The accounting cycle is the backbone of financial reporting for... Show more

Sign up to see the contentIt's free!

Access to all documents

Improve your grades

Join milions of students

Subjects

Triangle Congruence and Similarity Theorems

Triangle Properties and Classification

Linear Equations and Graphs

Geometric Angle Relationships

Trigonometric Functions and Identities

Equation Solving Techniques

Circle Geometry Fundamentals

Division Operations and Methods

Basic Differentiation Rules

Exponent and Logarithm Properties

Show all topics

Human Organ Systems

Reproductive Cell Cycles

Biological Sciences Subdisciplines

Cellular Energy Metabolism

Autotrophic Energy Processes

Inheritance Patterns and Principles

Biomolecular Structure and Organization

Cell Cycle and Division Mechanics

Cellular Organization and Development

Biological Structural Organization

Show all topics

Chemical Sciences and Applications

Atomic Structure and Composition

Molecular Electron Structure Representation

Atomic Electron Behavior

Matter Properties and Water

Mole Concept and Calculations

Gas Laws and Behavior

Periodic Table Organization

Chemical Thermodynamics Fundamentals

Chemical Bond Types and Properties

Show all topics

European Renaissance and Enlightenment

European Cultural Movements 800-1920

American Revolution Era 1763-1797

American Civil War 1861-1865

Global Imperial Systems

Mongol and Chinese Dynasties

U.S. Presidents and World Leaders

Historical Sources and Documentation

World Wars Era and Impact

World Religious Systems

Show all topics

Classic and Contemporary Novels

Literary Character Analysis

Rhetorical Theory and Practice

Classic Literary Narratives

Reading Analysis and Interpretation

Narrative Structure and Techniques

English Language Components

Influential English-Language Authors

Basic Sentence Structure

Narrative Voice and Perspective

Show all topics

44

•

Feb 12, 2026

•

mier jsro

@mierjsro

The accounting cycle is the backbone of financial reporting for... Show more

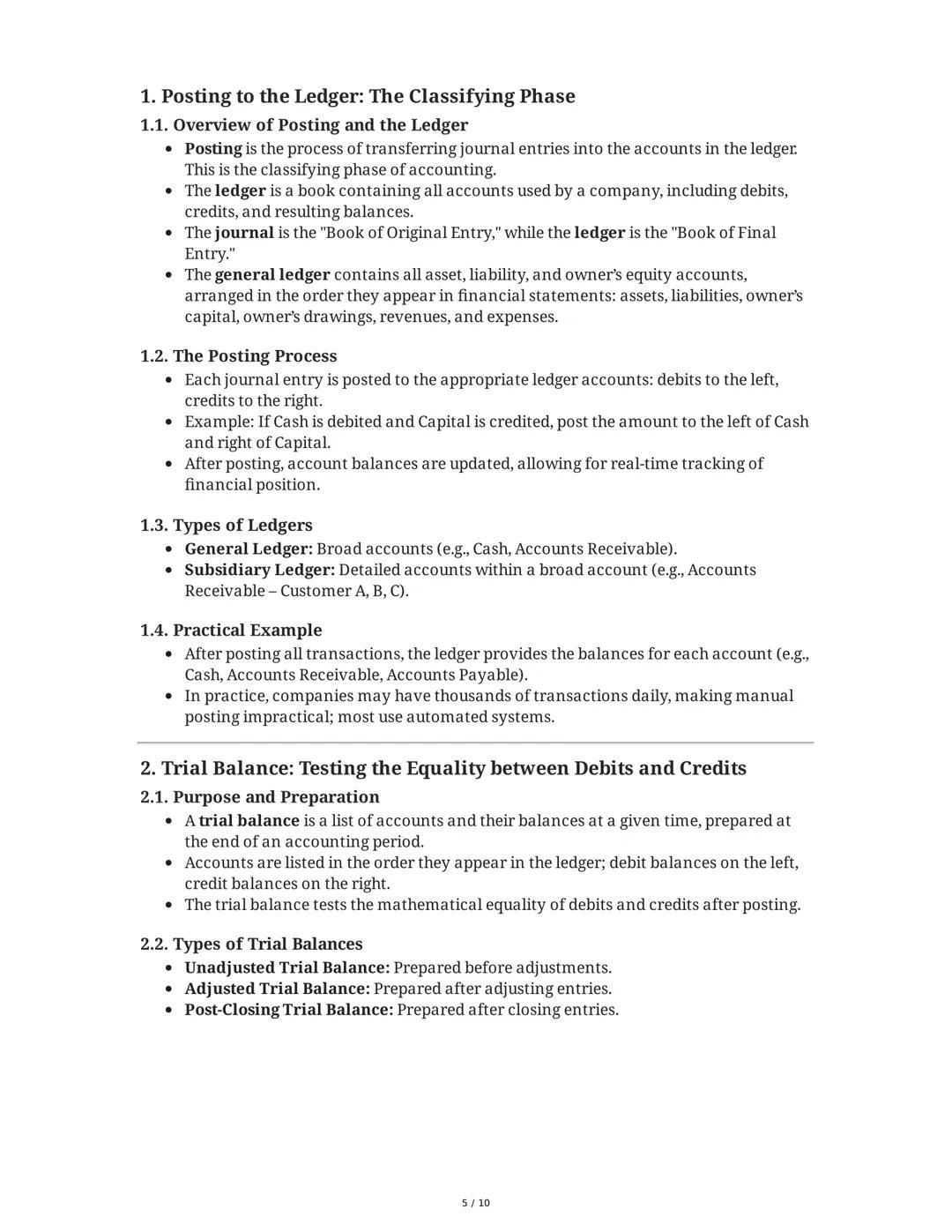

Ever wonder how businesses keep track of thousands of transactions? The answer lies in posting to the ledger. Posting is the process of transferring journal entries to accounts in the ledger, organizing financial data by category.

The general ledger is like a master filing system containing all accounts a company uses. Think of the journal as the "Book of Original Entry" where transactions are first recorded, while the ledger is the "Book of Final Entry" where information gets classified. Accounts in the ledger follow a specific order: assets, liabilities, owner's capital, owner's drawings, revenues, and expenses.

During posting, debits go on the left side of accounts and credits on the right. For example, if you record a $500 cash deposit with a debit to Cash and credit to Capital, you'd put $500 on the left side of the Cash account and $500 on the right side of the Capital account. After posting all transactions, the ledger gives you up-to-date balances for each account.

Quick Tip: Most businesses today use accounting software that automatically posts journal entries to the ledger, saving tremendous time and reducing errors!

A trial balance is like a quick math check to ensure your accounting equation stays balanced. It lists all accounts with their balances - debit balances on the left, credit balances on the right - and confirms that total debits equal total credits.

Don't be fooled by a balanced trial balance, though. It only checks for mathematical equality, not accuracy. Common errors that won't show up include omitted transactions, duplicate recordings, or using incorrect accounts within the same classification (like debiting the wrong expense account).

