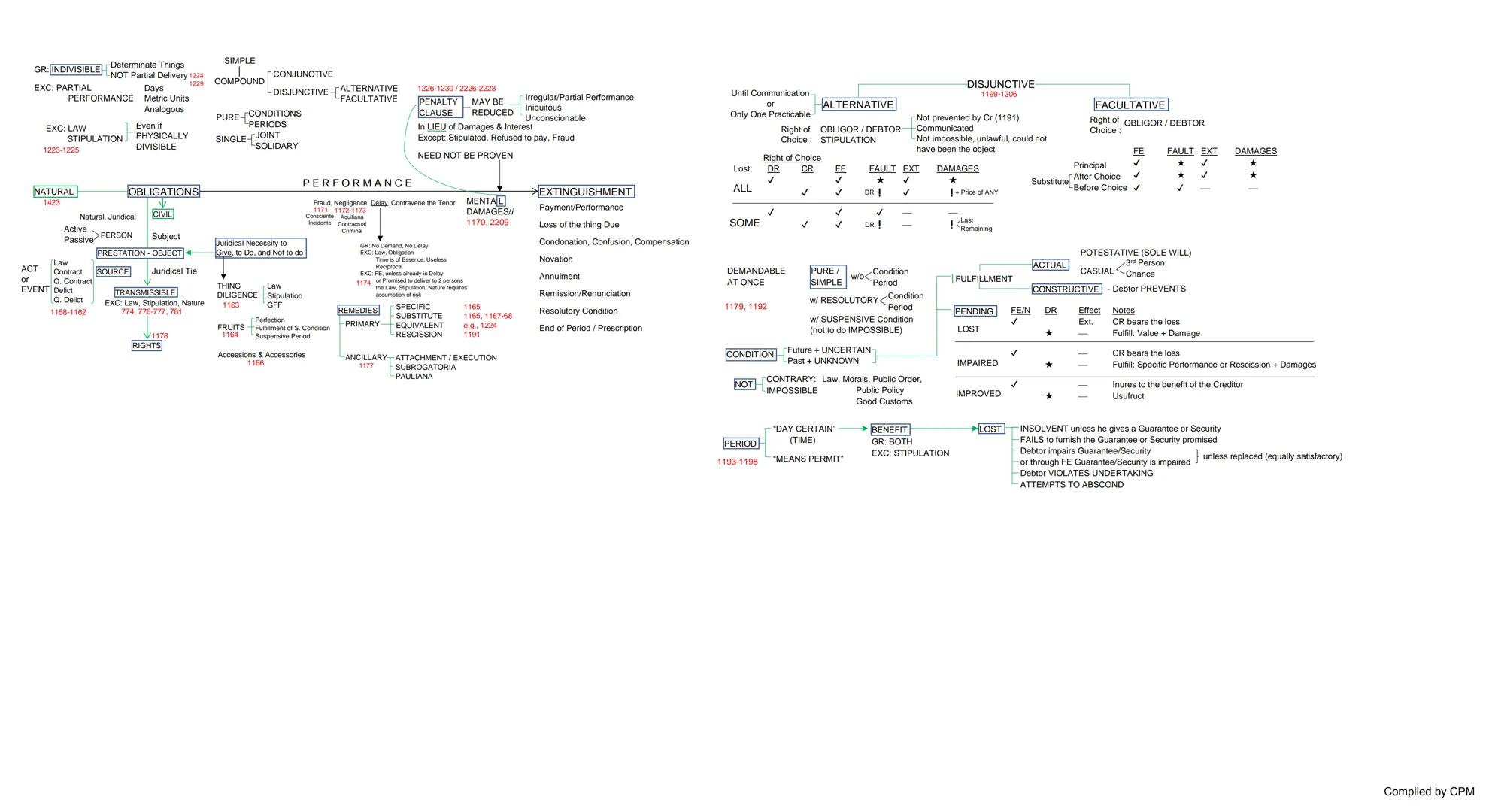

Obligations can be classified in various ways, including simple vs. compound (having one or multiple objects), conjunctive vs. disjunctive (requiring all or just one of several prestations), and joint vs. solidary (divided among parties or binding all parties to the entire obligation).

The nature of obligations affects how they must be performed:

When obligations are breached, remedies include:

Penalty clauses may be included in contracts to establish predetermined damages, though courts may reduce penalties that are iniquitous or unconscionable.

