Ever wondered how banks calculate the money you owe or... Show more

Sign up to see the contentIt's free!

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

802

•

Dec 13, 2025

•

Gojo

@satorufux

Ever wondered how banks calculate the money you owe or... Show more

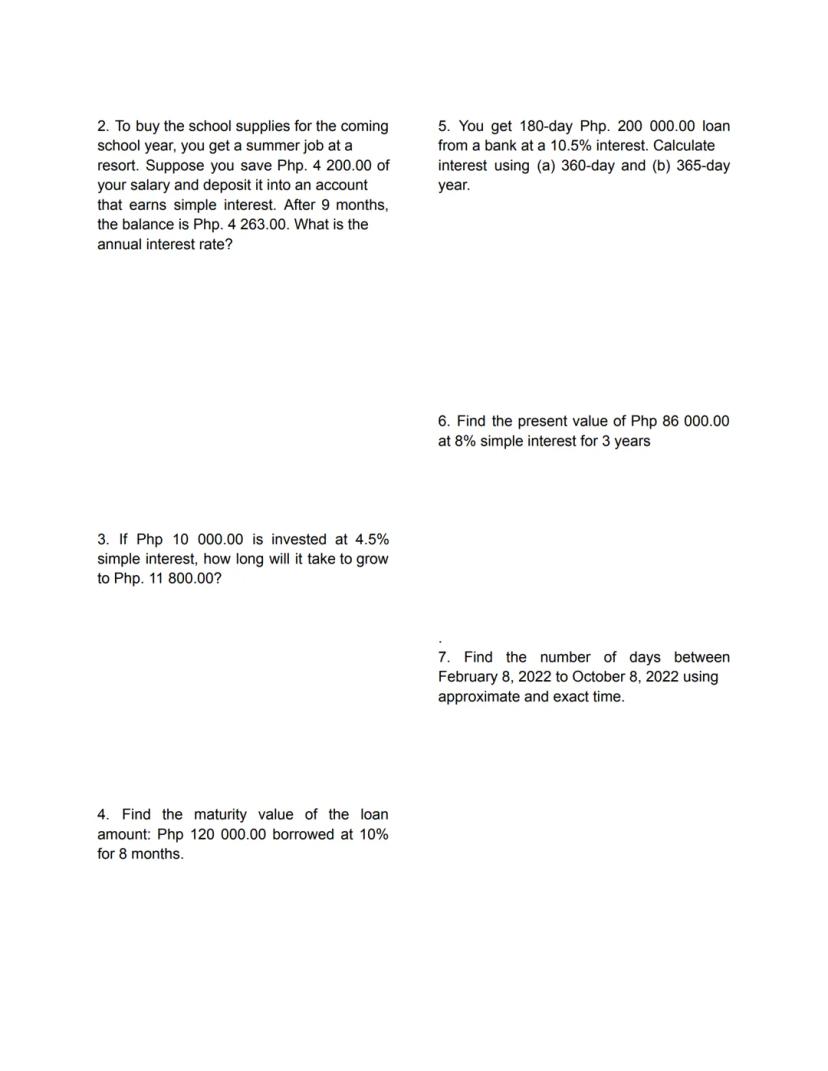

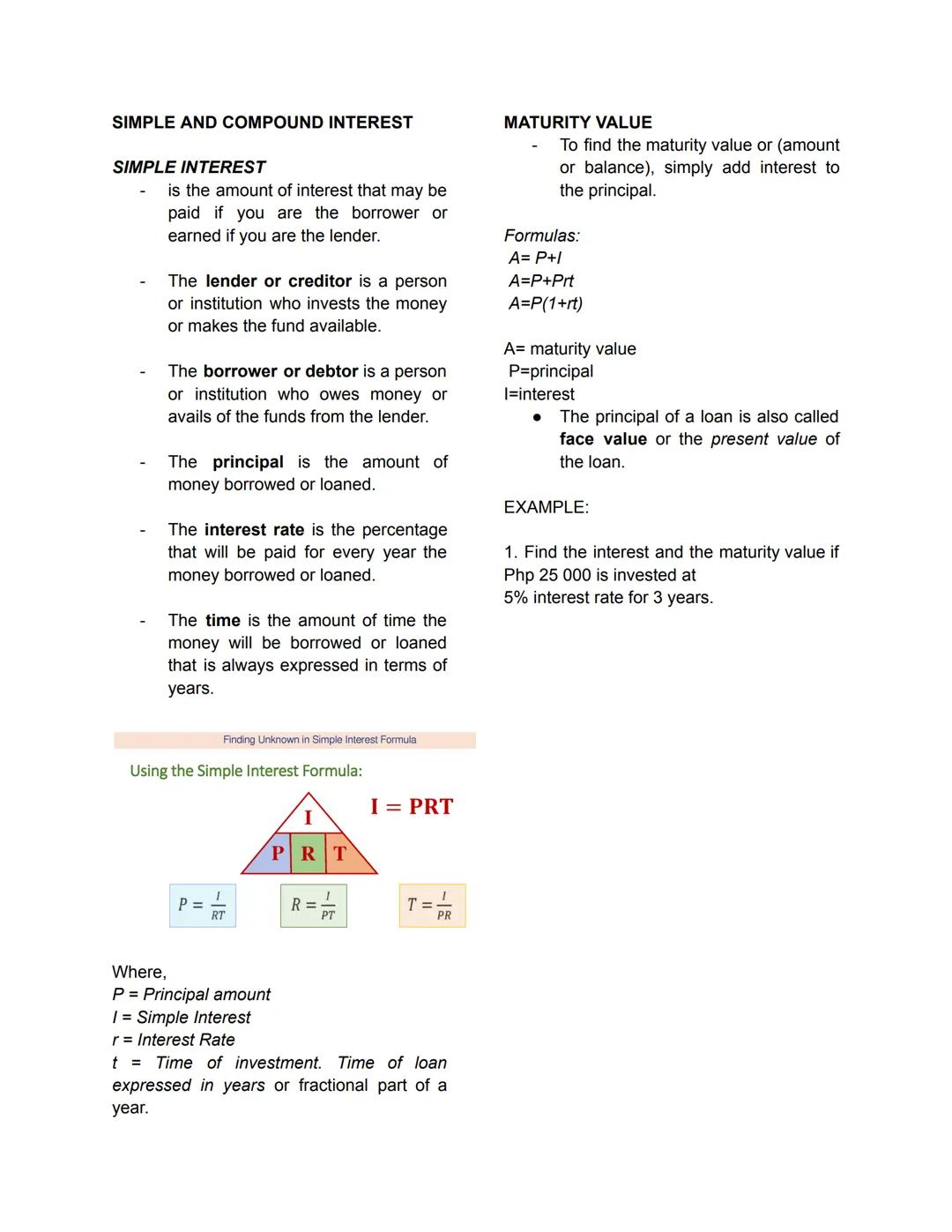

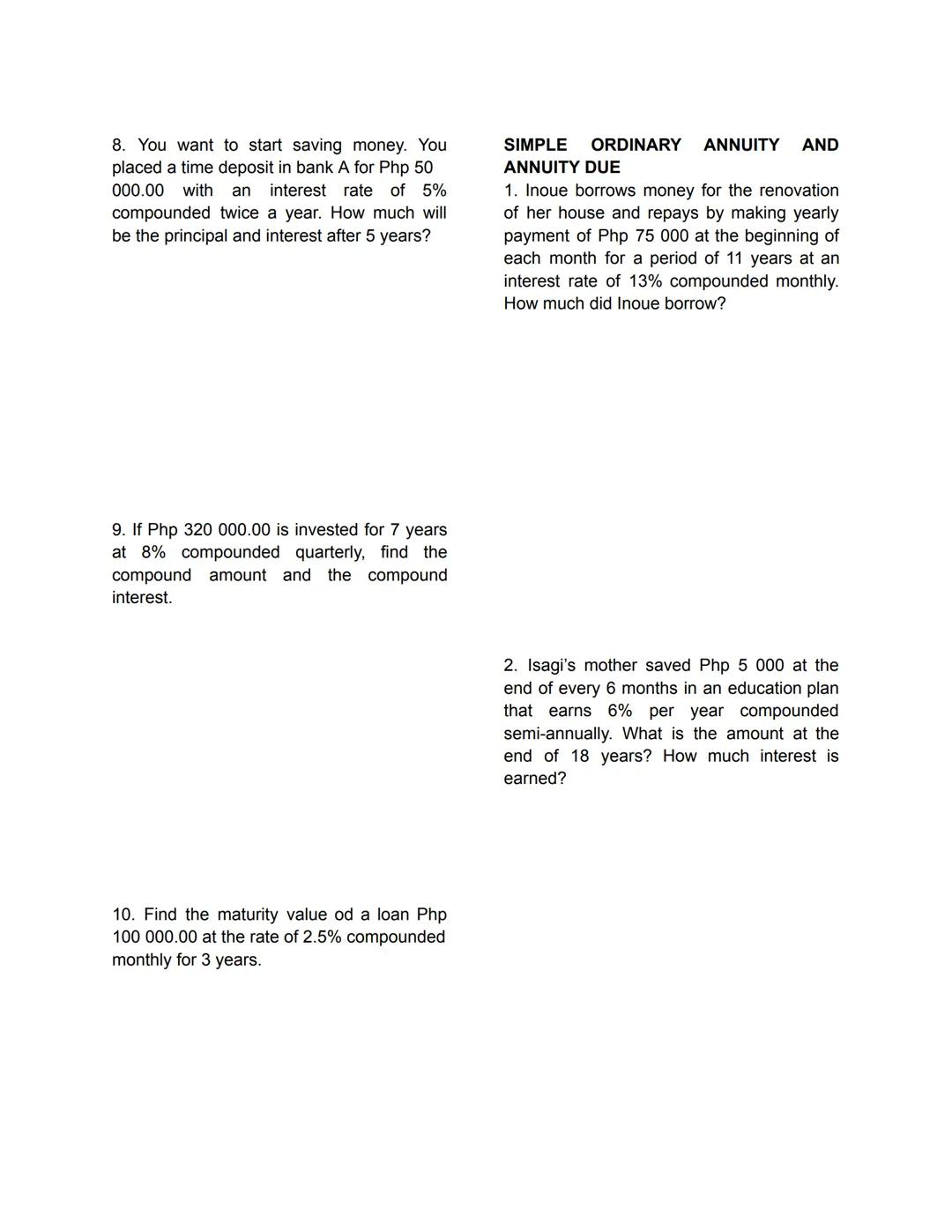

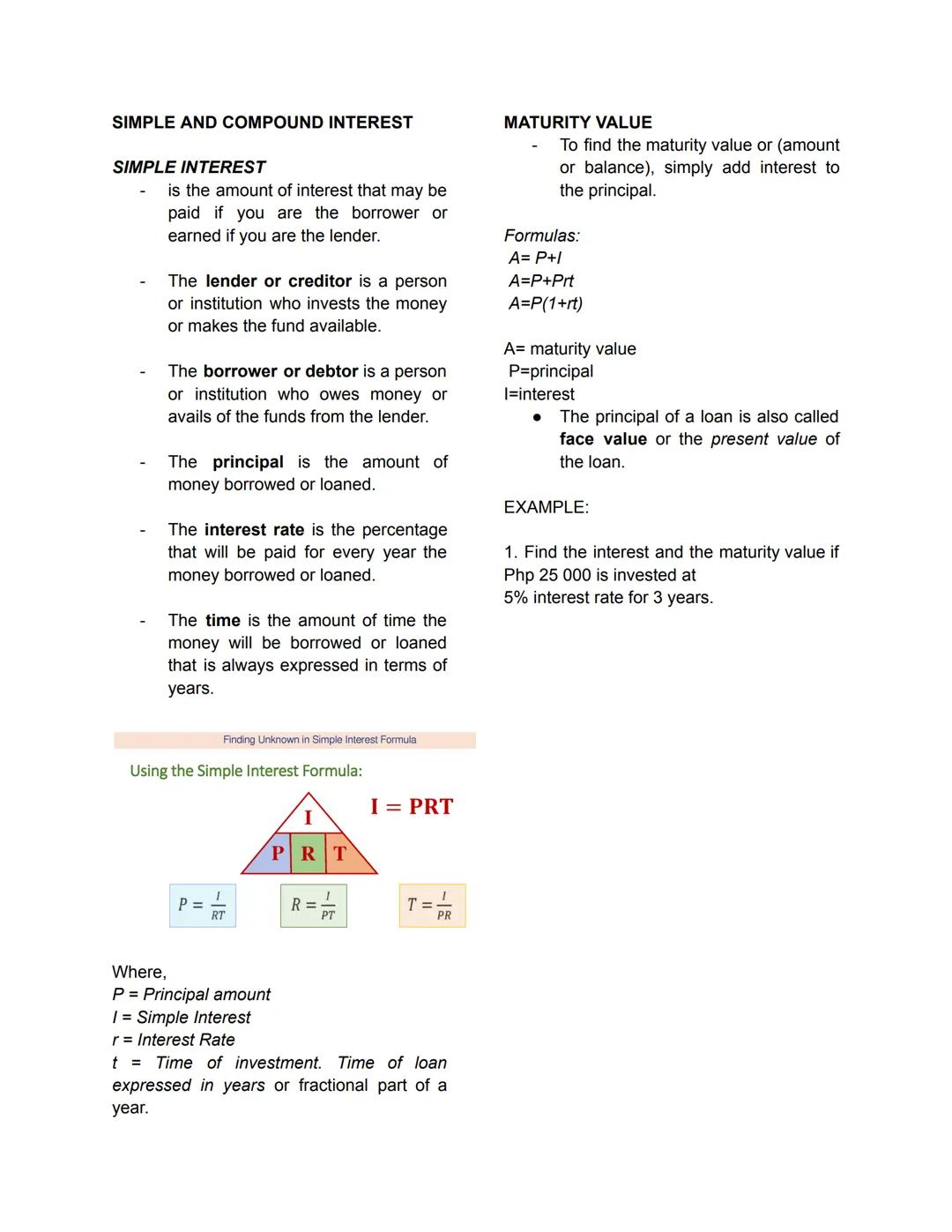

Think of simple interest as the straightforward way money grows over time. When you borrow money, you're the debtor, and when you lend money, you're the creditor. The original amount is called the principal, and you pay or earn a percentage each year called the interest rate.

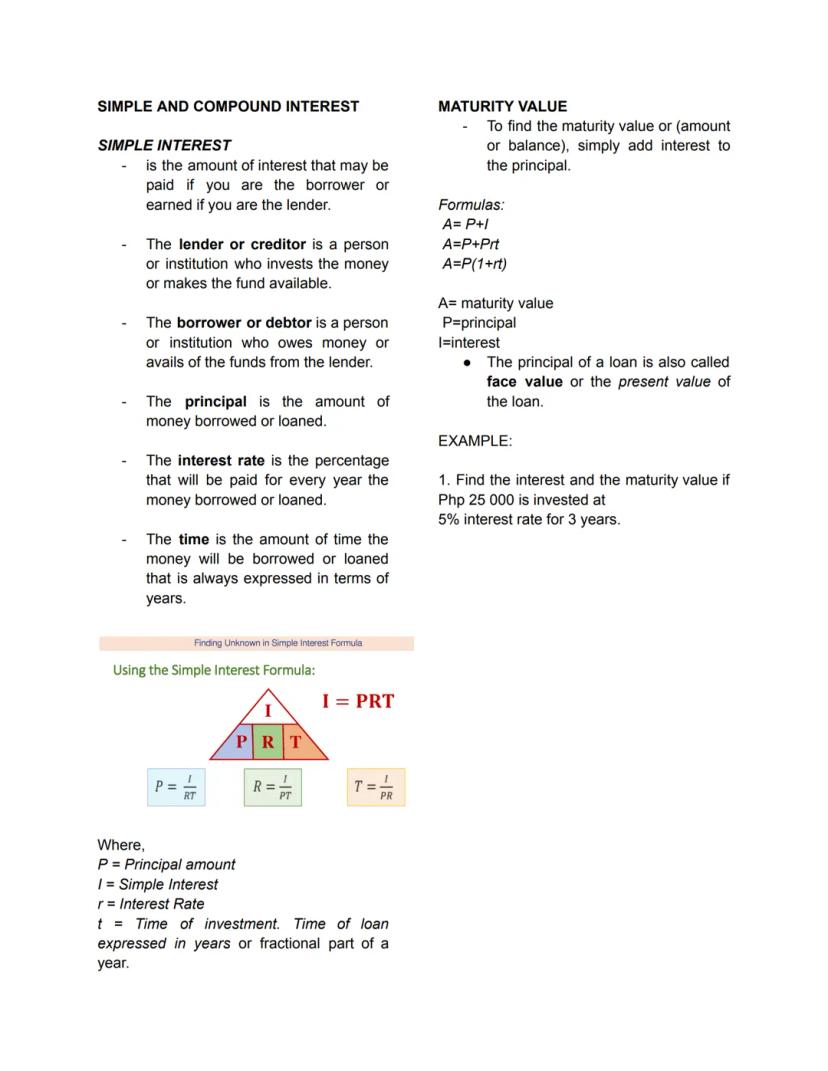

