Taxation is the process by which citizens and businesses contribute... Show more

Sign up to see the contentIt's free!

Access to all documents

Improve your grades

Join milions of students

Subjects

Triangle Congruence and Similarity Theorems

Triangle Properties and Classification

Linear Equations and Graphs

Geometric Angle Relationships

Trigonometric Functions and Identities

Equation Solving Techniques

Circle Geometry Fundamentals

Division Operations and Methods

Basic Differentiation Rules

Exponent and Logarithm Properties

Show all topics

Human Organ Systems

Reproductive Cell Cycles

Biological Sciences Subdisciplines

Cellular Energy Metabolism

Autotrophic Energy Processes

Inheritance Patterns and Principles

Biomolecular Structure and Organization

Cell Cycle and Division Mechanics

Cellular Organization and Development

Biological Structural Organization

Show all topics

Chemical Sciences and Applications

Atomic Structure and Composition

Molecular Electron Structure Representation

Atomic Electron Behavior

Matter Properties and Water

Mole Concept and Calculations

Gas Laws and Behavior

Periodic Table Organization

Chemical Thermodynamics Fundamentals

Chemical Bond Types and Properties

Show all topics

European Renaissance and Enlightenment

European Cultural Movements 800-1920

American Revolution Era 1763-1797

American Civil War 1861-1865

Global Imperial Systems

Mongol and Chinese Dynasties

U.S. Presidents and World Leaders

Historical Sources and Documentation

World Wars Era and Impact

World Religious Systems

Show all topics

Classic and Contemporary Novels

Literary Character Analysis

Rhetorical Theory and Practice

Classic Literary Narratives

Reading Analysis and Interpretation

Narrative Structure and Techniques

English Language Components

Influential English-Language Authors

Basic Sentence Structure

Narrative Voice and Perspective

Show all topics

555

•

Feb 8, 2026

•

studywithnessa

@studywithnessa

Taxation is the process by which citizens and businesses contribute... Show more

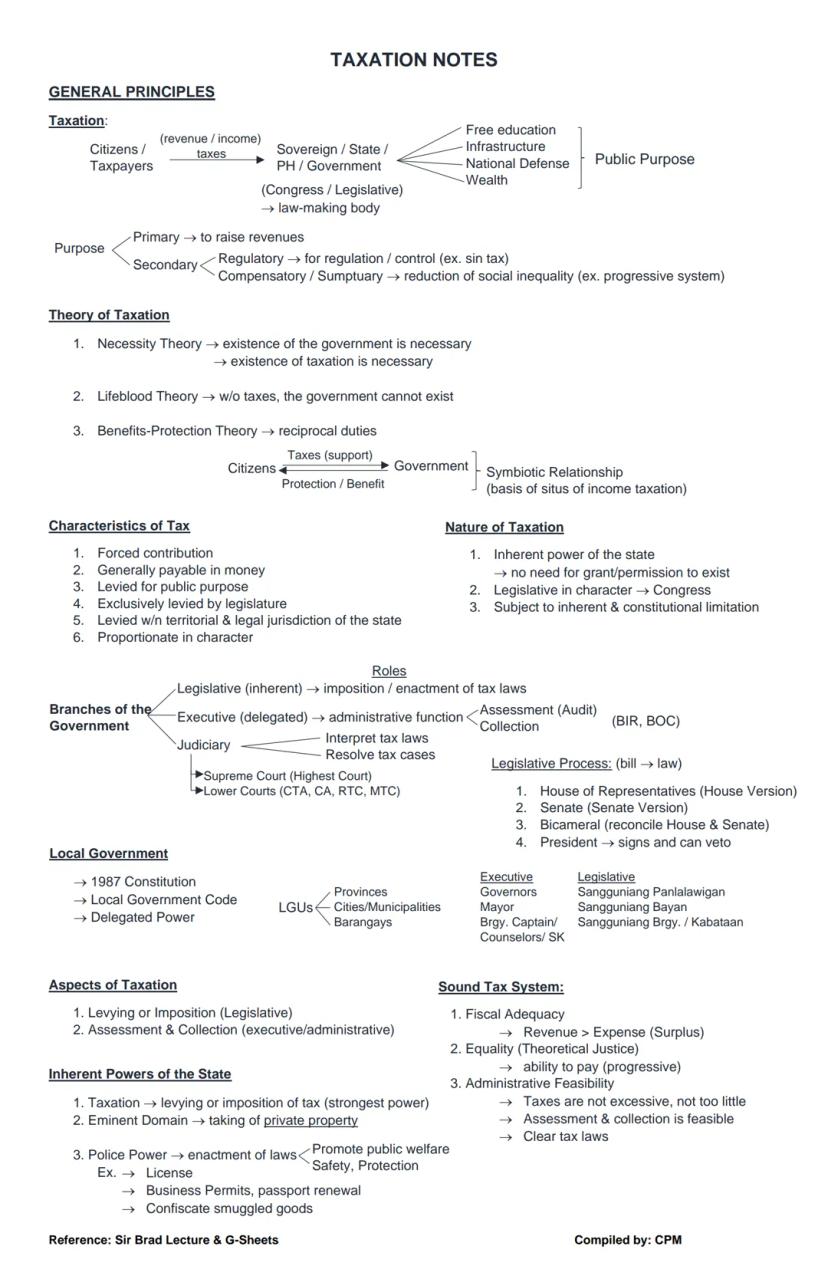

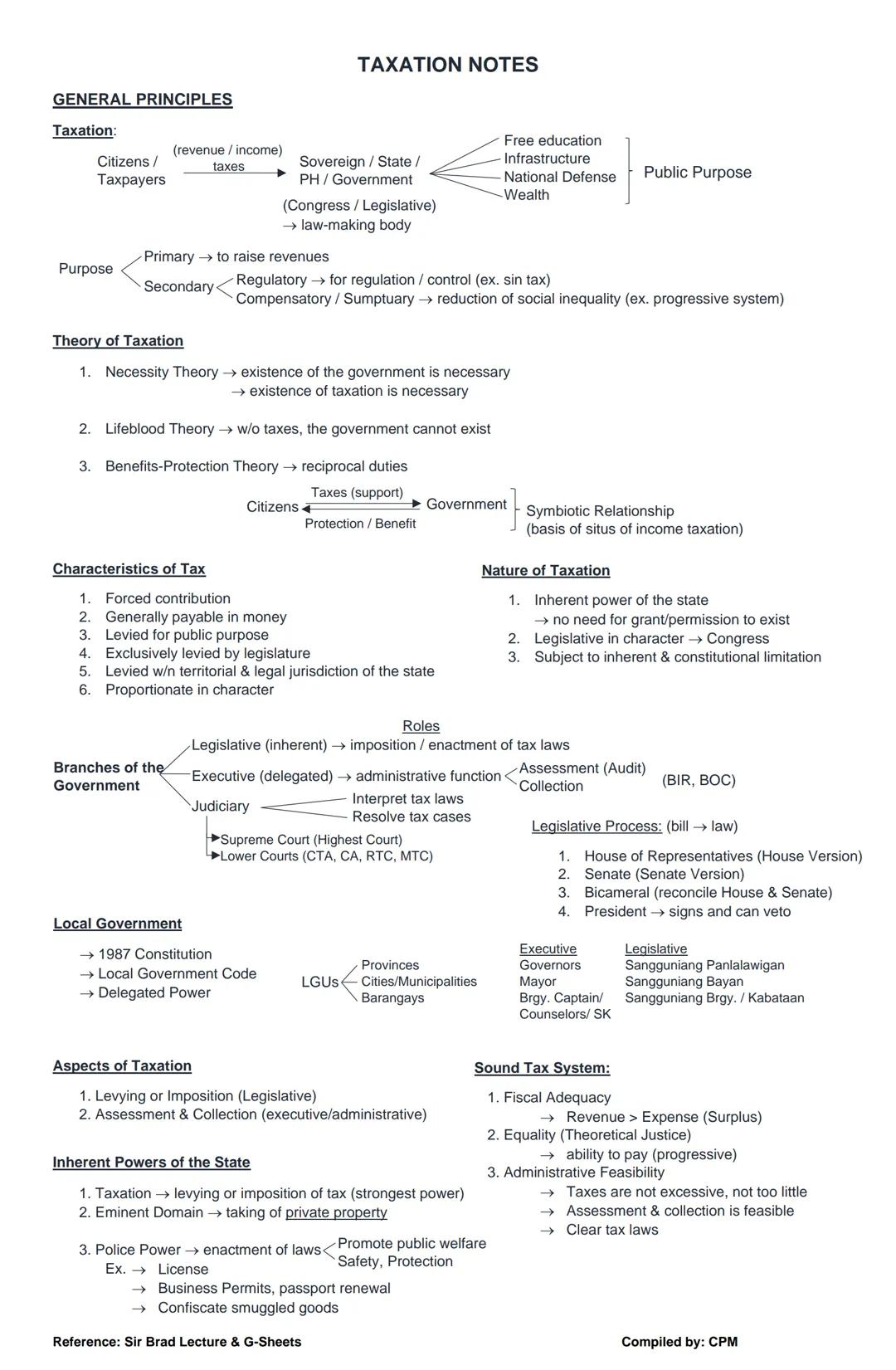

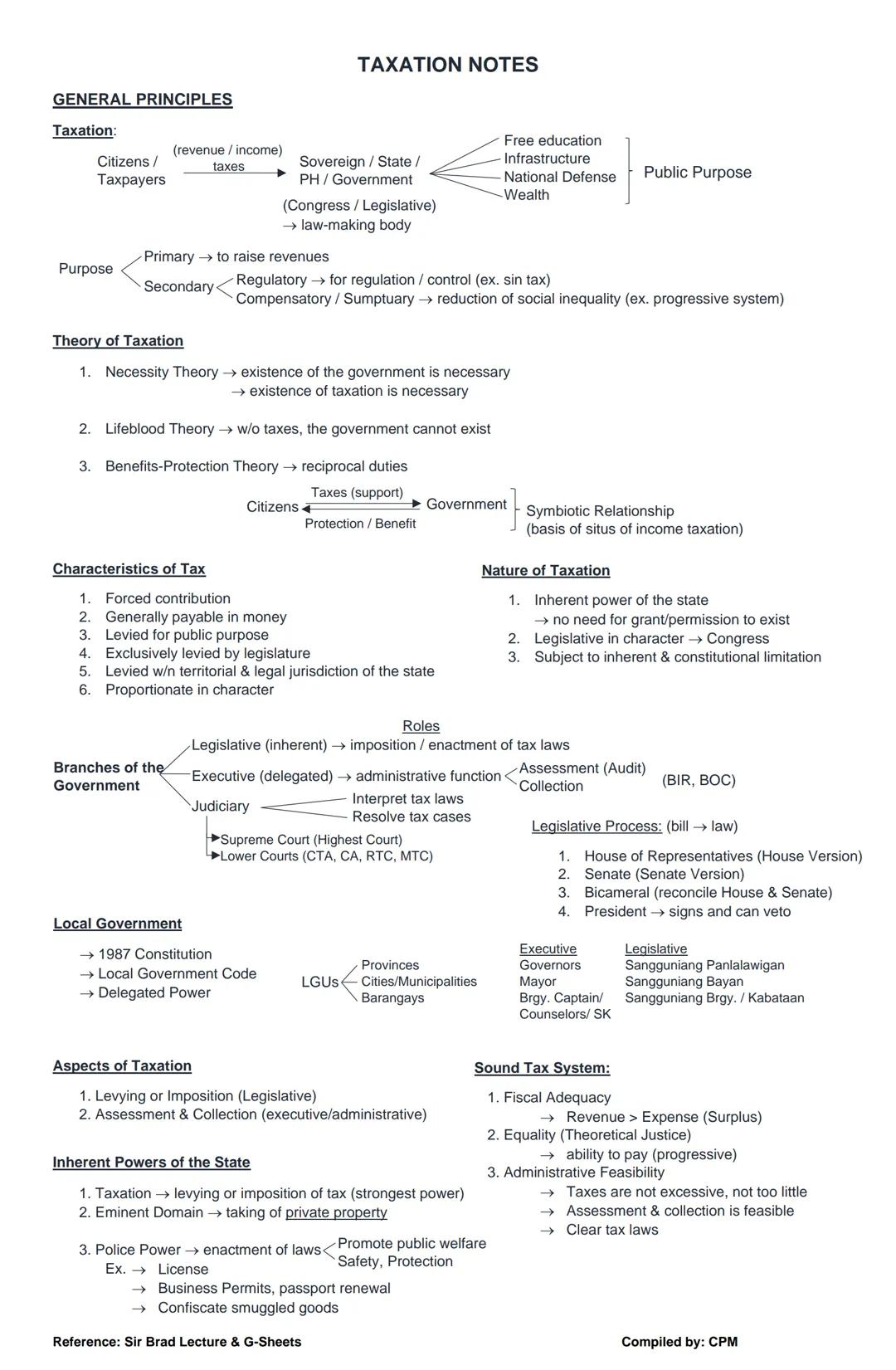

Taxation represents a vital connection between citizens and their government. As taxpayers provide revenue, the government uses these funds to deliver public services such as free education, infrastructure, and national defense.

The primary purpose of taxation is to raise revenue, but it serves secondary purposes too. Regulatory taxation helps control certain activities (like sin taxes on alcohol or tobacco), while compensatory taxation aims to reduce social inequality through progressive tax systems.

Several theories explain taxation's importance. The Necessity Theory states that since government existence is necessary, taxation must also be necessary. The Lifeblood Theory asserts that without taxes, the government cannot function. The Benefits-Protection Theory describes the reciprocal relationship where citizens pay taxes and receive government protection in return.

Important Note: Taxation is characterized by being a forced contribution, generally payable in money, levied for public purposes, exclusively imposed by the legislature, within the state's jurisdiction, and proportionate in character.

The three branches of government play distinct roles in taxation. The legislative branch has the inherent power to create tax laws, while the executive branch (through agencies like BIR and BOC) handles administrative functions like assessment and collection. The judiciary interprets tax laws and resolves disputes.

A sound tax system follows three principles: fiscal adequacy (revenue exceeds expenses), equality (based on ability to pay), and administrative feasibility (taxes are reasonable to implement and collect).