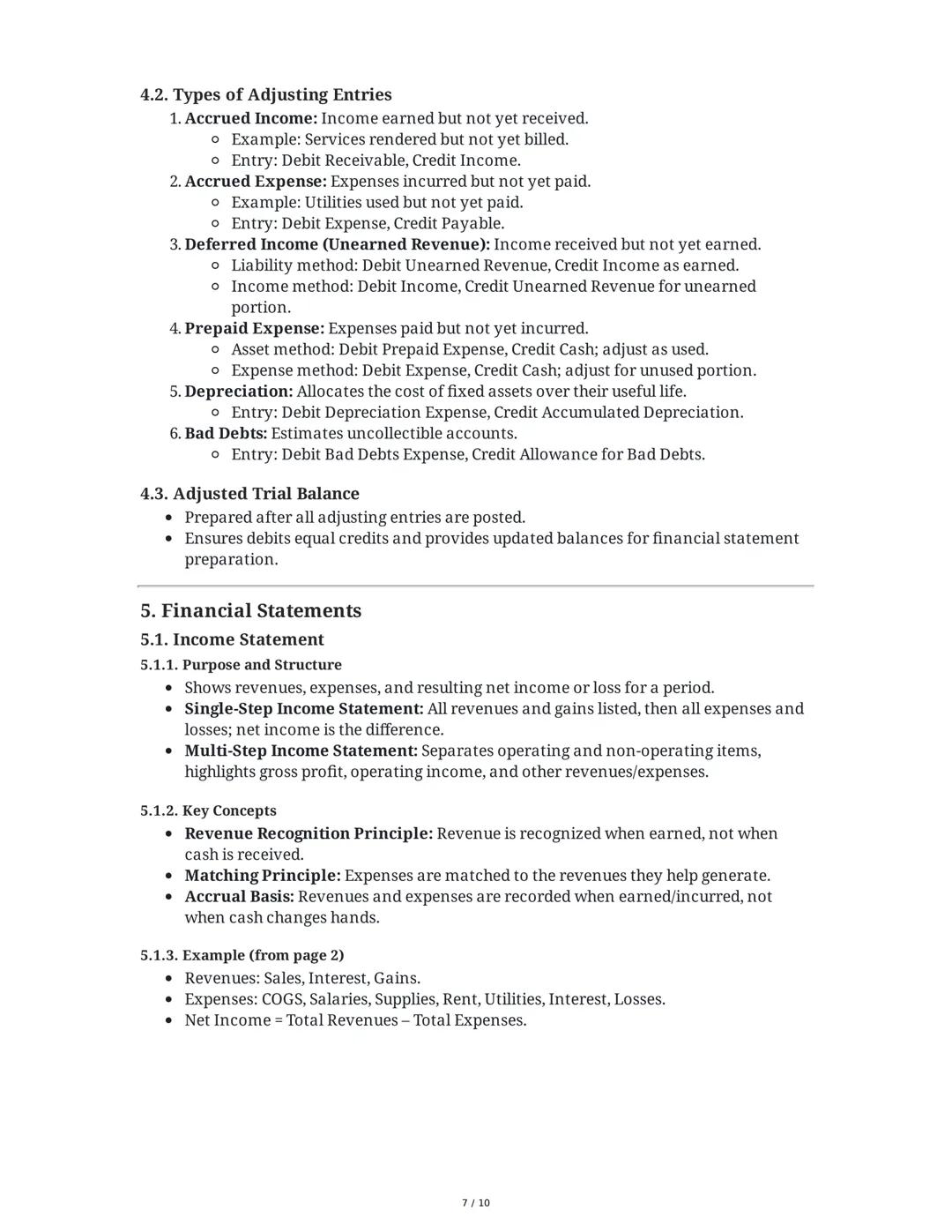

Adjusting entries are crucial for accurate financial reporting. They update accounts based on two important principles: the accrual concept (recognizing income when earned and expenses when incurred) and the matching principle (matching expenses with the revenues they help generate).

Several types of adjusting entries include:

After adjusting entries are posted, an adjusted trial balance is prepared as the foundation for creating financial statements.