The magic formula is I = PRT, where I is interest, P is principal, R is the rate (as a decimal), and T is time in years. You can rearrange this formula to find any missing piece - just divide both sides to isolate what you need.

To find the maturity value (total amount you'll have), simply add the interest to the principal: A = P + I or use the shortcut A = P. This tells you exactly how much money will be involved at the end of the loan or investment period.

Pro tip: Always convert your interest rate to a decimal by dividing by 100 before plugging it into formulas!

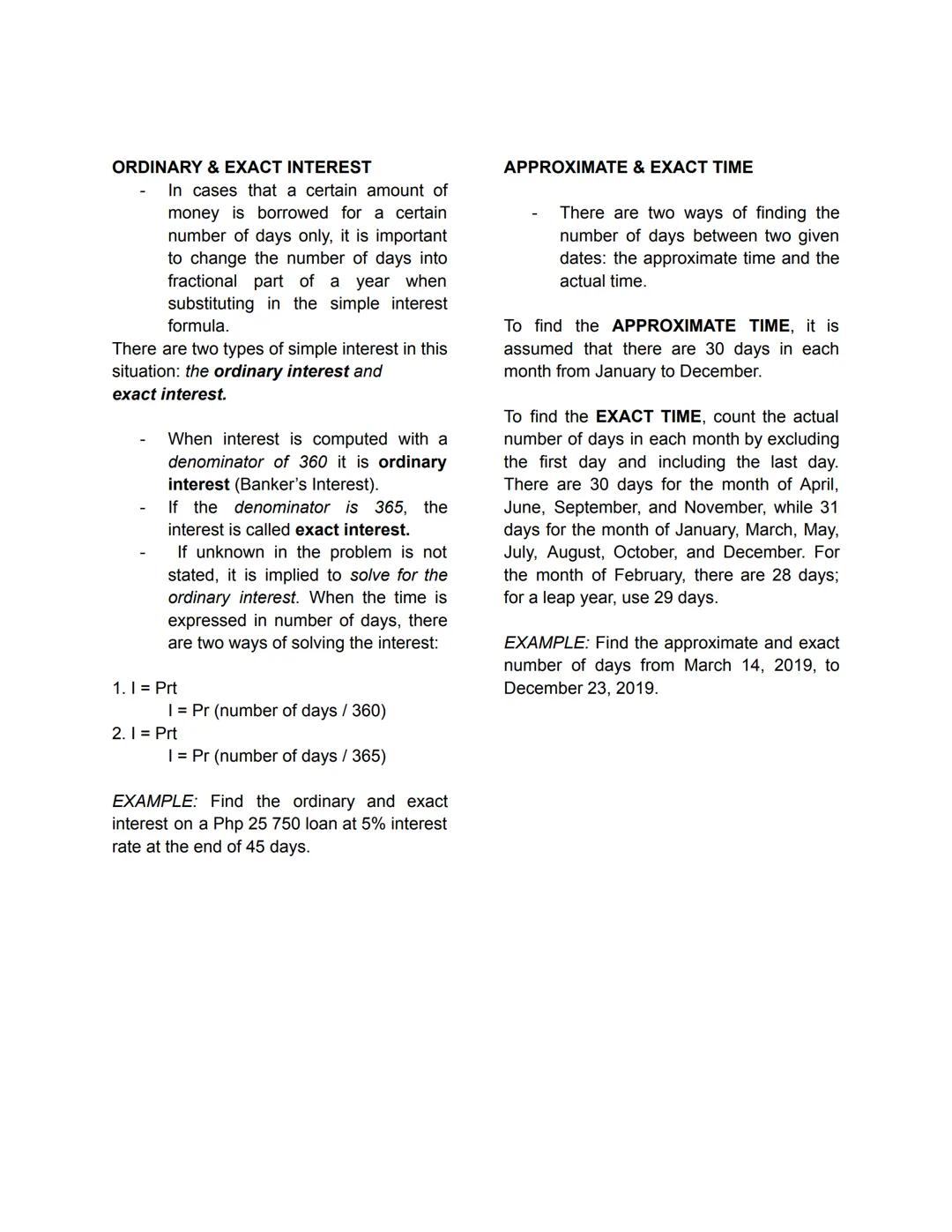

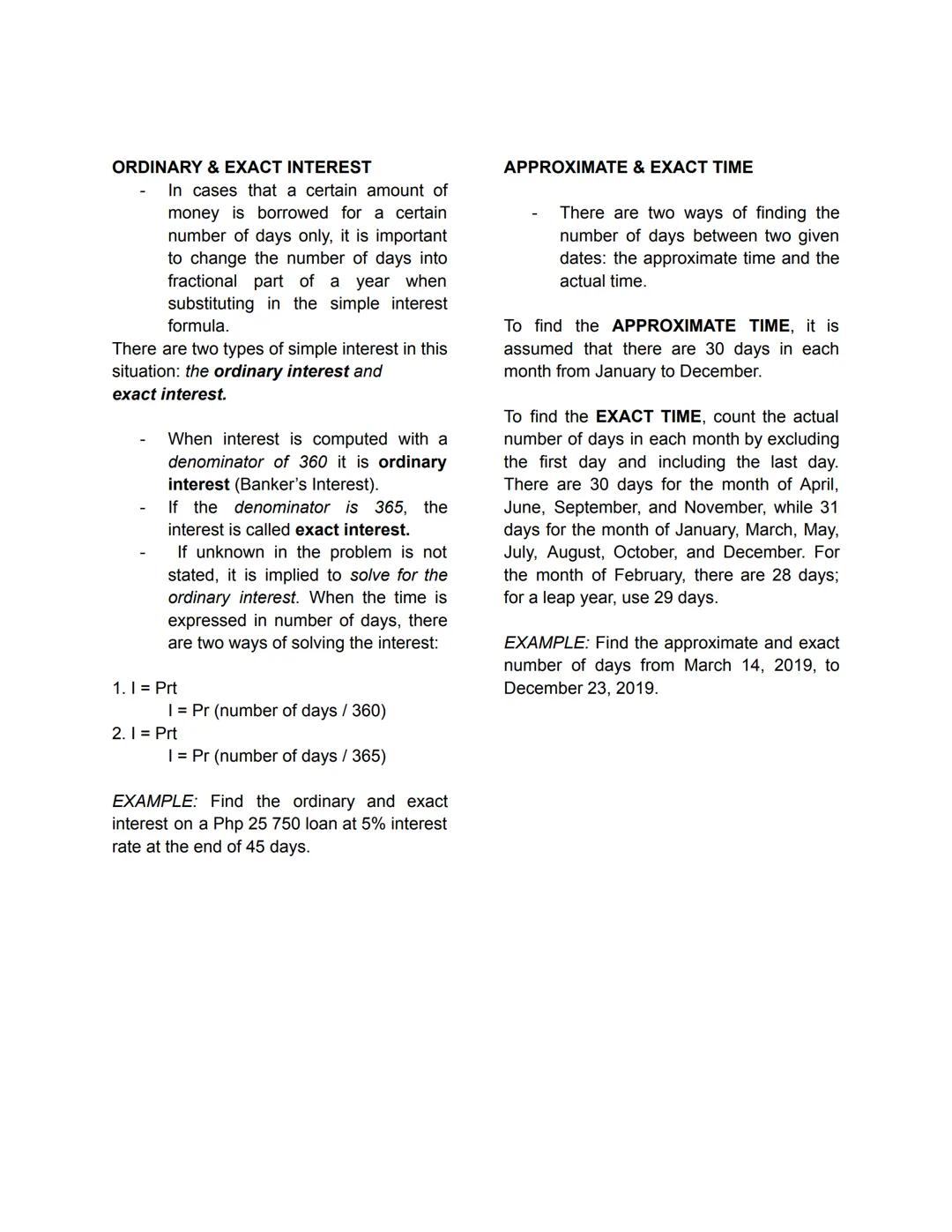

When dealing with loans that last only a few days or months, you'll encounter two types of interest calculations. Ordinary interest uses 360 days as a year (banker's interest), while exact interest uses the actual 365 days. Banks often prefer ordinary interest because it gives them slightly more money!