⚖️ The law presumes obligations are joint (divided equally), not solidary—if you want all parties to be responsible for the entire obligation, this must be expressly stated in the contract.

Our AI companion is specifically built for the needs of students. Based on the millions of content pieces we have on the platform we can provide truly meaningful and relevant answers to students. But its not only about answers, the companion is even more about guiding students through their daily learning challenges, with personalised study plans, quizzes or content pieces in the chat and 100% personalisation based on the students skills and developments.

You can download the app in the Google Play Store and in the Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

studywithnessa

@studywithnessa

Intellectual property rights, banking regulations, data privacy, and other business laws form the backbone of modern commerce and legal frameworks. Understanding these concepts is essential for navigating today's complex business environment and protecting your rights.

Access to all documents

Improve your grades

Join milions of students

Intellectual property rights protect the creations of the human mind and grant exclusive ownership to creators. The Philippine intellectual property system aims to protect and secure intellectual property rights while promoting national development and the common good.

Intellectual property is categorized as either original (no previous owner, like a new creation) or derivative (transferred from a previous owner). Understanding the difference between a mode of acquiring ownership and a title is important—title is the legal justification, while mode is the actual means of transfer.

There are various ways to acquire ownership (OLD TIPS):

💡 Intellectual property doesn't just protect creators—it plays a critical social function by facilitating technology transfer, attracting foreign investment, and ensuring market access for innovations.

Access to all documents

Improve your grades

Join milions of students

Banks undergo various examinations to ensure they comply with banking laws and protect depositors. These examinations can be regular (conducted by the Monetary Board and PDIC every 12 months) or special (conducted by PDIC when closure is threatened).

The examination process includes investigating potential fraud and irregularities, resulting in a Final Report of Examination (FRE). This report may lead to Prompt Corrective Action (PCA) against unsound banking practices through cease and desist orders or fines.

If PCA fails, or if a bank experiences serious financial problems, more serious actions may be taken. A bank may be considered for closure if it has:

The banking regulatory framework involves several co-regulators, including the Anti-Money Laundering Council (AMLC), Philippine Competition Commission (PCC), PDIC, BSP, SEC, and others working together to ensure the stability of the financial system.

⚠️ When a bank fails, the PDIC ensures depositors are protected up to ₱500,000 per depositor, making it critical to understand how your deposits are insured and the priority of claims.

Access to all documents

Improve your grades

Join milions of students

The Data Privacy Act (RA 10173) protects individuals' personal information in the Philippines. The law applies to both natural and juridical persons who control or process personal information, requiring appropriate organizational, physical, and technical controls.

The National Privacy Commission (NPC) oversees implementation, led by a Privacy Commissioner who must have 35+ years of experience, good moral character, and expertise in IT and data privacy. Two Deputy Commissioners assist with data privacy systems and personnel.

Personal information processing requires consent from the data subject unless it falls under specific exceptions like:

The law gives data subjects important rights, including:

🔐 Organizations must report data breaches involving sensitive personal information within 72 hours to the NPC—a crucial requirement that helps protect individuals from identity fraud.

Access to all documents

Improve your grades

Join milions of students

The Electronic Commerce Act (RA 8792) establishes a legal framework for electronic transactions in the Philippines. The law is guided by four key principles: form equivalence (electronic documents are legally valid), functional equivalence (electronic documents are treated the same as physical ones), technology neutrality (covering both old and new technology), and media neutrality (not discriminating based on medium).

The law applies to both commercial and non-commercial transactions, domestically and internationally. It establishes penalties for hacking, unauthorized access, interference (like ransomware), and piracy.

Key concepts include:

The law recognizes that electronic communications can be used to establish rights, extinguish obligations, and prove facts—giving legal validity to digital transactions.

📱 Electronic transactions are now foundational to business operations—understanding the legal framework protects you when conducting business online or through digital means.

Access to all documents

Improve your grades

Join milions of students

Corporate governance provides the framework for how companies are directed and controlled. In the Philippines, the Code of Corporate Governance (RCCG) applies to corporations with:

The code establishes key principles around board governance, disclosure and transparency, internal control and risk management, and stakeholder relationships. The board of directors must be competent and working (P1), with clear responsibilities and accountabilities (P2).

Board committees should have formal charters (P3) and directors must show commitment (P4) and independence (P5). Regular performance assessment (P6) and high ethical standards (P7) are required.