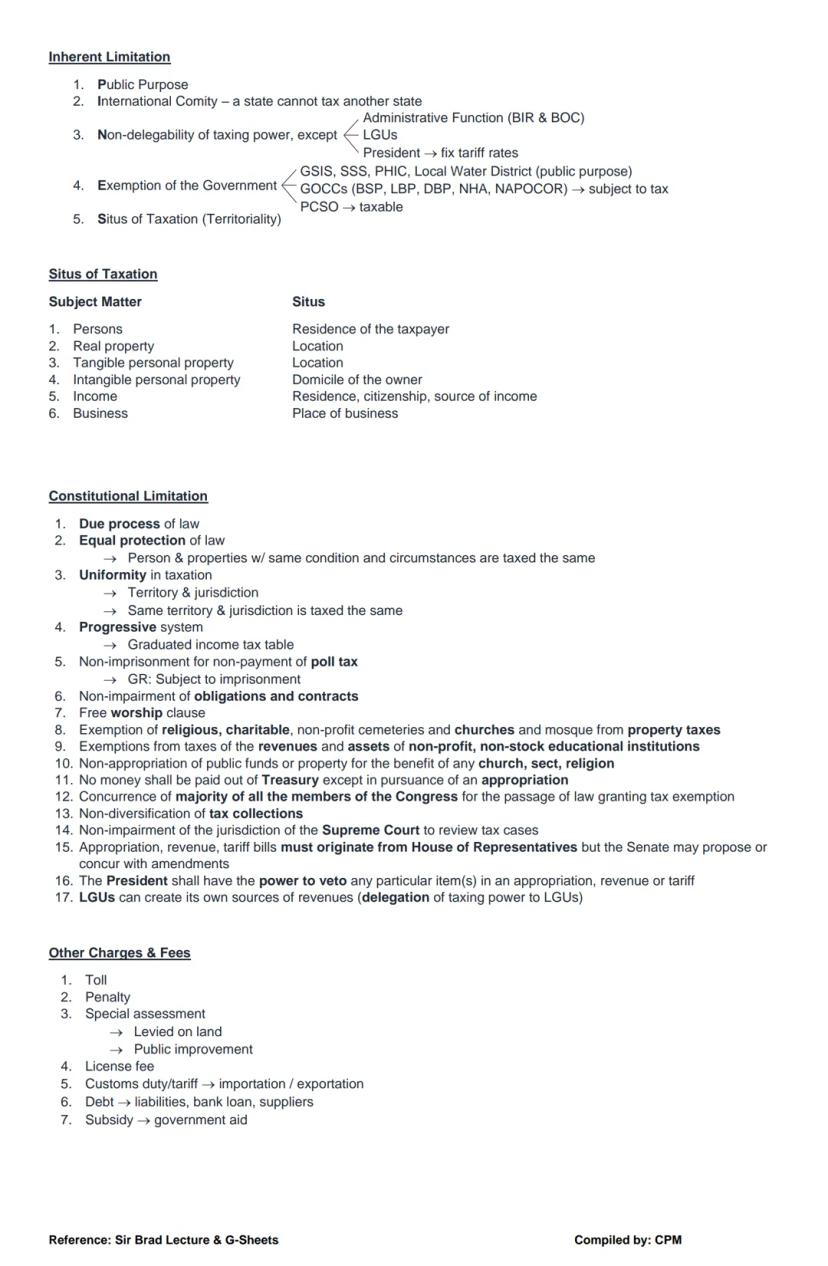

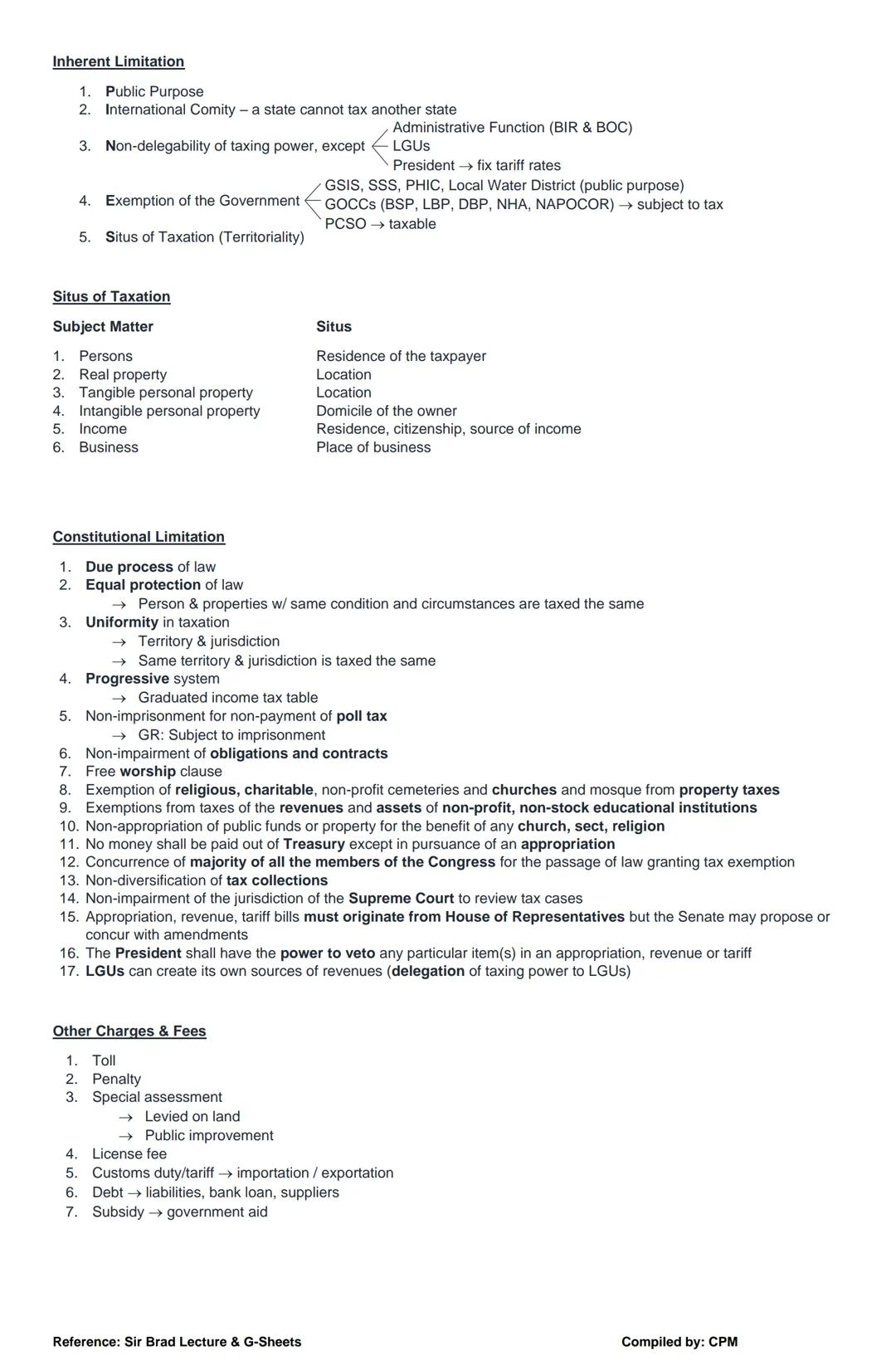

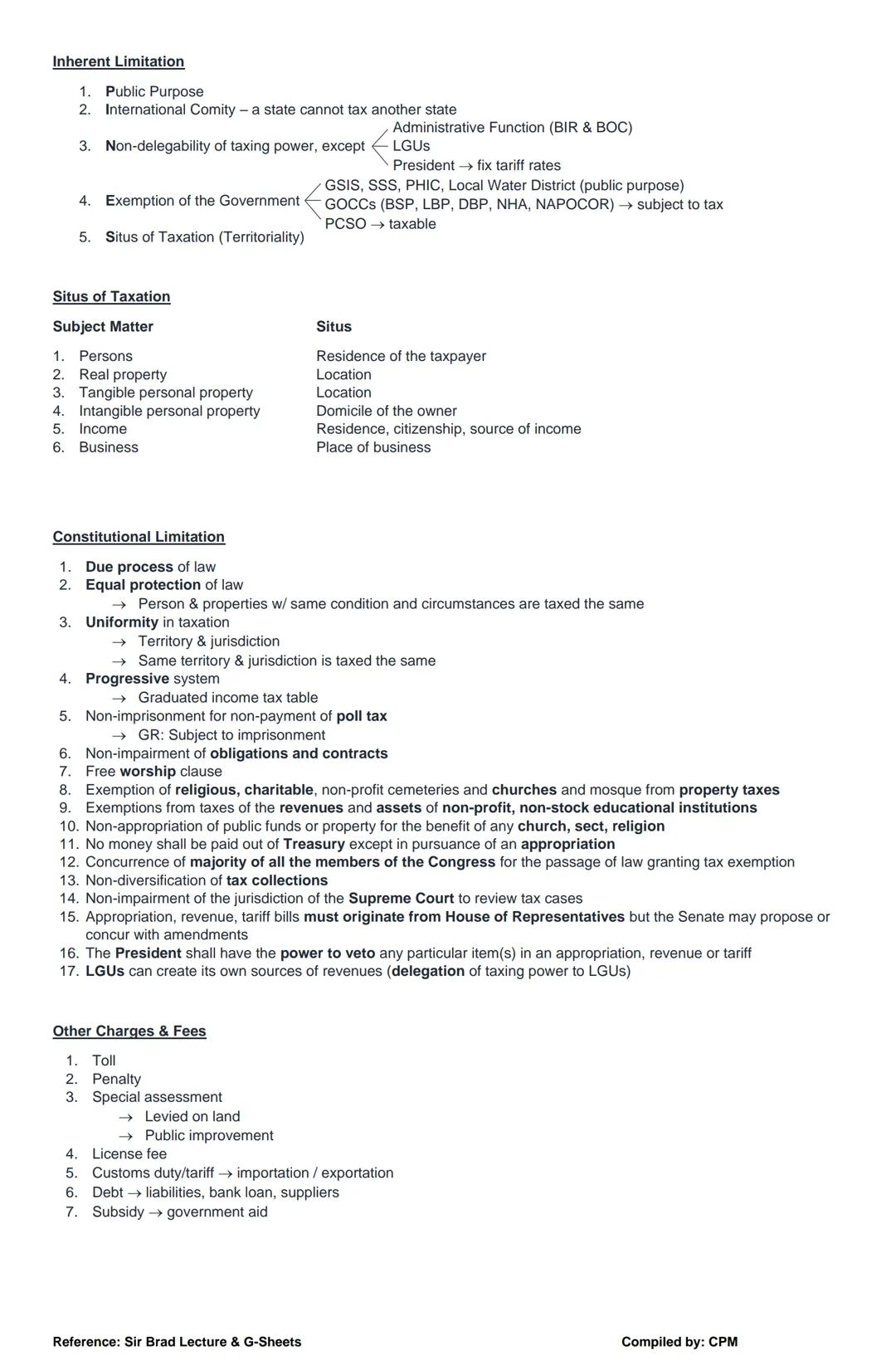

Taxation, though powerful, faces important limitations. Inherent limitations include the requirement of public purpose, meaning taxes must benefit the public rather than private interests. The principle of international comity prevents one state from taxing another, while non-delegability restricts who can impose taxes (though administrative functions may be delegated to agencies like BIR or LGUs).

The situs of taxation (or territoriality) principle determines where taxation can occur. Different types of property have different tax situses - for example, real property is taxed where it's located, while income may be taxed based on residence, citizenship, or source.

Constitutional limitations provide further guardrails. The constitution requires due process and equal protection in taxation, ensuring people and properties in similar circumstances are taxed similarly. The progressive system mandates graduated income tax rates based on ability to pay.

Did you know? Religious organizations, educational institutions, and non-profit cemeteries enjoy constitutional tax exemptions on their property.

Other constitutional protections include the prohibition of imprisonment for non-payment of poll tax, the non-impairment of obligations and contracts, and freedom of religious worship. The constitution also mandates that tax exemption laws require a majority vote from Congress.

Beyond taxes, governments may collect other charges including tolls for specific services, penalties for violations, special assessments on land benefiting from public improvements, license fees for privileges, and customs duties on imports and exports.

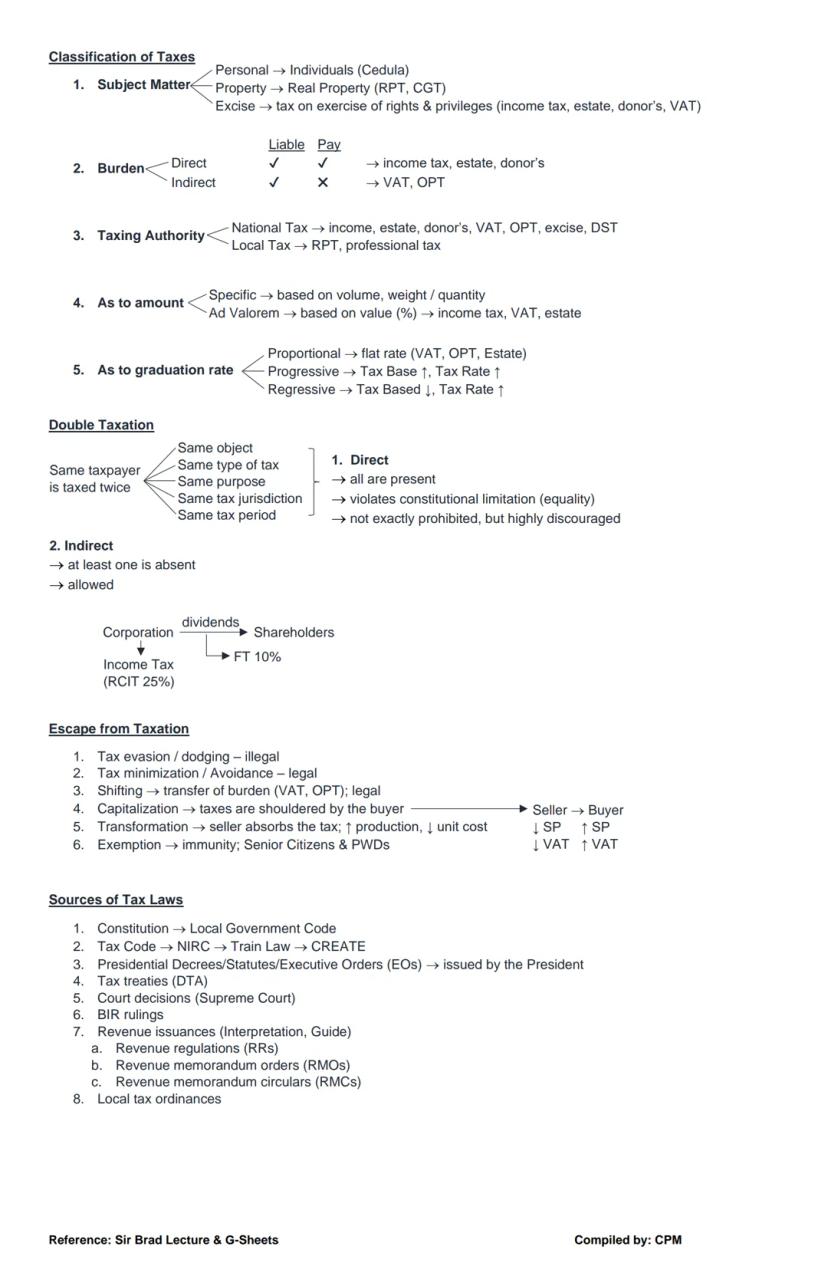

Taxes can be classified in multiple ways to better understand their application and impact. By subject matter, taxes may be personal (affecting individuals, like cedula), property-based (like real property tax), or excise taxes (on rights and privileges, like income tax).

When categorized by burden, taxes are either direct (where the liable person pays, like income tax) or indirect (where the burden is passed to others, like VAT). By taxing authority, we distinguish between national taxes (income, estate taxes) and local taxes (real property tax).

Taxes may also be classified by amount as specific (based on quantity) or ad valorem (based on percentage of value). By graduation rate, taxes can be proportional (flat rate), progressive (rate increases with tax base), or regressive (rate decreases as tax base increases).

Tax Spotlight: Double taxation occurs when the same taxpayer is taxed twice on the same income or property. Direct double taxation (where all five elements are present) violates constitutional limitations, while indirect double taxation (where at least one element is absent) is permitted.

Several methods exist to escape taxation. Tax evasion (illegal dodging) differs from tax avoidance (legal minimization). Tax shifting legally transfers the tax burden to others, as with VAT. Capitalization occurs when taxes are built into purchase prices, while transformation happens when sellers absorb taxes by improving efficiency.

The primary sources of tax laws include the Constitution, the Tax Code (NIRC with TRAIN and CREATE amendments), Presidential Decrees, tax treaties, court decisions, BIR rulings, and revenue issuances. Local tax ordinances also serve as sources for local taxation.