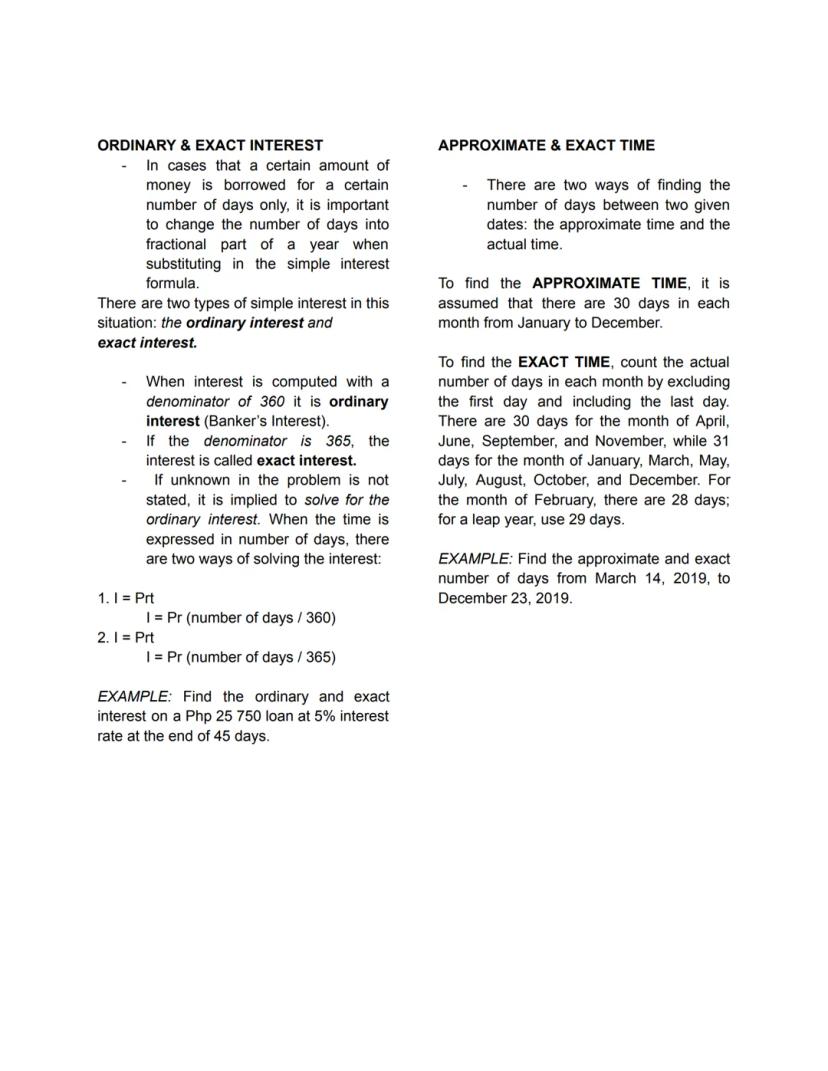

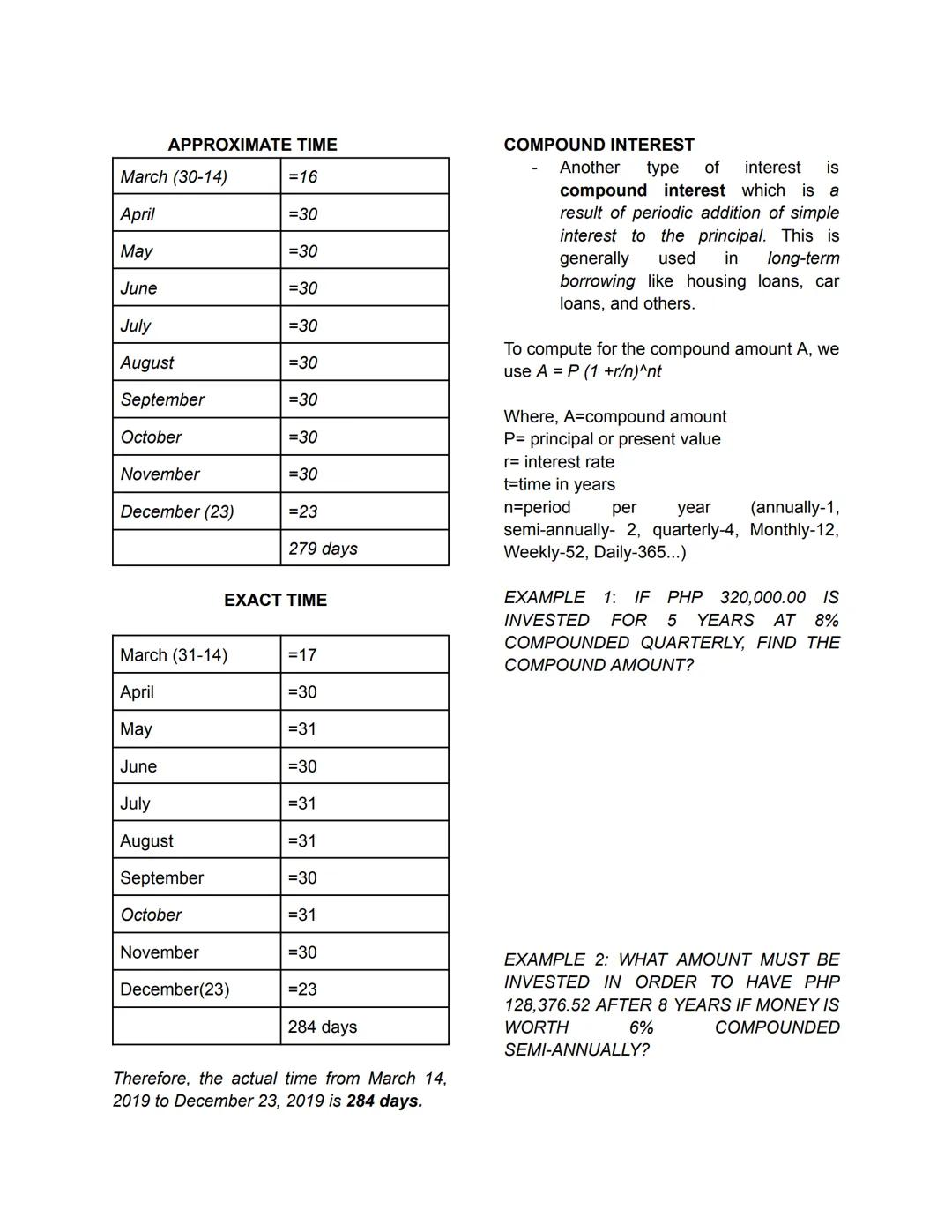

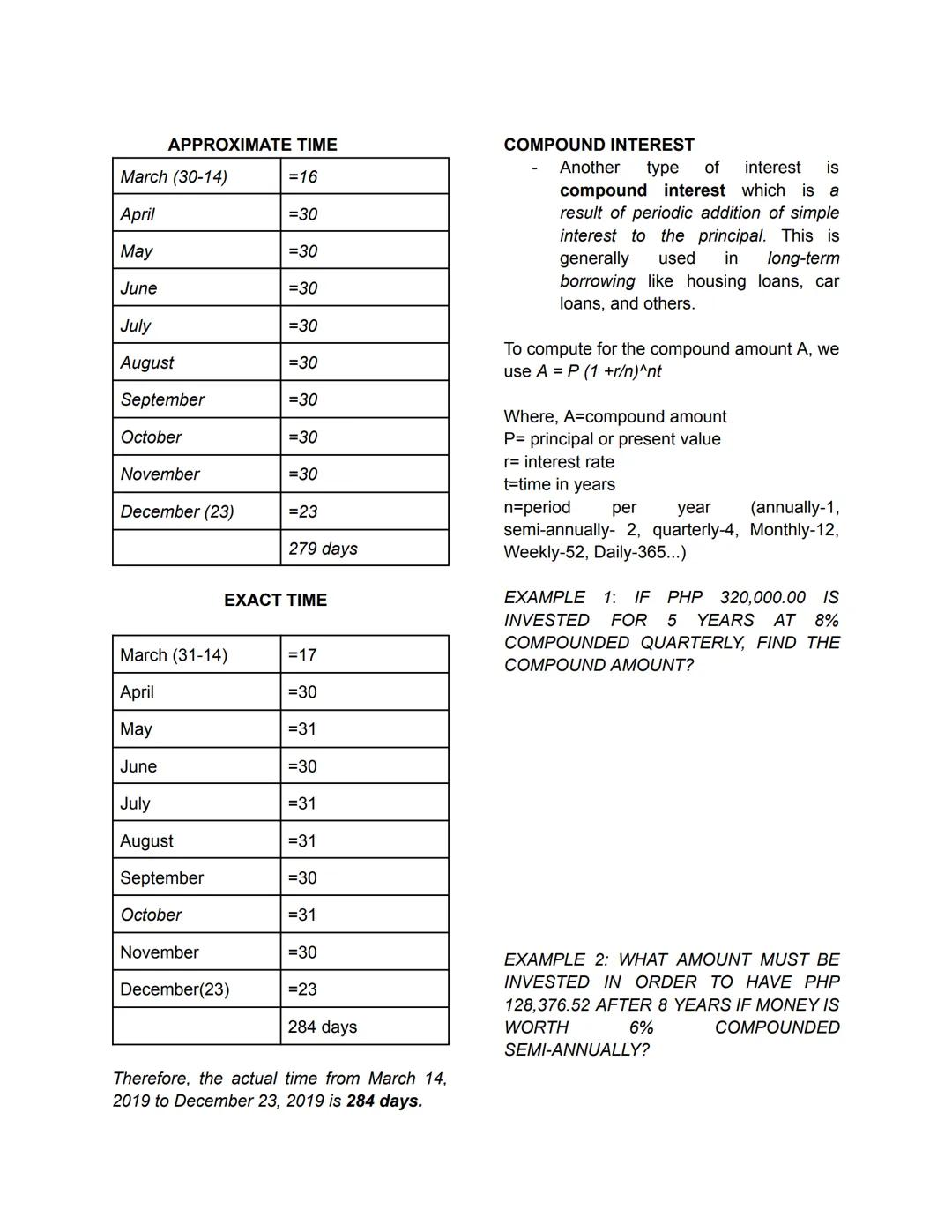

For time calculations, you have two options as well. Approximate time assumes every month has exactly 30 days - super easy for quick calculations. Exact time counts the actual days in each month, excluding the first day but including the last day.

Remember the days in each month: 30 days for April, June, September, and November; 31 days for January, March, May, July, August, October, and December; and 28 days for February (29 in leap years). Unless specified otherwise, problems usually ask for ordinary interest with approximate time.

Quick check: If the problem doesn't specify which method to use, go with ordinary interest (360 days) - it's the default!