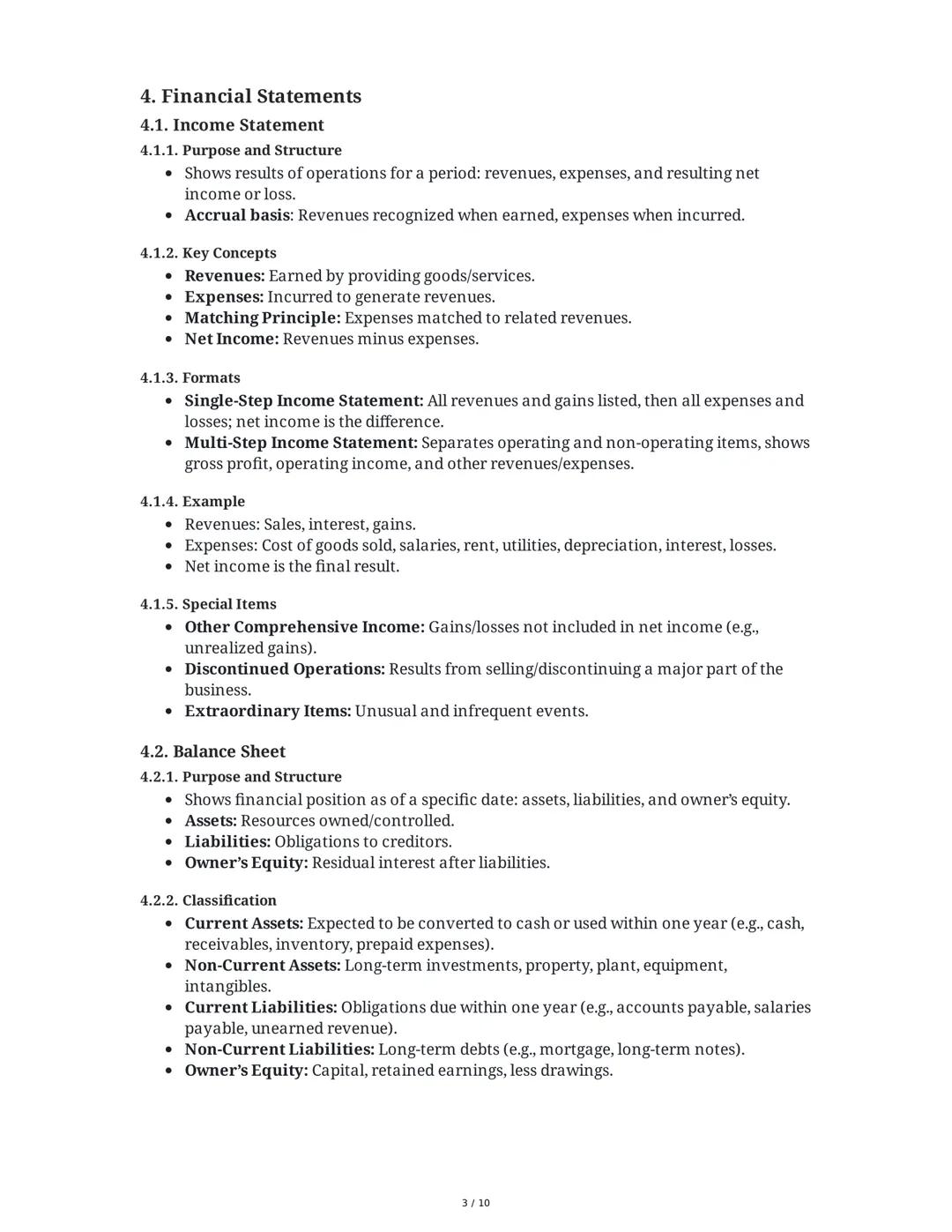

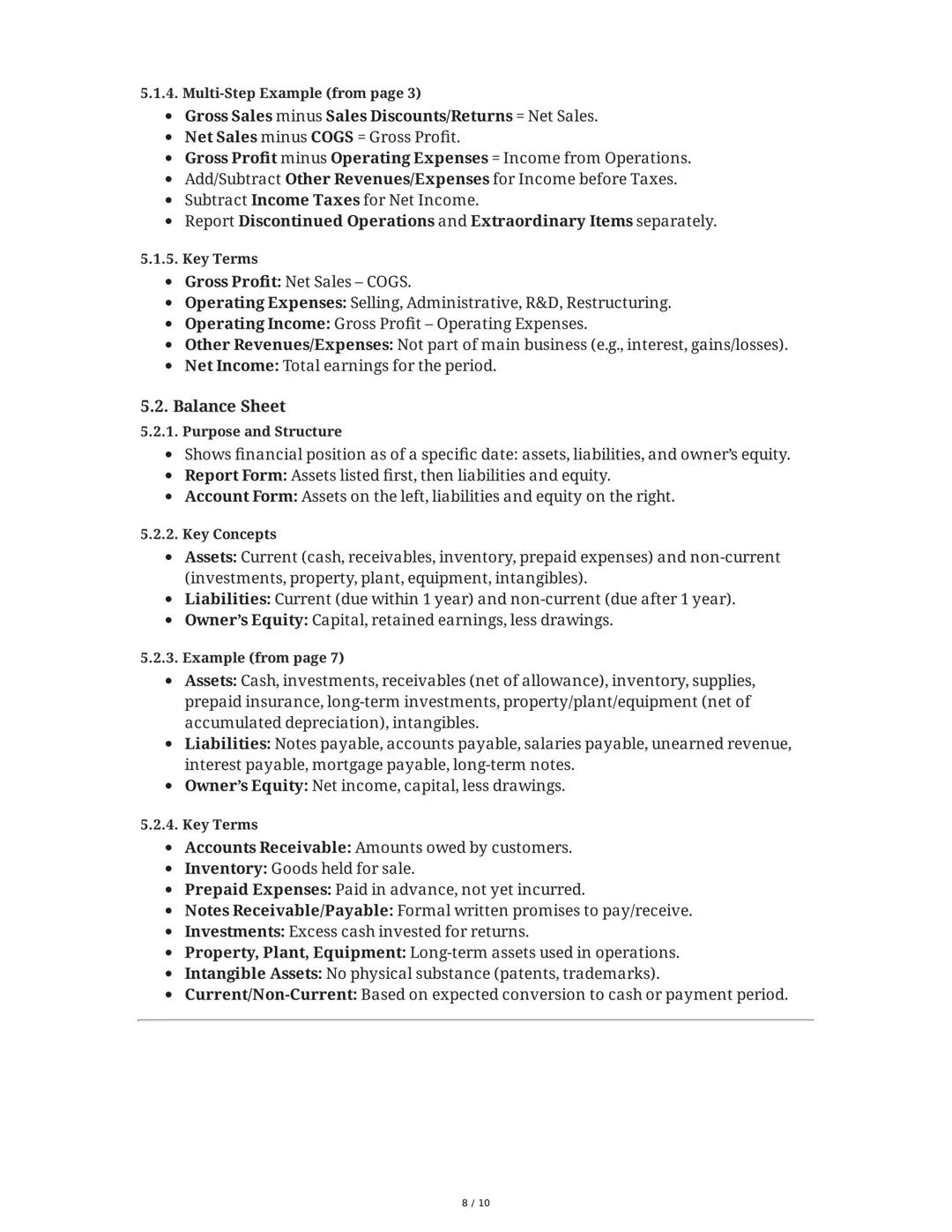

Financial statements translate all your accounting work into information people can actually use! The income statement (sometimes called a profit and loss statement) shows how much money a business made or lost over a specific period.

Income statements follow the basic formula: Revenues - Expenses = Net Income. They're based on the accrual basis of accounting, which means revenues appear when earned and expenses when incurred, regardless of when cash changes hands.

There are two main formats for income statements. A single-step income statement simply lists all revenues, then all expenses, and calculates the difference. The more detailed multi-step income statement separates operating items (main business activities) from non-operating items and shows useful subtotals like gross profit and operating income.

The balance sheet complements the income statement by showing a company's financial position at a specific moment. It's organized into three sections: assets (resources owned), liabilities (obligations owed), and owner's equity (the owner's claim after liabilities).

Remember This: The income statement answers "How profitable was the business?" while the balance sheet answers "What does the business own and owe?"

The balance sheet follows the fundamental accounting equation: Assets = Liabilities + Owner's Equity. It can be presented in two formats: report form (assets first, then liabilities and equity) or account form (assets on left, liabilities and equity on right).

Balance sheets classify items as either current or non-current. Current assets will convert to cash within one year (like cash, receivables, inventory), while non-current assets are long-term (like buildings, equipment, patents). Similarly, current liabilities are due within a year, while non-current liabilities extend beyond that timeframe.