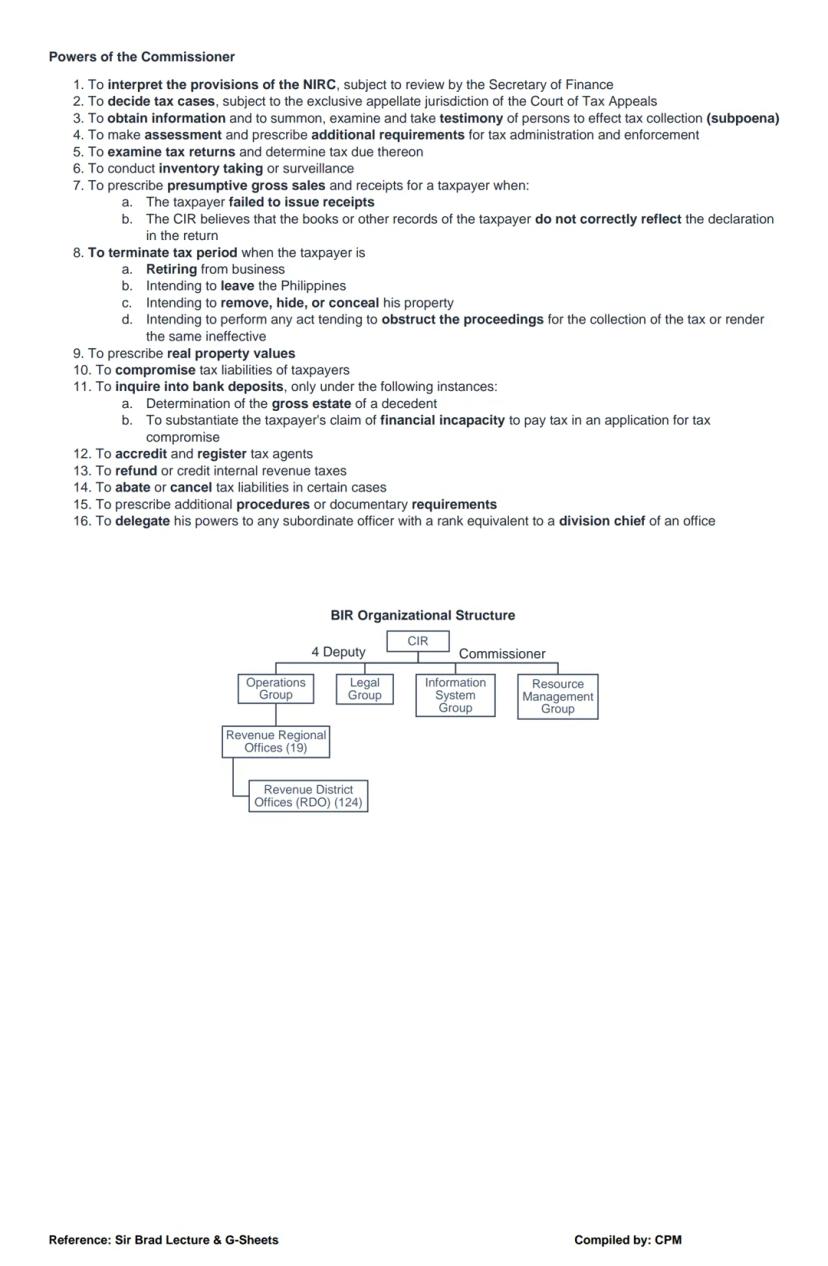

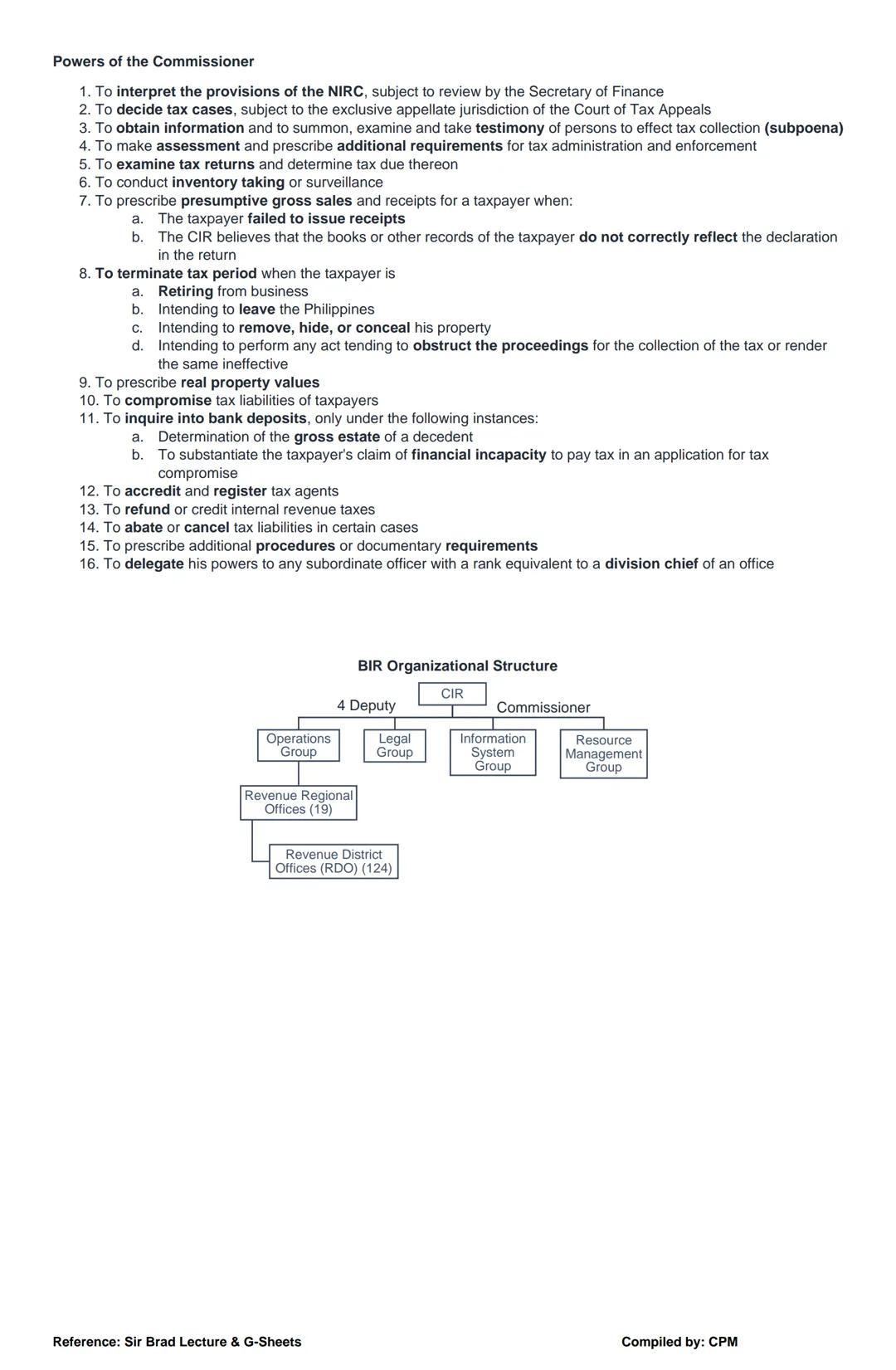

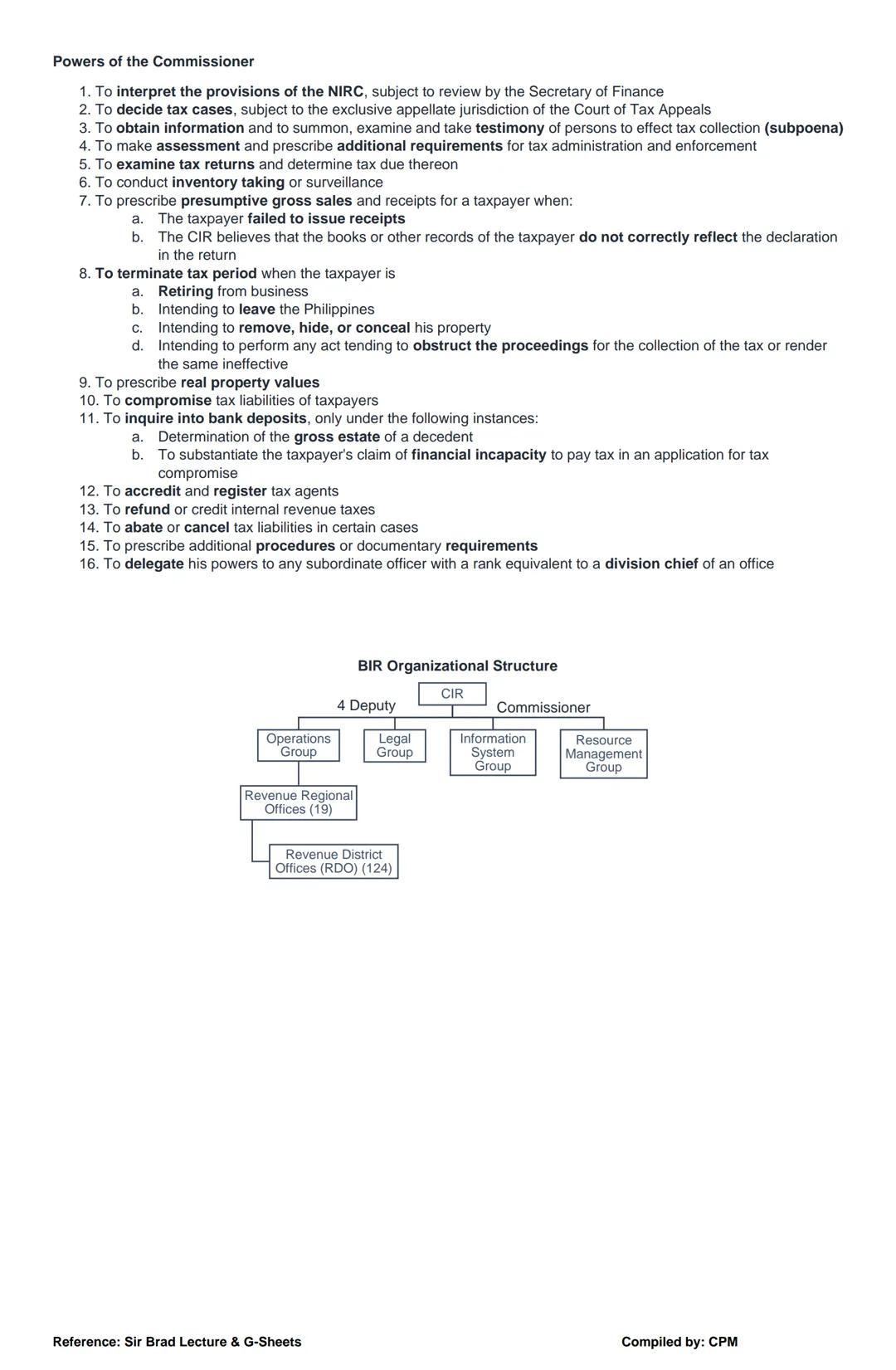

The Commissioner of Internal Revenue holds extensive powers to ensure effective tax administration. These include interpreting NIRC provisions (subject to review by the Finance Secretary) and making decisions on tax cases that can be appealed to the Court of Tax Appeals.

The Commissioner can obtain information through subpoena power and examine witnesses to enforce tax collection. This authority extends to assessing taxes, prescribing requirements for compliance, and examining tax returns to determine proper tax liability.

When taxpayers fail to issue receipts or maintain accurate records, the Commissioner can prescribe presumptive gross sales. In cases where taxpayers attempt to evade taxes by retiring from business or leaving the Philippines, the Commissioner can terminate the tax period early.

Important: The Commissioner can compromise tax liabilities and inquire into bank deposits in specific situations, such as when determining a decedent's estate or evaluating a taxpayer's claim of financial inability to pay taxes.

Additional powers include accrediting tax agents, refunding or crediting taxes, abating tax liabilities in certain situations, and prescribing additional procedures or requirements. The Commissioner can delegate powers to subordinate officers with rank equivalent to division chief.

The Bureau of Internal Revenue operates through a structured organization headed by the Commissioner who oversees four Deputy Commissioners managing different groups: Legal, Information System, Resource Management, and Operations. The Operations Group supervises 19 Revenue Regional Offices, which in turn oversee 124 Revenue District Offices (RDOs) throughout the country.