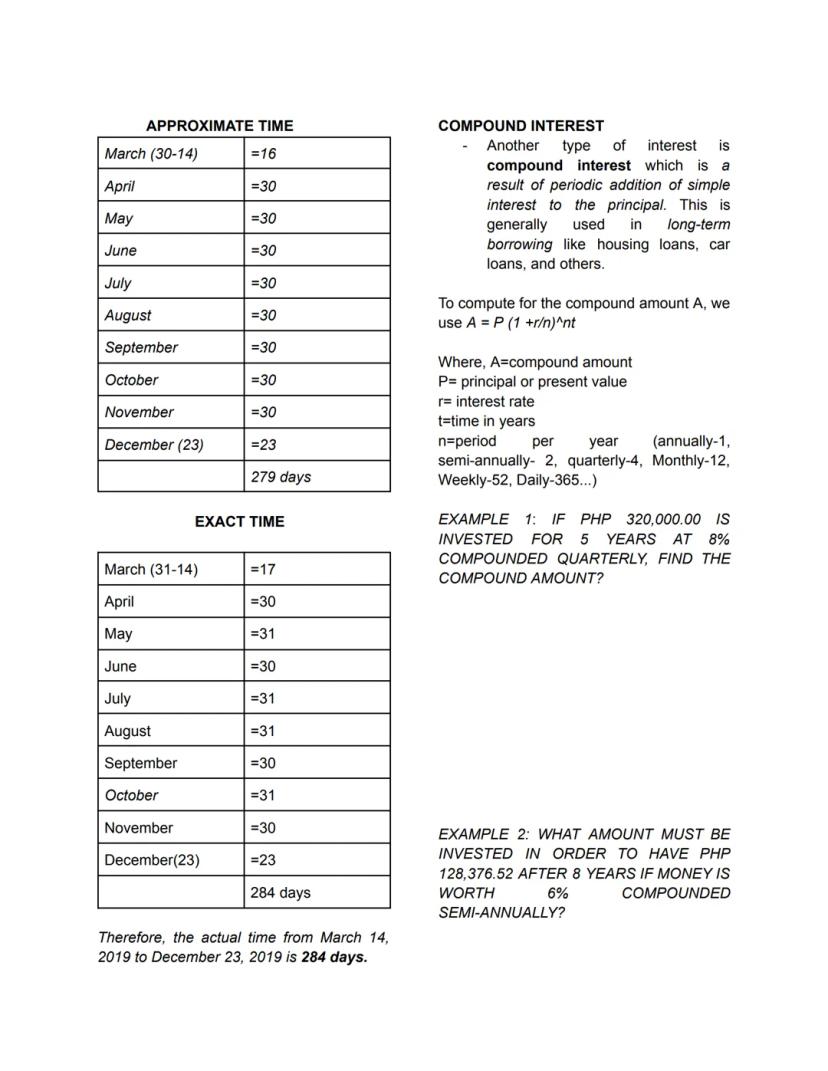

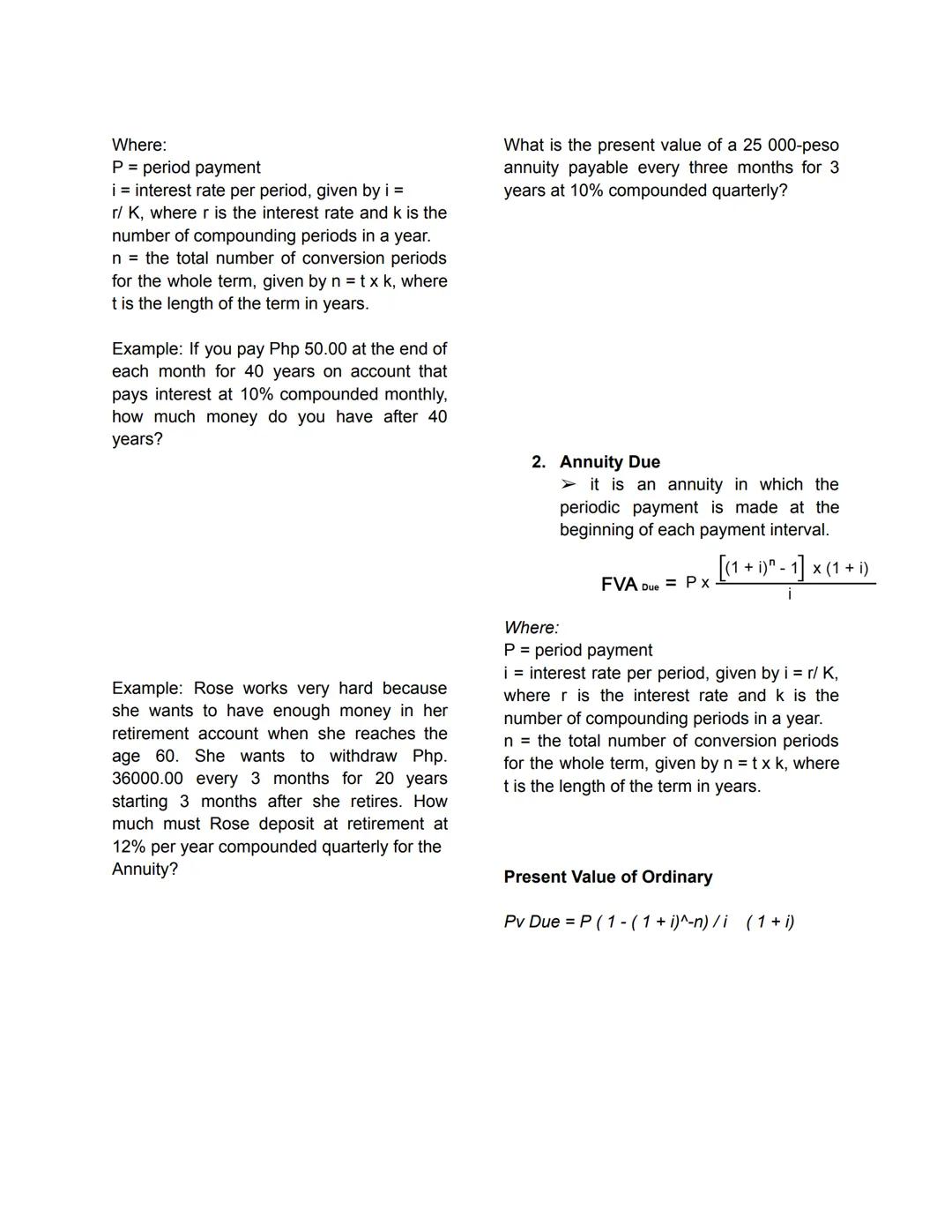

Compound interest is where things get exciting - it's interest earning interest! Unlike simple interest, compound interest gets added to your principal regularly, creating a snowball effect that can dramatically increase your money over time.

The formula A = P^nt might look scary, but it's manageable. Here, A is your final amount, P is principal, r is annual interest rate, n is how many times per year it compounds, and t is years. Common compounding periods are annually , semi-annually , quarterly , or monthly .

The key difference from simple interest is that your money grows faster because each period's interest gets added to the principal for the next calculation. This is why starting to save early makes such a huge difference - time is your best friend with compound interest!

Money tip: Even small amounts invested early with compound interest can grow to surprising amounts over time!