Companies must implement corporate disclosure policies (P8), maintain external audit standards (P9), and report on non-financial and sustainability issues (P10). They should establish comprehensive communication channels (P11), develop strong internal controls (P12), and ensure shareholders' rights are protected (P13).

👥 Good corporate governance isn't just about compliance—it creates trust with stakeholders and improves company performance by ensuring decisions are made with proper oversight.

Access to all documents

Improve your grades

Join milions of students

The Ease of Doing Business and Efficient Government Service Delivery Act (RA 11032) aims to reduce bureaucratic red tape and improve government service delivery. The law promotes integrity and accountability in public service and establishes measures for transparency in government transactions.

The Anti-Red Tape Authority (ARTA) implements and monitors compliance across the Executive Department, GOCCs, and LGUs, supported by an Advisory Council that provides policy guidance. Key reforms include:

For specific services, the law sets clear timelines: Barangay/LGU permits (7 days), Sanggunian approvals (20 days), and Fire Safety certificates (7 days).

⏱️ When government agencies fail to process applications within the prescribed period, applications are deemed automatically approved—a powerful incentive for agencies to improve efficiency!

Access to all documents

Improve your grades

Join milions of students

The Securities Regulation Code aims to develop the capital market, democratize wealth, and protect investors in the Philippines. The SEC requires the registration of securities, securities market professionals, and markets unless they qualify for exemptions.

Securities represent shares, interests, or participation in corporations or profit-making ventures, categorized as either equity or debt. The Howey Test identifies an investment contract as having: (1) an investment of money, (2) in a common enterprise, (3) with expectation of profit, (4) primarily through others' efforts.

The code provides investor protection through several mechanisms:

The code also regulates tender offers, which become mandatory when acquiring 15% of a public company or 35% within a 12-month period, ensuring minority shareholders receive fair treatment.

📊 Understanding securities regulations is crucial for investors—they provide safeguards against fraud and ensure transparency in capital markets, helping you make informed investment decisions.

Access to all documents

Improve your grades

Join milions of students

BP 22 makes it unlawful to issue checks without sufficient funds. It differs from estafa (under the Revised Penal Code), as BP 22 is mala prohibita (wrong because it's prohibited) while estafa is mala in se (inherently wrong).

For BP 22, the elements are simpler than estafa:

After receiving notice of dishonor, the issuer has 5 banking days to deposit or arrange payment for the check. Failure to do so creates a presumption of knowledge of insufficient funds.

Penalties for BP 22 include:

📝 Even if you don't intend to deceive, issuing checks without sufficient funds is still punishable under BP 22—always ensure you have adequate funds before issuing checks.

Access to all documents

Improve your grades

Join milions of students

The Anti-Money Laundering Act (AMLA) aims to prevent the Philippines from becoming a money laundering site and facilitates cooperation with international investigations. The Anti-Money Laundering Council (AMLC), comprised of the BSP Governor, Insurance Commissioner, and SEC Chairperson, oversees implementation.

Money laundering involves three stages:

The law requires preventive measures from covered institutions:

The AMLC has powers to investigate, freeze accounts with court orders, and file forfeiture cases. All information handled by AMLC remains confidential even after staff separation.

🔍 Financial institutions use a risk-based approach to detect suspicious transactions—unusual patterns like "breaking up" large transactions into smaller ones under ₱500,000 are red flags for potential money laundering.

Access to all documents

Improve your grades

Join milions of students

Obligations can be classified in various ways, including simple vs. compound (having one or multiple objects), conjunctive vs. disjunctive (requiring all or just one of several prestations), and joint vs. solidary (divided among parties or binding all parties to the entire obligation).

The nature of obligations affects how they must be performed:

When obligations are breached, remedies include:

Penalty clauses may be included in contracts to establish predetermined damages, though courts may reduce penalties that are iniquitous or unconscionable.

⚖️ The law presumes obligations are joint (divided equally), not solidary—if you want all parties to be responsible for the entire obligation, this must be expressly stated in the contract.

Our AI companion is specifically built for the needs of students. Based on the millions of content pieces we have on the platform we can provide truly meaningful and relevant answers to students. But its not only about answers, the companion is even more about guiding students through their daily learning challenges, with personalised study plans, quizzes or content pieces in the chat and 100% personalisation based on the students skills and developments.

You can download the app in the Google Play Store and in the Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

8

Smart Tools NEW

Transform this note into: ✓ 50+ Practice Questions ✓ Interactive Flashcards ✓ Full Practice Test ✓ Essay Outlines

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user