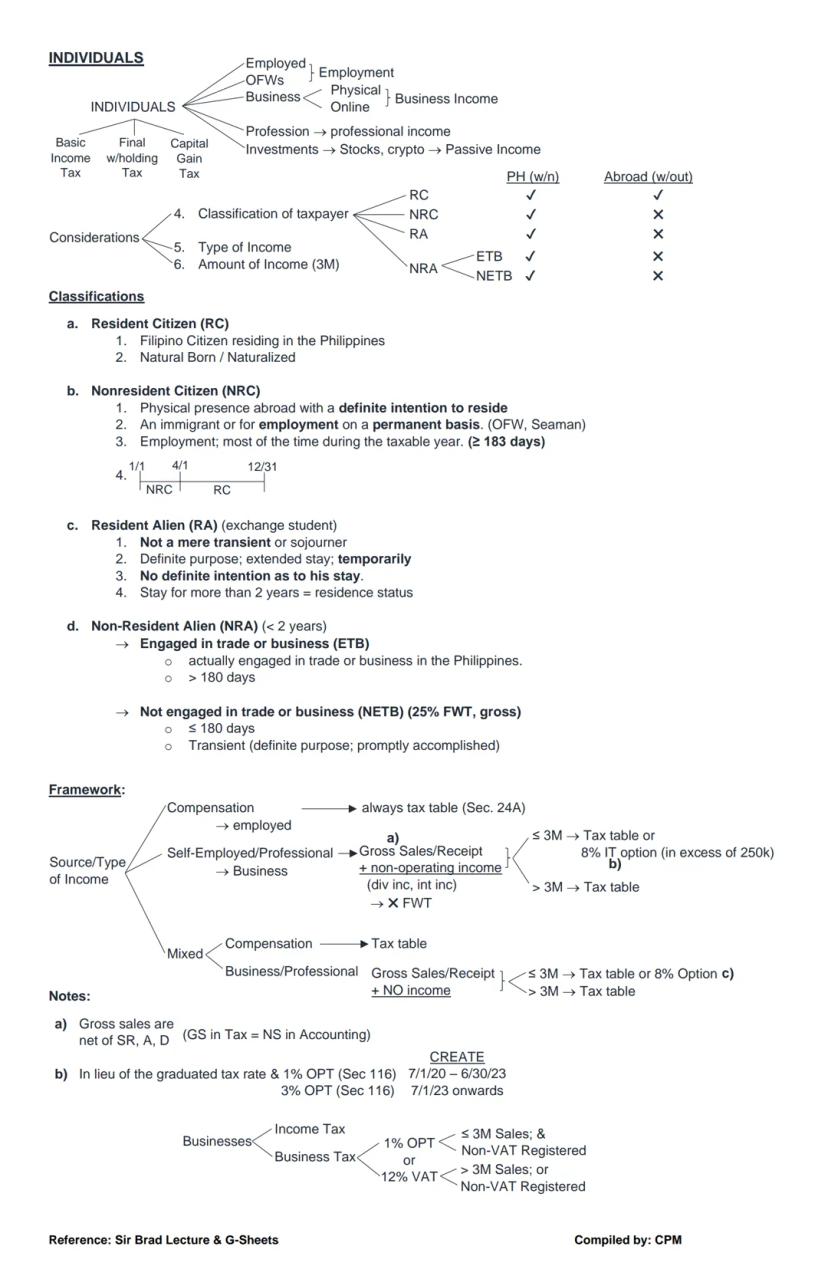

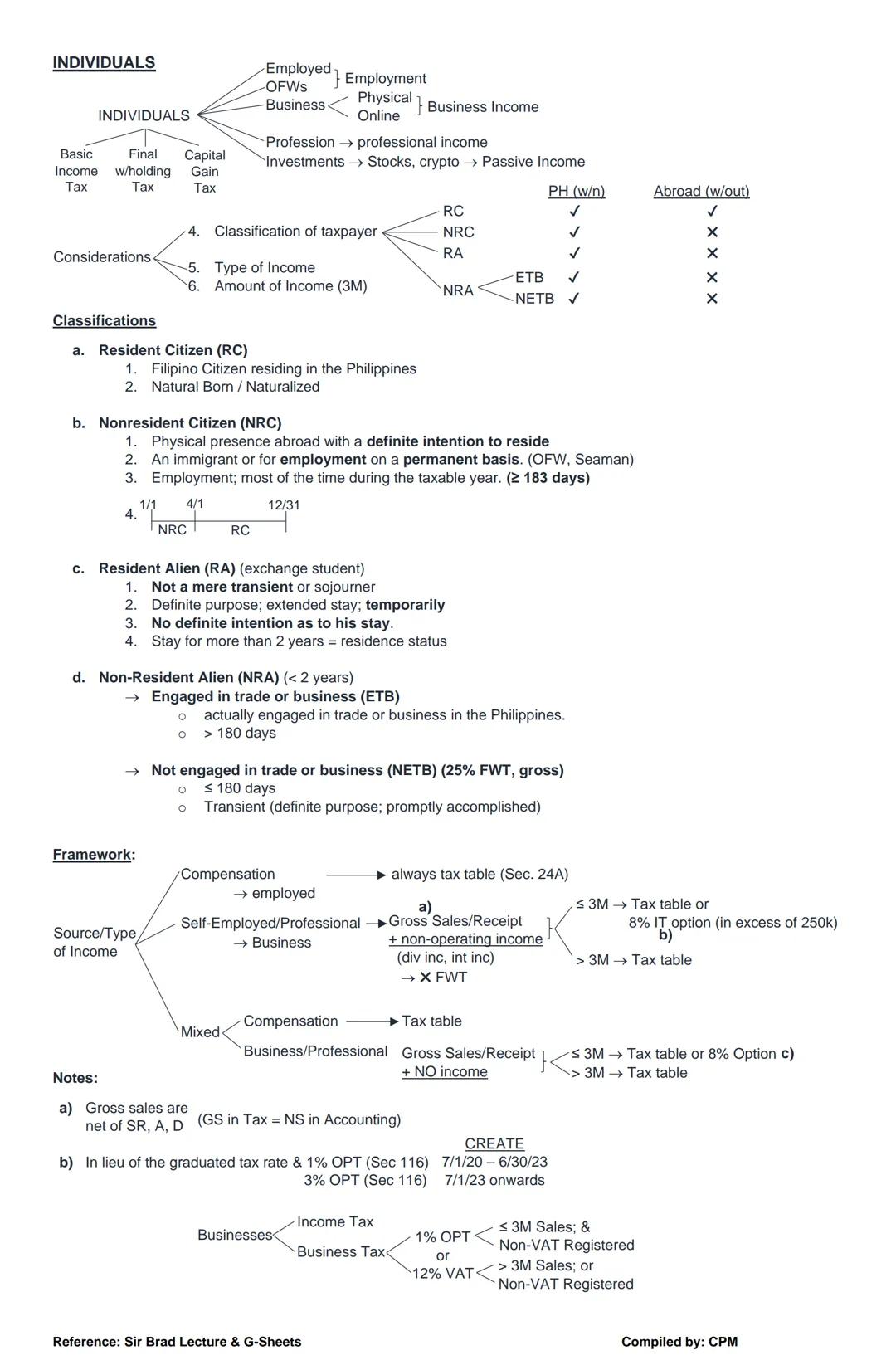

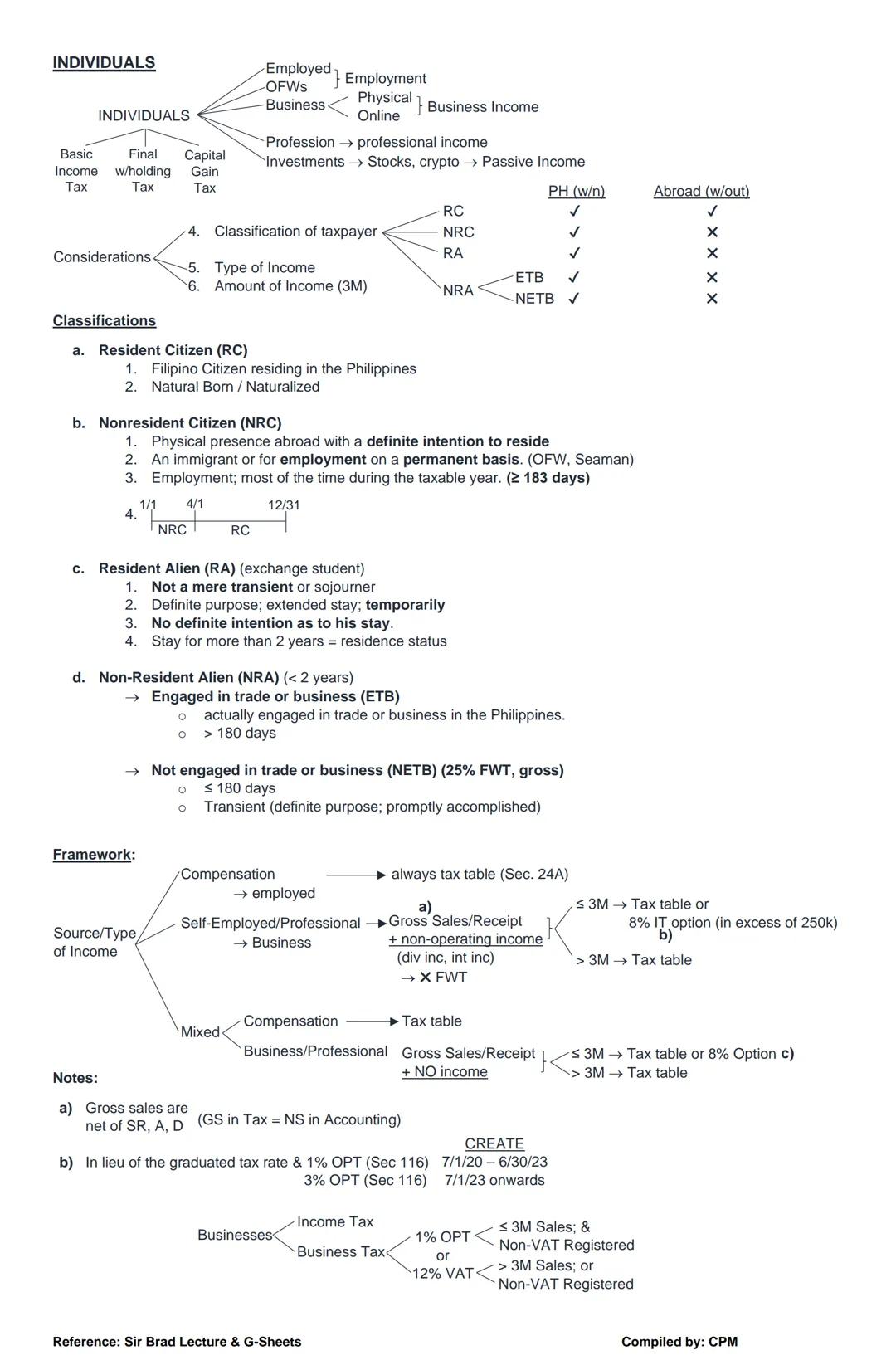

The Philippine tax system classifies individual taxpayers based on residence, citizenship, and source of income. Understanding your classification is crucial as it determines what income is taxable and which tax rates apply to you.

Resident Citizens (RC) are Filipino citizens residing in the Philippines who are taxed on both domestic and foreign income. Nonresident Citizens (NRC) include Filipinos physically present abroad (like OFWs) who are taxed only on Philippine-sourced income. An important distinction: if you're abroad for employment on a permanent basis or for at least 183 days, you're considered an NRC.

Resident Aliens (RA) are foreigners staying in the Philippines for extended periods (like exchange students) with no definite intention to leave. By contrast, Non-Resident Aliens may be either Engaged in Trade or Business (ETB) if they stay over 180 days, or Not Engaged in Trade or Business (NETB) if 180 days or less.

Tax Planning Tip: Self-employed professionals with gross sales/receipts not exceeding ₱3M can choose between the tax table rate or the 8% income tax option (in excess of ₱250k). The 8% option often results in lower tax liability!

Your tax treatment also depends on your income source. For employed individuals, compensation income always follows the tax table. For self-employed or professionals, your gross sales/receipts determine your options. If not exceeding ₱3M, you can choose between the tax table or the 8% option. Mixed income earners (those with both compensation and business income) have similar options if their gross sales don't exceed ₱3M.

Remember that business income is subject to both income tax and business tax. If you're non-VAT registered, you'll pay either income tax plus the 3% percentage tax (or 1% during certain COVID relief periods), or 12% VAT if your sales exceed ₱3M.

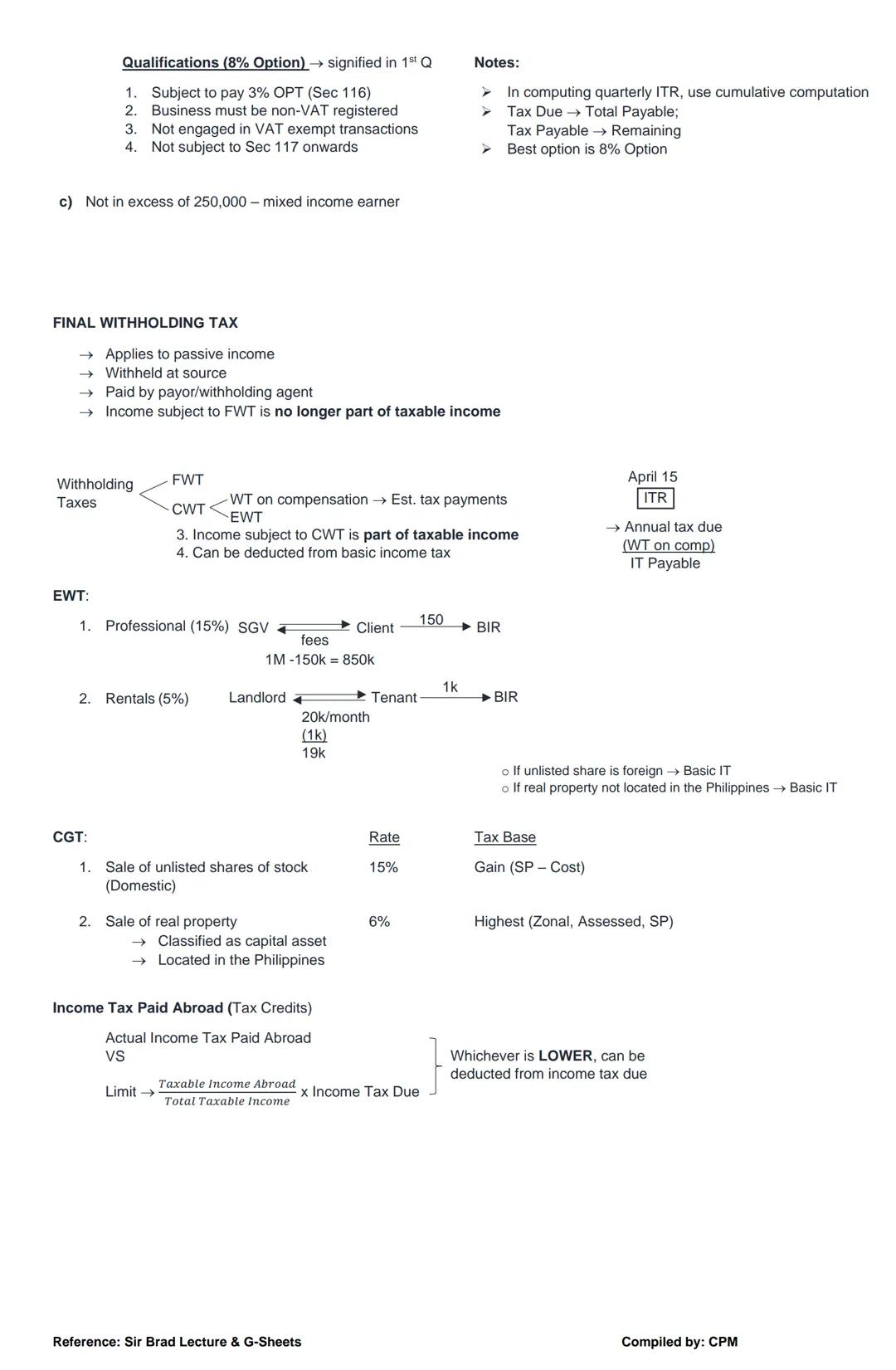

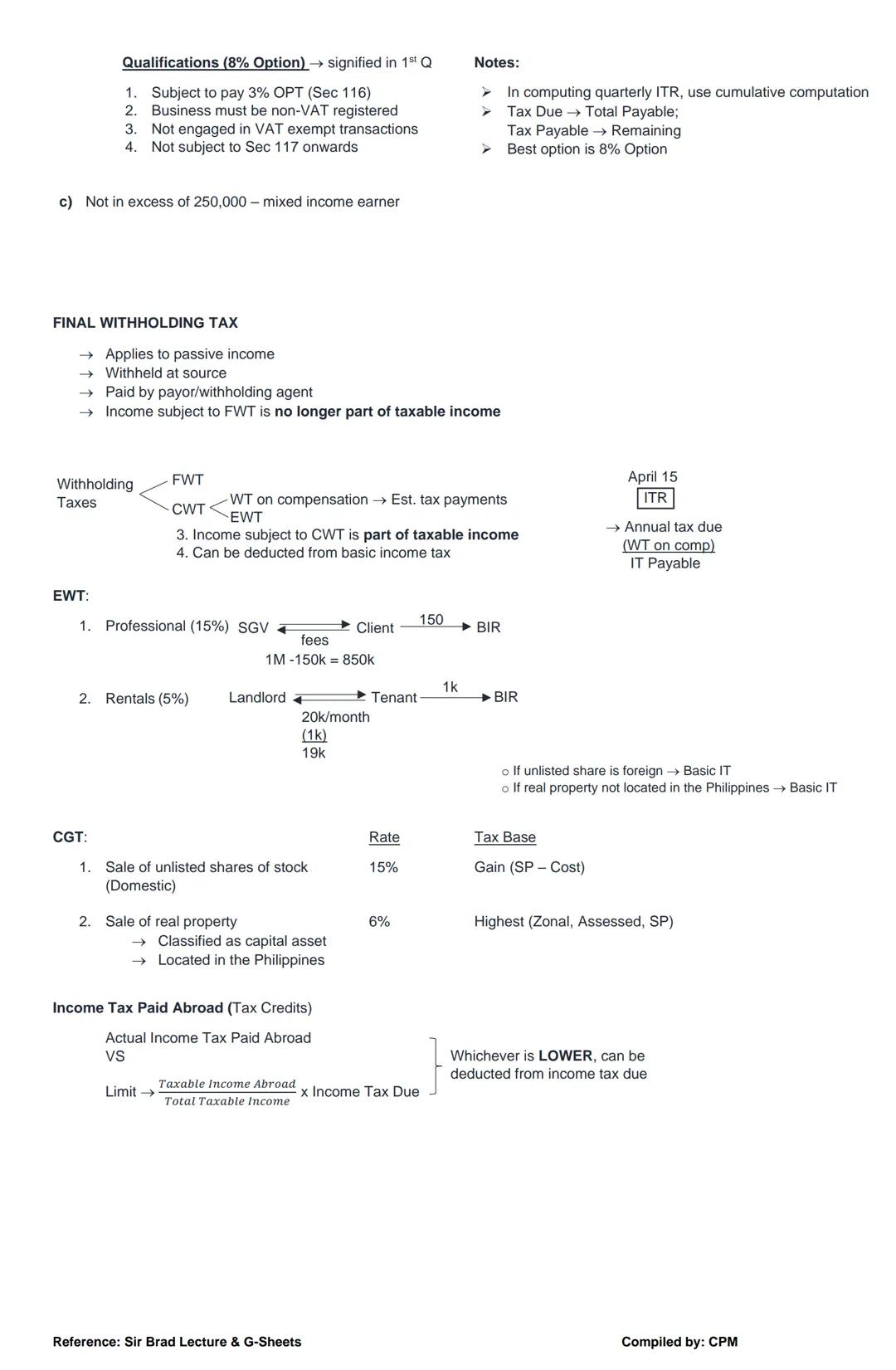

To qualify for the 8% tax option, you must meet several criteria. You must be subject to the 3% percentage tax (Section 116), be non-VAT registered, not engaged in VAT-exempt transactions, and not subject to taxes under Section 117 onwards. This option must be signified in your first quarter return and is irrevocable for the year.

For quarterly income tax returns, use cumulative computation. Remember that tax due represents your total payable amount, while tax payable is what remains after credits and payments.

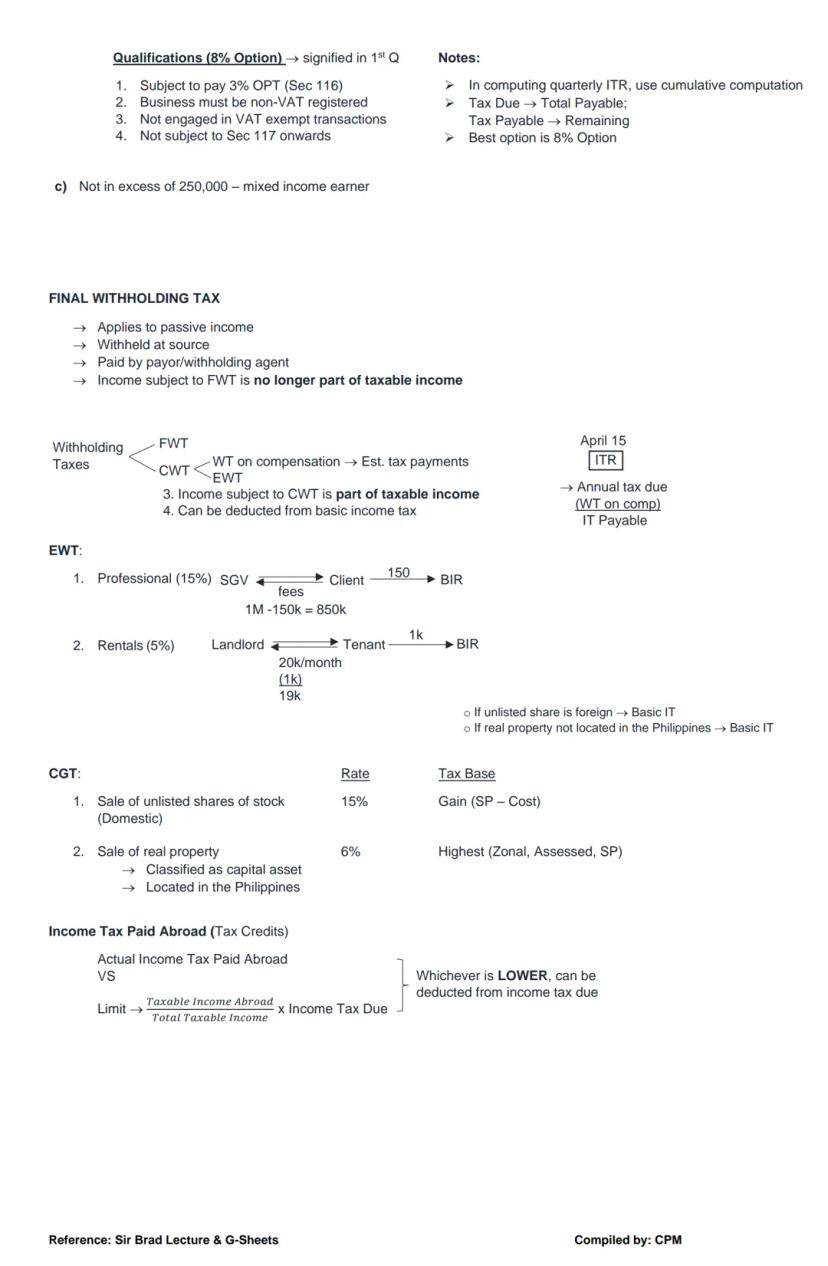

Final Withholding Tax (FWT) applies to passive income like interest and dividends. The key characteristic is that it's withheld at source by the payor, and income subject to FWT is excluded from your taxable income for regular tax computation.