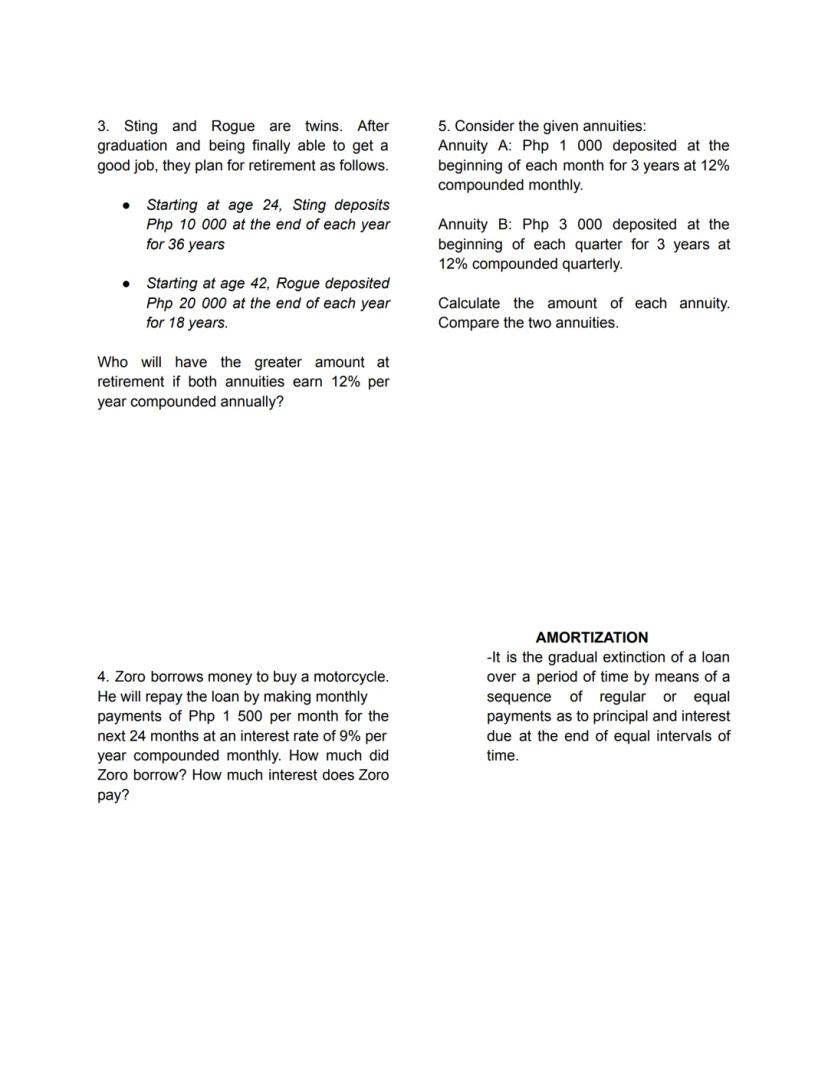

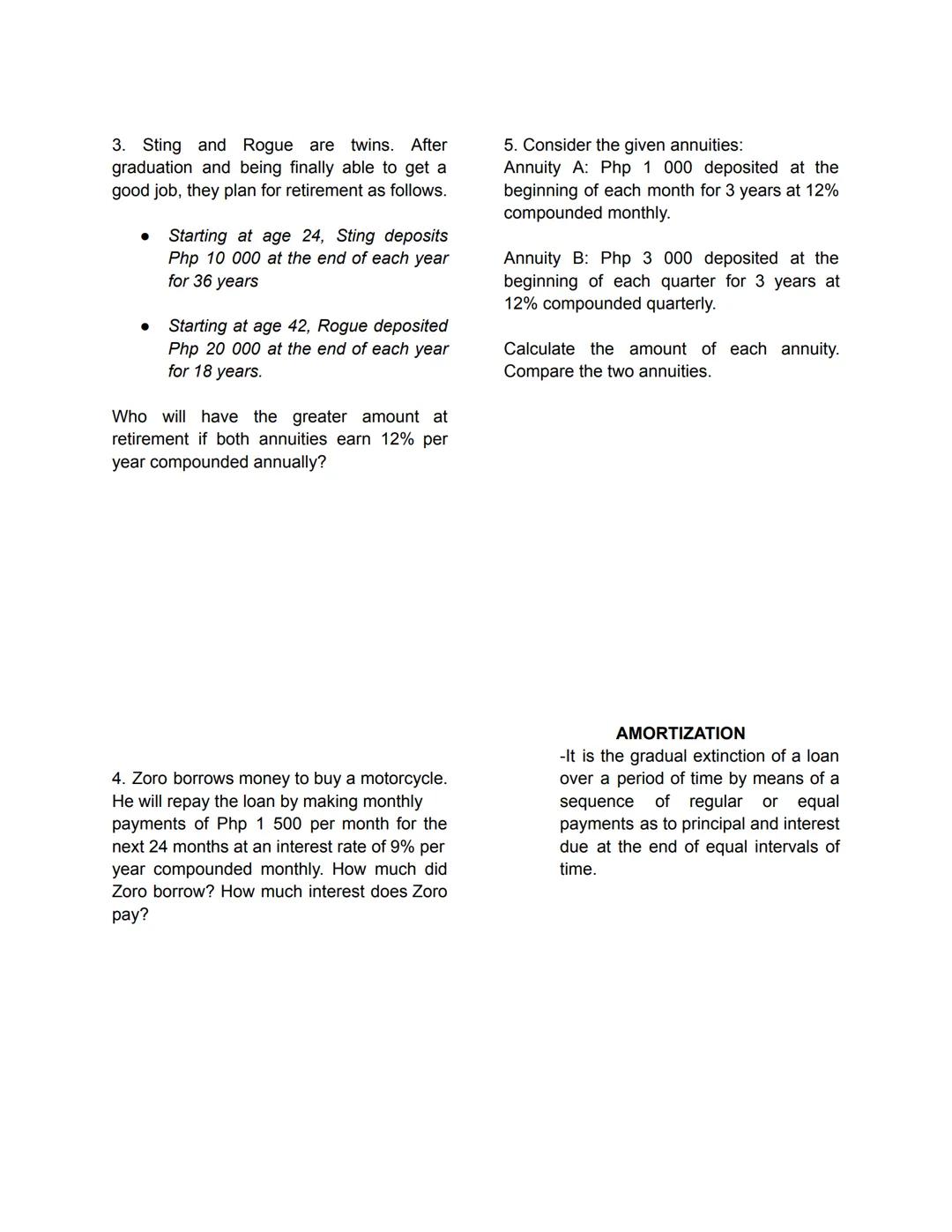

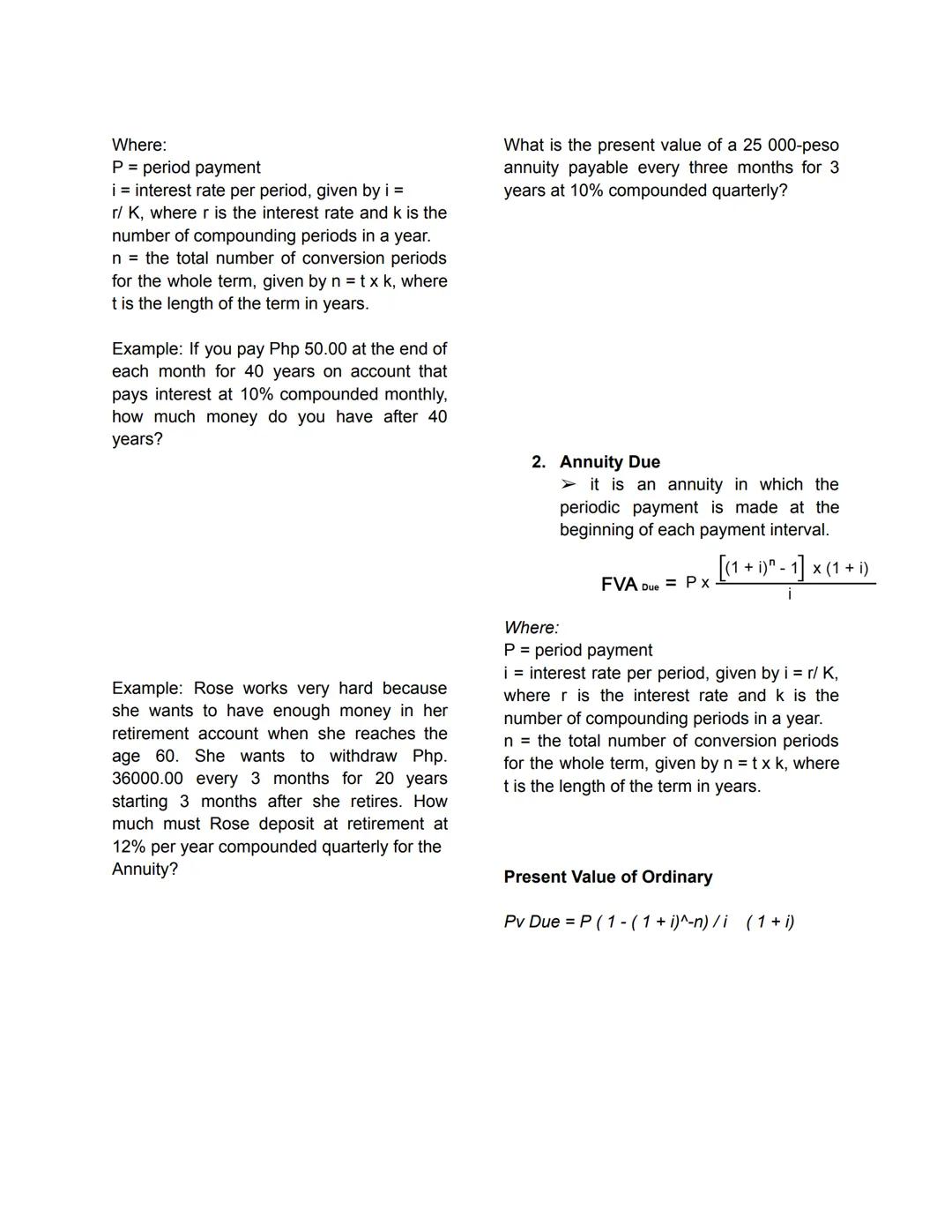

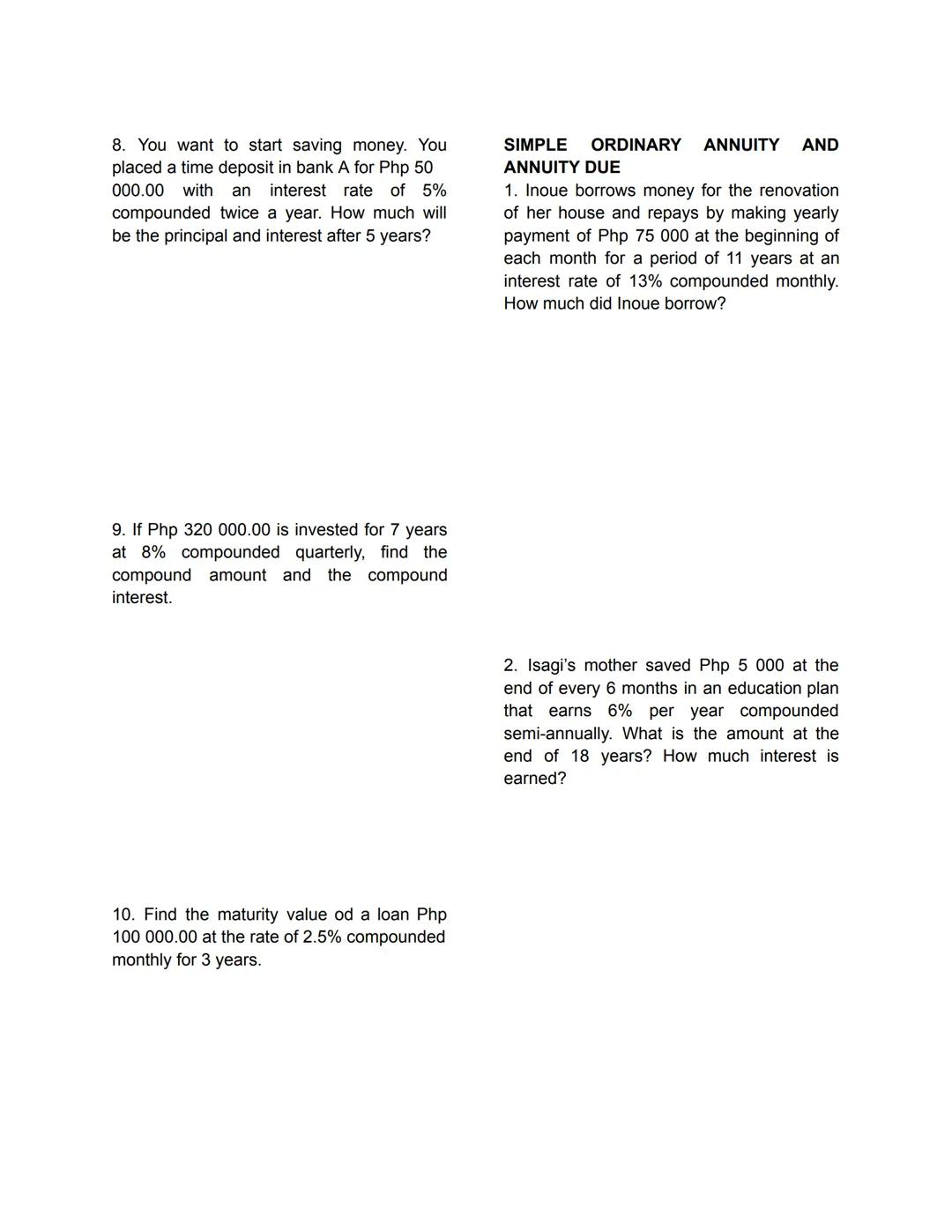

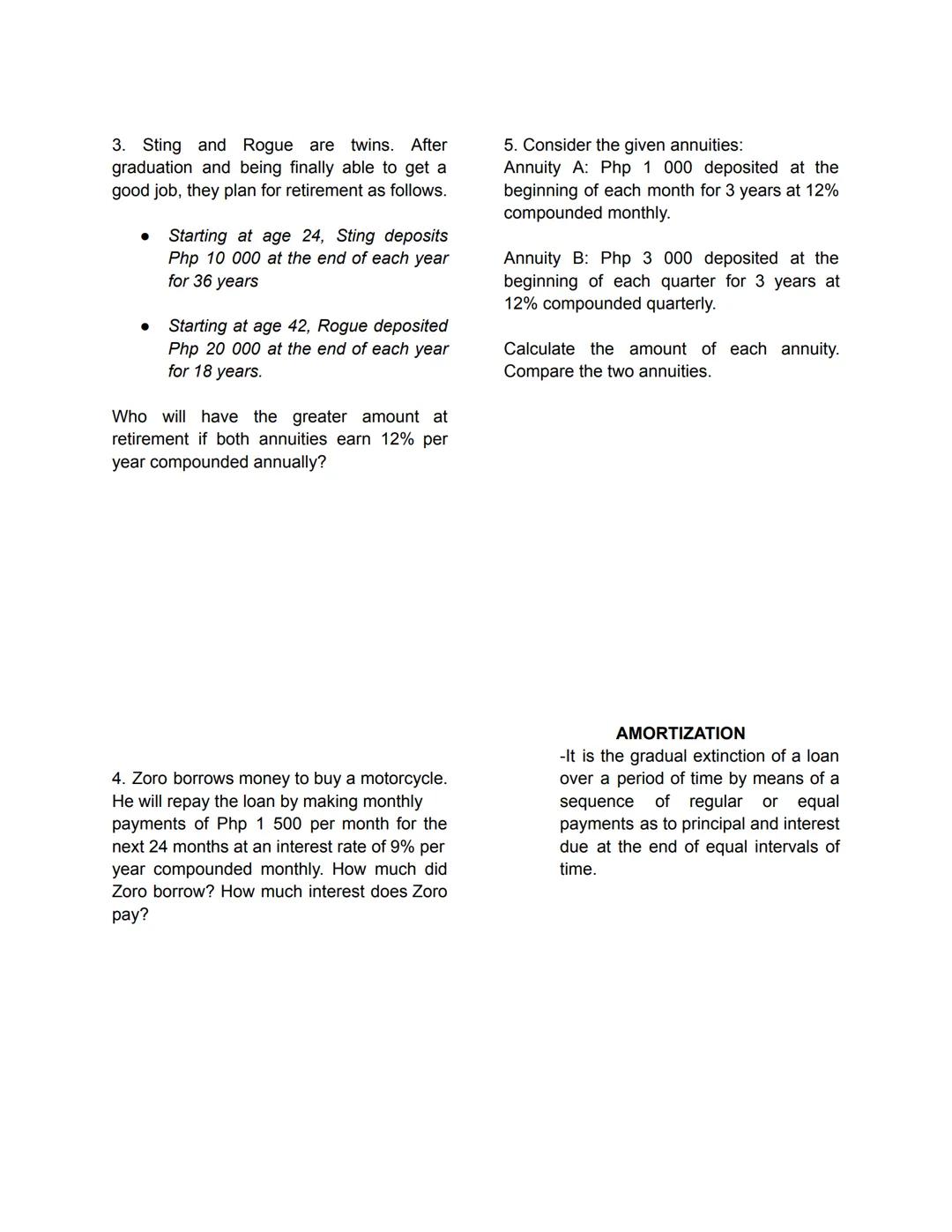

An annuity is simply a series of equal payments made at regular intervals - think monthly car payments or quarterly tuition fees. There are two main types: annuity certain and annuity uncertain (indefinite like insurance payments).

Simple annuities have matching payment and compounding periods (like monthly payments with monthly compounding), while general annuities don't match. Most problems deal with simple annuities, so focus there first.