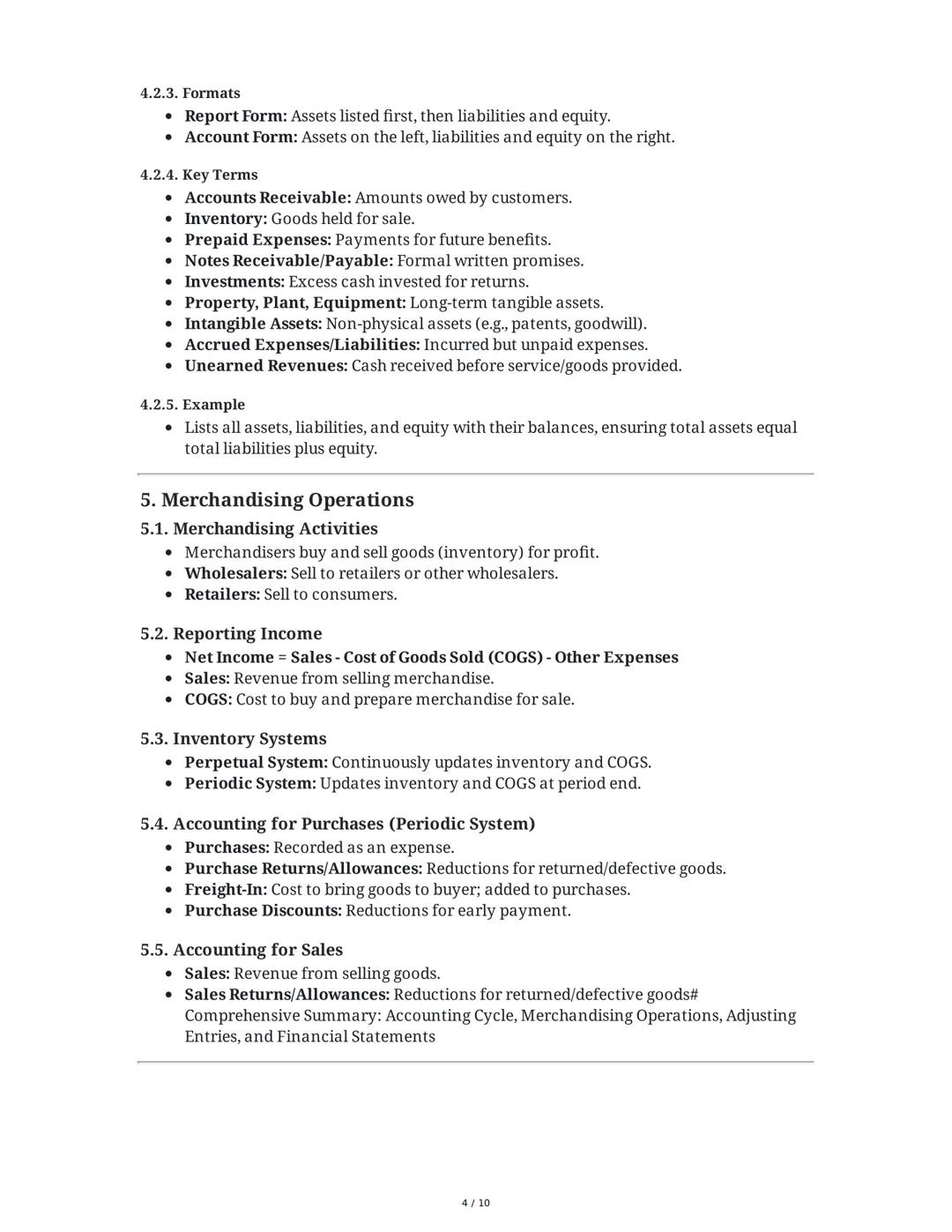

Merchandising operations involve businesses that buy and sell inventory. Unlike service businesses, merchandisers have a key expense called Cost of Goods Sold (COGS) - the cost of inventory sold to customers. Their income formula becomes: Sales - COGS - Other Expenses = Net Income.

Merchandisers use one of two inventory systems:

When accounting for purchases, businesses track not just the base cost but also purchase returns/allowances (reductions for returns), freight-in (shipping costs), and purchase discounts (savings for early payment).

Posting transactions keeps your ledger current and organized. When journalizing, you record events chronologically, but posting classifies them by account type. For example, all cash transactions (both increases and decreases) appear together in the Cash account after posting.

The general ledger contains broad accounts while subsidiary ledgers provide detailed breakdowns. For instance, the Accounts Receivable subsidiary ledger might have separate accounts for each customer who owes you money.

After posting all transactions, balances in each account are calculated. For accounts with normal debit balances (assets, expenses, drawings), subtract total credits from total debits. For accounts with normal credit balances (liabilities, revenue, capital), subtract total debits from total credits.

Creating a trial balance is straightforward:

The trial balance serves three important purposes: it checks the equality of debits and credits, provides account balances in one place, and helps identify errors before preparing financial statements.

Study Hack: If your trial balance doesn't balance, calculate the difference between columns. If it's divisible by 9, you might have transposed digits (like writing $95 as $59) or shifted a decimal point!

Merchandising businesses focus on buying and selling goods for profit. Wholesalers sell to other businesses, while retailers sell directly to consumers. Both calculate profit using the formula: Net Income = Sales - COGS - Operating Expenses.

The way businesses track inventory significantly impacts their accounting:

In a periodic system:

In a perpetual system:

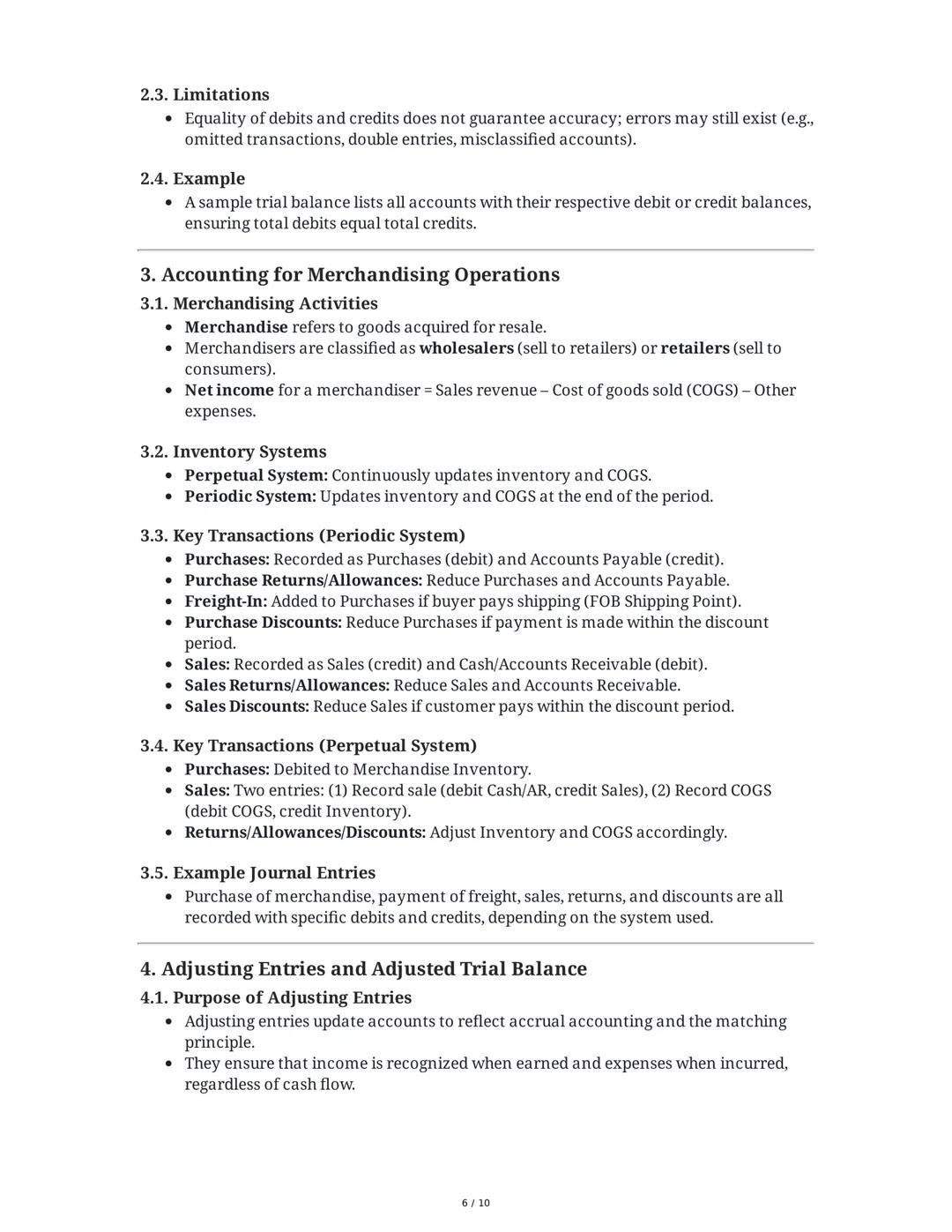

Adjusting entries ensure your financial statements reflect economic reality. They implement the accrual basis of accounting by making sure revenues and expenses are recorded in the proper period.

For example, if you've earned $500 in interest that hasn't been received yet, you'd debit Interest Receivable $500 and credit Interest Revenue $500. Or if employees worked $3,000 worth of hours that haven't been paid yet, you'd debit Salaries Expense $3,000 and credit Salaries Payable $3,000.

After all adjusting entries are posted, you create an adjusted trial balance that forms the basis for your financial statements.

Adjusting entries fall into several categories that address different timing issues:

Accrued Income: When you've earned revenue but haven't received payment. For example, if you've completed work but haven't billed the client, you'd debit Accounts Receivable and credit Service Revenue.

Accrued Expenses: When you've incurred expenses but haven't paid for them yet. For instance, if you've used electricity but haven't received the bill, you'd debit Utilities Expense and credit Utilities Payable.

Deferred Income: When customers pay you before you deliver services. Initially recorded as a liability (Unearned Revenue), you gradually recognize revenue as you provide the service.

Prepaid Expenses: When you pay for benefits before using them. These start as assets (like Prepaid Insurance) and become expenses as you use them up.

Depreciation: Allocates the cost of long-term assets over their useful lives, reflecting their gradual consumption. You debit Depreciation Expense and credit Accumulated Depreciation.

Bad Debts: Estimates uncollectible accounts receivable. You debit Bad Debts Expense and credit Allowance for Bad Debts.

The income statement comes in two formats:

Real-World Relevance: Businesses prefer multi-step income statements because they show which parts of the business are performing well or poorly, making it easier to identify improvement areas!

A multi-step income statement provides a detailed breakdown of a company's performance. It starts with gross sales minus returns and discounts to get net sales. Subtracting cost of goods sold gives you gross profit - the profit from just buying and selling merchandise before considering operating costs.

After subtracting operating expenses (like salaries, rent, and advertising), you get operating income - profit from normal business activities. Then you add or subtract other revenues/expenses to find income before taxes. Finally, after subtracting income taxes, you arrive at net income - the bottom line.

The balance sheet provides a snapshot of what a business owns and owes at a specific moment. Assets typically appear in order of liquidity (how quickly they can be converted to cash):

Liabilities are listed by when they're due:

Owner's equity shows the owner's claim to business assets after all liabilities are paid.

Remember the fundamental accounting equation must always balance: Assets = Liabilities + Owner's Equity.

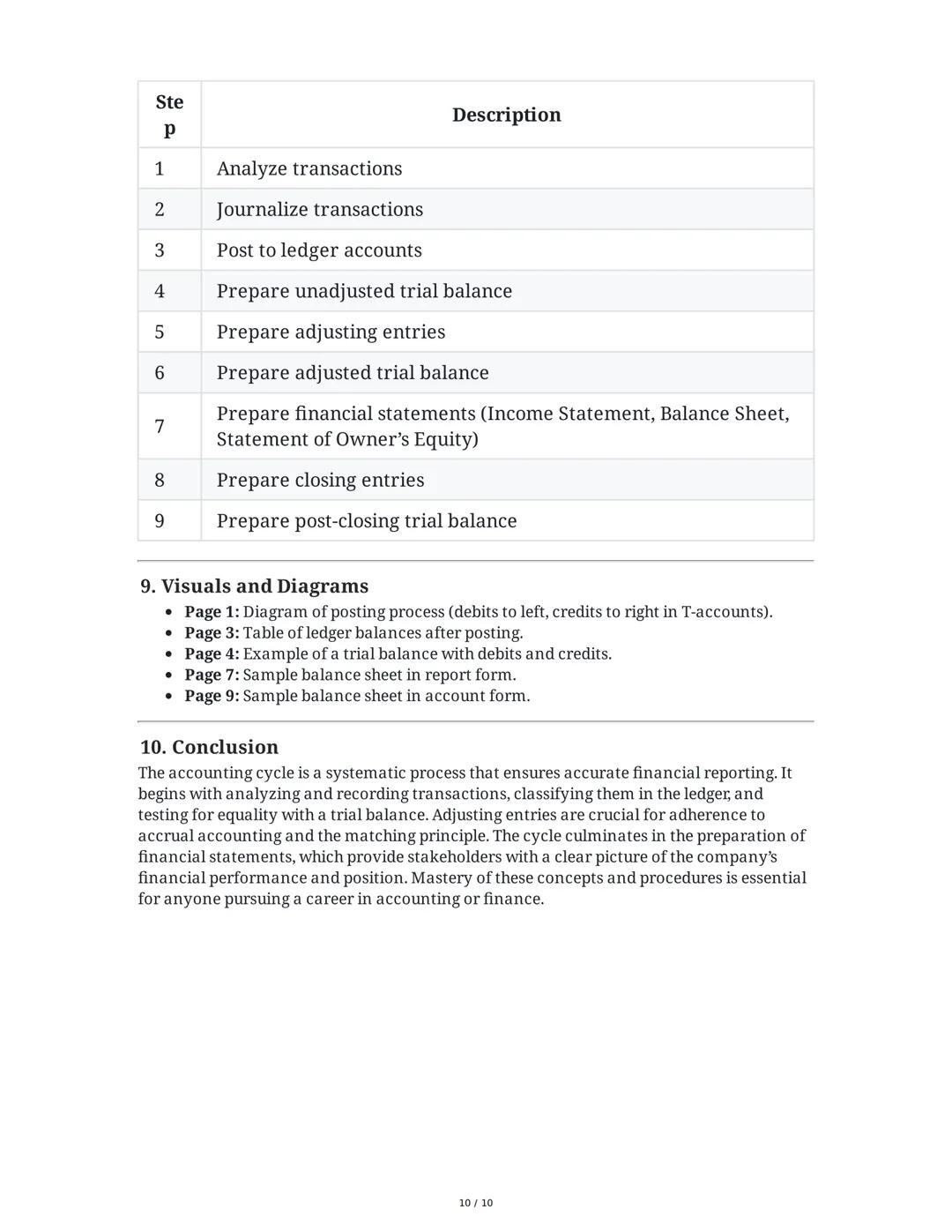

The accounting cycle is a step-by-step process that businesses follow each accounting period. Mastering these steps helps you understand how raw financial data transforms into meaningful reports:

Several key accounting principles guide this process:

Accrual vs. Cash Basis: The accrual basis recognizes revenues and expenses when earned/incurred, regardless of cash flow. The simpler cash basis only recognizes transactions when cash changes hands.