Tax Tip: Understanding the difference between withholding tax types can save you money! While FWT is final and excluded from taxable income, creditable withholding taxes can be deducted from your basic income tax due.

Creditable Withholding Tax (CWT) works differently. These amounts (like the 15% withheld on professional fees) become part of your taxable income but can be deducted from your basic income tax when filing your annual return in April.

Capital Gains Tax (CGT) applies to certain capital assets. Sale of unlisted shares is taxed at 15% of the gain, while real property classified as capital asset faces 6% CGT on the highest value among zonal, assessed, or selling price. These transactions are processed separately from your regular income tax.

If you paid taxes abroad, you may claim foreign tax credits. You'll need to determine whether the actual tax paid abroad or the calculated limit based on Philippine tax due is lower, as this becomes your allowable deduction from Philippine income tax.

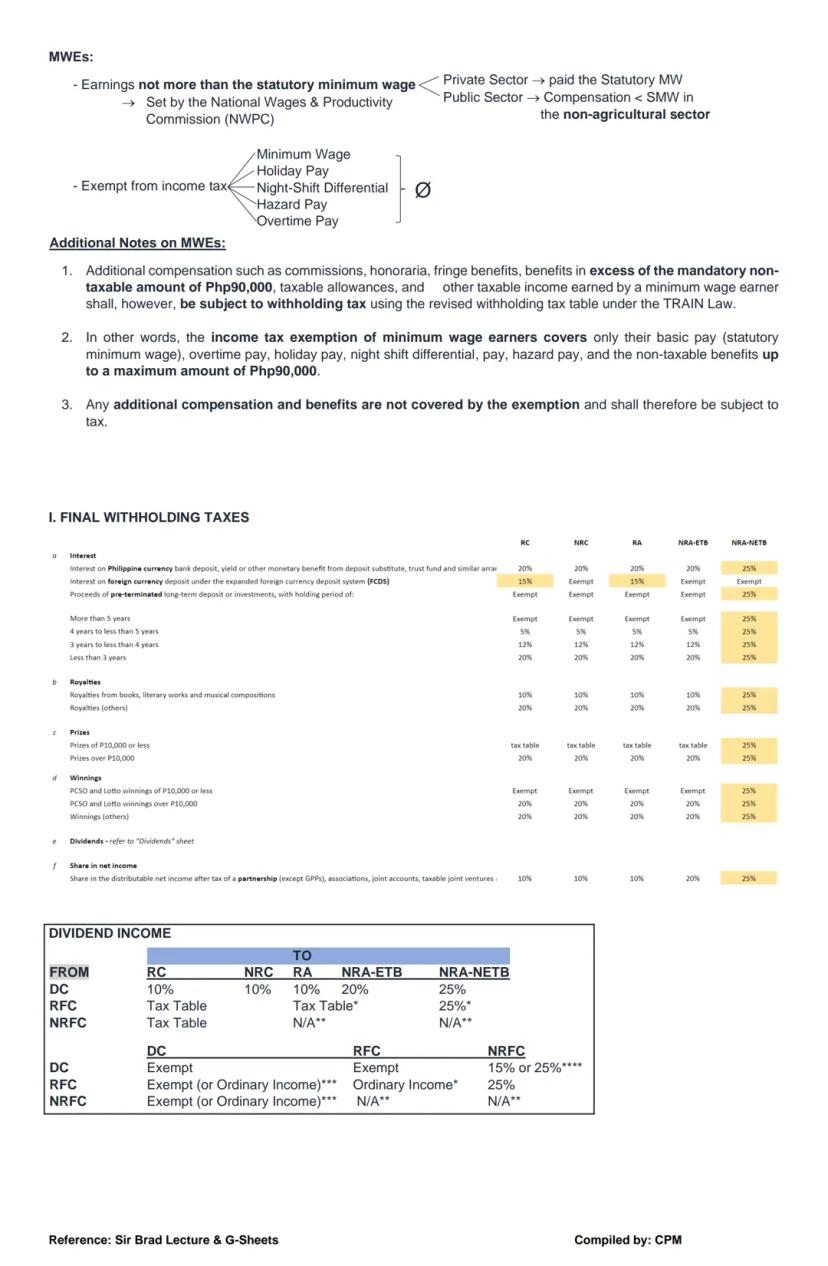

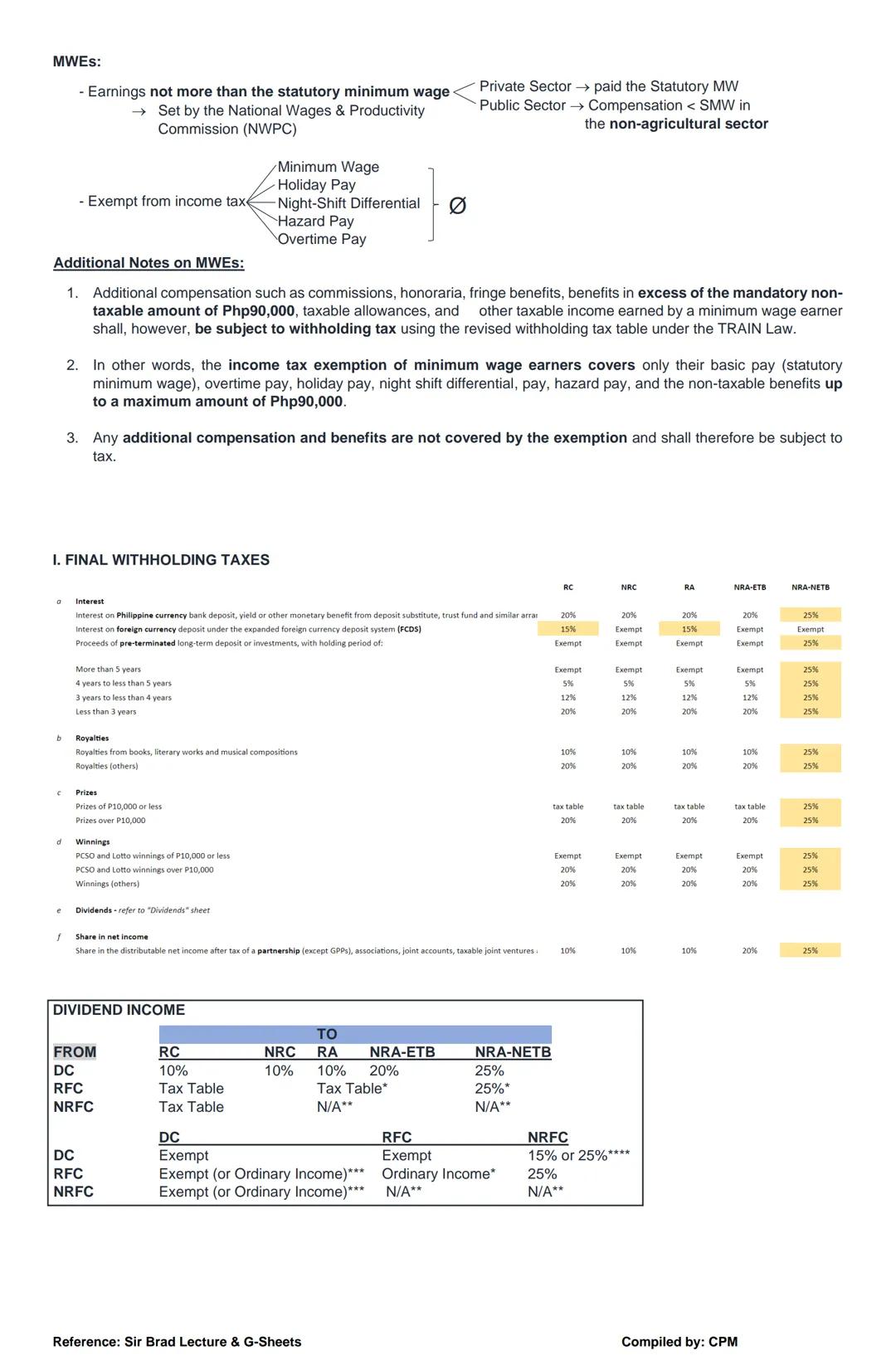

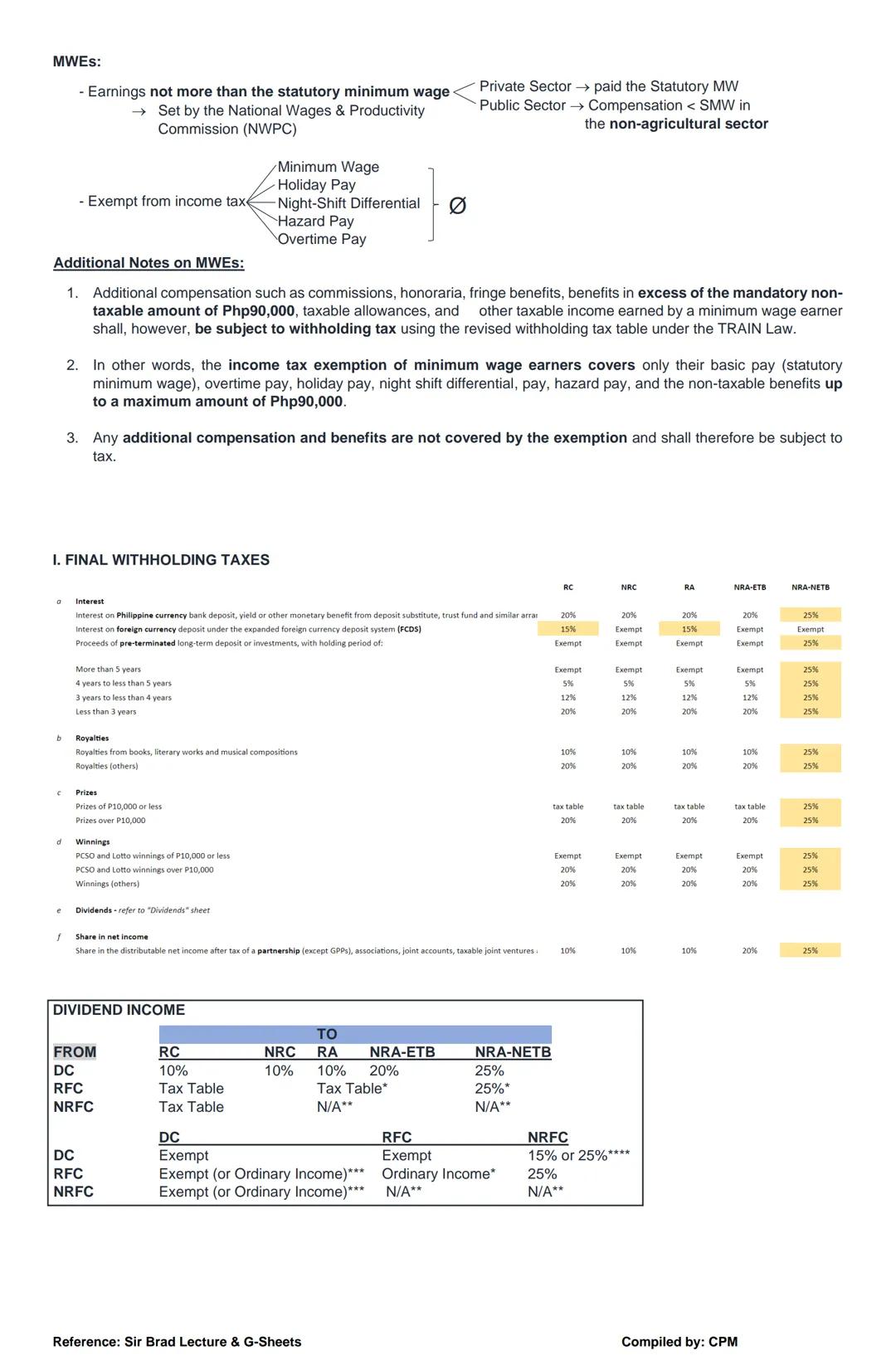

Minimum Wage Earners (MWEs) enjoy exemption from income tax on their earnings. This applies to private sector employees earning not more than the statutory minimum wage set by the National Wages & Productivity Commission and public sector workers with compensation below the minimum wage in the non-agricultural sector.

The tax exemption covers their basic pay (statutory minimum wage) along with overtime pay, holiday pay, night shift differential, and hazard pay. Additionally, non-taxable benefits up to ₱90,000 are also exempt.

Important: If you're a minimum wage earner, any income beyond your basic pay and specified allowances—such as commissions, honoraria, fringe benefits exceeding ₱90,000, and other taxable income—is still subject to withholding tax.

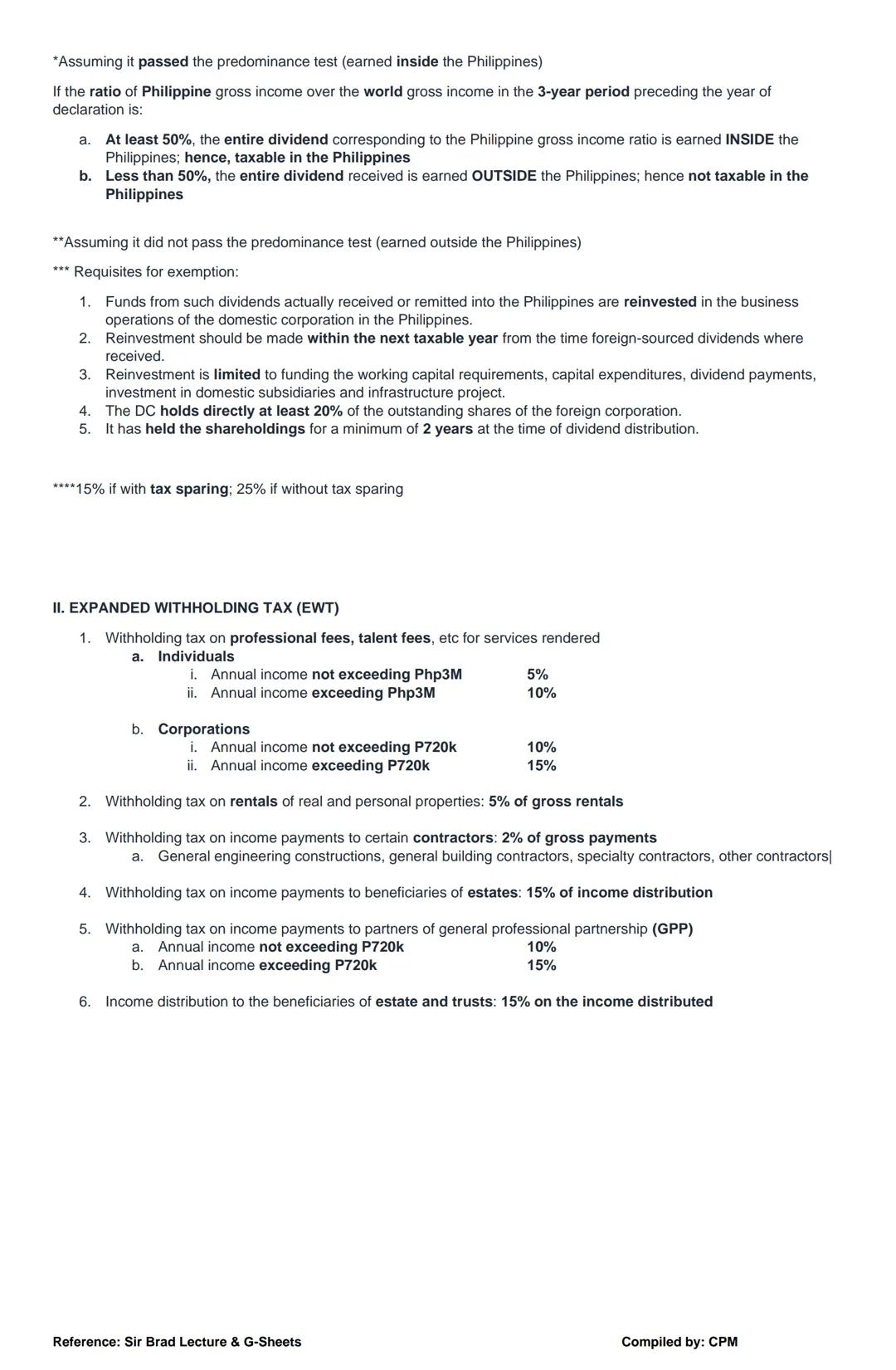

Various types of income are subject to Final Withholding Tax at different rates. Interest income from bank deposits in Philippine currency faces varying rates depending on the withholding period, while foreign currency deposits under the expanded FCDS have their own rates.