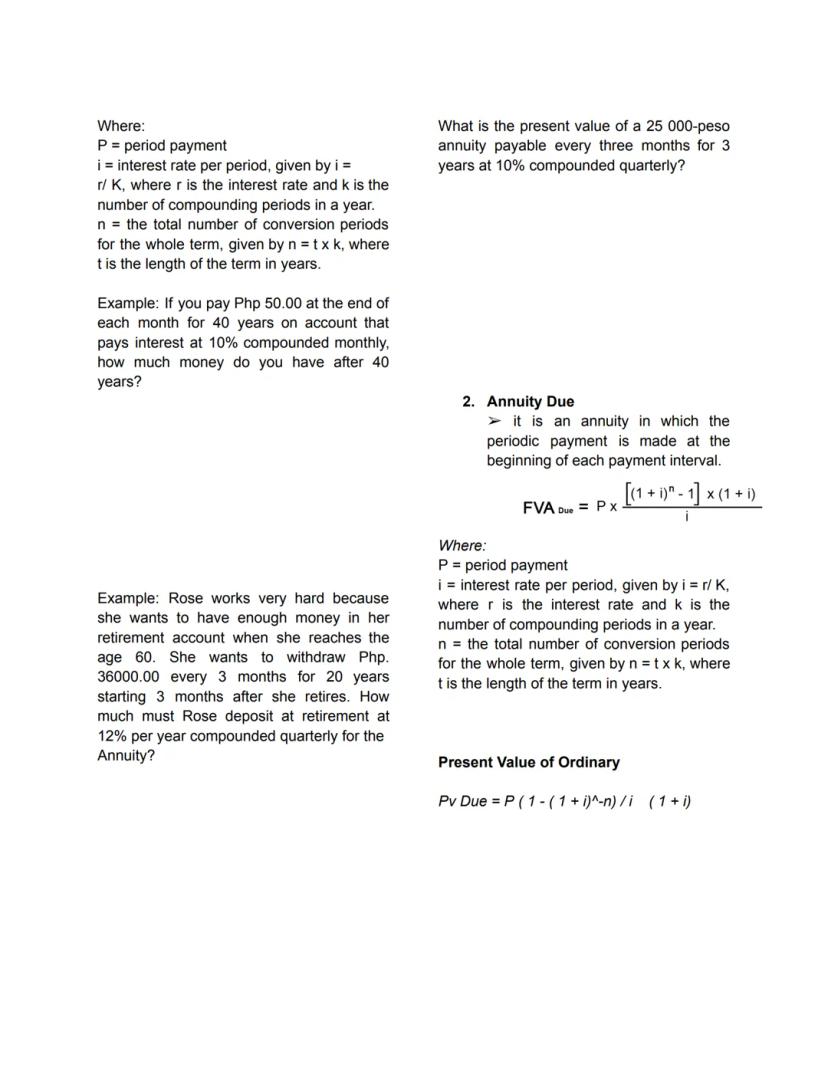

Ordinary annuities make payments at the end of each period, while annuities due make payments at the beginning. The formulas are similar - annuity due just multiplies by an extra factor because money has more time to grow.

For future value, use FVA = P × /i to find how much all your payments will be worth. For present value, use PV = P × /i to find how much you need today to fund future payments.

Real-world connection: Every time you make monthly payments on anything, you're dealing with annuities!

When working with ordinary annuities, remember that payments happen at the end of each period. The future value formula FVA = P × /i shows you how much your series of payments will grow to, including all the compound interest earned.

Present value calculations answer the opposite question: how much money do you need today to provide a series of future payments? This is crucial for retirement planning - you calculate how much to deposit now to withdraw a specific amount later.

Annuities due are similar but more valuable because payments start immediately. Since each payment has more time to grow, multiply your ordinary annuity result by . The extra factor accounts for that additional compounding period.

The key variables remain the same: P is your periodic payment, i is the interest rate per period (annual rate ÷ compounding frequency), and n is total number of payments (years × payments per year).

Study hack: Practice identifying whether payments happen at the beginning or end of periods - it determines which formula to use!

Real-world annuity problems help you see why these calculations matter. When parents save for college by depositing money annually, they're creating a future value annuity due - the money grows over time to fund education expenses.

Present value problems often involve loans or determining how much to borrow. If you know your payment capacity, you can calculate the maximum loan amount you can handle. This is exactly how banks determine your borrowing limit.

The timing of payments makes a significant difference in calculations. Beginning-of-period payments (annuity due) always result in higher values than end-of-period payments (ordinary annuity) because of extra compounding time.

Practice problems typically give you most variables and ask you to find one missing piece. Master the basic formulas, then focus on identifying what type of annuity you're dealing with and what the problem is asking you to find.

Test strategy: Always identify whether you're solving for present value, future value, and whether it's ordinary or due before choosing your formula!

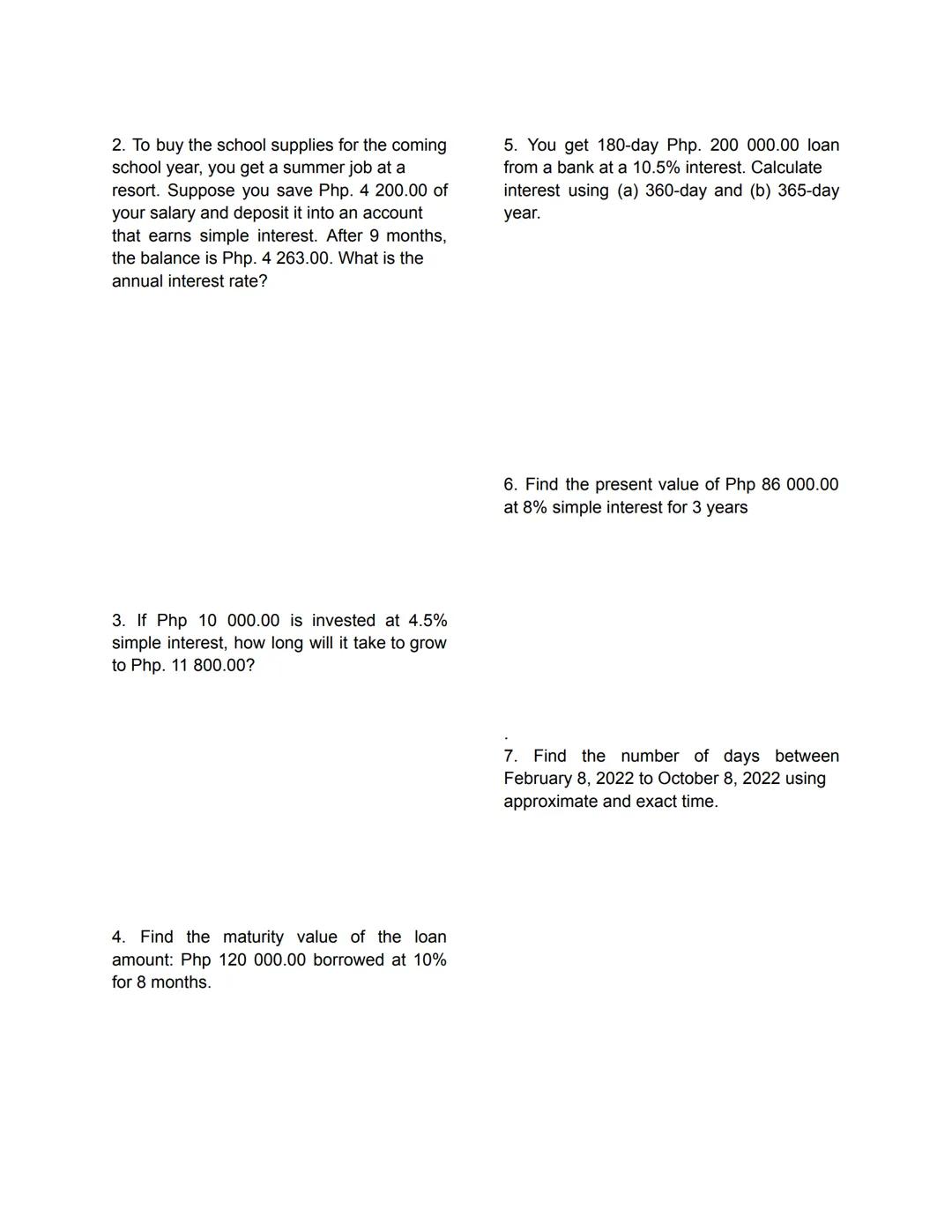

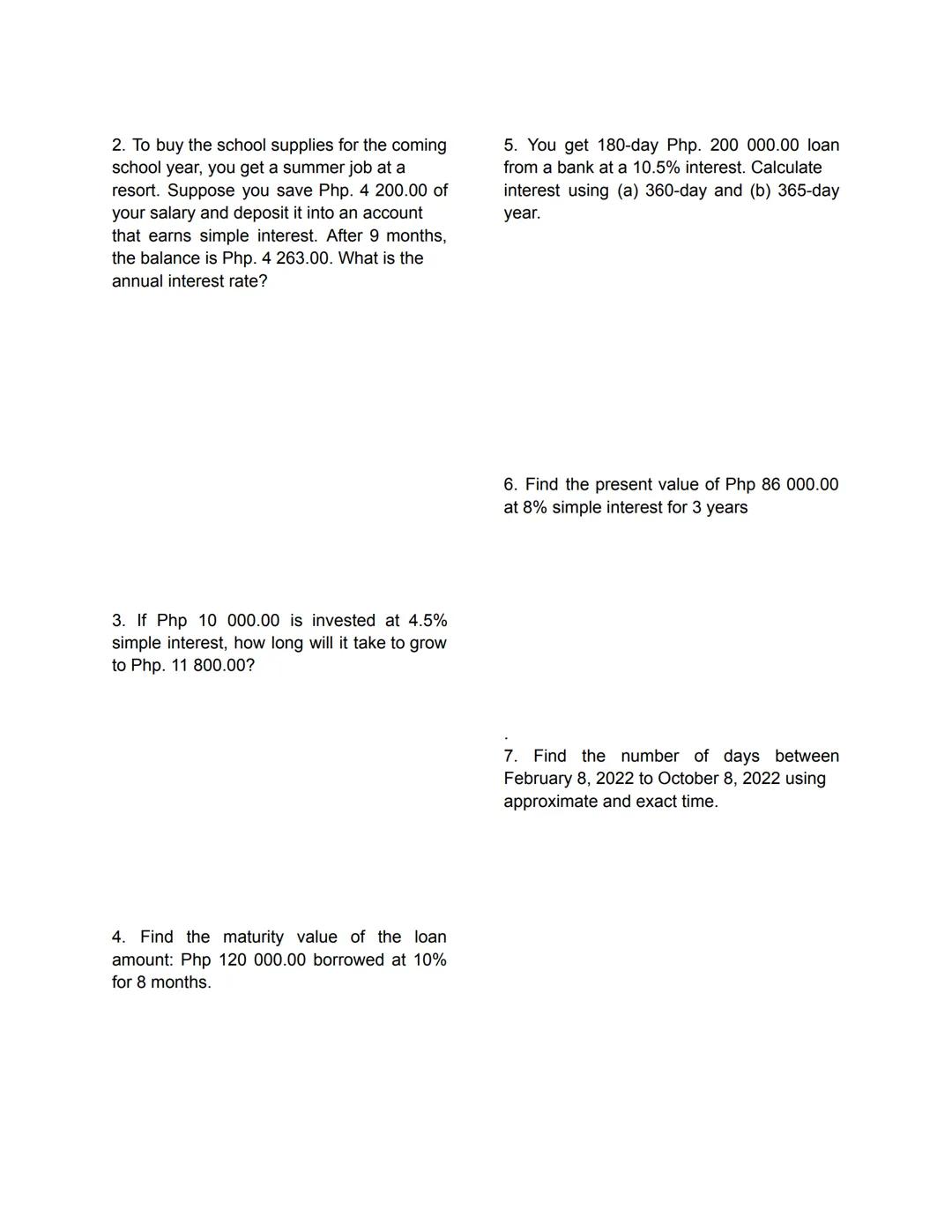

These sample problems cover the most common types you'll encounter on tests. Simple interest problems usually give you three of the four variables (P, I, R, T) and ask you to find the fourth using algebraic manipulation of I = PRT.