Matching Principle: Expenses should be recognized in the same period as the revenues they help generate.

Revenue Recognition Principle: Revenue is recorded when earned , not necessarily when payment is received.

Historical Cost Principle: Assets are typically recorded at their original purchase price, not their current market value.

Career Connection: Understanding the accounting cycle gives you valuable skills for business, whether you become an accountant or just need to understand financial reports in any career!

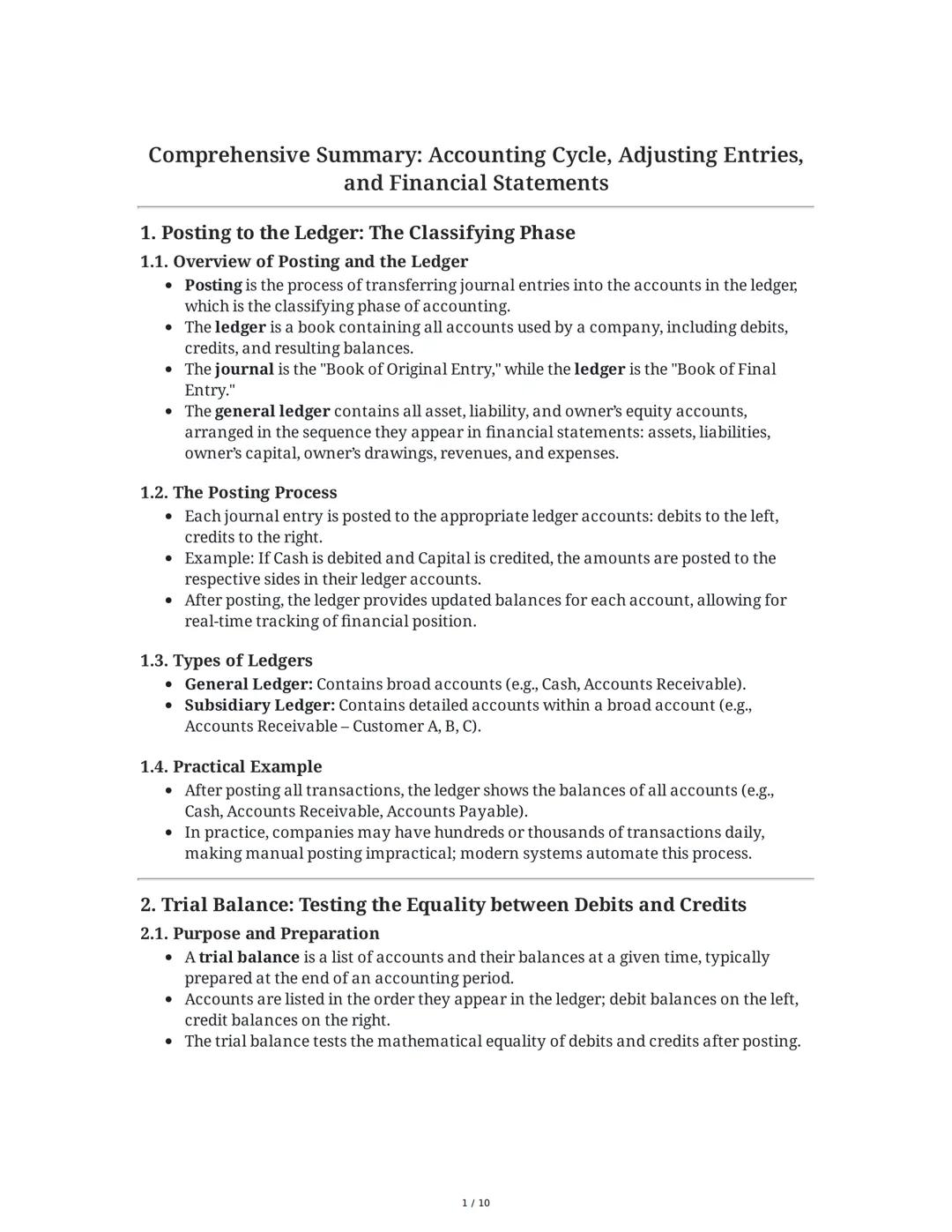

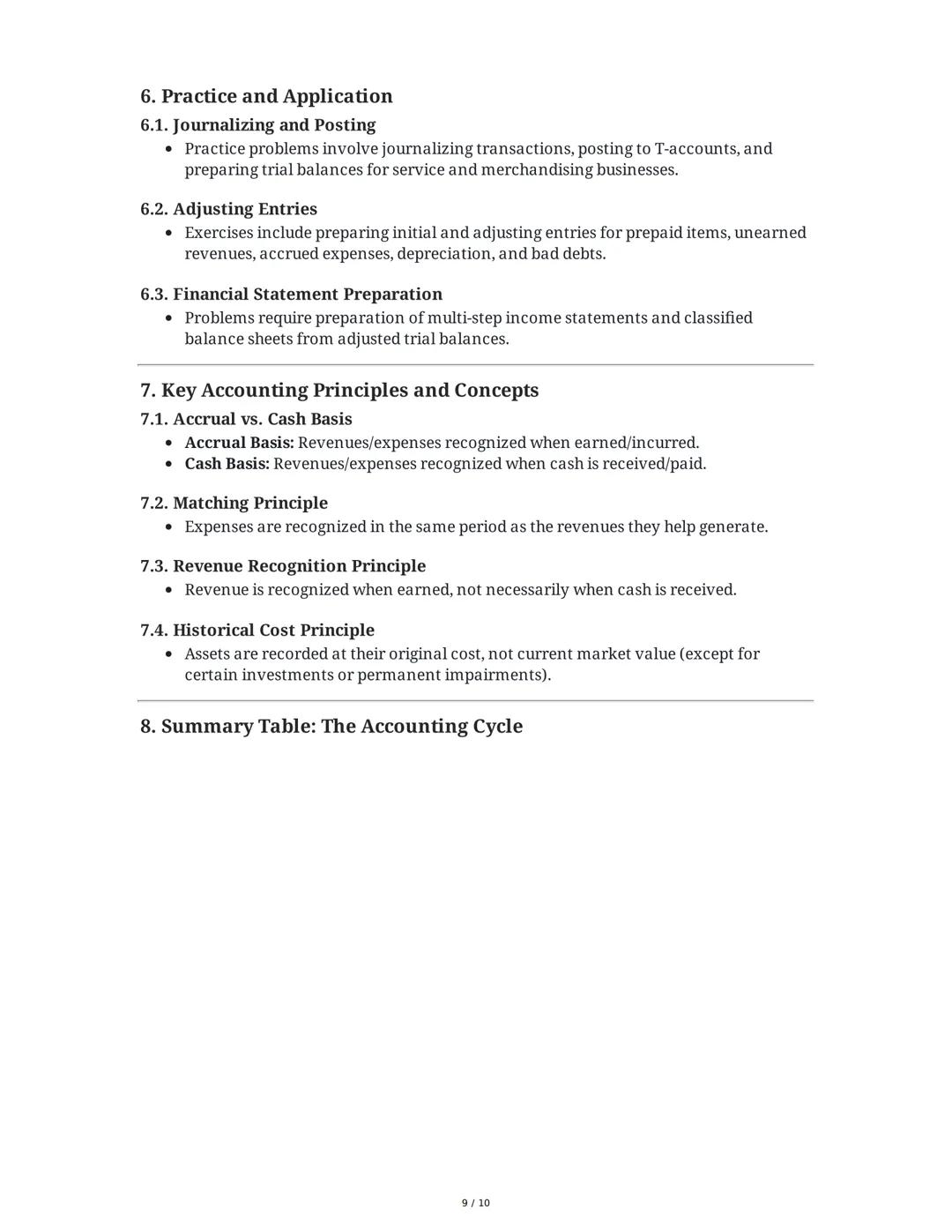

The accounting cycle is a systematic sequence that transforms financial events into useful information. Here's a clear breakdown of each step:

Analyze transactions: Identify business events with financial impact and determine which accounts are affected.

Journalize transactions: Record events chronologically in the journal with appropriate debits and credits.

Post to ledger: Transfer journal information to individual accounts in the ledger to track each account's balance.

Prepare unadjusted trial balance: List all accounts with their balances to verify debit/credit equality before adjustments.

Prepare adjusting entries: Record end-of-period adjustments to recognize revenues/expenses in the proper period.

Prepare adjusted trial balance: Create an updated list of accounts after adjustments to verify equality.

Prepare financial statements: Create the income statement, balance sheet, and statement of owner's equity from the adjusted trial balance.

Prepare closing entries: Reset revenue, expense, and drawing accounts to zero for the next period.

Prepare post-closing trial balance: Final check to ensure debits equal credits after closing.

Visuals like T-account diagrams, sample trial balances, and example financial statements help reinforce these concepts. Remember that while small businesses might complete this cycle manually, most companies use accounting software that automates many steps, reducing errors and saving time.

The accounting cycle isn't just a procedure - it's the foundation for reliable financial reporting that helps businesses make informed decisions, satisfy legal requirements, and communicate with stakeholders.

Our AI companion is specifically built for the needs of students. Based on the millions of content pieces we have on the platform we can provide truly meaningful and relevant answers to students. But its not only about answers, the companion is even more about guiding students through their daily learning challenges, with personalised study plans, quizzes or content pieces in the chat and 100% personalisation based on the students skills and developments.

You can download the app in the Google Play Store and in the Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

mier jsro

@mierjsro

The accounting cycle is the backbone of financial reporting for every business. It takes raw transaction data and transforms it into meaningful financial statements through a systematic process. Understanding this cycle helps you see how businesses track money, measure performance,... Show more

Access to all documents

Improve your grades

Join milions of students

Ever wonder how businesses keep track of thousands of transactions? The answer lies in posting to the ledger. Posting is the process of transferring journal entries to accounts in the ledger, organizing financial data by category.

The general ledger is like a master filing system containing all accounts a company uses. Think of the journal as the "Book of Original Entry" where transactions are first recorded, while the ledger is the "Book of Final Entry" where information gets classified. Accounts in the ledger follow a specific order: assets, liabilities, owner's capital, owner's drawings, revenues, and expenses.