Royalties are taxed differently based on their nature, with varying rates for books/literary works versus other types of royalties. Prizes and winnings also face specific tax treatment—PCSO and lotto winnings up to ₱10,000 are exempt, while larger amounts and other types of winnings face different rates.

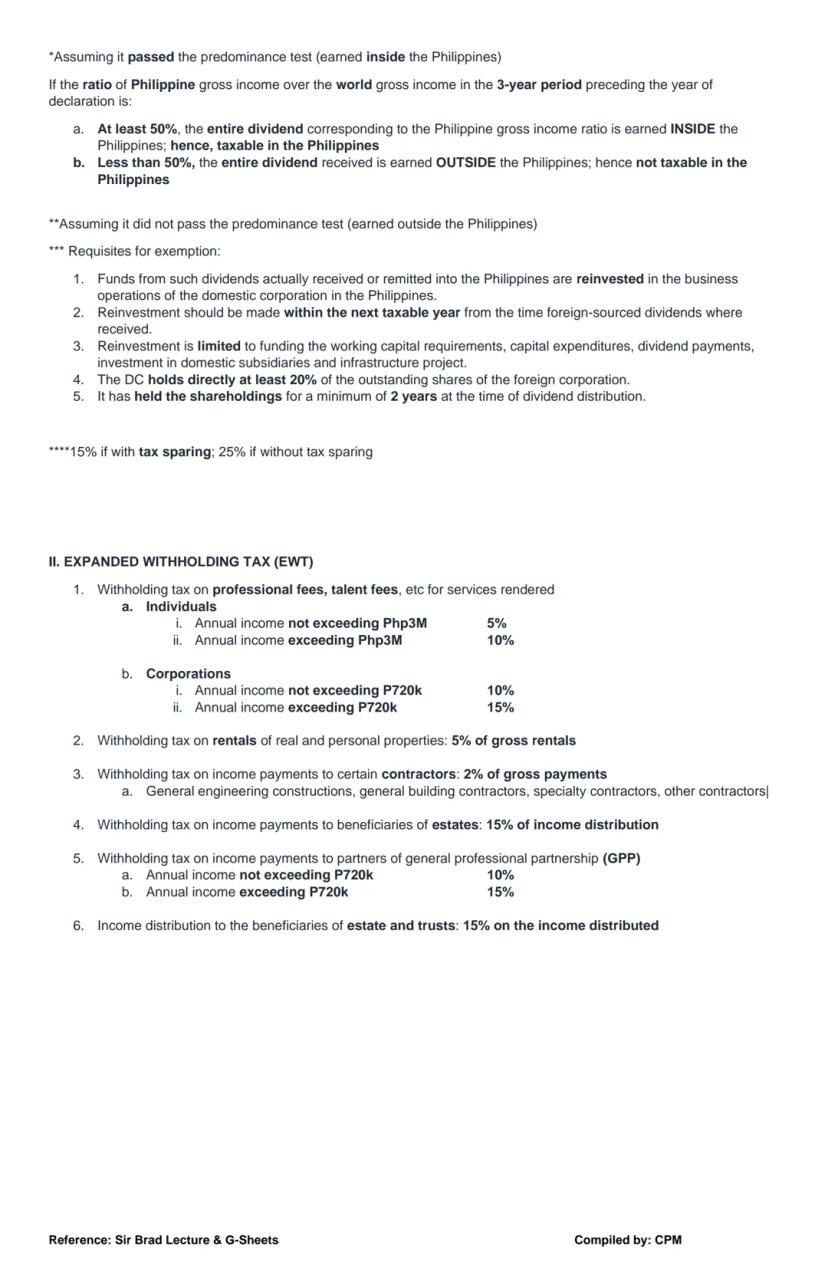

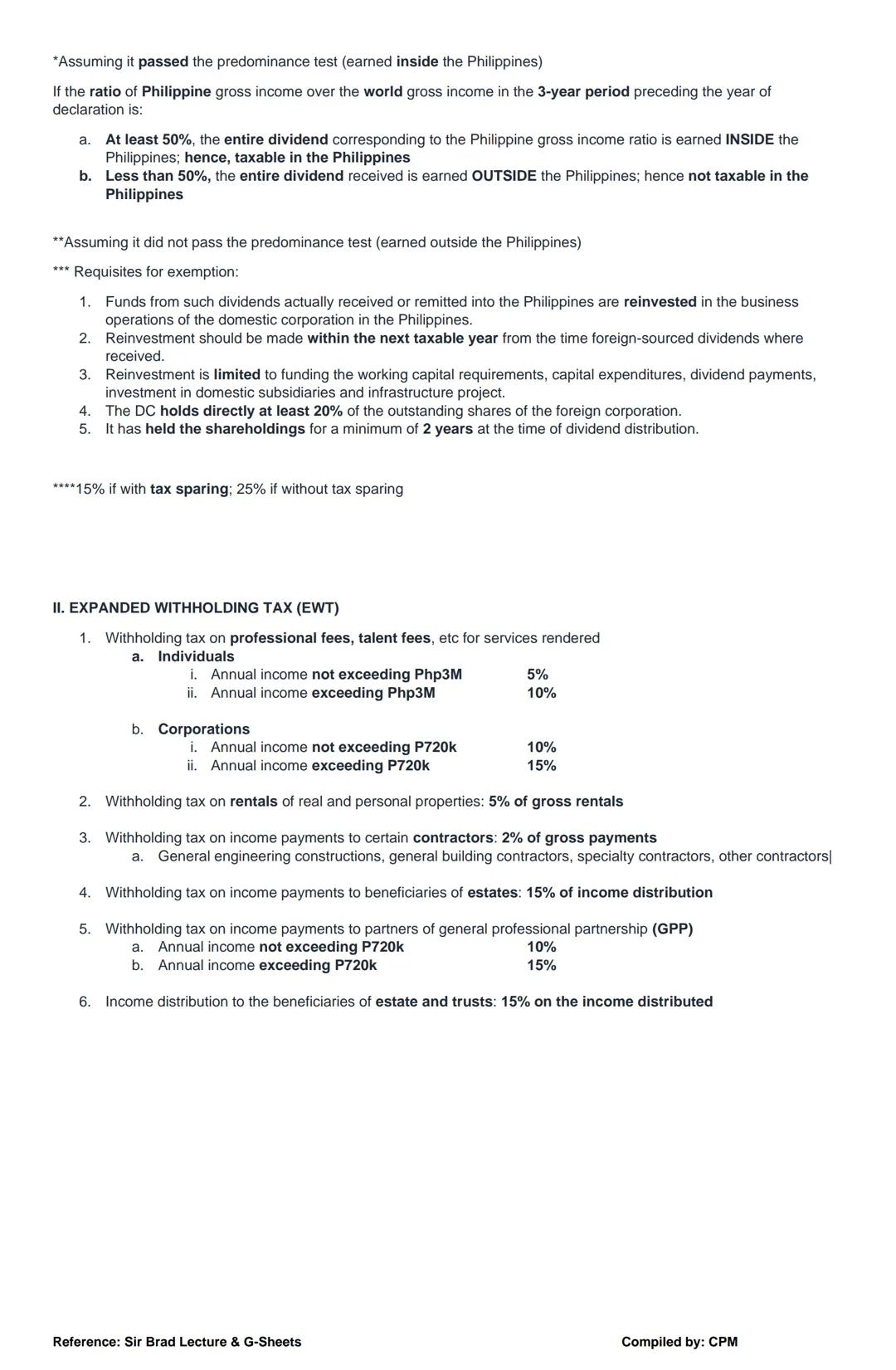

Dividends received by individuals from domestic corporations are generally subject to a 10% final tax. However, dividends from foreign corporations require a complex "predominance test" to determine taxability. This test examines whether the ratio of Philippine gross income over worldwide gross income in the preceding three years is at least 50%.

The predominance test determines how foreign dividends are taxed. If at least 50% of a foreign corporation's gross income over the past three years came from Philippine sources, the entire dividend corresponding to that ratio is considered earned inside the Philippines and taxable. If less than 50%, the dividend is considered earned outside the Philippines and not taxable.

Foreign-sourced dividends may qualify for exemption under specific conditions. The funds must be reinvested in Philippine business operations within the next taxable year, used for specific purposes (working capital, capital expenditures, dividend payments, etc.), and the domestic corporation must directly hold at least 20% of the foreign corporation's outstanding shares for a minimum of two years.

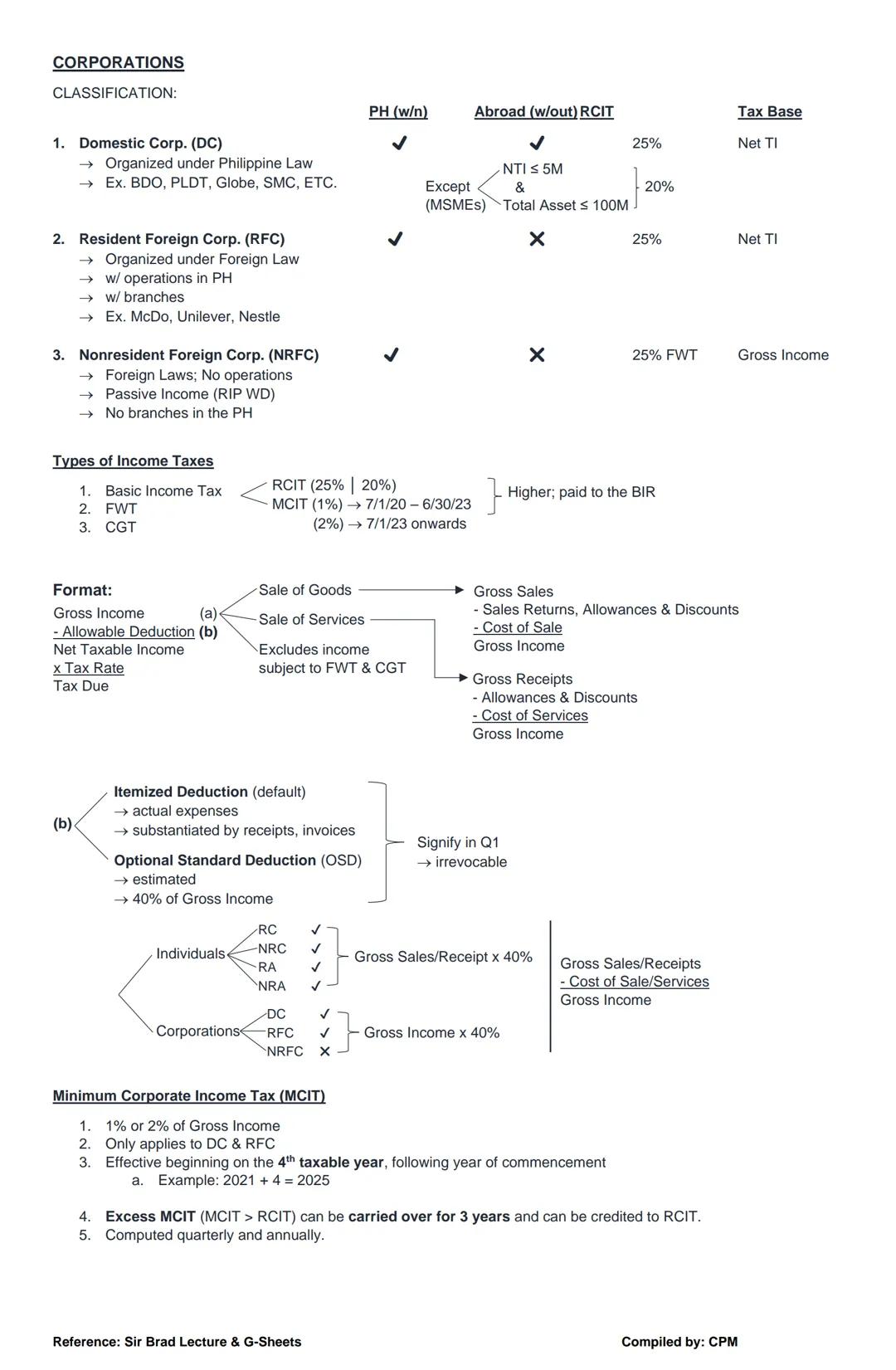

Expanded Withholding Tax (EWT) applies to various income payments. Professional fees are subject to different rates based on the recipient's status:

Tax Tip: Keep track of withholding tax certificates for professional services you provide. These will be crucial when filing your annual income tax return to claim credits for taxes already withheld.

Rental payments for real and personal properties face a 5% withholding tax on gross rentals. Payments to certain contractors are subject to 2% withholding on gross payments, while income distributions to estate beneficiaries face 15% withholding.

Income payments to partners of general professional partnerships (GPPs) are subject to 10% withholding if annual income doesn't exceed ₱720k, or 15% if it does. Similarly, income distributions to beneficiaries of estates and trusts face a 15% withholding tax on the distributed amount.