Time period calculations between dates require careful counting. Remember to exclude the starting date but include the ending date when counting exact time. For approximate time, just assume 30 days per month for easier calculation.

Present value problems work backwards from a future amount to find what you need to invest today. These problems are especially important for understanding loans and investments - you're finding the principal that will grow to a specific target.

Interest rate problems often give you the principal and final amount, asking you to calculate what rate was earned. These help you compare different investment options in real life.

Exam tip: Write down the given information first, then identify which formula applies before jumping into calculations!

Compound interest problems show the real power of letting money grow over time. Whether you're calculating savings account growth or loan amounts, the formula A = P^nt handles various compounding frequencies from daily to annually.

Annuity problems get more complex when comparing different scenarios. You might need to calculate multiple annuities to see which investment strategy works better, or determine loan amounts based on payment capacity.

The key is breaking complex problems into steps: identify the type of problem, list known variables, choose the correct formula, and solve systematically. Many problems combine multiple concepts - like finding both compound amount and compound interest earned.

Time deposit problems are particularly relevant since many students will open savings accounts. Understanding how different compounding frequencies affect growth helps you make better banking decisions.

Life skill bonus: These calculations help you make smart financial decisions about loans, investments, and savings throughout your life!

Long-term investment comparisons reveal surprising truths about compound interest. Starting early with smaller amounts often beats starting late with larger amounts - time is more powerful than you might think when compound interest is involved.

Loan calculations help you understand the total cost of borrowing. When you know the monthly payment and loan term, you can calculate both the original loan amount and total interest paid over the life of the loan.

Different annuity types (monthly vs. quarterly payments) can be compared to see which grows faster. Higher frequency payments usually win because money starts earning interest sooner, but the difference depends on the interest rate and compounding frequency.

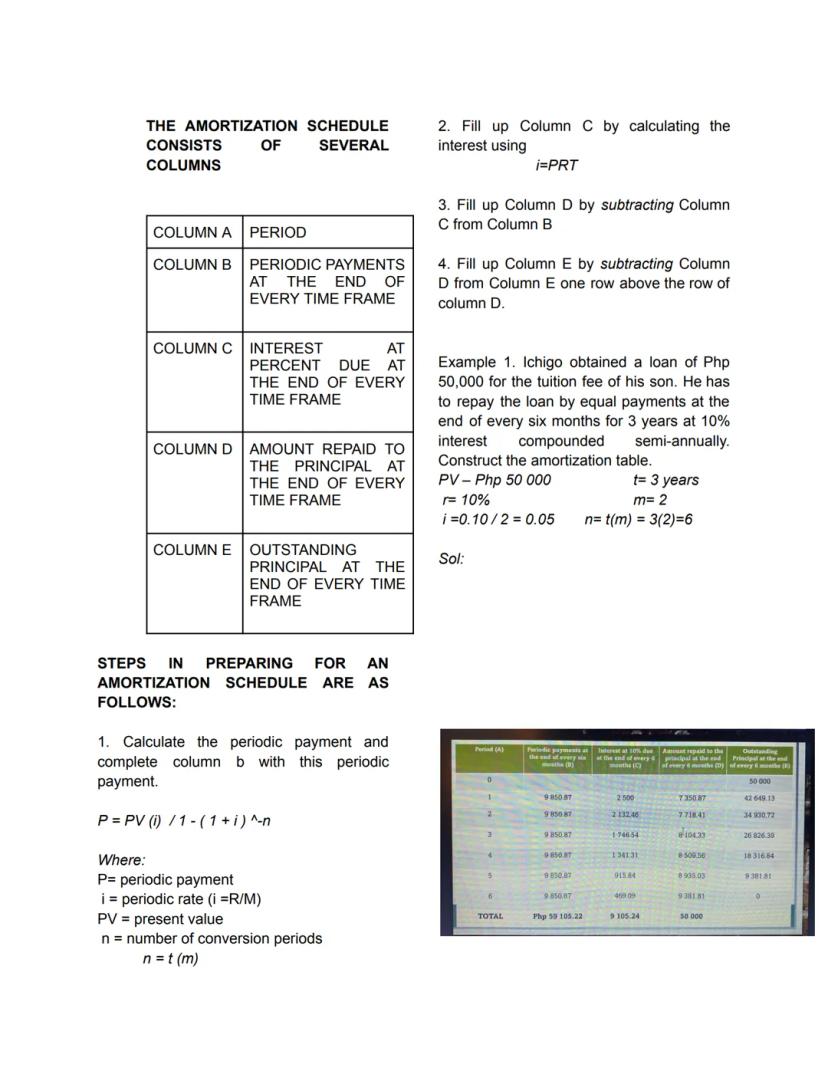

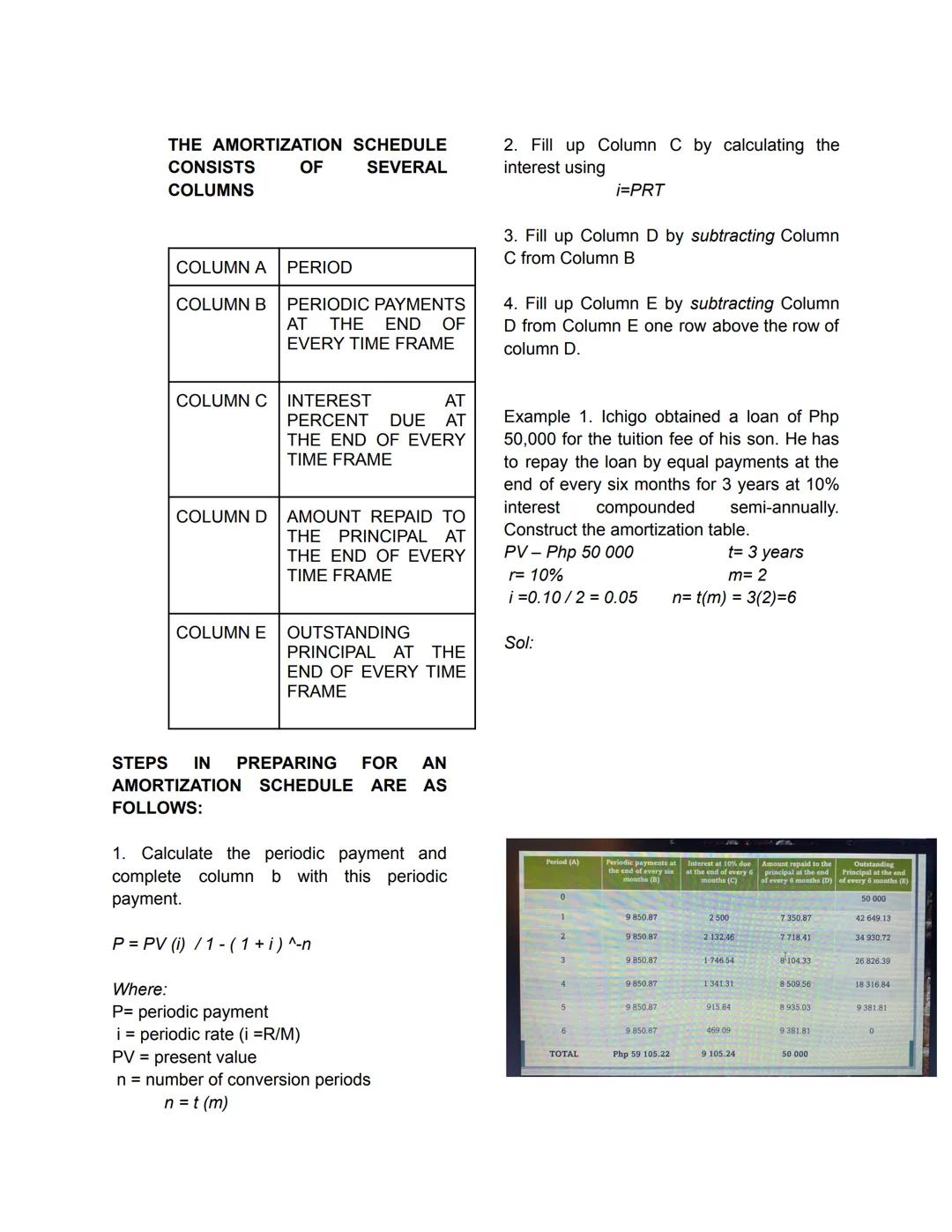

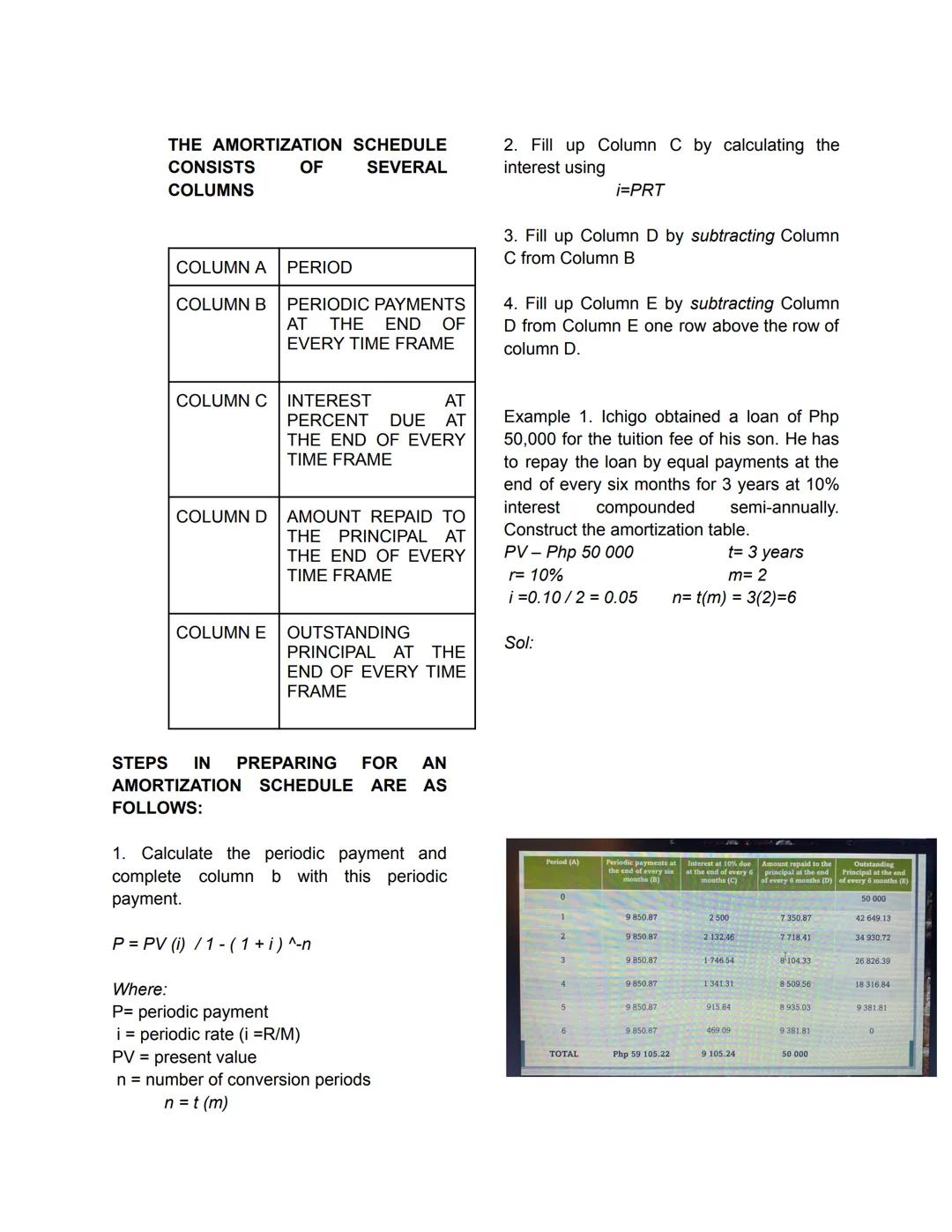

Amortization is the process of gradually paying off a loan through regular payments. Each payment covers both interest on the remaining balance and a portion of the principal, with the principal portion increasing over time as the balance decreases.

Financial wisdom: Starting to invest or save even small amounts early in life can lead to surprisingly large amounts later due to compound interest!