During posting, debits go on the left side of accounts and credits on the right. For example, if you record a $500 cash deposit with a debit to Cash and credit to Capital, you'd put $500 on the left side of the Cash account and $500 on the right side of the Capital account. After posting all transactions, the ledger gives you up-to-date balances for each account.

Quick Tip: Most businesses today use accounting software that automatically posts journal entries to the ledger, saving tremendous time and reducing errors!

Access to all documents

Improve your grades

Join milions of students

A trial balance is like a quick math check to ensure your accounting equation stays balanced. It lists all accounts with their balances - debit balances on the left, credit balances on the right - and confirms that total debits equal total credits.

Don't be fooled by a balanced trial balance, though. It only checks for mathematical equality, not accuracy. Common errors that won't show up include omitted transactions, duplicate recordings, or using incorrect accounts within the same classification (like debiting the wrong expense account).

Adjusting entries are crucial for accurate financial reporting. They update accounts based on two important principles: the accrual concept (recognizing income when earned and expenses when incurred) and the matching principle (matching expenses with the revenues they help generate).

Several types of adjusting entries include:

After adjusting entries are posted, an adjusted trial balance is prepared as the foundation for creating financial statements.

Access to all documents

Improve your grades

Join milions of students

Financial statements translate all your accounting work into information people can actually use! The income statement (sometimes called a profit and loss statement) shows how much money a business made or lost over a specific period.

Income statements follow the basic formula: Revenues - Expenses = Net Income. They're based on the accrual basis of accounting, which means revenues appear when earned and expenses when incurred, regardless of when cash changes hands.

There are two main formats for income statements. A single-step income statement simply lists all revenues, then all expenses, and calculates the difference. The more detailed multi-step income statement separates operating items (main business activities) from non-operating items and shows useful subtotals like gross profit and operating income.

The balance sheet complements the income statement by showing a company's financial position at a specific moment. It's organized into three sections: assets (resources owned), liabilities (obligations owed), and owner's equity (the owner's claim after liabilities).

Remember This: The income statement answers "How profitable was the business?" while the balance sheet answers "What does the business own and owe?"

Access to all documents

Improve your grades

Join milions of students

The balance sheet follows the fundamental accounting equation: Assets = Liabilities + Owner's Equity. It can be presented in two formats: report form (assets first, then liabilities and equity) or account form (assets on left, liabilities and equity on right).

Balance sheets classify items as either current or non-current. Current assets will convert to cash within one year (like cash, receivables, inventory), while non-current assets are long-term (like buildings, equipment, patents). Similarly, current liabilities are due within a year, while non-current liabilities extend beyond that timeframe.