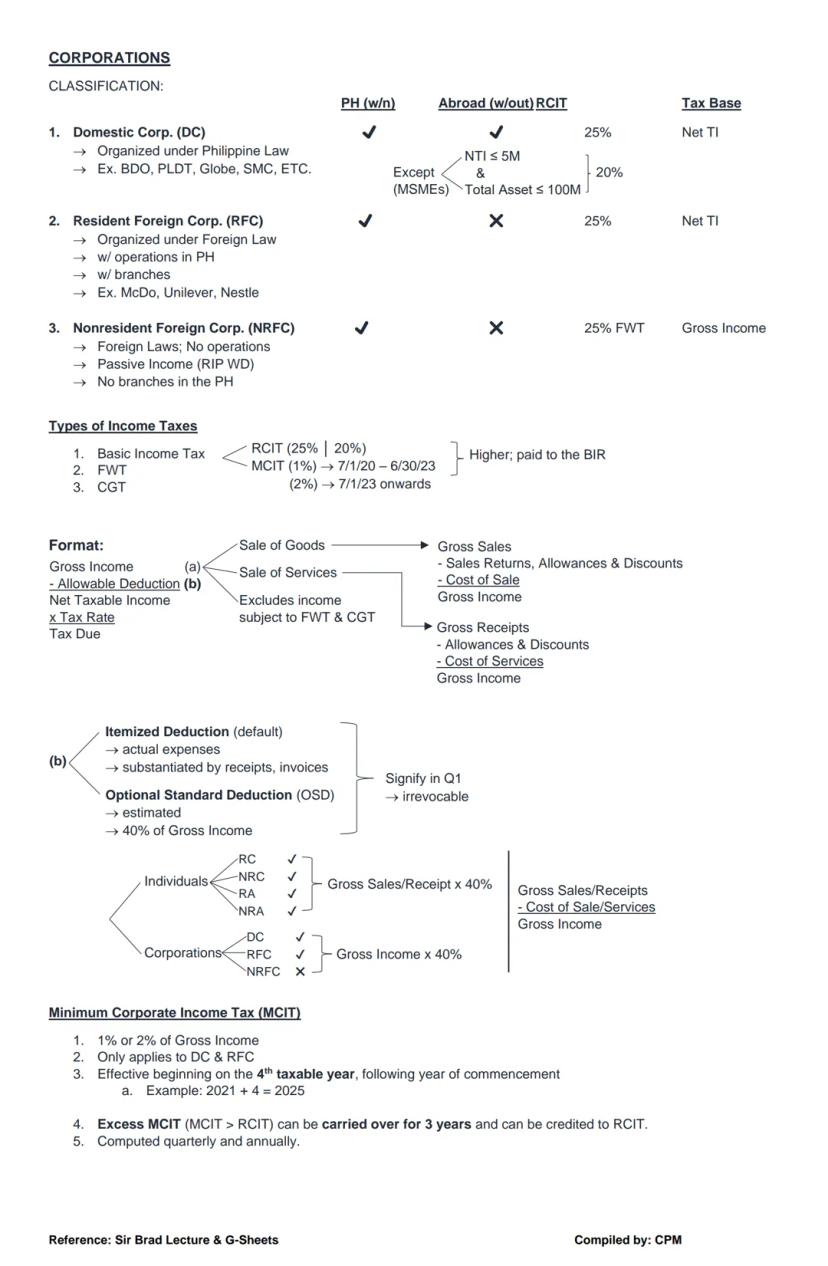

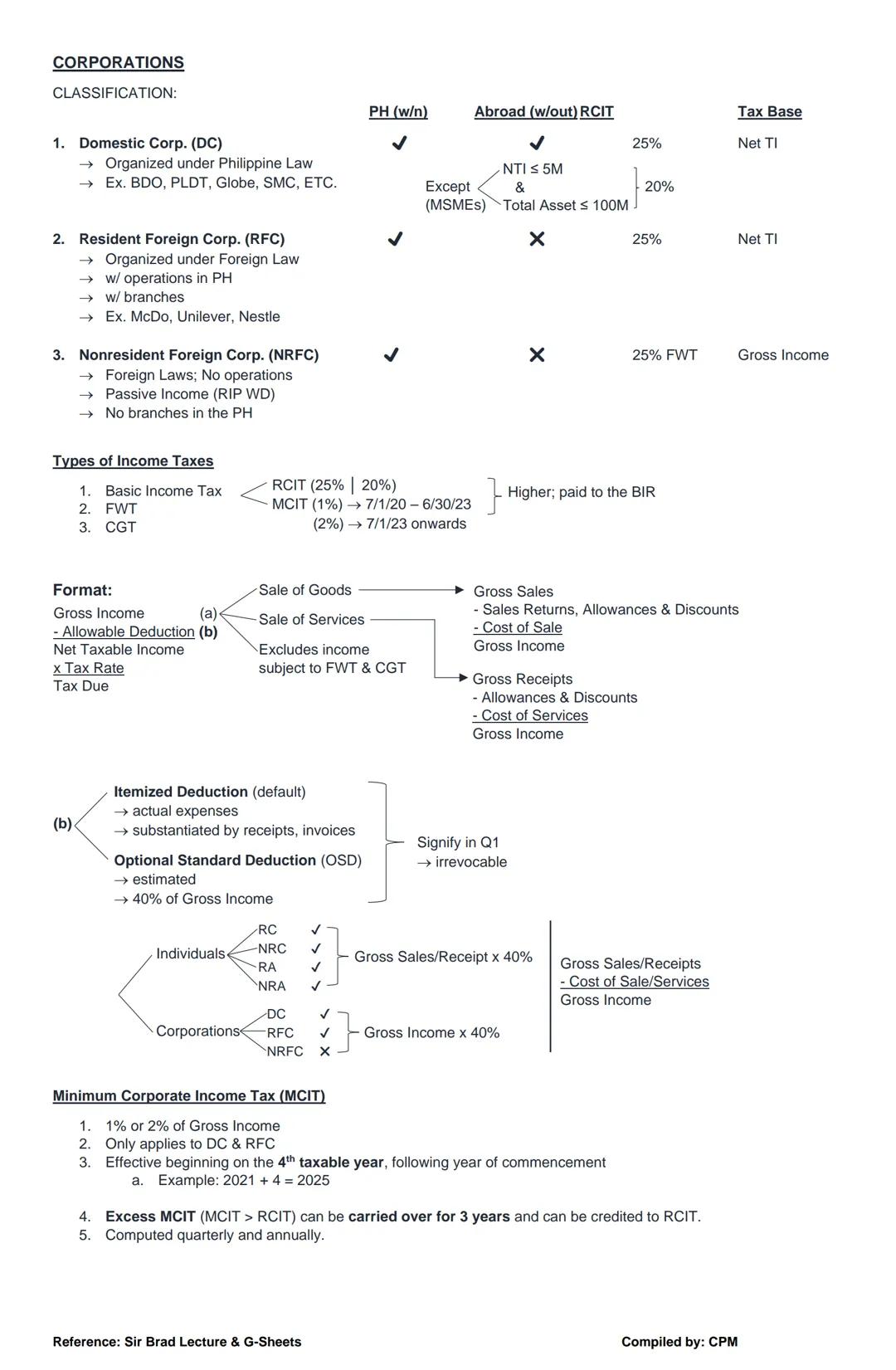

Corporations are classified into three main types under Philippine tax law. Domestic Corporations (DC) are organized under Philippine law, like BDO or PLDT. Resident Foreign Corporations (RFC) are organized under foreign law but operate in the Philippines with local branches, such as McDonald's or Nestle. Nonresident Foreign Corporations (NRFC) are foreign entities with no Philippine operations that earn passive income from Philippine sources.

Corporate income taxes come in three forms: Basic Income Tax, Final Withholding Tax (FWT), and Capital Gains Tax (CGT). The standard calculation format starts with gross income, subtracts allowable deductions to find net taxable income, then applies the appropriate tax rate.

Tax Update: Under CREATE, corporations now generally pay 25% Regular Corporate Income Tax (RCIT), but qualified micro, small, and medium enterprises (MSMEs) with total assets not exceeding ₱100M benefit from a reduced 20% rate.

The Regular Corporate Income Tax (RCIT) applies at 25% (or 20% for qualifying MSMEs) of net taxable income. However, companies must also calculate their Minimum Corporate Income Tax (MCIT), which is 1% of gross income (2% from July 1, 2023 onwards). Whichever amount is higher—RCIT or MCIT—must be paid to the BIR.

For deductions, corporations can choose between Itemized Deductions (actual expenses substantiated by receipts) or Optional Standard Deduction (OSD), which is 40% of gross income. The choice must be indicated in the first quarter filing and is irrevocable for the tax year.

MCIT only applies to domestic and resident foreign corporations beginning their fourth taxable year. If MCIT exceeds RCIT, the excess can be carried over for three years and credited against future RCIT liabilities.

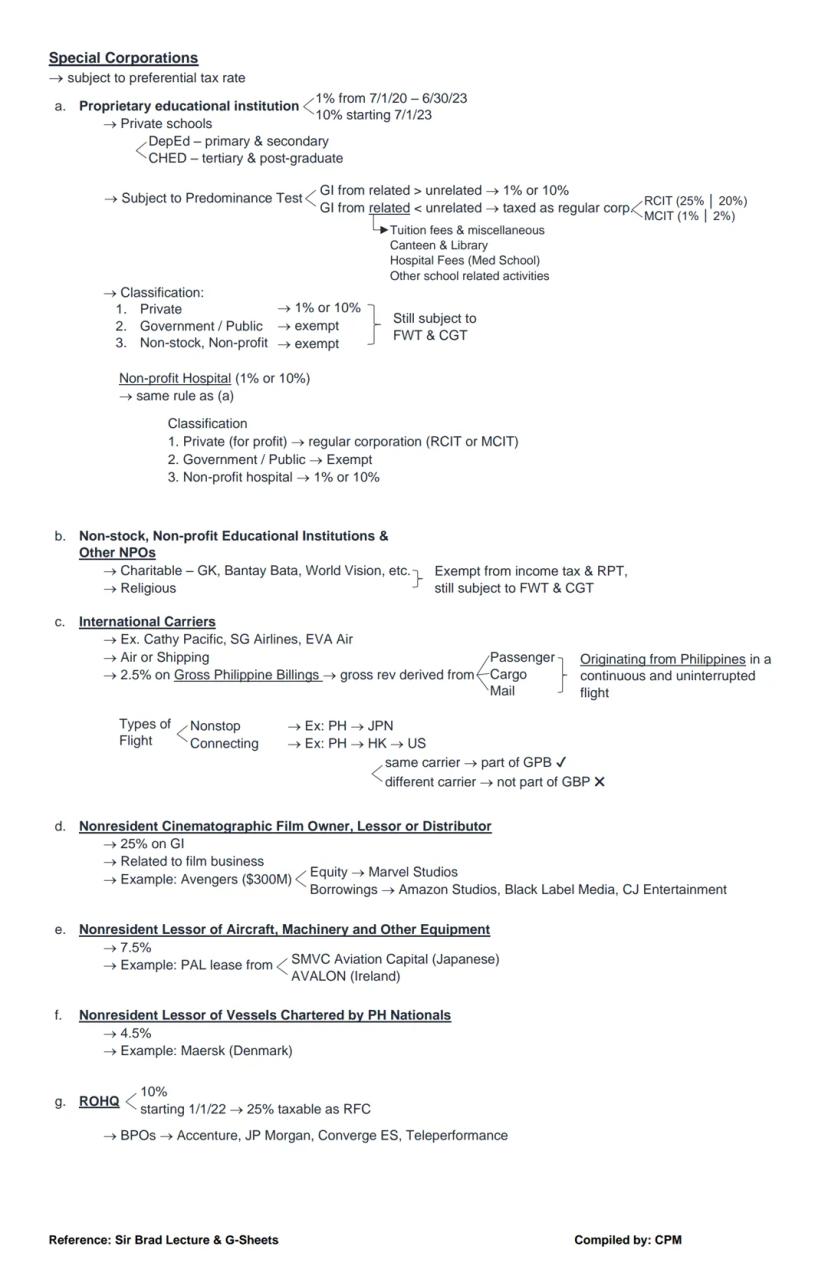

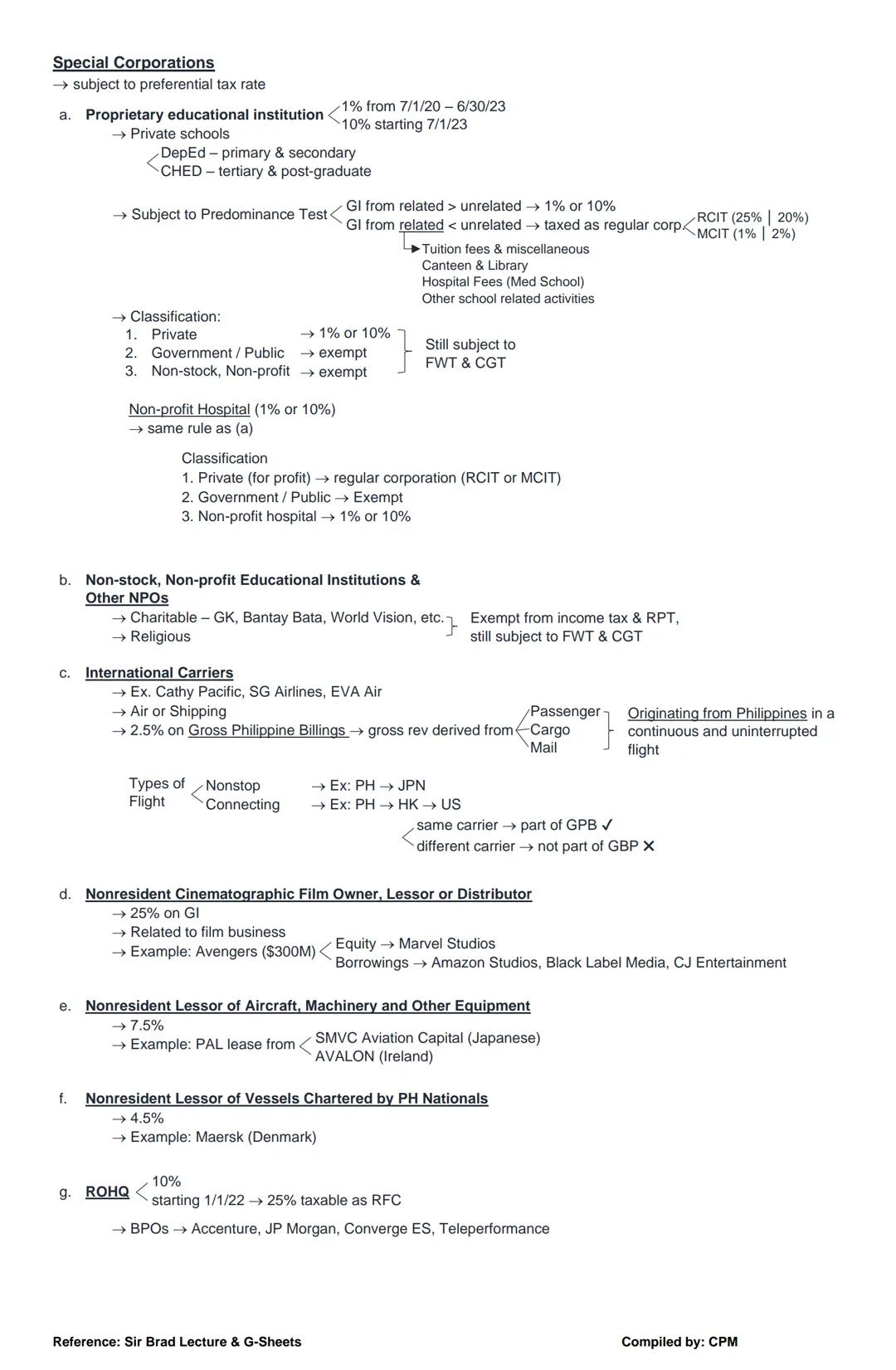

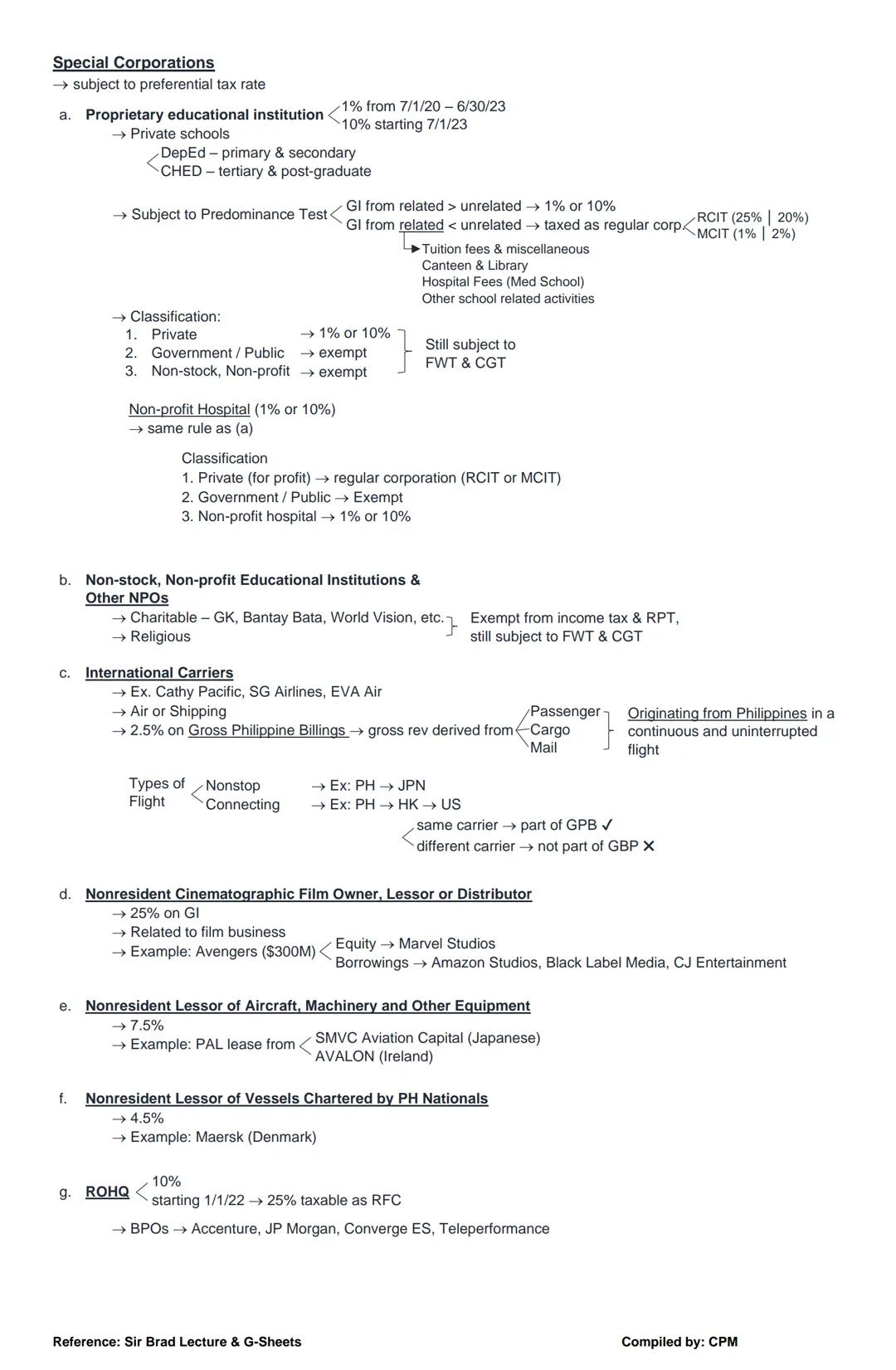

Certain corporations enjoy preferential tax rates under Philippine tax law. Proprietary educational institutions and non-profit hospitals are taxed at only 1% from July 2020 to June 2023, and 10% starting July 2023, provided they pass the predominance test (income from related activities exceeds unrelated income).