An amortization schedule breaks down each loan payment into interest and principal portions. This table shows exactly how your loan balance decreases over time and how much interest you pay each period.

The schedule has five columns: period number, periodic payment amount, interest due, principal repayment, and outstanding balance. Column B stays the same (equal payments), while Column C (interest) decreases over time as the balance shrinks.

To build the schedule, first calculate the periodic payment using the present value annuity formula. Then for each period: calculate interest on the remaining balance, subtract interest from payment to find principal repayment, and subtract principal repayment from the remaining balance.

The process continues until the loan is fully paid. Early payments are mostly interest, but later payments are mostly principal. This is why extra principal payments early in a loan can save significant interest over time.

Money-saving tip: Understanding amortization helps you see why making extra principal payments early can dramatically reduce total interest paid!

Our AI companion is specifically built for the needs of students. Based on the millions of content pieces we have on the platform we can provide truly meaningful and relevant answers to students. But its not only about answers, the companion is even more about guiding students through their daily learning challenges, with personalised study plans, quizzes or content pieces in the chat and 100% personalisation based on the students skills and developments.

You can download the app in the Google Play Store and in the Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE THE SCHOOLGPT. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE THE SCHOOLGPT. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

Gojo

@satorufux

Ever wondered how banks calculate the money you owe or earn? Understanding simple interest, compound interest, and annuities is crucial for making smart financial decisions - from student loans to savings accounts to future investments.

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

Think of simple interest as the straightforward way money grows over time. When you borrow money, you're the debtor, and when you lend money, you're the creditor. The original amount is called the principal, and you pay or earn a percentage each year called the interest rate.

The magic formula is I = PRT, where I is interest, P is principal, R is the rate (as a decimal), and T is time in years. You can rearrange this formula to find any missing piece - just divide both sides to isolate what you need.

To find the maturity value (total amount you'll have), simply add the interest to the principal: A = P + I or use the shortcut A = P. This tells you exactly how much money will be involved at the end of the loan or investment period.

Pro tip: Always convert your interest rate to a decimal by dividing by 100 before plugging it into formulas!

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

When dealing with loans that last only a few days or months, you'll encounter two types of interest calculations. Ordinary interest uses 360 days as a year (banker's interest), while exact interest uses the actual 365 days. Banks often prefer ordinary interest because it gives them slightly more money!

For time calculations, you have two options as well. Approximate time assumes every month has exactly 30 days - super easy for quick calculations. Exact time counts the actual days in each month, excluding the first day but including the last day.

Remember the days in each month: 30 days for April, June, September, and November; 31 days for January, March, May, July, August, October, and December; and 28 days for February (29 in leap years). Unless specified otherwise, problems usually ask for ordinary interest with approximate time.

Quick check: If the problem doesn't specify which method to use, go with ordinary interest (360 days) - it's the default!

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

Compound interest is where things get exciting - it's interest earning interest! Unlike simple interest, compound interest gets added to your principal regularly, creating a snowball effect that can dramatically increase your money over time.

The formula A = P^nt might look scary, but it's manageable. Here, A is your final amount, P is principal, r is annual interest rate, n is how many times per year it compounds, and t is years. Common compounding periods are annually , semi-annually , quarterly , or monthly .

The key difference from simple interest is that your money grows faster because each period's interest gets added to the principal for the next calculation. This is why starting to save early makes such a huge difference - time is your best friend with compound interest!

Money tip: Even small amounts invested early with compound interest can grow to surprising amounts over time!

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

An annuity is simply a series of equal payments made at regular intervals - think monthly car payments or quarterly tuition fees. There are two main types: annuity certain and annuity uncertain (indefinite like insurance payments).

Simple annuities have matching payment and compounding periods (like monthly payments with monthly compounding), while general annuities don't match. Most problems deal with simple annuities, so focus there first.

Ordinary annuities make payments at the end of each period, while annuities due make payments at the beginning. The formulas are similar - annuity due just multiplies by an extra factor because money has more time to grow.

For future value, use FVA = P × /i to find how much all your payments will be worth. For present value, use PV = P × /i to find how much you need today to fund future payments.

Real-world connection: Every time you make monthly payments on anything, you're dealing with annuities!

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

When working with ordinary annuities, remember that payments happen at the end of each period. The future value formula FVA = P × /i shows you how much your series of payments will grow to, including all the compound interest earned.

Present value calculations answer the opposite question: how much money do you need today to provide a series of future payments? This is crucial for retirement planning - you calculate how much to deposit now to withdraw a specific amount later.

Annuities due are similar but more valuable because payments start immediately. Since each payment has more time to grow, multiply your ordinary annuity result by . The extra factor accounts for that additional compounding period.

The key variables remain the same: P is your periodic payment, i is the interest rate per period (annual rate ÷ compounding frequency), and n is total number of payments (years × payments per year).

Study hack: Practice identifying whether payments happen at the beginning or end of periods - it determines which formula to use!

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

Real-world annuity problems help you see why these calculations matter. When parents save for college by depositing money annually, they're creating a future value annuity due - the money grows over time to fund education expenses.

Present value problems often involve loans or determining how much to borrow. If you know your payment capacity, you can calculate the maximum loan amount you can handle. This is exactly how banks determine your borrowing limit.

The timing of payments makes a significant difference in calculations. Beginning-of-period payments (annuity due) always result in higher values than end-of-period payments (ordinary annuity) because of extra compounding time.

Practice problems typically give you most variables and ask you to find one missing piece. Master the basic formulas, then focus on identifying what type of annuity you're dealing with and what the problem is asking you to find.

Test strategy: Always identify whether you're solving for present value, future value, and whether it's ordinary or due before choosing your formula!

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

These sample problems cover the most common types you'll encounter on tests. Simple interest problems usually give you three of the four variables (P, I, R, T) and ask you to find the fourth using algebraic manipulation of I = PRT.

Time period calculations between dates require careful counting. Remember to exclude the starting date but include the ending date when counting exact time. For approximate time, just assume 30 days per month for easier calculation.

Present value problems work backwards from a future amount to find what you need to invest today. These problems are especially important for understanding loans and investments - you're finding the principal that will grow to a specific target.

Interest rate problems often give you the principal and final amount, asking you to calculate what rate was earned. These help you compare different investment options in real life.

Exam tip: Write down the given information first, then identify which formula applies before jumping into calculations!

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

Compound interest problems show the real power of letting money grow over time. Whether you're calculating savings account growth or loan amounts, the formula A = P^nt handles various compounding frequencies from daily to annually.

Annuity problems get more complex when comparing different scenarios. You might need to calculate multiple annuities to see which investment strategy works better, or determine loan amounts based on payment capacity.

The key is breaking complex problems into steps: identify the type of problem, list known variables, choose the correct formula, and solve systematically. Many problems combine multiple concepts - like finding both compound amount and compound interest earned.

Time deposit problems are particularly relevant since many students will open savings accounts. Understanding how different compounding frequencies affect growth helps you make better banking decisions.

Life skill bonus: These calculations help you make smart financial decisions about loans, investments, and savings throughout your life!

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

Long-term investment comparisons reveal surprising truths about compound interest. Starting early with smaller amounts often beats starting late with larger amounts - time is more powerful than you might think when compound interest is involved.

Loan calculations help you understand the total cost of borrowing. When you know the monthly payment and loan term, you can calculate both the original loan amount and total interest paid over the life of the loan.

Different annuity types (monthly vs. quarterly payments) can be compared to see which grows faster. Higher frequency payments usually win because money starts earning interest sooner, but the difference depends on the interest rate and compounding frequency.

Amortization is the process of gradually paying off a loan through regular payments. Each payment covers both interest on the remaining balance and a portion of the principal, with the principal portion increasing over time as the balance decreases.

Financial wisdom: Starting to invest or save even small amounts early in life can lead to surprisingly large amounts later due to compound interest!

Access to all documents

Improve your grades

Join milions of students

By signing up you accept Terms of Service and Privacy Policy

An amortization schedule breaks down each loan payment into interest and principal portions. This table shows exactly how your loan balance decreases over time and how much interest you pay each period.

The schedule has five columns: period number, periodic payment amount, interest due, principal repayment, and outstanding balance. Column B stays the same (equal payments), while Column C (interest) decreases over time as the balance shrinks.

To build the schedule, first calculate the periodic payment using the present value annuity formula. Then for each period: calculate interest on the remaining balance, subtract interest from payment to find principal repayment, and subtract principal repayment from the remaining balance.

The process continues until the loan is fully paid. Early payments are mostly interest, but later payments are mostly principal. This is why extra principal payments early in a loan can save significant interest over time.

Money-saving tip: Understanding amortization helps you see why making extra principal payments early can dramatically reduce total interest paid!

Our AI companion is specifically built for the needs of students. Based on the millions of content pieces we have on the platform we can provide truly meaningful and relevant answers to students. But its not only about answers, the companion is even more about guiding students through their daily learning challenges, with personalised study plans, quizzes or content pieces in the chat and 100% personalisation based on the students skills and developments.

You can download the app in the Google Play Store and in the Apple App Store.

That's right! Enjoy free access to study content, connect with fellow students, and get instant help – all at your fingertips.

8

Smart Tools NEW

Transform this note into: ✓ 50+ Practice Questions ✓ Interactive Flashcards ✓ Full Mock Exam ✓ Essay Outlines

App Store

Google Play

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE THE SCHOOLGPT. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user

The app is very easy to use and well designed. I have found everything I was looking for so far and have been able to learn a lot from the presentations! I will definitely use the app for a class assignment! And of course it also helps a lot as an inspiration.

Stefan S

iOS user

This app is really great. There are so many study notes and help [...]. My problem subject is French, for example, and the app has so many options for help. Thanks to this app, I have improved my French. I would recommend it to anyone.

Samantha Klich

Android user

Wow, I am really amazed. I just tried the app because I've seen it advertised many times and was absolutely stunned. This app is THE HELP you want for school and above all, it offers so many things, such as workouts and fact sheets, which have been VERY helpful to me personally.

Anna

iOS user

I think it’s very much worth it and you’ll end up using it a lot once you get the hang of it and even after looking at others notes you can still ask your Artificial intelligence buddy the question and ask to simplify it if you still don’t get it!!! In the end I think it’s worth it 😊👍 ⚠️Also DID I MENTION ITS FREEE YOU DON’T HAVE TO PAY FOR ANYTHING AND STILL GET YOUR GRADES IN PERFECTLY❗️❗️⚠️

Thomas R

iOS user

Knowunity is the BEST app I’ve used in a minute. This is not an ai review or anything this is genuinely coming from a 7th grade student (I know 2011 im young) but dude this app is a 10/10 i have maintained a 3.8 gpa and have plenty of time for gaming. I love it and my mom is just happy I got good grades

Brad T

Android user

Not only did it help me find the answer but it also showed me alternative ways to solve it. I was horrible in math and science but now I have an a in both subjects. Thanks for the help🤍🤍

David K

iOS user

The app's just great! All I have to do is enter the topic in the search bar and I get the response real fast. I don't have to watch 10 YouTube videos to understand something, so I'm saving my time. Highly recommended!

Sudenaz Ocak

Android user

In school I was really bad at maths but thanks to the app, I am doing better now. I am so grateful that you made the app.

Greenlight Bonnie

Android user

I found this app a couple years ago and it has only gotten better since then. I really love it because it can help with written questions and photo questions. Also, it can find study guides that other people have made as well as flashcard sets and practice tests. The free version is also amazing for students who might not be able to afford it. Would 100% recommend

Aubrey

iOS user

Best app if you're in Highschool or Junior high. I have been using this app for 2 school years and it's the best, it's good if you don't have anyone to help you with school work.😋🩷🎀

Marco B

iOS user

THE QUIZES AND FLASHCARDS ARE SO USEFUL AND I LOVE THE SCHOOLGPT. IT ALSO IS LITREALLY LIKE CHATGPT BUT SMARTER!! HELPED ME WITH MY MASCARA PROBLEMS TOO!! AS WELL AS MY REAL SUBJECTS ! DUHHH 😍😁😲🤑💗✨🎀😮

Elisha

iOS user

This app is phenomenal down to the correct info and the various topics you can study! I greatly recommend it for people who struggle with procrastination and those who need homework help. It has been perfectly accurate for world 1 history as far as I’ve seen! Geometry too!

Paul T

iOS user