Merchandising operations involve businesses that buy and sell inventory. Unlike service businesses, merchandisers have a key expense called Cost of Goods Sold (COGS) - the cost of inventory sold to customers. Their income formula becomes: Sales - COGS - Other Expenses = Net Income.

Merchandisers use one of two inventory systems:

When accounting for purchases, businesses track not just the base cost but also purchase returns/allowances (reductions for returns), freight-in (shipping costs), and purchase discounts (savings for early payment).

Access to all documents

Improve your grades

Join milions of students

Posting transactions keeps your ledger current and organized. When journalizing, you record events chronologically, but posting classifies them by account type. For example, all cash transactions (both increases and decreases) appear together in the Cash account after posting.

The general ledger contains broad accounts while subsidiary ledgers provide detailed breakdowns. For instance, the Accounts Receivable subsidiary ledger might have separate accounts for each customer who owes you money.

After posting all transactions, balances in each account are calculated. For accounts with normal debit balances (assets, expenses, drawings), subtract total credits from total debits. For accounts with normal credit balances (liabilities, revenue, capital), subtract total debits from total credits.

Creating a trial balance is straightforward:

The trial balance serves three important purposes: it checks the equality of debits and credits, provides account balances in one place, and helps identify errors before preparing financial statements.

Study Hack: If your trial balance doesn't balance, calculate the difference between columns. If it's divisible by 9, you might have transposed digits (like writing $95 as $59) or shifted a decimal point!

Access to all documents

Improve your grades

Join milions of students

Merchandising businesses focus on buying and selling goods for profit. Wholesalers sell to other businesses, while retailers sell directly to consumers. Both calculate profit using the formula: Net Income = Sales - COGS - Operating Expenses.

The way businesses track inventory significantly impacts their accounting:

In a periodic system:

In a perpetual system:

Adjusting entries ensure your financial statements reflect economic reality. They implement the accrual basis of accounting by making sure revenues and expenses are recorded in the proper period.

For example, if you've earned $500 in interest that hasn't been received yet, you'd debit Interest Receivable $500 and credit Interest Revenue $500. Or if employees worked $3,000 worth of hours that haven't been paid yet, you'd debit Salaries Expense $3,000 and credit Salaries Payable $3,000.

After all adjusting entries are posted, you create an adjusted trial balance that forms the basis for your financial statements.

Access to all documents

Improve your grades

Join milions of students

Adjusting entries fall into several categories that address different timing issues:

Accrued Income: When you've earned revenue but haven't received payment. For example, if you've completed work but haven't billed the client, you'd debit Accounts Receivable and credit Service Revenue.

Accrued Expenses: When you've incurred expenses but haven't paid for them yet. For instance, if you've used electricity but haven't received the bill, you'd debit Utilities Expense and credit Utilities Payable.

Deferred Income: When customers pay you before you deliver services. Initially recorded as a liability (Unearned Revenue), you gradually recognize revenue as you provide the service.

Prepaid Expenses: When you pay for benefits before using them. These start as assets (like Prepaid Insurance) and become expenses as you use them up.

Depreciation: Allocates the cost of long-term assets over their useful lives, reflecting their gradual consumption. You debit Depreciation Expense and credit Accumulated Depreciation.

Bad Debts: Estimates uncollectible accounts receivable. You debit Bad Debts Expense and credit Allowance for Bad Debts.

The income statement comes in two formats:

Real-World Relevance: Businesses prefer multi-step income statements because they show which parts of the business are performing well or poorly, making it easier to identify improvement areas!

Access to all documents

Improve your grades

Join milions of students

A multi-step income statement provides a detailed breakdown of a company's performance. It starts with gross sales minus returns and discounts to get net sales. Subtracting cost of goods sold gives you gross profit - the profit from just buying and selling merchandise before considering operating costs.

After subtracting operating expenses (like salaries, rent, and advertising), you get operating income - profit from normal business activities. Then you add or subtract other revenues/expenses to find income before taxes. Finally, after subtracting income taxes, you arrive at net income - the bottom line.

The balance sheet provides a snapshot of what a business owns and owes at a specific moment. Assets typically appear in order of liquidity (how quickly they can be converted to cash):

Liabilities are listed by when they're due:

Owner's equity shows the owner's claim to business assets after all liabilities are paid.

Remember the fundamental accounting equation must always balance: Assets = Liabilities + Owner's Equity.

Access to all documents

Improve your grades

Join milions of students

The accounting cycle is a step-by-step process that businesses follow each accounting period. Mastering these steps helps you understand how raw financial data transforms into meaningful reports:

Several key accounting principles guide this process:

Accrual vs. Cash Basis: The accrual basis recognizes revenues and expenses when earned/incurred, regardless of cash flow. The simpler cash basis only recognizes transactions when cash changes hands.

Matching Principle: Expenses should be recognized in the same period as the revenues they help generate.

Revenue Recognition Principle: Revenue is recorded when earned , not necessarily when payment is received.

Historical Cost Principle: Assets are typically recorded at their original purchase price, not their current market value.

Career Connection: Understanding the accounting cycle gives you valuable skills for business, whether you become an accountant or just need to understand financial reports in any career!

Access to all documents

Improve your grades

Join milions of students

The accounting cycle is a systematic sequence that transforms financial events into useful information. Here's a clear breakdown of each step:

Analyze transactions: Identify business events with financial impact and determine which accounts are affected.

Journalize transactions: Record events chronologically in the journal with appropriate debits and credits.

Post to ledger: Transfer journal information to individual accounts in the ledger to track each account's balance.

Prepare unadjusted trial balance: List all accounts with their balances to verify debit/credit equality before adjustments.

Prepare adjusting entries: Record end-of-period adjustments to recognize revenues/expenses in the proper period.

Prepare adjusted trial balance: Create an updated list of accounts after adjustments to verify equality.

Prepare financial statements: Create the income statement, balance sheet, and statement of owner's equity from the adjusted trial balance.

Prepare closing entries: Reset revenue, expense, and drawing accounts to zero for the next period.

Prepare post-closing trial balance: Final check to ensure debits equal credits after closing.

Visuals like T-account diagrams, sample trial balances, and example financial statements help reinforce these concepts. Remember that while small businesses might complete this cycle manually, most companies use accounting software that automates many steps, reducing errors and saving time.

The accounting cycle isn't just a procedure - it's the foundation for reliable financial reporting that helps businesses make informed decisions, satisfy legal requirements, and communicate with stakeholders.

Our AI companion is specifically built for the needs of students. Based on the millions of content pieces we have on the platform we can provide truly meaningful and relevant answers to students. But its not only about answers, the companion is even more about guiding students through their daily learning challenges, with personalised study plans, quizzes or content pieces in the chat and 100% personalisation based on the students skills and developments.

You can download the app in the Google Play Store and in the Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

0

Smart Tools NEW

Transform this note into: ✓ 50+ Practice Questions ✓ Interactive Flashcards ✓ Full Practice Test ✓ Essay Outlines

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE Knowunity AI. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user