The classification of educational institutions affects their tax treatment. Private schools enjoy the preferential rate, government/public schools are fully exempt, and non-stock, non-profit educational institutions are also exempt from income tax but still subject to final withholding tax (FWT) and capital gains tax (CGT).

Tax Alert: Educational institutions must carefully track income sources! If income from unrelated activities exceeds related activities, they lose the preferential rate and are taxed as regular corporations at 25% or 20% RCIT.

International carriers transporting passengers, cargo, or mail on flights originating from the Philippines pay a special 2.5% tax on Gross Philippine Billings. For connecting flights, only portions using the same carrier count toward this tax base.

Foreign film owners and distributors face a 25% tax on gross income related to film business, while non-resident lessors of aircraft and machinery pay 7.5% tax. Non-resident lessors of vessels chartered by Filipino nationals pay a more favorable 4.5% tax.

Regional Operating Headquarters (ROHQs) previously enjoyed a 10% tax rate, but starting January 1, 2022, they're taxed at the regular 25% rate as RFCs. Regional or Area Headquarters that don't generate Philippine income are exempt from income tax, supporting operations like PWC's service delivery centers.

Our AI companion is specifically built for the needs of students. Based on the millions of content pieces we have on the platform we can provide truly meaningful and relevant answers to students. But its not only about answers, the companion is even more about guiding students through their daily learning challenges, with personalised study plans, quizzes or content pieces in the chat and 100% personalisation based on the students skills and developments.

You can download the app in the Google Play Store and in the Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

studywithnessa

@studywithnessa

Taxation is the process by which citizens and businesses contribute funds to the government to finance public services. Through taxes, the government collects revenue to provide essential services like education, infrastructure, and national defense. Understanding the principles and systems of... Show more

Access to all documents

Improve your grades

Join milions of students

Taxation represents a vital connection between citizens and their government. As taxpayers provide revenue, the government uses these funds to deliver public services such as free education, infrastructure, and national defense.

The primary purpose of taxation is to raise revenue, but it serves secondary purposes too. Regulatory taxation helps control certain activities (like sin taxes on alcohol or tobacco), while compensatory taxation aims to reduce social inequality through progressive tax systems.

Several theories explain taxation's importance. The Necessity Theory states that since government existence is necessary, taxation must also be necessary. The Lifeblood Theory asserts that without taxes, the government cannot function. The Benefits-Protection Theory describes the reciprocal relationship where citizens pay taxes and receive government protection in return.

Important Note: Taxation is characterized by being a forced contribution, generally payable in money, levied for public purposes, exclusively imposed by the legislature, within the state's jurisdiction, and proportionate in character.

The three branches of government play distinct roles in taxation. The legislative branch has the inherent power to create tax laws, while the executive branch (through agencies like BIR and BOC) handles administrative functions like assessment and collection. The judiciary interprets tax laws and resolves disputes.

A sound tax system follows three principles: fiscal adequacy (revenue exceeds expenses), equality (based on ability to pay), and administrative feasibility (taxes are reasonable to implement and collect).

Access to all documents

Improve your grades

Join milions of students

Taxation, though powerful, faces important limitations. Inherent limitations include the requirement of public purpose, meaning taxes must benefit the public rather than private interests. The principle of international comity prevents one state from taxing another, while non-delegability restricts who can impose taxes (though administrative functions may be delegated to agencies like BIR or LGUs).

The situs of taxation (or territoriality) principle determines where taxation can occur. Different types of property have different tax situses - for example, real property is taxed where it's located, while income may be taxed based on residence, citizenship, or source.

Constitutional limitations provide further guardrails. The constitution requires due process and equal protection in taxation, ensuring people and properties in similar circumstances are taxed similarly. The progressive system mandates graduated income tax rates based on ability to pay.

Did you know? Religious organizations, educational institutions, and non-profit cemeteries enjoy constitutional tax exemptions on their property.

Other constitutional protections include the prohibition of imprisonment for non-payment of poll tax, the non-impairment of obligations and contracts, and freedom of religious worship. The constitution also mandates that tax exemption laws require a majority vote from Congress.

Beyond taxes, governments may collect other charges including tolls for specific services, penalties for violations, special assessments on land benefiting from public improvements, license fees for privileges, and customs duties on imports and exports.

Access to all documents

Improve your grades

Join milions of students

Taxes can be classified in multiple ways to better understand their application and impact. By subject matter, taxes may be personal (affecting individuals, like cedula), property-based (like real property tax), or excise taxes (on rights and privileges, like income tax).

When categorized by burden, taxes are either direct (where the liable person pays, like income tax) or indirect (where the burden is passed to others, like VAT). By taxing authority, we distinguish between national taxes (income, estate taxes) and local taxes (real property tax).

Taxes may also be classified by amount as specific (based on quantity) or ad valorem (based on percentage of value). By graduation rate, taxes can be proportional (flat rate), progressive (rate increases with tax base), or regressive (rate decreases as tax base increases).

Tax Spotlight: Double taxation occurs when the same taxpayer is taxed twice on the same income or property. Direct double taxation (where all five elements are present) violates constitutional limitations, while indirect double taxation (where at least one element is absent) is permitted.

Several methods exist to escape taxation. Tax evasion (illegal dodging) differs from tax avoidance (legal minimization). Tax shifting legally transfers the tax burden to others, as with VAT. Capitalization occurs when taxes are built into purchase prices, while transformation happens when sellers absorb taxes by improving efficiency.

The primary sources of tax laws include the Constitution, the Tax Code (NIRC with TRAIN and CREATE amendments), Presidential Decrees, tax treaties, court decisions, BIR rulings, and revenue issuances. Local tax ordinances also serve as sources for local taxation.

Access to all documents

Improve your grades

Join milions of students

The Commissioner of Internal Revenue holds extensive powers to ensure effective tax administration. These include interpreting NIRC provisions (subject to review by the Finance Secretary) and making decisions on tax cases that can be appealed to the Court of Tax Appeals.

The Commissioner can obtain information through subpoena power and examine witnesses to enforce tax collection. This authority extends to assessing taxes, prescribing requirements for compliance, and examining tax returns to determine proper tax liability.

When taxpayers fail to issue receipts or maintain accurate records, the Commissioner can prescribe presumptive gross sales. In cases where taxpayers attempt to evade taxes by retiring from business or leaving the Philippines, the Commissioner can terminate the tax period early.

Important: The Commissioner can compromise tax liabilities and inquire into bank deposits in specific situations, such as when determining a decedent's estate or evaluating a taxpayer's claim of financial inability to pay taxes.

Additional powers include accrediting tax agents, refunding or crediting taxes, abating tax liabilities in certain situations, and prescribing additional procedures or requirements. The Commissioner can delegate powers to subordinate officers with rank equivalent to division chief.

The Bureau of Internal Revenue operates through a structured organization headed by the Commissioner who oversees four Deputy Commissioners managing different groups: Legal, Information System, Resource Management, and Operations. The Operations Group supervises 19 Revenue Regional Offices, which in turn oversee 124 Revenue District Offices (RDOs) throughout the country.

Access to all documents

Improve your grades

Join milions of students

The Philippine tax system classifies individual taxpayers based on residence, citizenship, and source of income. Understanding your classification is crucial as it determines what income is taxable and which tax rates apply to you.

Resident Citizens (RC) are Filipino citizens residing in the Philippines who are taxed on both domestic and foreign income. Nonresident Citizens (NRC) include Filipinos physically present abroad (like OFWs) who are taxed only on Philippine-sourced income. An important distinction: if you're abroad for employment on a permanent basis or for at least 183 days, you're considered an NRC.

Resident Aliens (RA) are foreigners staying in the Philippines for extended periods (like exchange students) with no definite intention to leave. By contrast, Non-Resident Aliens may be either Engaged in Trade or Business (ETB) if they stay over 180 days, or Not Engaged in Trade or Business (NETB) if 180 days or less.

Tax Planning Tip: Self-employed professionals with gross sales/receipts not exceeding ₱3M can choose between the tax table rate or the 8% income tax option (in excess of ₱250k). The 8% option often results in lower tax liability!

Your tax treatment also depends on your income source. For employed individuals, compensation income always follows the tax table. For self-employed or professionals, your gross sales/receipts determine your options. If not exceeding ₱3M, you can choose between the tax table or the 8% option. Mixed income earners (those with both compensation and business income) have similar options if their gross sales don't exceed ₱3M.

Remember that business income is subject to both income tax and business tax. If you're non-VAT registered, you'll pay either income tax plus the 3% percentage tax (or 1% during certain COVID relief periods), or 12% VAT if your sales exceed ₱3M.

Access to all documents

Improve your grades

Join milions of students

To qualify for the 8% tax option, you must meet several criteria. You must be subject to the 3% percentage tax (Section 116), be non-VAT registered, not engaged in VAT-exempt transactions, and not subject to taxes under Section 117 onwards. This option must be signified in your first quarter return and is irrevocable for the year.

For quarterly income tax returns, use cumulative computation. Remember that tax due represents your total payable amount, while tax payable is what remains after credits and payments.

Final Withholding Tax (FWT) applies to passive income like interest and dividends. The key characteristic is that it's withheld at source by the payor, and income subject to FWT is excluded from your taxable income for regular tax computation.

Tax Tip: Understanding the difference between withholding tax types can save you money! While FWT is final and excluded from taxable income, creditable withholding taxes can be deducted from your basic income tax due.

Creditable Withholding Tax (CWT) works differently. These amounts (like the 15% withheld on professional fees) become part of your taxable income but can be deducted from your basic income tax when filing your annual return in April.

Capital Gains Tax (CGT) applies to certain capital assets. Sale of unlisted shares is taxed at 15% of the gain, while real property classified as capital asset faces 6% CGT on the highest value among zonal, assessed, or selling price. These transactions are processed separately from your regular income tax.

If you paid taxes abroad, you may claim foreign tax credits. You'll need to determine whether the actual tax paid abroad or the calculated limit based on Philippine tax due is lower, as this becomes your allowable deduction from Philippine income tax.

Access to all documents

Improve your grades

Join milions of students

Minimum Wage Earners (MWEs) enjoy exemption from income tax on their earnings. This applies to private sector employees earning not more than the statutory minimum wage set by the National Wages & Productivity Commission and public sector workers with compensation below the minimum wage in the non-agricultural sector.

The tax exemption covers their basic pay (statutory minimum wage) along with overtime pay, holiday pay, night shift differential, and hazard pay. Additionally, non-taxable benefits up to ₱90,000 are also exempt.

Important: If you're a minimum wage earner, any income beyond your basic pay and specified allowances—such as commissions, honoraria, fringe benefits exceeding ₱90,000, and other taxable income—is still subject to withholding tax.

Various types of income are subject to Final Withholding Tax at different rates. Interest income from bank deposits in Philippine currency faces varying rates depending on the withholding period, while foreign currency deposits under the expanded FCDS have their own rates.

Royalties are taxed differently based on their nature, with varying rates for books/literary works versus other types of royalties. Prizes and winnings also face specific tax treatment—PCSO and lotto winnings up to ₱10,000 are exempt, while larger amounts and other types of winnings face different rates.

Dividends received by individuals from domestic corporations are generally subject to a 10% final tax. However, dividends from foreign corporations require a complex "predominance test" to determine taxability. This test examines whether the ratio of Philippine gross income over worldwide gross income in the preceding three years is at least 50%.

Access to all documents

Improve your grades

Join milions of students

The predominance test determines how foreign dividends are taxed. If at least 50% of a foreign corporation's gross income over the past three years came from Philippine sources, the entire dividend corresponding to that ratio is considered earned inside the Philippines and taxable. If less than 50%, the dividend is considered earned outside the Philippines and not taxable.

Foreign-sourced dividends may qualify for exemption under specific conditions. The funds must be reinvested in Philippine business operations within the next taxable year, used for specific purposes (working capital, capital expenditures, dividend payments, etc.), and the domestic corporation must directly hold at least 20% of the foreign corporation's outstanding shares for a minimum of two years.

Expanded Withholding Tax (EWT) applies to various income payments. Professional fees are subject to different rates based on the recipient's status:

Tax Tip: Keep track of withholding tax certificates for professional services you provide. These will be crucial when filing your annual income tax return to claim credits for taxes already withheld.

Rental payments for real and personal properties face a 5% withholding tax on gross rentals. Payments to certain contractors are subject to 2% withholding on gross payments, while income distributions to estate beneficiaries face 15% withholding.

Income payments to partners of general professional partnerships (GPPs) are subject to 10% withholding if annual income doesn't exceed ₱720k, or 15% if it does. Similarly, income distributions to beneficiaries of estates and trusts face a 15% withholding tax on the distributed amount.

Access to all documents

Improve your grades

Join milions of students

Corporations are classified into three main types under Philippine tax law. Domestic Corporations (DC) are organized under Philippine law, like BDO or PLDT. Resident Foreign Corporations (RFC) are organized under foreign law but operate in the Philippines with local branches, such as McDonald's or Nestle. Nonresident Foreign Corporations (NRFC) are foreign entities with no Philippine operations that earn passive income from Philippine sources.

Corporate income taxes come in three forms: Basic Income Tax, Final Withholding Tax (FWT), and Capital Gains Tax (CGT). The standard calculation format starts with gross income, subtracts allowable deductions to find net taxable income, then applies the appropriate tax rate.

Tax Update: Under CREATE, corporations now generally pay 25% Regular Corporate Income Tax (RCIT), but qualified micro, small, and medium enterprises (MSMEs) with total assets not exceeding ₱100M benefit from a reduced 20% rate.

The Regular Corporate Income Tax (RCIT) applies at 25% (or 20% for qualifying MSMEs) of net taxable income. However, companies must also calculate their Minimum Corporate Income Tax (MCIT), which is 1% of gross income (2% from July 1, 2023 onwards). Whichever amount is higher—RCIT or MCIT—must be paid to the BIR.

For deductions, corporations can choose between Itemized Deductions (actual expenses substantiated by receipts) or Optional Standard Deduction (OSD), which is 40% of gross income. The choice must be indicated in the first quarter filing and is irrevocable for the tax year.

MCIT only applies to domestic and resident foreign corporations beginning their fourth taxable year. If MCIT exceeds RCIT, the excess can be carried over for three years and credited against future RCIT liabilities.

Access to all documents

Improve your grades

Join milions of students

Certain corporations enjoy preferential tax rates under Philippine tax law. Proprietary educational institutions and non-profit hospitals are taxed at only 1% from July 2020 to June 2023, and 10% starting July 2023, provided they pass the predominance test (income from related activities exceeds unrelated income).

The classification of educational institutions affects their tax treatment. Private schools enjoy the preferential rate, government/public schools are fully exempt, and non-stock, non-profit educational institutions are also exempt from income tax but still subject to final withholding tax (FWT) and capital gains tax (CGT).

Tax Alert: Educational institutions must carefully track income sources! If income from unrelated activities exceeds related activities, they lose the preferential rate and are taxed as regular corporations at 25% or 20% RCIT.

International carriers transporting passengers, cargo, or mail on flights originating from the Philippines pay a special 2.5% tax on Gross Philippine Billings. For connecting flights, only portions using the same carrier count toward this tax base.

Foreign film owners and distributors face a 25% tax on gross income related to film business, while non-resident lessors of aircraft and machinery pay 7.5% tax. Non-resident lessors of vessels chartered by Filipino nationals pay a more favorable 4.5% tax.

Regional Operating Headquarters (ROHQs) previously enjoyed a 10% tax rate, but starting January 1, 2022, they're taxed at the regular 25% rate as RFCs. Regional or Area Headquarters that don't generate Philippine income are exempt from income tax, supporting operations like PWC's service delivery centers.

Our AI companion is specifically built for the needs of students. Based on the millions of content pieces we have on the platform we can provide truly meaningful and relevant answers to students. But its not only about answers, the companion is even more about guiding students through their daily learning challenges, with personalised study plans, quizzes or content pieces in the chat and 100% personalisation based on the students skills and developments.

You can download the app in the Google Play Store and in the Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

16

Smart Tools NEW

Transform this note into: ✓ 50+ Practice Questions ✓ Interactive Flashcards ✓ Full Practice Test ✓ Essay Outlines

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user